Modelling of Forward Libor and Swap Rates

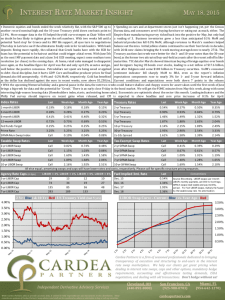

advertisement

Modelling of Forward Libor

and Swap Rates

Marek Rutkowski

Faculty of Mathematics and Information Science

Warsaw University of Technology, 00-661 Warszawa, Poland

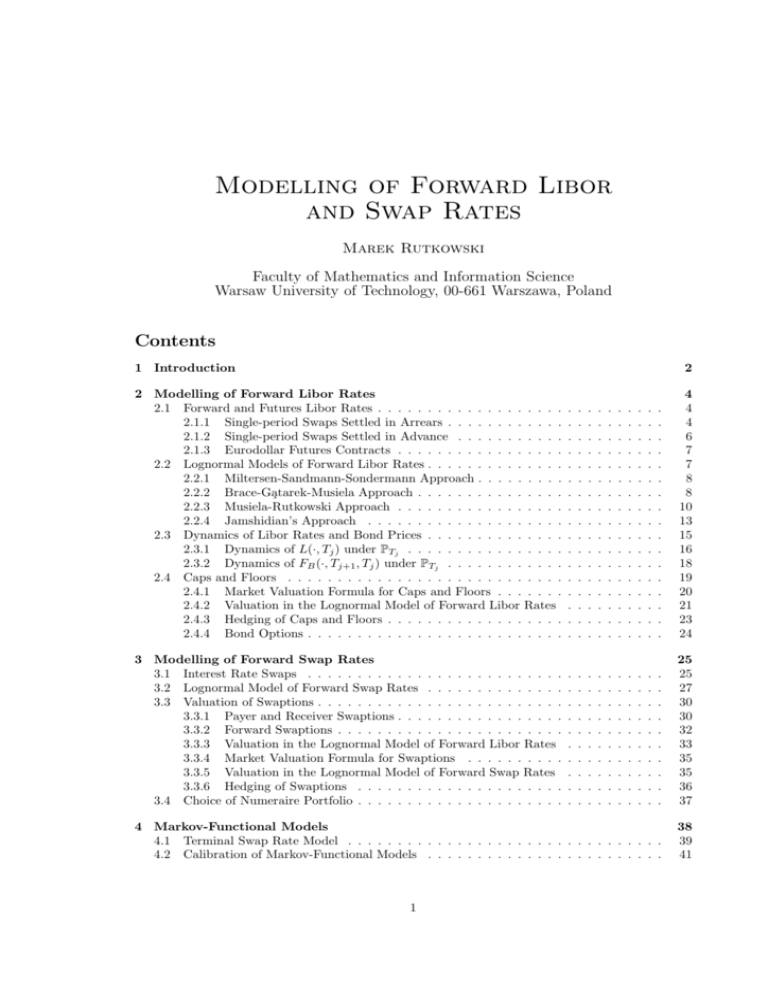

Contents

1 Introduction

2

2 Modelling of Forward Libor Rates

2.1 Forward and Futures Libor Rates . . . . . . . . . . . . . . . . . . .

2.1.1 Single-period Swaps Settled in Arrears . . . . . . . . . . . .

2.1.2 Single-period Swaps Settled in Advance . . . . . . . . . . .

2.1.3 Eurodollar Futures Contracts . . . . . . . . . . . . . . . . .

2.2 Lognormal Models of Forward Libor Rates . . . . . . . . . . . . . .

2.2.1 Miltersen-Sandmann-Sondermann Approach . . . . . . . . .

2.2.2 Brace-Ga̧tarek-Musiela Approach . . . . . . . . . . . . . . .

2.2.3 Musiela-Rutkowski Approach . . . . . . . . . . . . . . . . .

2.2.4 Jamshidian’s Approach . . . . . . . . . . . . . . . . . . . .

2.3 Dynamics of Libor Rates and Bond Prices . . . . . . . . . . . . . .

2.3.1 Dynamics of L(·, Tj ) under PTj . . . . . . . . . . . . . . . .

2.3.2 Dynamics of FB (·, Tj+1 , Tj ) under PTj . . . . . . . . . . . .

2.4 Caps and Floors . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.4.1 Market Valuation Formula for Caps and Floors . . . . . . .

2.4.2 Valuation in the Lognormal Model of Forward Libor Rates

2.4.3 Hedging of Caps and Floors . . . . . . . . . . . . . . . . . .

2.4.4 Bond Options . . . . . . . . . . . . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

4

4

6

7

7

8

8

10

13

15

16

18

19

20

21

23

24

3 Modelling of Forward Swap Rates

3.1 Interest Rate Swaps . . . . . . . . . . . . . . . . . . . . . . . . . .

3.2 Lognormal Model of Forward Swap Rates . . . . . . . . . . . . . .

3.3 Valuation of Swaptions . . . . . . . . . . . . . . . . . . . . . . . . .

3.3.1 Payer and Receiver Swaptions . . . . . . . . . . . . . . . . .

3.3.2 Forward Swaptions . . . . . . . . . . . . . . . . . . . . . . .

3.3.3 Valuation in the Lognormal Model of Forward Libor Rates

3.3.4 Market Valuation Formula for Swaptions . . . . . . . . . .

3.3.5 Valuation in the Lognormal Model of Forward Swap Rates

3.3.6 Hedging of Swaptions . . . . . . . . . . . . . . . . . . . . .

3.4 Choice of Numeraire Portfolio . . . . . . . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

25

25

27

30

30

32

33

35

35

36

37

4 Markov-Functional Models

4.1 Terminal Swap Rate Model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.2 Calibration of Markov-Functional Models . . . . . . . . . . . . . . . . . . . . . . . .

38

39

41

1

2

1

M.Rutkowski

Introduction

The last decade was marked by a rapidly growing interest in the arbitrage-free modelling of bond

market. Undoubtedly, one of the major achievements in this area was a new approach to the

term structure modelling proposed by Heath, Jarrow and Morton in their work published in 1992,

commonly known as the HJM methodology. One of its main features is that it covers a large variety

of previously proposed models and provides a unified approach to the modelling of instantaneous

interest rates and to the valuation of interest-rate sensitive derivatives. Let us give a very concise

description of the HJM approach (for a detailed account we refer, for instance, to Chapter 13 in

Musiela and Rutkowski (1997a)).

The HJM methodology is based on an exogenous specification of the dynamics of instantaneous,

continuously compounded forward rates f (t, T ). For any fixed maturity T ≤ T ∗ , the dynamics of

the forward rate f (t, T ) are

df (t, T ) = α(t, T ) dt + σ(t, T ) · dWt ,

where α and σ are adapted stochastic processes with values in R and Rd , respectively, and W is

a d-dimensional standard Brownian motion with respect to the underlying probability measure P

which plays the role of the real-world probability. More formally, for every fixed T ≤ T ∗ , where

T ∗ > 0 is the horizon date, we have

Z

Z

t

t

α(u, T ) du +

f (t, T ) = f (0, T ) +

0

0

σ(u, T ) · dWu

for some Borel-measurable function f (0, ·) : [0, T ∗] → R and stochastic processes applications α(·, T )

and σ(·, T ). Let us notice that, for any fixed maturity date T ≤ T ∗ , the initial condition f (0, T ) is

determined by the current value of the continuously compounded forward rate for the future date T

which prevails at time 0. In practical terms, the function f (0, T ) is determined by the current yield

curve, which can be estimated on the basis of observed market prices of bonds (and other relevant

instruments).

Let us denote by B(t, T ) the price at time t ≤ T of a unit zero-coupon bond which matures at

the date T ≤ T ∗ . In the present setup, the price B(t, T ) can be recovered from the formula

Z

B(t, T ) = exp −

T

f (t, u) du .

t

The problem of the absence of arbitrage opportunities in the bond market can be formulated in

terms of the existence of a suitably defined martingale measure. It appears that in an arbitrage-free

setting – that is, under the martingale measure – the drift coefficient α in the dynamics of the

intstantaneous forward rate is uniquely determined by the volatility coefficient σ, and a stochastic

process which can be interpreted as the market price of the interest-rate risk.

If we denote by P∗ the martingale measure for the bond market, and by W ∗ the associated

standard Brownian motion, then

dB(t, T ) = B(t, T ) rt dt + b(t, T ) · dWt∗ ,

where rt = f (t, t) is the short-term interest rate, and the bond price volatility b(t, T ) satisfies

Z

b(t, T ) = −

T

σ(t, u) du.

t

(1)

3

Modelling of Forward Libor and Swap Rates

Furthermore, it appears that in the special case when the coefficient σ follows a deterministic function, the valuation formulae for interest rate-sensitive derivatives are independent of the choice of

the risk premium. In this sense, the choice of a particular model from the broad class of HJM models

hinges uniquely on the specification of the volatility coefficient σ.

The HJM methodology appeared to be very successful both from the theoretical and practical

viewpoints. Since the HJM approach to the term structure modelling is based on an arbitrage-free

dynamics of the instantaneous continuously compounded forward rates, it requires a certain degree

of smoothness with respect to the tenor of the bond prices and their volatilities. For this reason,

working with such models is not always convenient.

An alternative construction of an arbitrage-free family of bond prices, making no reference to

the instantaneous rates, is in some circumstances more suitable. The first step in this direction was

done by Sandmann and Sondermann (1993), who focused on the effective annual interest rate. This

approach was further developed in ground-breaking papers by Miltersen et al. (1997) and Brace et

al. (1997), who proposed to model instead the family of forward Libor rates. The main goal was to

produce an arbitrage-free term structure model which would support the common practice of pricing

such interest-rate derivatives as caps and swaptions through a suitable version of Black’s formula.

This practical requirement enforces the lognormality of the forward Libor (or swap) rate under the

corresponding forward martingale measure.

Let us recall that, by market convention, the forward Libor rate over the future accrual pariod

[T, T + δ], as seen at time t, is set to satisfy

1 + δL(t, T ) =

or equivalently,

B(t, T )

,

B(t, T + δ)

B(t, T ) − B(t, T + δ)

.

