High Liner Foods

advertisement

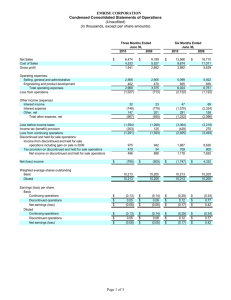

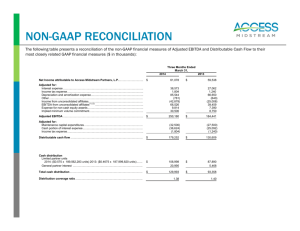

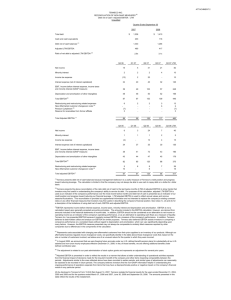

Intrafish Seafood Investment Forum May 22, 2013 New York Kelly Nelson, EVP & CFO Heather Keeler-Hurshman Director of Investor Relations 1 Disclaimer Certain statements made in this presentation are forward-looking and are subject to important risks, uncertainties and assumptions concerning future conditions that may ultimately prove to be inaccurate and may differ materially from actual future events or results. Actual results or events may differ materially from those predicted. Certain material factors or assumptions were applied in drawing the conclusions as reflected in the forward-looking information. Additional information about these material factors or assumptions is contained in High Liner's annual MD&A and is available on SEDAR (www.sedar.com). 2 Presentation Currencies • HLF is traded on the Toronto Stock Exchange and references to stock price and dividends are in Canadian dollars. • Effective with the company’s 2012 annual report all financial statements are presented in USD. – 2010, 2011 and 2012 are fully converted and restated under IFRS rules to USD – Previous years Canadian GAAP statements are converted from Canadian dollars at the annual period end & average USD/CAD exchange rates and remain under Canadian GAAP. 3 Listings Data - CAD* TSX: Recent Price: 52-Week Range $31.20 $18.82 - $39.00 Shares Outstanding ~15.1million Quarterly Dividend1 $0.18 Current Yield1 2.3% Total Market Cap * Recent prices as at May 17, 2013 1 4 HLF Based on the dividend rate effective June 1, 2013 $473 million High Liner Foods Corporate History (1) (1) Icelandic Brand under license 5 Business Profile Product Form Branded 23% 36% Value Added Other Brands Other 64% 77% 6 Business Profile Geography Retail / Food Service 35% 35% Food Service Retail USA * Canada 65% 7 65% Our Business Model Broadest market reach in industry Market leading brands Diversified global procurement Frozen food logistics expertise Innovative product development 8 Foodservice Overview • Leading Foodservice Brands – FPI, Icelandic, Maribel and Viking • Strengths – – – – Leading Innovation Dominant Supplier Position Diverse Product Line Cover All segments – Chain Restaurants, Food Services Distributors, Healthcare, and Education – Private Label • Key Customers – Sysco, US Foods, GFS, Reinhart, PFG – Arby’s, Carl’s JR, Nestle, Omaha Steaks, Schwann’s, MacDonald’s 9 Retail Overview • Leading Brands – Sea Cuisine, Fisher Boy, and High Liner • Strengths – – – – – Sell to all retailers Sell to every area of store Recognized brands Leading Innovation Private Label • Customers – Grocery – Wal*mart, Target, Whole Foods, Safeway, Kroger , Sobeys, Loblaw – Club - Costco, Sam’s, BJ’s 10 Rationalized Production Capacity •Reduced from 6 plants to 4 •Low cost manufacturing footprint 11 Achieving Our Vision Financial Highlights: • Strong sales, adjusted EBITDA, and adjusted net income • Creating value for shareholders – increased share price /dividends Operational Highlights: • Completed the acquisition of Icelandic USA in December 2011 • Completed integration of Icelandic USA in November 2012 • Closed two plants Dec 12/ Jan 13 Recognition for New Products: • Voted Best New Product by Canadian Living (4 years in a row) • Frozen Fish / Prepared Meal Category • Pan Sear, Market Cuts, Flame Savours 12 Financial Review 13 Sales in US$000s $943 mm $1,000,000 $900,000 $800,000 $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $2006 14 2007 2008 2009 2010 2011 2012 EBITDA in US$000s $91.7 mm $110,000 $100,000 $90,000 $80,000 $70,000 $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 $0 Standardized EBITDA *Proforma includes additional $9 mm of synergies Adjusted EBITDA (1) : Standardized EBITDA, excluding impairment of PPE, business acquisition and integration expenses, gains or losses on disposal of assets, and the increase in cost of goods sold relating to inventory acquired from business acquisitions, above its book value Adjusted EBITDA (2) : Adjusted EBITDA (1) excluding stock-based compensation expense 15 Dividend History (Cdn$) Annual Equity Dividends per Share $0.80 $0.70 $0.60 $0.50 $0.40 $0.30 $0.20 $0.10 $- Current run rate $0.72 1/4 year 2003 16 2005 2007 2009 2011 2013 P YTD 2012 – Strong Momentum • Integration of Icelandic USA completed ahead of schedule • Now expecting annual ongoing synergies of at least $18 million, the high end of original estimate of $16-$18 million • Plant consolidation completed • Strong sales, Adjusted EBITDA and Adjusted EPS growth • Canadian Retail operations turnaround continues • 9.9% sales volume growth • New Flame Savours product contributed to sales growth 17 Q1 2013Q1 - A2013 Challenging Quarter Quarter - A Challenging Sales as Reported (in US$ millions) • Decline