Lululemon Athletica - University of Oregon Investment Group

4/17/2012

Consumer Goods

Lululemon Athletica

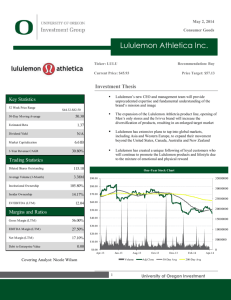

Ticker: LULU

Current Price: $71.93

Recommendation: Hold

Implied Price: $75.41

Investment Thesis

Key Statistics

52 Week Price Range

50-Day Moving Average

Estimated Beta

Dividend Yield

$41.18 - $77.13

$XX$XX.XX

$73.37

1.60

N/A

Lululemon is a firm with a unique business model that has experienced tremendous growth over the past few years and should continue to see strong revenues for the next few years

Analysts are over estimating the amount of stores to be opened in the coming years

Recommended a hold due to lack of patents on innovations and, from a valuation basis, it seems as though the market has factored in a lot of the growth that the company could experience in the future Market Capitalization

3-Year Revenue CAGR

Trading Statistics

Diluted Shares Outstanding

Average Volume (3-Month)

Institutional Ownership

Insider Ownership

EV/EBITDA

Margins and Ratios

$10.07 Billion

41.47%

143.56 million

1.916950 million

105.80%

10.27%

32.12

$90.00

$80.00

$70.00

$60.00

Lululemon Price (5- Year)

35000000

30000000

25000000

Gross Margin

EBITDA Margin

Net Margin

Debt to Enterprise Value

59.90%

32%

18%

0.00%

$50.00

$40.00

20000000

15000000

$30.00

Leverage Ratio 0.00x

10000000

$20.00

5000000

$10.00

$0.00

Jul-07 Dec-07 May-08 Oct-08 Mar-09 Aug-09 Jan-10 Jun-10 Nov-10 Apr-11 Sep-11 Feb-12

0

Covering Analysts: Ryan

Swift, Ryans@uoregon.edu,

Nitin Agrawal

1

Volume Price 50-Day Avg 200-Day Avg

University of Oregon Investment Group

University of Oregon Investment Group 4/17/2012

2500

2000

1500

1000

500

0

Business Overview

Sales per square foot

2008 2009 2010 2011

Lululemon Athletica was founded by Chip Wilson who took a commercial yoga class in Vancouver and was immediately drawn in to the concept. After spending many years in the surf, skate, and snowboarding business, Chip found that the post-yoga rush provided a similar experience to surfing and snowboarding. It only seemed natural that yoga would become a popular ideology again. At the time, yoga was performed using cotton clothing and this seemed inappropriate because it neither removed sweat adequately nor did it allow for maximum flexibility. Given his passion and expertise in technical athletic fabrics, he began a movement in yoga clothing where he relied on feedback from yoga instructors to optimize his apparel.

Lululemon was founded in 1998 to meet these goals. It opened its first store in

November 2000 in Kitsilano, a beach area of Vancouver BC. Beyond getting feedback from instructors on how to improve the performance of the apparel, the firm sought to act as a community hub where people can interact and share the physical and mental aspects of having a healthy lifestyle.

The firm currently has three reportable segments: corporate-owned stores, direct to consumers, and other.

Corporate-Owned Stores

The corporate-owned stores segment includes all sales to customers through corporate-owned stores in North America and Australia. In 2011, net revenue from Lululemon’s corporate-owned stores increased from $591,031,000 to

$817,318,000 representing an increase of $226.3 million or 38%. Additionally, comparable stores sales saw an increase of 20% or $114.2 million in fiscal

2011when excluding the effects of foreign currency fluctuations. This segment is by far Lululemon’s largest revenue base. Going forward the segment will continue to be successful as Lululemon looks to expand its base in 2012 by opening 30 stores in the United States and 2 ivivva athletica stores in Canada.

Direct To Consumers

The Direct to Consumers segment involves Lululemon’s e-commerce website.

Currently, only 10.62% of revenue comes from the Direct to Consumer segment while 81.66% comes from the corporate-owned stores; however, the firm believes this will become an increasingly important segment going forward.

Total revenue for Fiscal 2011 was up $48,965,000 to $106,313,000 representing a growth rate of 85.38%. As the retail world shifts from brick-and-mortar stores to online channels, Lululemon’s commitment to increasing its presence in ecommerce will help the company expand its customer base and improve brand awareness in new markets, particularly in those outside of the United States.