B(t, T + δ)

The last formula makes it obvious that the volatility of the forward Libor rate is not deterministic

if the bond price volatility follows a determinisitc function. For this reason the Black’s formula

for caps is manifestly incompatible with the Gaussian HJM model – that is, the HJM model in

which the bond price volatility b(t, T ) is deterministic. Consequently, the “market formula” for caps

cannot be derived in this setup (though the value of a cap is given by a closed-form expression in

the Gaussian HJM framework). On the other hand, it is interesting to notice that Brace et al.

(1997) parametrize their version of the lognormal forward Libor model introduced by Miltersen et

al. (1997) with a piecewise constant volatility function. They need to consider smooth volatility

functions in order to analyse the model in the HJM framework, however. The backward induction

approach to the modelling of forward Libor and swap rate developed in Musiela and Rutkowski

(1997) and Jamshidian (1997) overcomes this technical difficulty. In addition, in contrast to the

previous papers, it allows also for the modelling of forward Libor (and swap) rates associated with

accrual periods of differing lengths.

It should be stressed that a similar (but not identical) approach to the modelling of market rate

was developed in a series of papers by Hunt et al. (1996, 1997) and Hunt and Kennedy (1997,

1998). Since special emphasis is put here on the existence of the underlying low-dimensional Markov

process that governs directly the dynamics of interest rates, this alternative approach is termed

the Markov-functional approach. This property leads to a considerable simplification in numerical

procedures associated with the model’s implementation. Another important feature of this approach

is its ability of providing a perfect fit to market prices of a given family of interest-rate options (e.g.,

a family of caps with a fixed maturity and varying strike level).

Another tractable term structure model – which is beyond the scope of the present text, however

– is the rational lognormal model proposed by Flesaker and Hughston (1996a, 1996b) (see also

Rutkowski (1997) and Jin and Glasserman (1997) in this regard).

Let us finally mention that we use throughout the notation adopted in Musiela and Rutkowski

(1997a). The interested reader is referred to this monograph for more details on term structure

modelling as well as for the general background.

L(t, T ) =

4

M.Rutkowski

2

Modelling of Forward Libor Rates

In this section, we present various approaches to the modelling of forward Libor rates. Due to

the limited space, we focus on model’s construction and its basic properties and the valuation of

the most typical derivatives. For further details, the interested reader is referred to the original

papers: Musiela and Sondermann (1993), Sandmann and Sondermann (1993), Goldys et al. (1994),

Sandmann et al. (1995), Brace et al. (1997), Jamshidian (1997, 1999), Miltersen et al. (1997), Musiela

and Rutkowski (1997b), Rady (1997), Sandmann and Sondermann (1997), Rutkowski (1998, 1999),

Yasuoka (1998), and Glasserman and Kou (1999). The issues related to the model’s implementation1

are extensively treated in Brace (1996), Andersen and Andreasen (1997), Sidenius (1997), Brace et

al. (1998), Musiela and Sawa (1998), Hull and White (1999), Schlögl (1999), Yasuoka (1999), Lotz

and Schlögl (1999), and Glasserman and Zhao (2000), Brace and Womersley (2000), and Dun et

al. (2000).

2.1

Forward and Futures Libor Rates

Our first task is to examine these properties of forward and futures contracts related to the notion

of the Libor rate which are universal; that is, which do not rely on specific assumptions imposed on

a particular model of the term structure of interest rates. To this end, we fix an index j, and we

consider various interest-rate sensitive derivatives related to the period [Tj , Tj+1 ]. To be more specific,

we shall focus in this section on single-period forward swaps – that is, forward rate agreements.

We need to introduce some notation. We assume that we are given a prespecified collection of

reset/settlement dates 0 < T0 < T1 < · · · < Tn = T ∗ , referred to as the tenor structure. Also,

we denote δj = Tj − Tj−1 for j = 1, . . . , n. We write B(t, Tj ) to denote the price at time t of a

Tj -maturity zero-coupon bond. P∗ is the spot martingale measure, while for any j = 0, . . . , n we

write PTj to denote the forward martingale measure associated with the date Tj . The corresponding d-dimensional Brownian motions are denoted by W ∗ and W Tj , respectively. Also, we write

FB (t, T, U ) = B(t, T )/B(t, U ) so that

FB (t, Tj+1 , Tj ) =

B(t, Tj+1 )

,

B(t, Tj )

∀ t ∈ [0, Tj ],

is the forward price at time t of the Tj+1 -maturity zero-coupon bond for the settlement date Tj .

We use the symbol πt (X) to denote the value (i.e., the arbitrage price) at time t of a European

contingent claim X. Finally, we shall use the letter E for the Doléans exponential, for instance,

Z

Z ·

Z t

1 t

γu · dWu∗ = exp

γu · dWu∗ −

|γu |2 du ,

Et

2 0

0

0

where the dot ‘ · ’ and | · | stand for the inner product and Euclidean norm in Rd , respectively.

2.1.1

Single-period Swaps Settled in Arrears

Let us first consider a single-period swap agreement settled in arrears; i.e., with the reset date Tj

and the settlement date Tj+1 (multi-period interest rate swaps are examined in Section 3). By

the contractual features, the long party pays δj+1 κ and receives B −1 (Tj , Tj+1 ) − 1 at time Tj+1 .

Equivalently, he pays an amount Y1 = 1 + δj+1 κ and receives Y2 = B −1 (Tj , Tj+1 ) at this date. The

values at time t ≤ Tj of these payoffs are

πt (Y1 ) = B(t, Tj+1 ) 1 + δj+1 κ , πt (Y2 ) = B(t, Tj ).

The second equality above is trivial, since the payoff Y2 is equivalent to the unit payoff at time Tj .

Consequently, for any fixed t ≤ Tj , the value of the forward swap rate, which makes the contract

1 In

particular, an arbitrage-free discretization of the lognormal model of forward Libor rates.

5

Modelling of Forward Libor and Swap Rates

worthless at time t, can be found by solving for κ = κ(t, Tj , Tj+1 ) the following equation

πt (Y2 ) − πt (Y1 ) = B(t, Tj ) − B(t, Tj+1 ) 1 + δj+1 κ = 0.

It is thus apparent that

κ(t, Tj , Tj+1 ) =

B(t, Tj ) − B(t, Tj+1 )

,

δj+1 B(t, Tj+1 )

∀ t ∈ [0, Tj ].

Note that the forward swap rate κ(t, Tj , Tj+1 ) coincides with the forward Libor rate L(t, Tj ) which,

by the market convention, is set to satisfy

1 + δj+1 L(t, Tj ) =

B(t, Tj )

= E PTj+1 (B −1 (Tj , Tj+1 ) | Ft )

B(t, Tj+1 )

(2)

for every t ∈ [0, Tj ]. Let us notice that the last equality is a consequence of the definition of the

forward measure PTj+1 . We conclude that in order to determine the forward Libor rate L(·, Tj ), it is

enough to find the forward price FX (t, Tj+1 ) at time t of the contingent claim X = B −1 (Tj , Tj+1 )

in the forward contact that settles at time Tj+1 . Indeed, it is well known (see, for instance, Musiela

and Rutkowski (1997a)) that

FX (t, Tj+1 ) = B(t, Tj+1 ) E PTj+1 (B −1 (Tj , Tj+1 ) | Ft ).

Furthermore, it is evident that the process L(·, Tj ) follows necessarily a martingale under the forward

probability measure PTj+1 . Recall that in the Heath-Jarrow-Morton framework, we have, under

PTj+1 ,

T

(3)

dFB (t, Tj , Tj+1 ) = FB (t, Tj , Tj+1 ) b(t, Tj ) − b(t, Tj+1 ) · dWt j+1 ,

where, for each maturity date T, the process b(·, T ) represents the price volatility of the T -maturity

zero-coupon bond. On the other hand, if the process L(·, Tj ) is strictly positive, it can be shown to

admit the following representation2

Tj+1

dL(t, Tj ) = L(t, Tj )λ(t, Tj ) · dWt

,

where λ(·, Tj ) is an adapted stochastic process which satifies mild integrability conditions. Combining the last two formulae with (2), we arrive at the following fundamental relationship, which plays

an essential role in the construction of the lognormal model of forward Libor rates,

δj+1 L(t, Tj )

λ(t, Tj ) = b(t, Tj ) − b(t, Tj+1 ),

1 + δj+1 L(t, Tj )

∀ t ∈ [0, Tj ].

(4)

For instance, in the construction which is based on the backward induction, relationship (4) will allow

us to determine the forward measure for the date Tj , provided that PTj+1 , W Tj+1 and the volatility

λ(t, Tj ) of the forward Libor rate L(·, Tj−1 ) are known. One may assume, for instance, that λ(·, Tj )

is a prespecified deterministic function). Recall that in the Heath-Jarrow-Morton framework3 the

Radon-Nikodým density of PTj with respect to PTj+1 is known to satisfy

Z ·

dPTj

T

= ETj

(5)

b(t, Tj ) − b(t, Tj+1 ) · dWt j+1 .

dPTj+1

0

In view of (4), we thus have

dPTj

= ETj

dPTj+1

2 This

3 See

Z

0

·

δj+1 L(t, Tj )

T

λ(t, Tj ) · dWt j+1 .

1 + δj+1 L(t, Tj )

representation is a consequence of the martingale representation property of the standard Brownian motion.

Heath et al. (1992).

6

M.Rutkowski

For our further purposes, it is also useful to observe that this density admits the following representation

dPTj

= cFB (Tj , Tj , Tj+1 ) = c 1 + δj+1 L(Tj , Tj ) , PTj+1 -a.s.,

(6)

dPTj+1

where c > 0 is the normalizing constant, and thus

dPTj

dPTj+1

= cFB (t, Tj , Tj+1 ) = c 1 + δj+1 L(t, Tj ) ,

PTj+1 -a.s.

|Ft

Finally, the dynamics of the process L(·, Tj ) under the probability measure PTj are given by a

somewhat involved stochastic differential equation

δ L(t, T )|λ(t, T )|2

T

j+1

j

j

dt + λ(t, Tj ) · dWt j .

dL(t, Tj ) = L(t, Tj )

1 + δj+1 L(t, Tj )

As we shall see in what follows, it is nevertheless not hard to determine the probability law of L(·, Tj )

under the forward measure PTj – at least in the case of the deterministic volatility λ(·, Tj ) of the

forward Libor rate.