in selling prices for commodity products 350 300 287.6private label sales • Weak 250 • Soft U.S. restaurant sales and early Lent 200 150 100 50 0 275.2 • Production and distribution challenges with move to Newport News • On track for annual projected synergies • Reduced interest expense and leverage ratio Q1 2012 Q1 2013 18 Financial – Challenging Q1 2013 Q1Review 2013 - A Quarter EBITDA (in US$ millions) $35 • Decline in selling prices for commodity products $30 $25 • Weak private label sales $20 • Soft U.S. restaurant sales and early Lent $15 • Production and distribution challenges with move $10 $5 $0 to Newport News • On track for annual projected synergies Q1 2012 Q1 2013 • Reduced interest expense and leverage ratio Standardized EBITDA Adjusted EBITDA : same definition as (1) except including non-cash stock compensation expense (1) Adjusted EBITDA is earnings before interest, taxes, depreciation and amortization, excluding impairment of property, plant and equipment, business acquisition and integration expenses, stock compensation expense, gains or losses on disposal of assets, and the increase in cost of goods sold relating to inventory acquired from business acquisitions, above its book value, as part of the fair value 19 requirements of purchase price accounting. Financial – Challenging Q1 2013 Q1Review 2013 - A Quarter Diluted EPS • Decline in selling prices for commodity products $1.00 $0.90 $0.80 $0.70 $0.60 $0.50 $0.40 $0.30 $0.20 $0.10 $0.00 • Weak private label sales • Soft U.S. restaurant sales and early Lent • Production and distribution challenges with move to Newport News • On track for annual projected synergies Q1 2012 Q1 2013 • Reduced interest expense and leverage ratio Diluted EPS is Net income divided by the average diluted number of shares EPS, based on Adjusted Net Income(1) except including non-cash stock compensation expense EPS, based on Adjusted Net Income, see note (1) (1) Adjusted Net Income is net income excluding the after-tax impairment of property, plant and equipment, business acquisition and integration expenses, stock compensation expense, the increase in cost of goods sold relating to inventory acquired from business acquisitions over its book value, non-cash expense from revaluing an embedded derivative associated with the long-term debt LIBOR floor, marking to market an interest rate swap related to the 20 embedded derivative, the write-off of deferred financing charges on the re-pricing of the Term Loan and withholding tax related inter-company dividends. Q1 2013 Challenging QuarterQuarter Q1- A 2013 - A Challenging • Decline •in Decline selling prices for commodity products products in selling prices for commodity • Weak private label saleslabel sales • Weak private • Soft U.S.• restaurant sales and sales early Lent Soft U.S. restaurant and early Lent • Production and distribution challengeschallenges with movewith move • Production and distribution to NewporttoNews Newport News • On track• for projected synergiessynergies On annual track for annual projected • Reduced interest expense leverage • Reduced interest and expense and ratio leverage ratio 21 2012 – Deleveraging $40-50 mm free cash flow 8.0x 7.0x 6.7x Dec 31/11 6.0x 5.0x 4.0x Dec 31/11Proforma Icelandic 4.4x 3.4x Dec 31/12 3.7x 3.0x 2.0x 3.0x Mar 31/13 PF Full Synergies 1.0x Target < 0.0x Debt to EBITDA 22 PF = Proforma for $9mm of Icelandic synergies + $2mm for Burin plant closure 2013 – Debt Amendments Term Loan ($233 mm) • Reduced rates 5.5% + 1.50 LIBOR floor to 3.5% + 1.25 LIBOR floor • Less restrictive financial covenants • More room for dividends • More flexible for acquisitions • ABL ($180 mm Working capital facility) • Improved pricing grid • More flexible for acquisitions • Cost savings • 2013 $4.7 cash, $6.2 total ($30 cents per share) 23 Outlook & Growth Strategy 24 Our Vision 25 Industry Drivers Long-term growth influenced by strong North American demographics An aging, health-conscious population 45+ years of age account for half of seafood consumption Health benefits tied to eating fish 26 Industry Forces • Fisheries recovering around the world • Growth from aquaculture species • Demand growth still greater than supply • Short-term cost declines but long-term fundamentals signal increasing costs • Seafood cost increasing less than other proteins • Positive outlook for 2013 27 Areas of Strategic Focus #1: PROFITABLE GROWTH • Icelandic Synergies Supply Chain Cost savings (Goal #3) • Organic Growth • Leverage scale • Product innovation • Acquisitions • Expand product portfolio • Strengthen market leadership 28 Achieve $150 million in EBITDA by 2015 (1) (1) Run rate Areas of Strategic Focus #2: SUSTAINABILITY Source all seafood from certifiable or sustainable or responsible fisheries and aquaculture farms by the end of 2013 29 Investment Rationale 30 Investor Presentation Questions? 31