Other

The Other segment of Lululemon’s business includes a wholesale channel through which Lululemon sells its products to premium yoga studios, health clubs, and fitness centers. Aside from wholesale, “Other” also includes franchise sales, wholesale accounts, sales from company-operated showrooms, and warehouse sales and outlets. Sales in this segment rose in the fiscal year of 2011 from $63,325,000 to $77,208,000 representing a growth of 7.71% year over year. The wholesale channel is meant to provide greater, more convenient access

UOIG 2

University of Oregon Investment Group 4/17/2012 to Lululemon’s products for its customers and it also believes that by targeting premium outlets, it can improve the brand image.

While previously franchise sales were part of the "Other" category, the company reported that it will no longer partake in the business and that it had reacquired its four remaining franchise stores during fiscal 2011. Lululemon used to enter into franchise agreements to distribute its products and to more quickly disseminate its brand name in exchange for one-time franchising fees and ongoing royalties based on gross revenue. Going forward, this segment should grow by opening new showroom locations and increasing its list of wholesale partners.

Strategic Positioning

Grassroots Marketing

A key to Lululemon’s success in the retailing world is based on their community marketing approach. Lululemon seeks to differentiate its brand through a community-based approach of building brand awareness and customer loyalty by employing social media and in-store community boards. All of Lululemon’s stores offer free yoga and fitness classes to local communities. The company dedicates a significant amount of time to understanding the market it is entering and then tailoring the experience appropriately. The classes are led by

Lululemon ambassadors who embody the Lululemon brand by training and teaching exclusively in Lululemon gear. In exchange they receive 15% off of merchandise.

Many of Lululemon’s competitors seek to promote their brands through traditional forms of advertisement such as print media, television commercials, and celebrity endorsements. This often increases sales in new markets more rapidly. Lululemon, however, seeks to build extreme brand loyalty through its inclusive community with hopes the overall experience is what will drive its consumer-base going forward.

Vertical Retailing Strategy

Lululemon is sold exclusively through the firm’s own stores, high-end lifestyle centers and yoga studios. Its stores are primarily placed in urban shopping districts and malls that cater toward the high-income, trendy crowds. Unlike larger athletic companies such as Nike that sell their products to large department stores, Lululemon has stayed true to its boutique approach which has helped them achieve higher profit margins and cemented its position in consumers’ minds as an elite performance company.

Lululemon believes that the experience it creates with consumers is central to its strategy. Its sales associates, who are referred to as “educators”, seek to develop a personal connection with each customer and undergo 30 hours of in-house training. The vertical retailing strategy also allows stores to retain control over its operations to ensure that this experience is provided. Further, vertical retailing allows Lululemon to reduce response time and provide new products to the market within a month.

UOIG 3

University of Oregon Investment Group 4/17/2012

Business Growth Strategies

Although Lululemon has experienced dramatic growth in the past few years, it will look to expand further by increasing the number of domestic and international stores, creating new technologies, and increasing the range of its athletic activities and target markets.

Domestic and International Expansion

As of January 29 2012, Lululemon owned 155 stores in North America (47 in

Canada and 108 in the United States). According to management, it expects the majority of near-term store growth to occur in the United States. Management has forecasted that North America has capacity for 350 stores. It hopes to open thirty more stores in the United States along with two Ivivva Athletica stores (a youth brand that creates technical apparel for dancers, gymnasts, ice skaters, etc.) in Canada.

In order to broaden the appeal of their Products Lululemon will be branching out from yoga apparel. During Q1 2012 Lululemon will be launching swimming and surfing apparel and in the future, road biking, commuting, cold weather, spin and outerwear lines.

In addition to expanding within the United States, Lululemon has also hinted at stepping up its international expansion plans. The company already operates stores in New Zealand and Australia and is expected to open approximately five stores in fiscal 2012 in these markets. Lululemon also opened a London showroom in mid-April and is expected to open a second Hong Kong showroom by the end of May. If the firm is successful in marketing its products within these countries, it will serve as a huge catalyst for growth in the future.

Lululemon’s management has also expressed interest in forming joint-ventures with other Asian countries, which will further its revenues as well.