2.1.2

Single-period Swaps Settled in Advance

Consider now a similar swap which is, however, settled in advance – that is, at time Tj . Our

first goal is to determine the forward swap rate implied by such a contract. Note that under

the present assumptions, the long party (formally) pays an amount Y1 = 1 + δj+1 κ and receives

Y2 = B −1 (Tj , Tj+1 ) at the settlement date Tj (which coincides here with the reset date). The values

at time t ≤ Tj of these payoffs admit the following representations

πt (Y1 ) = B(t, Tj ) 1 + δj+1 κ , πt (Y2 ) = B(t, Tj )E PTj (B −1 (Tj , Tj+1 ) | Ft ).

The value κ = κ̂(t, Tj , Tj+1 ) of the modified forward swap rate, which makes the swap agreement

settled in advance worthless at time t, can be found from the equality

πt (Y2 ) − πt (Y1 ) = B(t, Tj ) E PTj (B −1 (Tj , Tj+1 ) | Ft ) − (1 + δj+1 κ) = 0.

It is clear that

−1

E PTj (B −1 (Tj , Tj+1 ) | Ft ) − 1 .

κ̂(t, Tj , Tj+1 ) = δj+1

We are in a position to introduce the modified forward Libor rate L̃(t, Tj ) by setting, for every

t ∈ [0, Tj ],

−1

L̃(t, Tj ) := δj+1

E PTj (B −1 (Tj , Tj+1 ) | Ft ) − 1 .

Let us make two remarks. First, it is clear that finding of the modified forward Libor rate L̃(·, Tj ) is

formally equivalent to finding the forward price of the claim B −1 (Tj , Tj+1 ) for the settlement date

Tj .4 Second, it is useful to observe that

L̃(t, Tj ) = E PTj

1 − B(T , T ) j

j+1 Ft = E PTj (L(Tj , Tj ) | Ft ).

δj+1 B(Tj , Tj+1 )

(7)

In particular, it is evident that at the reset date Tj the two kinds of forward Libor rates introduced

above coincide, since manifestly

L̃(Tj , Tj ) =

4 Recall

1 − B(Tj , Tj+1 )

= L(Tj , Tj ).

δj+1 B(Tj , Tj+1 )

that in the case of a forward Libor rate, the settlement date was Tj+1 .

7

Modelling of Forward Libor and Swap Rates

To summarize, the ‘standard’ forward Libor rate L(·, Tj ) satisfies

L(t, Tj ) = E PTj+1 (L(Tj , Tj ) | Ft ),

with the initial condition

L(0, Tj ) =

∀ t ∈ [0, Tj ],

B(0, Tj ) − B(0, Tj+1 )

.

δj+1 B(0, Tj+1 )

On the other hand, for the modified Libor rate L̃(·, Tj ) we have

L̃(t, Tj ) = E PTj (L̃(Tj , Tj ) | Ft ),

∀ t ∈ [0, Tj ],

with the initial condition

−1

E PTj (B −1 (Tj , Tj+1 )) − 1 .

L̃(0, Tj ) = δj+1

The calculation of the right-hand side above involve not only on the initial term structure, but also

the volatilities of bond prices (for more details, we refer to Rutkowski (1998)).

2.1.3

Eurodollar Futures Contracts

The next object of our studies is the futures Libor rate. A Eurodollar futures contract is a futures

contract in which the Libor rate plays the role of an underlying asset. By convention, at the contract’s

maturity date Tj , the quoted Eurodollar futures price, denoted by E(Tj , Tj ), is set to satisfy

E(Tj , Tj ) := 1 − δj+1 L(Tj , Tj ).

Equivalently, in terms of the zero-coupon bond price we have E(Tj , Tj ) = 2 − B −1 (Tj , Tj+1 ). From

the general theory, it follows that the Eurodollar futures price at time t ≤ Tj equals

(8)

E(t, Tj ) := E P∗ (E(Tj , Tj )) = 2 − E P∗ B −1 (Tj , Tj+1 ) | Ft

(recall that P∗ represents the spot martingale measure in a given model of the term structure). It

is thus natural to introduce the concept of the futures Libor rate, associated with the Eurodollar

futures contract, through the following definition.

Definition 2.1 Let E(t, Tj ) be the Eurodollar futures price at time t for the settlement date Tj .

The implied futures Libor rate Lf (t, Tj ) satisfies

E(t, Tj ) = 1 − δj+1 Lf (t, Tj ),

∀ t ∈ [0, Tj ].

It follows immediately from (8)–(9) that the following equality is valid

1 + δj+1 Lf (t, Tj ) = E P∗ B −1 (Tj , Tj+1 ) | Ft .

(9)

(10)

Equivalently, we have

Lf (t, Tj ) = E P∗ (L(Tj , Tj ) | Ft ) = E P∗ (L̃(Tj , Tj ) | Ft ).

Note that in any term structure model, the futures Libor rate necessarily follows a martingale under

the spot martingale measure P∗ (provided, of course, that P∗ is well-defined in this model).

2.2

Lognormal Models of Forward Libor Rates

We shall now describe alternative approaches to the modelling of forward Libor rates in a continuousand discrete-tenor setups.

8

2.2.1

M.Rutkowski

Miltersen-Sandmann-Sondermann Approach

The first attempt to provide a rigorous construction a lognormal model of forward Libor rates was

done by Miltersen et al. (1997). The interested reader is referred also to Musiela and Sondermann

(1993), Goldys et al. (1994), and Sandmann et al. (1995) for related previous studies. As a starting

point in their approach, Miltersen et al. (1997) postulate that the forward Libor rates process L(·, T )

satisfies

dL(t, T ) = µ(t, T ) dt + L(t, T )λ(t, T ) · dWt∗ ,

with a deterministic volatility function λ(·, T ) : [0, T ] → Rd . It is not difficult to deduce from the

last formula that the forward price of a zero-coupon bond satisfies

dF (t, T + δ, T ) = −F (t, T + δ, T ) 1 − F (t, T + δ, T ) λ(t, T ) · dWtT .

Subsequently, they focus on the partial differential equation satisfied by the function v = v(t, x),

which expresses the forward price of the bond option in terms of the forward bond price. It is

interesting to note that the PDE (11) was previously solved by Rady and Sandmann (1994) who

worked within a different framework, however.5 The PDE for the option’s price is

∂2v

∂v 1

+ |λ(t, T )|2 x2 (1 − x)2 2 = 0

∂t

2

∂x

(11)

with the terminal condition v(T, x) = (K − x)+ . As a result, Miltersen et al. (1997) obtained not

only the closed-form solution for the price of a bond option (this was already achieved in Rady and

Sandmann (1994)), but also the “market formula” for the caplet’s price. The rigorous approach

to the problem of existence of such a model was presented by Brace et al. (1997), who also worked

within the continuous-time Heath-Jarrow-Morton framework.

2.2.2

Brace-Ga̧tarek-Musiela Approach

To formally introduce the notion of a forward Libor rate, we assume that we are given a family

B(t, T ) of bond prices, and thus also the collection FB (t, T, U ) of forward processes. In contrast

to the previous section, we shall now assume that a strictly positive real number δ < T ∗ , which

represents the length of the accrual period, is fixed throughout. By definition, the forward δ-Libor

rate L(t, T ) for the future date T ≤ T ∗ − δ prevailing at time t is given by the conventional market

formula

(12)

1 + δL(t, T ) = FB (t, T, T + δ), ∀ t ∈ [0, T ].

The forward Libor rate L(t, T ) represents the add-on rate prevailing at time t over the future time

interval [T, T + δ]. We can also re-express L(t, T ) directly in terms of bond prices, as for any

T ∈ [0, T ∗ − δ], we have

B(t, T )

, ∀ t ∈ [0, T ].

(13)

1 + δL(t, T ) =

B(t, T + δ)

In particular, the initial term structure of forward Libor rates satisfies

L(0, T ) = δ −1

B(0, T )

−1 .

B(0, T + δ)

(14)

Given a family FB (t, T, T ∗) of forward processes, it is not hard to derive the dynamics of the

associated family of forward Libor rates. For instance, one finds that under the forward measure

PT +δ , we have

dL(t, T ) = δ −1 FB (t, T, T + δ) γ(t, T, T + δ) · dWtT +δ ,

5 In fact, they were concerned with the valuation of options on zero-coupon bonds for the term structure model

put forward by Bühler and Käsler (1989).

9

Modelling of Forward Libor and Swap Rates

where PT +δ is the forward measure for the date T + δ, and the asociated Wiener process W T +δ

equals

Z t

b(u, T + δ) du, ∀ t ∈ [0, T + δ].

WtT +δ = Wt∗ −

0

Put another way, the process L(·, T ) solves the equation

dL(t, T ) = δ −1 (1 + δL(t, T )) γ(t, T, T + δ) · dWtT +δ ,

(15)

subject to the initial condition (14). Suppose that forward Libor rates L(t, T ) are strictly positive.

Then formula (15) can be rewritten as follows

dL(t, T ) = L(t, T ) λ(t, T ) · dWtT +δ ,

(16)

where for any t ∈ [0, T ]

λ(t, T ) =

1 + δL(t, T )

γ(t, T, T + δ).

δL(t, T )

(17)

This shows that the collection of forward processes uniquely specifies the family of forward Libor

rates. The construction of a model of forward Libor rates relies on the following assumptions.

(LR.1) For any maturity T ≤ T ∗ − δ, we are given a Rd -valued, bounded deterministic function6

λ(·, T ), which represents the volatility of the forward Libor rate process L(·, T ).

(LR.2) We assume a strictly decreasing and strictly positive initial term structure B(0, T ), T ∈

[0, T ∗ ]. The associated initial term structure L(0, T ) of forward Libor rates satisfies, for every T ∈

[0, T ∗ −δ],

B(0, T ) − B(0, T + δ)

.

(18)

L(0, T ) =

δB(0, T + δ)

To construct a model satisfying (LR.1)–(LR.2), Brace et al. (1997) place themselves in the HeathJarrow-Morton setup and they assume that for every T ∈ [0, T ∗], the volatility b(t, T ) vanishes for

every t ∈ [(T − δ) ∨ 0, T ]. In essence, the construction elaborated in Brace et al. (1997) is based on

the forward induction, as opposed to the backward induction which we shall use in the next section.