Industry

Overview

Women’s Apparel

Lululemon chiefly operates in the Women’s Apparel market, which is a large, mature, and fragmented market that is extremely sensitive to economic trends.

The main activities of this industry include selling maternity wear, skirts and dresses, pants, jeans and shirts. Sports apparel, the niche that Lululemon currently occupies, also falls under this category. Revenue has declined at an annual rate of 1.1% from 2006 to 2011, which has taken a toll on the profits of retailers. In spite of the challenging business cycle, the industry expended the number of stores at an average rate of 0.9% per year in 2011. Additionally,

IBISworld predicts that revenue will grow at an average annual rate of 3.4% to a total market size of $47.9 billion in 2016. While the growth in revenue will initially be slow due to macroeconomic uncertainty and high unemployment, consumer confidence and disposable income is projected to rise, which will be a major catalyst for firms operating within this industry.

Firms within the Women’s Apparel market are also sensitive to changes in the price of cotton, an important raw input. In 2008, as the price of cotton and other

UOIG 4

University of Oregon Investment Group

40000

35000

30000

25000

20000

15000

10000

5000

0

Per Capita Disposable Income

4/17/2012 commodities surged, the bottom-line of many retailers took a large hit. Although producers are typically able to pass off some of the rise in commodity costs to consumers, weakening demand and lower disposable incomes made it difficult to increase prices. As a way of coping with this environment, retailers tried to cut costs in other ways by cutting the wages of workers or laying off employees and replacing many of their jobs with automated technology. As a result, the number of workers employed in the Women’s Apparel industry has decreased at an average annual rate of 1.7% till 2011. (Information taken from IBISworld).

Lululemon is not as sensitive to these fluctuations as the majority of its raw materials are petroleum based.

Gym, Health, and Fitness Clubs in the US

Although Lululemon is not itself a gym, fitness centers act as a complementary industry to the company and thus positive trends in this industry act as a positive sign for Lululemon. This industry has benefited from consumer trends fighting against obesity and improving health and wellness. As a result, gym memberships have increased during the past 10 years from 36.3 million in 2002 to an estimated 43.6 million in 2012. The introduction of women-oriented gyms has also increased the customer base by encouraging more women to partake in fitness.

There is an element of seasonality for industry participants where the greatest growth in gym memberships occurs during the first three months of the year. On average, 30% of new members join during this period due to New Year’s resolutions. In spite of favorable consumer trends, the gym industry is not recession-proof. During the financial crisis, consumers halted gym memberships and membership numbers began to decline for the first time in years. However, the increase in leisure time helped protect membership sales. Gym, health, and fitness clubs are also expected to benefit from the increased interest from youth and baby boomers, which will contribute to the average annual industry growth rate of 2.8% to $29 billion in 2017.

Macro factors

The macro factors that will be central to Lululemon’s success include per capita disposable income, time spent on leisure and sports, as well as consumer sentiment.

Per Capita Disposable Income

Per Capita disposable income, which measures a person’s ability to purchase goods or services, is computed by taking total income, subtracting taxes, savings, and non-tax payments, and dividing by the total population. According to IBISworld, the estimated value in 2012 is $32,953 with a forecasted value of

$36,845, representing a compound growth rate of 2.3% for the next five years.

From 2007-2012, the compound average growth rate was 0.1%. After the financial crisis, credit tightened and unemployment increased from 4.6% to

10.6% in the time period between 2007 and 2010. Wages failed to increase during the crisis and the savings rate rose from 1.4% in 2005 to 4.9% in 2009, decreasing the funds available for purchasing goods.

Conditions began to stabilize in 2010 as corporate profits began to increase, which not only aided investor stock portfolios, but also removed pressure on businesses to depress wages. Therefore, while disposable income growth dropped by 3.2% in 2009; it grew 0.9% in 2010. Challenges still remain as a depressed housing market, high unemployment, and rising prices continue to stunt growth in disposable income. Additionally, if the United States continues

UOIG 5

University of Oregon Investment Group 4/17/2012

5.3

5.25

5.2

5.15

5.1

5.05

4.95

120

100

80

60

40

20

0

5

Hours Spent On

Leisure and Sports

Consumer Sentiment Index

to run a fiscal deficit, higher tax rates may be necessary in order to balance the deficit which would have a negative impact on discretionary income.