They start by postulating that the dynamics of L(t, T ) under the spot martingale measure P∗ are

governed by the following SDE

dL(t, T ) = µ(t, T ) dt + L(t, T )λ(t, T ) · dWt∗ ,

where λ is a deterministic function, and the drift coefficient µ is unspecified. Recall that the

arbitrage-free dynamics of the instantaneous forward rate f (t, T ) are

df (t, T ) = σ(t, T ) · σ ∗ (t, T ) dt + σ(t, T ) · dWt∗ ,

where σ ∗ (t, T ) =

RT

t

σ(t, u) du = −b(t, T ). On the other hand, the relationship (cf. (13))

Z

T +δ

f (t, u) du

1 + δL(t, T ) = exp

(19)

T

is valid. Applying Itô’s formula to both sides of (19), and comparing the diffusion terms, we find

that

Z T +δ

δL(t, T )

λ(t, T ).

σ(t, u) du =

σ ∗ (t, T + δ) − σ ∗ (t, T ) =

1 + δL(t, T )

T

6 Volatility λ could well follow an adapted stochastic process; we deliberately focus here on a lognormal model of

forward Libor rates in which λ is deterministic.

10

M.Rutkowski

To solve the last equation for σ ∗ in terms of L, it is necessary to impose some sort of initial condition

on σ ∗ . For instance, by setting σ(t, T ) = 0 for 0 ≤ t ≤ T ≤ t+δ, we obtain the following relationship

[δ −1 (T −t)]

∗

b(t, T ) = −σ (t, T ) = −

X

k=1

δL(t, T − kδ)

λ(t, T − kδ).

1 + δL(t, T − kδ)

(20)

The existence and uniqueness of solutions to SDEs which govern the instantaneous forward rate

f (t, T ) and the forward Libor rate L(t, T ) for σ ∗ given by (20) can be shown using forward induction.

Taking this result for granted, we conclude that L(t, T ) satisfies, under the spot martingale measure

P∗

dL(t, T ) = L(t, T )σ ∗ (t, T ∗ + δ) · λ(t, T ) dt + L(t, T )λ(t, T ) · dWt∗ .

In this way, Brace et al. (1997) are able to completely specify their model of forward Libor rates.

2.2.3

Musiela-Rutkowski Approach

In this section, we describe an alternative approach to the modelling of forward Libor rates; the

construction presented below is a slight modification of that given by Musiela and Rutkowski (1997b).

Let us start by introducing some notation. We assume that we are given a prespecified collection

of reset/settlement dates 0 < T0 < T1 < · · · < Tn = T ∗ , referred to as the tenor structure (by

Pj

convention, T−1 = 0). Let us denote δj = Tj − Tj−1 for j = 0, . . . , n. Then obviously Tj = i=0 δi

for every j = 0, . . . , n. We find it convenient to denote, for m = 0, . . . , n,

∗

= T∗ −

Tm

n

X

δj = Tn−m .

j=n−m+1

For any j = 0, . . . , n − 1, we define the forward Libor rate L(·, Tj ) by setting

L(t, Tj ) =

B(t, Tj ) − B(t, Tj+1 )

,

δj+1 B(t, Tj+1 )

∀ t ∈ [0, Tj ].

Definition 2.2 For any j = 0, . . . , n, a probability measure PTj on (Ω, FTj ), equivalent to P, is said

to be the forward Libor measure for the date Tj if, for every k = 0, . . . , n the relative bond price

Un−j+1 (t, Tk ) :=

B(t, Tk )

,

B(t, Tj )

∀ t ∈ [0, Tk ∧ Tj ],

follows a local martingale under PTj .

It is clear that the notion of forward Libor measure is in fact identical with that of a forward

probability measure for a given date. Also, it is trivial to observe that the forward Libor rate

L(·, Tj ) necessarily follows a local martingale under the forward Libor measure for the date Tj+1 . If,

in addition, it is a strictly positive process, the existence of the associated volatility process can be

justified by standard arguments.

In our further development, we shall go the other way around; that is, we will assume that for any

date Tj , the volatility λ(·, Tj ) of the forward Libor rate L(·, Tj ) is exogenously given. In principle, it

can be a deterministic Rd -valued function of time, an Rd -valued function of the underlying forward

Libor rates, or it can follow a d-dimensional adapted stochastic process. For simplicity, we assume

throughout that the volatilities of forward Libor rates are bounded processes (or functions). To be

more specific, we make the following standing assumptions.

Assumptions (LR). We are given a family of bounded adapted processes λ(·, Tj ), j = 0, . . . , n − 1,

which represent the volatilities of forward Libor rates L(·, Tj ). In addition, we are given an initial

term structure of interest rates, specified by a family B(0, Tj ), j = 0, . . . , n, of bond prices. We

assume here that B(0, Tj ) > B(0, Tj+1 ) for j = 0, . . . , n − 1.

11

Modelling of Forward Libor and Swap Rates

Our aim is to construct a family L(·, Tj ), j = 0, . . . , n − 1 of forward Libor rates, a collection

of mutually equivalent probability measures PTj , j = 1, . . . , n, and a family W Tj , j = 1, . . . , n of

processes in such a way that: (i) for any j = 1, . . . , n the process W Tj follows a d-dimensional

standard Brownian motion under the probability measure PTj , (ii) for any j = 0, . . . , n − 1, the

forward Libor rate L(·, Tj ) satisfies the SDE

Tj+1

dL(t, Tj ) = L(t, Tj ) λ(t, Tj ) · dWt

with the initial condition

L(0, Tj ) =

,

∀ t ∈ [0, Tj ],

(21)

B(0, Tj ) − B(0, Tj+1 )

.

δj+1 B(0, Tj+1 )

As already mentioned, the construction of the model is based on backward induction, therefore we

start by defining the forward Libor rate with the longest maturity, i.e., Tn−1 . We postulate that

L(·, Tn−1 ) = L(·, T1∗ ) is governed under the underlying probability measure P by the following SDE7

dL(t, T1∗ ) = L(t, T1∗) λ(t, T1∗ ) · dWt

with the initial condition

L(0, T1∗ ) =

B(0, T1∗ ) − B(0, T ∗ )

.

δn B(0, T ∗ )

Put another way, we have

L(t, T1∗ ) =

B(0, T1∗ )

∗

B(0, T1∗ ) − B(0, T ∗ ) Et

δn B(0, T ∗ )

Z

0

·

λ(u, T1∗ ) · dWu .

L(·, T1∗ )

> B(0, T ), it is clear that the

follows a strictly positive martingale under

Since

PT ∗ = P. The next step is to define the forward Libor rate for the date T2∗ . For this purpose, we need

to introduce first the forward probability measure for the date T1∗ . By definition, it is a probability

measure Q, which is equivalent to P, and such that processes

U2 (t, Tk∗ ) =

B(t, Tk∗ )

B(t, T1∗ )

are Q-local martingales. It is important to observe that the process U2 (·, Tk∗ ) admits the following

representation

U1 (t, Tk∗ )

.

U2 (t, Tk∗ ) =

1 + δn L(t, T1∗ )

Let us formulate an auxiliary result, which is a straightforward consequence of Itô’s rule.

Lemma 2.1 Let G and H be real-valued adapted processes, such that

dGt = αt · dWt ,

dHt = βt · dWt .

Assume, in addition, that Ht > −1 for every t and denote Yt = (1 + Ht )−1 . Then

d(Yt Gt ) = Yt αt − Yt Gt βt · dWt − Yt βt dt .

It follows immediately from Lemma 2.1 that

dU2 (t, Tk∗ ) = ηtk · dWt −

δn L(t, T1∗ )

∗

λ(t,

T

)

dt

1

1 + δn L(t, T1∗ )

7 Notice that, for simplicity, we have chosen the underlying probability measure P to play the role of the forward

Libor measure for the date T ∗ . This choice is not essential, however.

12

M.Rutkowski

for a certain process η k . Therefore it is enough to find a probability measure under which the process

T1∗

Wt

Z

:= Wt −

t

0

δn L(u, T1∗)

λ(u, T1∗ ) du = Wt −

1 + δn L(u, T1∗ )

Z

t

0

γ(u, T1∗ ) du,

t ∈ [0, T1∗ ], follows a standard Brownian motion (the definition of γ(·, T1∗ ) is clear from the context).

This can be easily achieved using Girsanov’s theorem, as we may put

Z ·

dPT1∗

= ET1∗

γ(u, T1∗ ) · dWu , P-a.s.

dP

0

We are in a position to specify the dynamics of the forward Libor rate for the date T2∗ under PT1∗ ,

namely we postulate that

T∗

dL(t, T2∗ ) = L(t, T2∗ ) λ(t, T2∗ ) · dWt 1

with the initial condition

B(0, T2∗ ) − B(0, T1∗ )

.

δn−1 B(0, T1∗ )

L(0, T2∗ ) =

∗

Let us now assume that we have found processes L(·, T1∗ ), . . . , L(·, Tm

). This means, in particular,

∗

∗

and the associated Brownian motion W Tm−1 are already

that the forward Libor measure PTm−1

∗ . It is easy to check that

specified. Our aim is to determine the forward Libor measure PTm

Um+1 (t, Tk∗ ) :=

Um (t, Tk∗ )

B(t, Tk∗ )

=

.

∗)

∗)

B(t, Tm

1 + δn−m L(t, Tm

Using Lemma 2.1, we obtain the following relationship

T∗

Wt m

=

T∗

Wt m−1

Z

−

t

0

∗

δn−m L(u, Tm

)

∗

λ(u, Tm

) du

∗)

1 + δn−m L(u, Tm

∗

∗ can thus be easily found using Girsanov’s theorem.

]. The forward Libor measure PTm

for t ∈ [0, Tm

∗

) as the solution to the SDE

Finally, we define the process L(·, Tm+1

∗

Tm

∗

∗

∗

) = L(t, Tm+1

) λ(t, Tm+1

) · dWt

dL(t, Tm+1

with the initial condition

∗

)=

L(0, Tm+1

∗

∗

B(0, Tm+1

) − B(0, Tm

)

.