Time Spent on Leisure and Sports

Time spent on leisure and sports includes time spent socializing and communicating, watching television, browsing the internet, playing games, reading, playing sports, exercising as well as time spent traveling to and from these activities. The estimated value of this metric was 5.20 hours per day in

2011 and it experienced a compound annual growth rate of 0.43% from 2006-

2011. On average, Americans spend approximately 2 hours and 45 minutes watching TV, 45 minutes socializing, and 20 minutes on sports, exercise or recreation. These numbers are typically driven by changes in the unemployment rate, since Americans who are employed have less time for leisure than those who do not.

IBISworld forecasts time spent on leisure and sports to decrease to 5.08 hours per day in 2016 representing a compound annual growth rate of -0.47%. This is driven by an uptick in employment due to a recovering economy.

Because Lululemon more specifically operates in the athletic apparel industry, it is also worth looking at participation in sports, which has an estimated value of

18.6% in 2012 and a forecasted value of 19.2% in 2017. This represents a growth of 0.6% versus the 0.13% from 2007 to 2012. Participation in sports is also driven by unemployment and while this may reduce the participation rate for working individuals, the aging population will retire and push growth upward. There are two other favorable trends that may help Lululemon’s target demographic. The first is that the public appears to be moving away from participation in team sports and more toward individualized fitness activities, which has increased the number of gym memberships issued during the past five years. Additionally, there is a rise in alternative fitness techniques. Participation rates in activities such as yoga, tai chi, and pilates should increase due this trend.

Consumer Sentiment

Consumer sentiment is measured using a survey conducted by the University of

Michigan. In the survey, participants are asked to comment on household finances, business conditions, unemployment, inflation, among other items. The

CSI took a hit with the dot com bubble and plunged further in 2008 after the collapse of Bear Stearns and Lehman Brothers. It remained low through 2009, but as housing prices stabilized and corporations regained profitability has slowly improved.

IBIS world’s expected value in 2012 is 67.7, which represents a compound annual growth rate of -4.59% from 2007 to 2012, but it is expected to increase to

70.8 in 2017 indicating a modest compound growth rate of 0.92%. Due to the magnitude of the crisis, total economic recovery will take place slowly. By 2017 the CSI will be well below the 2007 average of 85.6.

Competition

Despite occupying a unique niche within the athletic apparel industry,

Lululemon has recently gained competitors in recent years. Traditionally, big companies such as Nike, Adidas, and Under Armour have dominated the athletic apparel industry and these firms continue to have an impact on the markets today. These firms are large with market caps upward of $5 Billion and try to distinguish themselves amongst competitors by securing endorsements by high-

UOIG 6

University of Oregon Investment Group 4/17/2012

Gross Margin 2008 2009 2010 2011

Under Armour 48.9% 48.2% 49.9% 48.2%

Nike

Gap

Lululemon

45.0% 44.6% 46.2% 45.1%

36.1% 37.5% 40.3% 40.4%

53.3% 50.7% 49.3% 55.5% profile athletes, creative marketing campaigns, and creating innovative technologies. With the exception of a commitment to creating innovative products in apparel, these initiatives are in contrast to Lululemons. In order to market its products, Lululemon completely shuns away from print or media advertising and instead focuses on selecting ambassadors within carefully selected markets. As a result, it’s possible for Lululemon’s competitors to achieve and maintain brand awareness and market share more quickly. These firms are more diversified in terms of the products they produce. Some of their competitors manufacture footwear and sporting goods. Furthermore, Lululemon is targeted towards women and focused on yoga and running activities. It also is only beginning its international expansion. Under Armour, Nike, and Adidas are targeted towards men and women of all ages, are diversified amongst virtually all sports and, with the exception of Under Armour, are well on their way to international markets.

Aside from the big name athletic apparel manufacturers, other competitors such as Gap’s Athleta brand, Lucy Activewear Inc. and Bebe Stores’ BEBE SPORT collection have emerged as competitors to Lululemon. Athleta was introduced as its own separate brand of Gap Inc. in 2009 and offers women’s yoga clothing, swimwear, running clothing, as well as athletic apparel for fitness, golf and tennis to women at a lower price point than Lululemon. BEBE SPORT and Lucy

Activewear also manufacture similar products aimed at women and are roughly priced within the same price category. Although these brands were recently introduced and do not seem to have impacted Lululemon’s revenues, as familiarity with these products gains, Lululemon could be forced to sell their products at a lower price thus reducing margins. Finally, it should be noted that

Lululemon does not own any patents or exclusive intellectual property rights to the technology, fabrics, or processes that underlie its products. This makes it easier for current and future competitors to manufacture and sell products with similar performance capabilities and styling.

Management and Employee Relations

CEO: Christine Day

Christine Day is the Chief Executive Officer and Director of Lululemon

Athletica Inc. She previously served as the Executive Vice President of retail operations from January 2008 through April 2008 and was appointed as Chief

Operating Officer in April 2008. Prior to Lululemon, she worked at Starbucks

Corporation where she was the President of the Asia Pacific Group from July

2004 through February 2007 and as the Co-president for Starbucks Coffee

International from July 2003 to October 2003. She earned her BA in

Administrative Management from Central Washington University and is a graduate of Harvard Business School’s Advanced Management Program.

According to Reuters, her total compensation is $3,472,890 and also has stock options with an estimated market value of $3,837,570.

CFO: John Currie

J ohn Currie is the Chief Financial officer and Executive Vice President of

Lululemon Athletica since January 2007. Before working for Lululemon, he worked for Intrawest Corporation from 1996 to 2006 and was the CFO from

2004 to 2006 as well as Senior Vice President of Financing and Taxation from

1997 to 2004. He is a chartered accountant and received his Bachelor of

Commerce degree from the University of British Columbia. According to

Reuters, his basic compensation was $1,105,580 and has stock options with an estimated market value of $7,819,560.

UOIG 7

University of Oregon Investment Group 4/17/2012

Recent News

April 17th, 2012 – Lululemon Ducks the Radar and Lands in

London (CNBC.com)

This article covers Lululemon’s ventures into London and how it is expected to open a showroom there. Other key facts covered are that the company ranks fourth in sales per square foot in retail ($2004 behind Apple, Tiffany, and

Coach) and achieved same-store sales growth of 20% the previous year.

Furthermore, it also discusses Lululemon’s grassroots initiatives as opposed to traditional print advertising and how with strong sales in the United States, international expansion could be the icing on the cake for the company.

2/2/2012 Lululemon CEO: Wilson Knew it was Time to Go

(Forbes.com)

This article discusses the resignation of Lululemon’s CEO from the company two years ago. Chief Product officer Sheree Waterson has taken over as

Wilson’s replacement. Wilson, will be best known for his controversial marketing campaign where he placed the phrase, “who is John Galt” on

Lululemon’s tote bags, which were not well-received products by consumers, but created a buzz that Wilson really enjoyed. Since his departure, Lululemon has not seemed to struggle and instead the author argued that the former CEO mostly realized that he was not CEO-material and that the company would be left in better hands upon his resignation.

Catalysts

Upside

Increased interest and demand for alternative fitness activities such as yoga

Uptick in the economy will allow for more disposable income and thus more money to spend on Lululemon’s products

New initiatives for men will broaden product offerings and improve brand awareness if successful

Potential for international expansion

Downside

Lofty growth expectations could lead to down turns in stock prices if it does not meet expectations

Potential for substitute products at a lower cost is an especially big risk because they do not own patents on their products

Comparable Analysis

When evaluating comparable firms, the chief metrics used in selection were revenue growth rates as well as margins. Lululemon has high forecasted growth rates and is earning strong margins relative to its peers. This is what sets the firm apart from its competitors. Choosing a firm with lower growth rates and or low margins would artificially depress the multiple and thus makes the comparables analysis less accurate in determining a fair price for Lululemon. In addition to these metrics, the overall business model was into consideration when choosing

UOIG 8

University of Oregon Investment Group 4/17/2012 companies to use for the comparables. Of the companies chosen (Under

Armour, Deckers, Tiffany and Company, and Coach Inc.), Under Armour and

Deckers were given a slightly higher weighting than the other two due to the fact that the companies were more similar to Lululemon in terms of actual revenues,

EBIT, EBITDA, and also having similar growth rates while being in the same general industry as Lululemon. Tiffany is mostly into the retailing of jewelry, which is not the same industry as Lululemon, and Coach is simply bigger than all of the comparables, which means that it is not as comparable in terms of market cap or market size in general.