∗)

δn−m B(0, Tm

Remarks. (i) It is not difficult to check that equality (6) is satisfied within the present setup.

(ii) If the volatility coefficient λ(·, Tm ) : [0, Tn ] → Rd is a deterministic function, then for each

date t ∈ [0, Tm ] the random variable L(t, Tm ) has a lognormal probability law under the forward

probability measure PTm+1 .

Let us now examine the existence and uniqueness of the implied savings account,8 in a discretetime setup. Intuitively, the value Bt∗ of a savings account at time t can be interpreted as the cash

amount accumulated up to time t by rolling over a series of zero-coupon bonds with the shortest

maturities available. To find the process B ∗ in a discrete-tenor framework, we do not have to specify

explicitly all bond prices; the knowledge of forward bond prices is sufficient. Indeed, it is clear that

FB (t, Tj , Tj+1 ) =

B(t, Tj )

FB (t, Tj , T ∗ )

=

.

∗

FB (t, Tj+1 , T )

B(t, Tj+1 )

8 The interested reader is referred to Musiela and Rutkowski (1997b) for the definition of an implied savings

account in a continuous-time setup. See also Döberlein and Schweizer (1998) and Döberlein et al. (1999) for further

developments and the general uniqueness result.

13

Modelling of Forward Libor and Swap Rates

This in turn yields, upon setting t = Tj

FB (Tj , Tj , Tj+1 ) = 1/B(Tj , Tj+1 ),

(22)

so that the price B(Tj , Tj+1 ) of a single-period bond is uniquely specified for every j. Though the

bond that matures at time Tj does not physically exist after this date, it seems justifiable to consider

FB (Tj , Tj , Tj+1 ) as its forward value at time Tj for the next future date Tj+1 . In other words, the

spot value at time Tj+1 of one cash unit received at time Tj equals B −1 (Tj , Tj+1 ). The discrete-time

savings account B ∗ thus equals, for k = 0, . . . , n (recall that T−1 = 0),

BT∗k =

k

Y

k

Y

−1

FB Tj−1 , Tj−1 , Tj =

B Tj−1 , Tj

j=0

j=0

since, by convention, we set B0∗ = 1. Note that FB Tj−1 , Tj−1 , Tj = 1 + δL(Tj−1 , Tj ) > 1 for j =

0, . . . , n, and since BT∗j = FB (Tj−1 , Tj−1 , Tj ) BT∗j−1 , we find that BT∗j > BT∗j−1 for every j = 0, . . . , n.

We conclude that the implied savings account B ∗ follows a strictly increasing discrete-time process.

Let us define the probability measure P∗ , equivalent to P on (Ω, FT ∗ ), by the formula9

dP∗

= BT∗ ∗ B(0, T ∗ ),

dP

P-a.s.

(23)

The probability measure P∗ appears to be a plausible candidate for a spot martingale measure.

Indeed, if we set

(24)

B(Tl , Tk ) = E P∗ (BT∗l /BT∗k | FTl )

for every l ≤ k ≤ n, then in the case of l = k − 1, equality (24) coincides with (22). Let us observe

that it is not possible to uniquely determine the continuous-time dynamics of a bond price B(t, Tj )

within the framework of the discrete-tenor model of forward Libor rates (the specification of forward

Libor rates for all maturities is necessary for this purpose).

2.2.4

Jamshidian’s Approach

The backward induction approach to modelling of forward Libor rates presented in the preceding

section was re-examined and essentially generalized by Jamshidian (1997). In this section, we present

briefly his approach to the modelling of forward Libor rates. As made apparent in the preceding

section, in the direct modelling of Libor rates, no explicit reference is made to the bond price

processes, which are used to formally define a forward Libor rate through equality (13). Nevertheless,

to explain the idea that underpins Jamshidian’s approach, we shall temporarily assume that we are

given a family of bond prices B(t, Tj ) for the future dates Tj , j = 1, . . . , n. By definition, the spot

Libor measure is that probability measure equivalent to P, under which all relative bond prices

are local martingales, when the price process obtained by rolling over single-period bonds, is taken

as a numeraire. The existence of such a measure can be either postulated, or derived from other

conditions.10 Let us put, for t ∈ [0, T ∗ ] (as before T−1 = 0)

Y

m(t)

Gt = B(t, Tm(t) )

B −1 (Tj−1 , Tj ),

(25)

j=0

where

m(t) = inf {k = 0, 1, . . . |

k

X

δi ≥ t} = inf {k = 0, 1, . . . | Tk ≥ t}.

i=0

9 Recall that P plays the role of the forward Libor measure for the date T ∗ . Therefore, formula (23) is a consequence

of standard definition of a forward measure.

10 One may assume, e.g., that bond prices B(t, T ) satisfy the weak no-arbitrage condition, meaning that there exists

j

a probability measure P̃, equivalent to P, and such that all processes B(t, Tk )/B(t, T ∗ ) are P̃-local martingales.

14

M.Rutkowski

It is easily seen that Gt represents the wealth at time t of a portfolio which starts at time 0 with one

unit of cash invested in a zero-coupon bond of maturity T0 , and whose wealth is then reinvested at

each date Tj , j = 0, . . . , n − 1, in zero-coupon bonds which mature at the next date; that is, Tj+1 .

Definition 2.3 A spot Libor measure PL is a probability measure on (Ω, FT ∗ ) which is equivalent

to P, and such that for any j = 0, . . . , n the relative bond price B(t, Tj )/Gt follows a local martingale

under PL .

Note that

Y

m(t)

B(t, Tk+1 )/Gt =

−1

1 + δj L(Tj−1 , Tj−1 )

j=0

k

Y

1 + δj L(t, Tj−1 )

j=m(t)+1

so that all relative bond prices B(t, Tj )/Gt , j = 0, . . . , n are uniquely determined by a collection of

forward Libor rates. In this sense, G is the correct choice of the reference price process in the present

setting. We shall now concentrate on the derivation of the dynamics under PL of forward Libor rates

L(·, Tj ), j = 0, . . . , n − 1. Our aim is to show that these dynamics involve only the volatilities of

forward Libor rates (as opposed to volatilities of bond prices or other processes). Therefore, it

is possible to define the whole family of forward Libor rates simultaneously under one probability

measure (of course, this feature can also be deduced from the preceding construction). To facilitate

the derivation of the dynamics of L(·, Tj ), we postulate temporarily that bond prices B(t, Tj ) follow

Itô processes under the underlying probability measure P, more explicitly

(26)

dB(t, Tj ) = B(t, Tj ) a(t, Tj ) dt + b(t, Tj ) · dWt

for every j = 0, . . . , n, where, as before, W is a d-dimensional standard Brownian motion under an

underlying probability measure P (it should be stressed, however, that we do not assume here that

P is a forward (or spot) martingale measure). Combining (25) with (26), we obtain

(27)

dGt = Gt a(t, Tm(t) ) dt + b(t, Tm(t) ) · dWt .

Furthermore, by applying Itô’s rule to equality

1 + δj+1 L(t, Tj ) =

B(t, Tj )

,

B(t, Tj+1 )

(28)

we find that

dL(t, Tj ) = µ(t, Tj ) dt + ζ(t, Tj ) · dWt ,

where

µ(t, Tj ) =

B(t, Tj )

a(t, Tj ) − a(t, Tj+1 ) − ζ(t, Tj )b(t, Tj+1 )

δj+1 B(t, Tj+1 )

and

ζ(t, Tj ) =

B(t, Tj )

b(t, Tj ) − b(t, Tj+1 ) .

δj+1 B(t, Tj+1 )

(29)

Using (28) and the last formula, we arrive at the following relationship

b(t, Tm(t) ) − b(t, Tj+1 ) =

j

X

k=m(t)

δk+1 ζ(t, Tk )

.

1 + δk+1 L(t, Tk )

(30)

By definition of a spot Libor measure PL , each relative price B(t, Tj )/Gt follows a local martingale

under PL . Since, in addition, PL is assumed to be equivalent to P, it is clear that it is given by the

Doléans exponential, that is

Z ·

dPL

= ET ∗

hu · dWu , P-a.s.

dP

0

15

Modelling of Forward Libor and Swap Rates

for some adapted process h. It it not hard to check, using Itô’s rule, that h necessarily satisfies, for

t ∈ [0, Tj ],

a(t, Tj ) − a(t, Tm(t) ) = b(t, Tm(t) ) − ht · b(t, Tj ) − b(t, Tm(t) )

for every j = 0, . . . , n. Combining (29) with the last formula, we obtain

B(t, Tj )

a(t, Tj ) − a(t, Tj+1 ) = ζ(t, Tj ) · b(t, Tm(t) ) − ht ,

δj+1 B(t, Tj+1 )

and this in turn yields

dL(t, Tj ) = ζ(t, Tj ) ·

b(t, Tm(t) ) − b(t, Tj+1 ) − ht dt + dWt .

Using (30), we conclude that process L(·, Tj ) satisfies

j

X

dL(t, Tj ) =

k=m(t)

δk+1 ζ(t, Tk ) · ζ(t, Tj )

dt + ζ(t, Tj ) · dWtL ,

1 + δk+1 L(t, Tk )

Rt

where the process WtL = Wt − 0 hu du follows a d-dimensional standard Brownian motion under

the spot Libor measure PL . To further specify the model, we assume that processes ζ(t, Tj ), j =

0, . . . , n − 1, have the following form, for t ∈ [0, Tj ],

ζ(t, Tj ) = λj t, L(t, Tj ), L(t, Tj+1 ), . . . , L(t, Tn ) ,

where λj : [0, Tj ] × Rn−j+1 → Rd are given functions. In this way, we obtain a system of SDEs

dL(t, Tj ) =

j

X

k=m(t)

δk+1 λk (t, Lk (t)) · λj (t, Lj (t))

dt + λj (t, Lj (t)) · dWtL ,

1 + δk+1 L(t, Tk )

where we write Lj (t) = (L(t, Tj ), L(t, Tj+1 ), . . . , L(t, Tn )). Under mild regularity assumptions, this

system can be solved recursively, starting from L(·, Tn−1 ). The lognormal model of forward Libor

rates corresponds to the choice of ζ(t, Tj ) = λ(t, Tj )L(t, Tj ), where λ(·, Tj ) : [0, Tj ] → Rd is a

deterministic function for every j.

2.3

Dynamics of Libor Rates and Bond Prices

We assume that the volatilities of processes L(·, Tj ) follow deterministic functions. Put another

way, we place ourselves within the framework of the lognormal model of forward Libor rates. It is

interesting to note that in all approaches, there is a uniquely determined correspondence between

forward measures (and forward Brownian motions) associated with different dates T0 , . . . , Tn . On

the other hand, however, there is a considerable degree of ambiguity in the way in which the spot

martingale measure is specified (in some instances, it is not introduced at all). Consequently, the

futures Libor rate Lf (·, Tj ), which equals (cf. Section 2.1.3)

Lf (t, Tj ) = E P∗ (L(Tj , Tj ) | Ft ) = E P∗ (L̃(Tj , Tj ) | Ft ),

(31)

is not necessarily specified in the same way in various approaches to the lognormal model of forward

Libor rates. For this reason, we start by examining the distributional properties of forward Libor

rates, which are identicall in all abovementioned models.

For a given function g : R

→ R and a fixed date u ≤ Tj , we are interested in the following payoff

of the form X = g L(u, Tj ) which settles at time Tj . Particular cases of such payoffs are

X1 = g B −1 (Tj , Tj+1 ) , X2 = g B(Tj , Tj+1 ) , X3 = g FB (u, Tj+1 , Tj ) .

16

M.Rutkowski

Recall that

B −1 (Tj , Tj+1 ) = 1 + δj+1 L(Tj , Tj ) = 1 + δj+1 L̃(Tj , Tj ) = 1 + δj+1 Lf (Tj , Tj ).

The choice of the “pricing measure” is thus largely the matter of convenience. Similarly, we have

B(Tj , Tj+1 ) =

1

= FB (Tj , Tj+1 , Tj ).

1 + δj+1 L(Tj , Tj )

(32)

More generally, the forward price of a Tj+1 -maturity bond for the settlement date Tj equals

FB (u, Tj+1 , Tj ) =

1

B(u, Tj+1 )

=

.

B(u, Tj )

1 + δj+1 L(u, Tj )

(33)

Generally speaking, to value the claim X = g(L(u, Tj )) = g̃(FB (u, Tj+1 , Tj )) which settles at time

Tj we may use the formula

πt (X) = B(t, Tj )E PTj (X | Ft ),

∀ t ∈ [0, Tj ].

It is thus clear that to value a claim in the case u ≤ Tj , it is enough to know the dynamics of either

L(·, Tj ) or FB (·, Tj+1 , Tj ) under the forward probability measure PTj . If u = Tj , we may equally well

use the the dynamics, under PTj , of either L̃(·, Tj ) or Lf (·, Tj ). For instance,

πt (X1 )

= B(t, Tj )E PTj (B −1 (Tj , Tj+1 ) | Ft )

= B(t, Tj )E PTj (FB−1 (Tj , Tj+1 , Tj ) | Ft )

but also

πt (X1 ) = B(t, Tj ) 1 + δj+1 E PTj (Z(Tj ) | Ft ) ,

where Z(Tj ) = L(Tj , Tj ) = L̃(Tj , Tj ) = Lf (Tj , Tj ).

2.3.1

Dynamics of L(·, Tj ) under PTj

We shall now derive the transition probability density function (p.d.f.) of the process L(·, Tj ) under

the forward probability measure PTj . Let us first prove the following related result, due to Jamshidian

(1997).

Proposition 2.1 Let t ≤ u ≤ Tj . Then

E PTj L(u, Tj ) | Ft = L(t, Tj ) +

δj+1 Var PTj+1 L(u, Tj ) | Ft

1 + δj+1 L(t, Tj )

.

(34)

In the case of the lognormal model of Libor rates, we have

E PTj L(u, Tj ) | Ft

where

vj2 (t, u) = Var PTj+1

2

δj+1 L(t, Tj ) evj (t,u) − 1

= L(t, Tj ) 1 +

1 + δj+1 L(t, Tj )

Z

u

t

Z

λ(s, Tj ) · dWsTj+1 =

u

!

,

(35)

|λ(s, Tj )|2 ds.

(36)

t

In particular, the modified Libor rate L̃(t, Tj ) satisfies11

L̃(t, Tj ) = E PTj L(Tj , Tj ) | Ft

11 This

2

δj+1 L(t, Tj ) evj (t,Tj ) − 1

= L(t, Tj ) 1 +

1 + δj+1 L(t, Tj )

equality can be referred to as the convexity correction.

!

.

17

Modelling of Forward Libor and Swap Rates

Proof.

Combining (6) with the martingale property of the process L(·, Tj ) under PTj+1 , we obtain

E PTj L(u, Tj ) | Ft =

so that

E PTj+1 (1 + δj+1 L(u, Tj ))L(u, Tj ) | Ft

1 + δj+1 L(t, Tj )

δj+1 E PTj+1 (L(u, Tj ) − L(t, Tj ))2 | Ft

E PTj L(u, Tj ) | Ft = L(t, Tj ) +

1 + δj+1 L(t, Tj )

.

In the case of the lognormal model, we have

1

2

L(u, Tj ) = L(t, Tj ) eηj (t,u)− 2 vj (t,u) ,

Z

where

u

ηj (t, u) =

t

Consequently,

λ(s, Tj ) dWsTj+1 .

(37)

2

E PTj+1 (L(u, Tj ) − L(t, Tj ))2 | Ft = L2 (t, Tj ) evj (t,u) − 1 .

This gives the desired equality (35). The last asserted equality is a consequence of (7).

2

To derive the transition probability density function (p.d.f.) of the process L(·, Tj ), notice that

for any t ≤ u ≤ Tj , and any bounded Borel measurable function g : R → R we have

E PTj+1 g(L(u, Tj )) 1 + δj+1 L(u, Tj ) Ft

.

E PTj g(L(u, Tj )) | Ft =

1 + δj+1 L(t, Tj )

The following simple lemma appears to be useful.

Lemma 2.2 Let ζ be a nonnegative random variable on a probability space (Ω, F , P) with the probability density function fP . Let Q be a probability measure equivalent to P. Suppose that for any

bounded Borel measurable function g : R → R we have

E P (g(ζ)) = E Q (1 + ζ)g(ζ) .

Then the p.d.f. fQ of ζ under Q satisfies fP (y) = (1 + y)fQ (y).

Proof.

The assertion is in fact trivial since, by assumption,

Z ∞

Z ∞

g(y)fP (y) dy =

g(y)(1 + y)fQ (y) dy

−∞

−∞

for any bounded Borel measurable function g : R → R.

2

Assume the lognormal model of Libor rates and fix x ∈ R. Recall that for any t ≥ u we have

L(u, Tj ) = L(t, Tj ) e

ηj (t,u)− 12 Var PT

j+1

(ηj (t,u))

,

where ηj (t, u) is given by (37) (so that it is independent of the σ-field Ft ). Markovian property of

L(·, Tj ) under the forward measure PTj+1 is thus apparent. Denote by pL (t, x; u, y) the transition

p.d.f. under PTj+1 of the process L(·, Tj ). Elementary calculations involving Gaussian densities yield

pL (t, x; u, y) =

=

PTj+1 {L(u, Tj ) = y | L(t, Tj ) = x}

(

2 )

ln(y/x) + 12 vj2 (t, u)

1

√

exp −

2vj2 (t, u)

2πvj (t, u)y

18

M.Rutkowski

for any x, y > 0 and t < u. Taking into account Lemma 2.2, we conclude that the transition p.d.f.

of the process12 L(·, Tj ), under the forward probability measure PTj , satisfies

p̃L (t, x; u, y) = PTj {L(u, Tj ) = y | L(t, Tj ) = x} =

1 + δj+1 y

pL (t, x; u, y).

1 + δj+1 x

We are in a position to state the following result, which can be used, for instance, to value a

contingent claim of the form X = h(L(Tj )) which settles at time Tj (cf. Schmidt (1996)).

Corollary 2.1 The transition p.d.f. under PTj of the forward Libor rate L(·, Tj ) equals, for any

t < u and x, y > 0,

(

2 )

ln(y/x) + 12 vj2 (t, u)

1 + δj+1 y

.

exp −

p̃L (t, x; u, y) = √

2vj2 (t, u)

2πvj (t, u) y(1 + δj+1 x)

2.3.2

Dynamics of FB (·, Tj+1 , Tj ) under PTj

Observe that the forward bond price FB (·, Tj+1 , Tj ) satisfies

FB (t, Tj+1 , Tj ) =

1

B(t, Tj+1 )

=

.

B(t, Tj )

1 + δj+1 L(t, Tj )

(38)

First, this implies that in the lognormal model of Libor rates, the dynamics of the forward bond

price FB (·, Tj+1 , Tj ) are governed by the following stochastic differential equation, under PTj ,

T

dFB (t) = −FB (t) 1 − FB (t) λ(t, Tj ) · dWt j ,

(39)

where we write FB (t) = FB (t, Tj+1 , Tj ). If the initial condition satisfies 0 < FB (0) < 1, this equation

can be shown to admit a unique strong solution (it satisfies 0 < FB (t) < 1 for every t > 0). This

makes clear that the process FB (·, Tj+1 , Tj ) – and thus also the process L(·, Tj ) – are Markovian

under PTj . Using Corollary 2.1 and relationship (38), one can find the transition p.d.f. of the Markov

process FB (·, Tj+1 , Tj ) under PTj ; that is,

pB (t, x; u, y) = PTj {FB (u, Tj+1 , Tj ) = y | FB (t, Tj+1 , Tj ) = x}.

We have the following result (see Rady and Sandmann (1994), Miltersen et al. (1997), and Jamshidian

(1997)).

Corollary 2.2 The transition p.d.f. under PTj of the forward bond price FB (·, Tj+1 , Tj ) equals, for

any t < u and arbitrary 0 < x, y < 1,

2

x(1−y)

1 2

ln y(1−x) + 2 vj (t, u)

x

.

exp −

pB (t, x; u, y) = √

2vj2 (t, u)

2πvj (t, u)y 2 (1 − y)

Proof.

Let us fix x ∈ (0, 1). Using (38), it is easy to show that

1−x

1 − y

; u,

,

pB (t, x; u, y) = δ −1 y −2 p̃L t,

δx

δy

where δ = δj+1 . The formula now follows from Corollary 2.1.

2

Let us observe that the results of this section can be applied to value the so-called irregular cash

flows, such as caps or floors settled in advance (for more details on this issue we refer to Schmidt

(1996)).

12 The Markov property of L(·, T ) under P

j

Tj can be easily deduced from the Markovian features of the forward

price FB (·, Tj , Tj+1 ) under PTj (see formulae (38)–(39)).

19

Modelling of Forward Libor and Swap Rates

2.4

Caps and Floors

An interest rate cap (known also as a ceiling rate agreement) is a contractual arrangement where

the grantor (seller) has an obligation to pay cash to the holder (buyer) if a particular interest rate

exceeds a mutually agreed level at some future date or dates. Similarly, in an interest rate floor, the

grantor has an obligation to pay cash to the holder if the interest rate is below a preassigned level.

When cash is paid to the holder, the holder’s net position is equivalent to borrowing (or depositing)

at a rate fixed at that agreed level. This assumes that the holder of a cap (or floor) agreement also

holds an underlying asset (such as a deposit) or an underlying liability (such as a loan). Finally, the

holder is not affected by the agreement if the interest rate is ultimately more favorable to him than

the agreed level. This feature of a cap (or floor) agreement makes it similar to an option. Specifically,

a forward start cap (or a forward start floor) is a strip of caplets (floorlets), each of which is a call

(put) option on a forward rate, respectively. Let us denote by κ and by δj the cap strike rate and

the length of the accrual period, respectively. We shall check that an interest rate caplet (i.e., one

leg of a cap) may also be seen as a put option with strike price 1 (per dollar of notional principal)

which expires at the caplet start day on a discount bond with face value 1 + κδj which matures at

the caplet end date.

Similarly to swap agreements, interest rate caps and floors may be settled either in arrears or

in advance. In a forward cap or floor, which starts at time T0 , and is settled in arrears at dates

Tj , j = 1, . . . , n, the cash flows at times Tj are Np (L(Tj−1 ) − κ)+ δj and Np (κ − L(Tj−1 ))+ δj ,

respectively, where Np stands for the notional principal (recall that δj = Tj − Tj−1 ). As usual, the

rate L(Tj−1 ) = L(Tj−1 , Tj−1 ) is determined at the reset date Tj−1 , and it satisfies

B(Tj−1 , Tj )−1 = 1 + δj L(Tj−1 ).

(40)

The price at time t ≤ T0 of a forward cap, denoted by FCt , is (we set Np = 1)

FCt

=

=

n

X

j=1

n

X

E P∗

B

t

(L(Tj−1 ) − κ)+ δj Ft

BTj

B(t, Tj ) E PTj (L(Tj−1 ) − κ)+ δj Ft .

(41)

j=1

On the other hand, since the cash flow of the j th caplet at time Tj is manifestly a FTj−1 -measurable

random variable, we may directly express the value of the cap in terms of expectations under forward

measures PTj−1 , j = 1, . . . , n. Indeed, we have

FCt =

n

X

B(t, Tj−1 ) E PTj−1 B(Tj−1 , Tj )(L(Tj−1 ) − κ)+ δj Ft .

(42)

j=1

Consequently, using (40) we get equality

FCt =

n

X

B(t, Tj−1 ) E PTj−1

+ 1 − δ̃j B(Tj−1 , Tj ) Ft ,

(43)

j=1

which is valid for every t ∈ [0, T ]. It is apparent that a caplet is essentially equivalent to a put option

on a zero-coupon bond; it may also be seen as an option on a single-period swap.

The equivalence of a cap and a put option on a zero-coupon bond can be explained in an intuitive

way. For this purpose, it is enough to examine two basic features of both contracts: the exercise set

and the payoff value. Let us consider the j th caplet. A caplet is exercised at time Tj−1 if and only

if L(Tj−1 ) − κ > 0, or equivalently, if

B(Tj−1 , Tj )−1 = 1 + L(Tj−1 )(Tj − Tj−1 ) > 1 + κδj = δ̃j .

20

M.Rutkowski

The last inequality holds whenever δ̃j B(Tj−1 , Tj ) < 1. This shows that both of the considered

options are exercised in the same circumstances. If exercised, the caplet pays δj (L(Tj−1 ) − κ) at

time Tj , or equivalently

δj B(Tj−1 , Tj )(L(Tj−1 ) − κ) = 1 − δ̃j B(Tj−1 , Tj ) = δ̃j δ̃j−1 − B(Tj−1 , Tj )

at time Tj−1 . This shows once again that the j th caplet, with strike level κ and nominal value 1, is

essentially equivalent to a put option with strike price (1 + κδj )−1 and nominal value δ̃j = (1 + κδj )

written on the corresponding zero-coupon bond with maturity Tj .

The analysis of a floor contract can be done long the simlar lines. By definition, the j th floorlet

pays (κ − L(Tj−1 ))+ at time Tj . Therefore,

FFt =

n

X

E P∗

j=1

but also

FFt =

n

X

B

t

(κ − L(Tj−1 ))+ δj Ft ,

BTj

B(t, Tj−1 ) E PTj−1

δ̃j B(Tj−1 , Tj ) − 1

+ Ft .

(44)

(45)

j=1

Combining (41) with (44) (or (43) with (45)), we obtain the following cap-floor parity relationship

FCt − FFt =

n

X

B(t, Tj−1 ) − δ̃j B(t, Tj )

(46)

j=1

which is also an immediate consequence of the no-arbitrage property, so that it does not depend on

model’s choice.

2.4.1

Market Valuation Formula for Caps and Floors

The main motivation for the introduction of a lognormal model of Libor rates was the market practice

of pricing caps and swaptions by means of Black-Scholes-like formulae. For this reason, we shall

first describe how market practitioners value caps. The formulae commonly used by practitioners

assume that the underlying instrument follows a geometric Brownian motion under some probability

measure, Q say. Since the formal definition of this probability measure is not available, we shall

informally refer to Q as the market probability.

Let us consider an interest rate cap with expiry date T and fixed strike level κ. Market practice

is to price the option assuming that the underlying forward interest rate process is lognormally

distributed with zero drift. Let us first consider a caplet – that is, one leg of a cap. Assume that the

forward Libor rate L(t, T ), t ∈ [0, T ], for the accrual period of length δ follows a geometric Brownian

motion under the “market probability”, Q say. More specifically

dL(t, T ) = L(t, T )σ dWt ,

(47)

where W follows a one-dimensional standard Brownian motion under Q, and σ is a strictly positive

constant. The unique solution of (47) is

(48)

L(t, T ) = L(0, T ) exp σWt − 12 σ 2 t2 , ∀ t ∈ [0, T ],

where the initial condition is derived from the yield curve Y (0, T ), namely

B(0, T )

= exp (T + δ)Y (0, T + δ) − T Y (0, T ) .

1 + δL(0, T ) =

B(0, T + δ)

The “market price” at time t of a caplet with expiry date T and strike level κ is calculated by means

of the formula

FC t = δB(t, T + δ) E Q (L(T, T ) − κ)+ Ft .

21

Modelling of Forward Libor and Swap Rates

More explicitly, for any t ∈ [0, T ] we have

FC t = δB(t, T + δ) L(t, T )N ê1 (t, T ) − κN ê2 (t, T ) ,

(49)

where N is the standard Gaussian cumulative distribution function

Z x

2

1

e−z /2 dz, ∀ x ∈ R,

N (x) = √

2π −∞

and

ê1,2 (t, T ) =

ln(L(t, T )/κ) ± 12 v̂02 (t, T )

v̂0 (t, T )

with v̂02 (t, T ) = σ 2 (T − t). This means that market practitioners price caplets using Black’s formula,

with discount from the settlement date T + δ.

A cap settled in arrears at times Tj , j = 1, . . . , n, where Tj − Tj−1 = δj , T0 = T, is priced by

the formula

n

X

δj B(t, Tj ) L(t, Tj−1 )N êj1 (t) − κN êj2 (t) ,

(50)

FCt =

j=1

where for every j = 0, . . . , n − 1

êj1,2 (t) =

ln(L(t, Tj−1 )/κ) ±

v̂j (t)

1

2

v̂j2 (t)

(51)

and v̂j2 (t) = (Tj−1 − t)σj2 for some constants σj , j = 1, . . . , n. Apparently, the market assumes that

for any maturity Tj , the corresponding forward Libor rate has a lognormal probability law under the

“market probability”. The value of a floor can be easily derived by combining (50)–(51) with the

cap-floor parity relationship (46). As we shall see in what follows, the valuation formulae obtained

for caps and floors in the lognormal model of forward Libor rates agree with the market practice.

2.4.2

Valuation in the Lognormal Model of Forward Libor Rates

We shall now examine the valuation of caps within the lognormal model of forward Libor rates of

Section 2.2.3. The dynamics of the forward Libor rate L(t, Tj−1 ) under the forward probability

measure PTj are

T

(52)

dL(t, Tj−1 ) = L(t, Tj−1 ) λ(t, Tj−1 ) · dWt j ,

where W Tj follows a d-dimensional Brownian motion under the forward measure PTj , and λ(·, Tj−1 ) :

[0, Tj−1 ] → Rd is a deterministic function. Consequently, for every t ∈ [0, Tj−1 ] we have

Z ·

λ(u, Tj−1 ) · dWuTj .

L(t, Tj−1 ) = L(0, Tj−1 )Et

0

In the present setup, the cap valuation formula (53) was first established by Miltersen et al. (1997),

who focused on the dynamics of the forward Libor rate for a given date. Equality (53) was subsequently rederived through a probabilistic approach in Goldys (1997) and Rady (1997). Finally, the

same result was established by means of the forward measure approach in Brace et al. (1997). The

following proposition is a consequence of formula (42), combined with the dynamics (52). As before,

N is the standard Gaussian probability distribution function.

Proposition 2.2 Consider an interest rate cap with strike level κ, settled in arrears at times Tj , j =

1, . . . , n. Assuming the lognormal model of Libor rates, the price of a cap at time t ∈ [0, T ] equals

FCt =

n

X

j=1

n

X

j

j

δj B(t, Tj ) L(t, Tj−1 )N ẽ1 (t) − κN ẽ2 (t) =

FC jt ,

j=1

(53)

22

M.Rutkowski

where FC jt stands for the price at time t of the j th caplet for n j = 1, . . . , n

ẽj1,2 (t) =

ln(L(t, Tj−1 )/κ) ±

ṽj (t)

and

ṽj2 (t)

Z

Tj−1

=

1

2

ṽj2 (t)

|λ(u, Tj−1 )|2 du.

t

Proof. We fix j and we consider the j th caplet. It is clear that its payoff at time Tj admits the

representation

(54)

FC jTj = δj (L(Tj−1 ) − κ)+ = δj L(Tj−1 ) ID − δj κ ID ,

where D = {L(Tj−1 ) > K} is the exercise set. Since the caplet settles at time Tj , it is convenient

to use the forward measure PTj to find its arbitrage price. We have

FC jt = B(t, Tj )E PTj FC jTj | Ft ),

∀ t ∈ [0, Tj ].

Obviously, it is enough to find the value of a caplet for t ∈ [0, Tj−1 ]. In view of (54), it is clear that

we need to evaluate the following conditional expectations

FC jt = δj B(t, Tj ) E PTj L(Tj−1 ) ID Ft − κδj B(t, Tj ) PTj (D | Ft )

= δj B(t, Tj )(I1 − I2 ),

where the meaning of I1 and I2 is clear from the context. Recall that L(Tj−1 ) is given by the formula

Z

Tj−1

L(Tj−1 ) = L(t, Tj−1 ) exp

t

λ(u, Tj−1 ) · dWuTj −

1

2

Z

Tj−1

|λ(u, Tj−1 )|2 du .

t

Since λ(·, Tj−1 ) is a deterministic function, the probability law under PTj of the Itô integral

Z

Tj−1

λ(u, Tj−1 ) · dWuTj

ζ(t, Tj−1 ) =

t

is Gaussian, with zero mean and the variance

Z

Var PTj (ζ(t, Tj−1 )) =

Tj−1

|λ(u, Tj−1 )|2 du.

t

Therfore, it is straightforward to show that13

I2 = κ N

ln(L(t, Tj−1 ) − ln κ − 12 vj2 (t)

vj (t)

!

.

To evaluate I1 , we introduce an auxiliary probability measure P̂Tj , equivalent to PTj on (Ω, FTj−1 ),

by setting

Z ·

dP̂Tj

= ETj−1

λ(u, Tj−1 ) · dWuTj .

dPTj

0

Then the process Ŵ Tj given by the formula

Z t

T

T

λ(u, Tj−1 ) du,

Ŵt j = Wt j −

0

13 See,

∀ t ∈ [0, Tj−1 ],

for instance, the proof of the Black-Scholes formula in Musiela and Rutkowski (1997a).

23

Modelling of Forward Libor and Swap Rates

follows the d-dimensional standard Brownian motion under P̂Tj . Furthermore, the forward price

L(Tj−1 ) admits the representation under P̂Tj , for t ∈ [0, Tj−1 ]

Z

Tj−1

L(Tj−1 ) = L(t, Tj−1 ) exp

t

λj−1 (u) · dŴuTj +

1

2

Z

Tj−1

|λj−1 (u)|2 du

t

where we set λj−1 (u) = λ(u, Tj−1 ). Since

Z

I1 = L(t, Tj−1 )E PTj ID exp

Tj−1

t

λj−1 (u) · dWuTj −

1

2

Z

Tj−1

|λj−1 (u)|2 du Ft

t

from the abstract Bayes rule we get I1 = L(t, Tj−1 ) P̂Tj (D | Ft ). Arguing in much the same way as

for I2 , we thus obtain

!

ln L(t, Tj−1 ) − ln κ + 12 vj2 (t)

.

I1 = L(t, Tj−1 ) N

vj (t)

2

This completes the proof of the proposition.

Once again, to derive the floors valuation formula, it is enough to make use of the cap-floor parity

(46).

2.4.3

Hedging of Caps and Floors

It is clear the replicating strategy for a cap is a simple sum of replicating strategies for caplets.

Therefore, it is enough to focus on a particular caplet. Let us denote by FC (t, Tj ) the forward price

of the j th caplet for the settlement date Tj . From (53), it is clear that

FC (t, Tj ) = δj L(t, Tj−1 )N ẽj1 (t) − κ N ẽj2 (t) ,

so that an application of Itô’s formula yields14

dFC (t, Tj ) = δj N ẽj1 (t) dL(t, Tj−1 ).

(55)

Let us consider the following self-financing trading strategy in the Tj -forward market. We start our

trade at time 0 with FC (0, Tj ) units of zero-coupon bonds.15 At any time t ≤ Tj−1 we assume

ψtj = N ẽj1 (t) positions in forward rate agreements (that is, single-period forward swaps) over the

period [Tj−1 , Tj ]. The associated gains/losses process V, in the Tj forward market,16 satisfies17

dVt = δj ψtj dL(t, Tj−1 ) = δj N ẽj1 (t) dL(t, Tj−1 ) = dFC (t, T )

with V0 = 0. Consequently,

Z

FC (Tj−1 , Tj ) = FC (0, Tj ) +

0

Tj−1

δj ψtj dL(t, Tj−1 ) = FC (0, Tj ) + VTj−1 .

It should be stressed that dynamic trading takes place on the interval [0, Tj−1 ] only, the gains/losses

(involving the initial investment) are incurred at time Tj , however. All quantities in the last formula

are expressed in units of Tj -maturity zero-coupon bonds. Also, the caplet’s payoff is known already at

time Tj−1 , so that it is completely specified by its forward price FC (Tj−1 , Tj ) = FC jTj−1 /B(Tj−1 , Tj ).

Therefore the last equality makes it clear that the strategy ψ introduced above does indeed replicate

the j th caplet.

14 The

calculations here are essentially the same as in the classic Black-Scholes model.

need thus to invest FC j0 = FC (0, Tj )B(0, Tj ) of cash at time 0.

16 That is, with the value expressed in units of T -maturity zero-coupon bonds.

j

17 To get a more intuitive insight in this formula, it is advisable to consider first a discretized version of ψ.

15 We

24

M.Rutkowski

It should be observed that formally the replicating strategy has also the second component, ηtj

say, which represents the number of forward contracts on Tj -maturity bond, with the settlement

date Tj . Since obviously FB (t, Tj , Tj ) = 1 for every t ≤ Tj , so that dFB (t, Tj , Tj ) = 0, for the

Tj -forward value of our strategy, we get Ṽt (ψ j , η j ) = ηtj = FC (t, Tj ) and

dṼt (ψ j , η j ) = ψtj δj dL(t, Tj−1 ) + ηtj dFB (t, Tj , Tj ) = δj N ẽj1 (t) dL(t, Tj−1 ).

It should be stressed however, with the exception for the initial investment at time 0 in Tj -maturity

bonds, no bonds trading is required for the caplet’s replication. In practical terms, the hedging of a

cap within the framework of the lognormal model of forward Libor rates in done exclusively through

dynamic trading in the underlying single-period swaps. Of course, the same remarks (and similar

calculations) apply also to floors. In this interpretation, the component η j simply represents the

future (i.e., as of time Tj−1 ) effects of a continuous trading in forward contracts.

Alternatively, the hedging of a cap can be done in the spot (i.e., cash) market, using two simple

portfolios of bonds. Indeed, it is easily seen that for the process

Vt (ψ j , η j ) = B(t, Tj−1 )Ṽt (ψ j , η j ) = FC jt

we have

Vt (ψ j , η j ) = ψtj B(t, Tj−1 ) − B(t, Tj ) + ηtj dFB (t, Tj , Tj )

and

dVt (ψ j , η j ) =

=

ψtj d B(t, Tj−1 ) − B(t, Tj ) + ηtj dB(t, Tj )

N ẽj1 (t) d B(t, Tj−1 ) − B(t, Tj ) + ηtj dB(t, Tj ).

This means that the components ψ j and η j now represent the number of units of portfolios B(t, Tj−1 )−

B(t, Tj ) and B(t, Tj ) held at time t.

2.4.4

Bond Options

We shall now give the bond option valuation formula within the framework of the lognormal model of

forward Libor rates. This result was first obtained by Rady and Sandmann (1994), who adopted the

PDE approach and who worked in a different setup (see also Goldys (1997), Miltersen et al. (1997),

and Rady (1997)). In the present framework, it is an immediate consequence of (53) combined with

(43).

Proposition 2.3 The price Ct at time t ≤ Tj−1 of a European call option, with expiration date

Tj−1 and strike price 0 < K < 1, written on a zero-coupon bond maturing at Tj = Tj−1 + δj , equals

(56)

Ct = (1 − K)B(t, Tj )N l1j (t) − K(B(t, Tj−1 ) − B(t, Tj ))N l2j (t) ,

where

j

(t)

l1,2

ln ((1 − K)B(t, Tj )) − ln K B(t, Tj−1 ) − B(t, Tj ) ± 12 ṽj (t)

=

ṽj (t)

and

ṽj2 (t) =

Z

Tj−1

|λ(u, Tj−1 )|2 du.

t

In view of (56), it is apparent that the replication of the bond option using the underlying bonds

of maturity Tj−1 and Tj is rather involved. This should be contrasted with the case of the Gaussian

Heath-Jarrow-Morton model18 in which hedging of bond options with the use of the underlying

bonds is straightforward. This illustrates the general feature that each particular way of modelling

the term structure is tailored to the specific class of derivatives and hedging instruments.

18 In

such a model the forward prices prices of bonds follow lognormal processes.

25

Modelling of Forward Libor and Swap Rates

3

Modelling of Forward Swap Rates

We shall first describe the most typical swap contracts and related options (the so-called swaptions).

Subsequently, we shall present a model of forward swap rates put forward by Jamshidian (1996,

1997). For the sake of expositional convenience, we shall follow the backward induction approach

due to Rutkowski (1999), however.

3.1

Interest Rate Swaps

Let us consider a forward (start) payer swap (that is, fixed-for-floating interest rate swap) settled in