Under Armour – 40% Weight

“Under Armour, Inc. engages in the design, development, marketing, and distribution of apparel, footwear, and accessories for men, women, and youth worldwide. The company offers its apparel in three fit types: compression, fitted, and loose that are designed to be worn in hot, cold, and changing temperatures. Its footwear products include football, baseball, lacrosse, softball and soccer cleats, as well as slides, performance training footwear, running footwear, basketball footwear, and hunting boots for athletes. The company’s accessories comprise baseball batting, football, golf, and running gloves; and licensees offer socks, team uniforms, baby and kids’ apparel, eyewear, and custom-molded mouth guards, as well as hats and bags. Under Armour, Inc. sells its products primarily under the UA and UNDER ARMOUR brands through wholesale channels, which include independent and specialty retailers, institutional athletic departments, leagues and teams, national and regional sporting goods chains, and department store chains; independent distributors; and directly to consumers through its own specialty and factory house stores, and Website. The company was founded in 1996 and is headquartered in

Baltimore, Maryland.”

Deckers Outdoor Corporation – 20% Weight

“Deckers Outdoor Corporation engages in the design, manufacture, and marketing of footwear and accessories for outdoor activities and casual lifestyle use for men, women, and children. The company offers luxury footwear, handbags, apparel, and cold weather accessories under the UGG brand name; open and closed-toe outdoor lifestyle footwear, multi-sport shoes, light hiking shoes, amphibious footwear, and rugged outdoor travel shoes under the Teva brand name; action sport footwear under the Sanuk brand name; high-end casual footwear for men and women under the TSUBO brand name; outdoor performance and lifestyle footwear under the Ahnu brand name; and work footwear under the MOZO brand name. The company sells its products primarily to specialty retailers, department stores, outdoor retailers, sporting goods retailers, shoe stores, and online retailers. Deckers Outdoor Corporation also sells its products directly to end-user consumers through its Websites, call centers, retail concept stores, and retail outlet stores, as well as through retailers in the United States. In addition, the company distributes its products through independent distributors and retailers in Europe, Canada, Australia, Asia, and

Latin America. It has a joint venture with Stella International Holdings Limited for the opening of retail stores and wholesale distribution for the UGG brand in

China. Deckers Outdoor Corporation was founded in 1973 and is headquartered in Goleta, California. “

UOIG 9

University of Oregon Investment Group 4/17/2012

Tiffany & Co. – 20% Weight

“Tiffany & Co., through its subsidiaries, engages in the design, manufacture, and retail of fine jewelry worldwide. Its jewelry products include fine and solitaire jewelry; diamond engagement rings and wedding bands to brides and grooms; and non-gemstone, sterling silver, gold, and platinum jewelry. The company also provides timepieces, sterling silver goods, china, crystal, stationery, fragrances, personal accessories, and leather goods. Tiffany & Co. sells its products through retail sales, Internet and catalog sales, business-tobusiness sales, and wholesale distribution primarily in the Americas, the Asia-

Pacific, Japan, and Europe. The company also sells its products through its stores, as well as through department store in Japan. As of January 31, 2012, it operated 247 stores, including 102 in the Americas, 58 in Asia-Pacific, 55 in

Japan, and 32 in Europe. The company was founded in 1837 and is headquartered in New York, New York.”

Coach Inc. – 20% Weight

“Coach, Inc. designs and markets accessories and gifts for women and men in the United States and internationally. It primarily offers handbags, women’s and men’s bag, accessories, business cases, footwear, wearables, jewelry, sunwear, travel bags, watches, and fragrance products. The company’s accessories, include money pieces, wristlets, cosmetic cases, wallets, card cases, time management and electronic accessories, key rings, charms, and women’s and men’s belts; business cases, such as computer bags, messenger-style bags, and totes; wearables comprise jackets, sweaters, gloves, hats, and scarves; jewelry consisting of bangle bracelets, necklaces, rings, and earrings; and luggage and related accessories, such as travel kits and valet trays. It provides women’s fragrance collections, including eau de perfume spray, eau de toilette spray, purse spray, body lotion, and body splashes. The company operates stores in

North America, Japan, Hong Kong, Macau, and mainland China, as well as sells through the Internet and the Coach catalog. It also sells its products to wholesale customers and distributors in approximately 20 countries. As of July 2, 2011, it had 345 retail and 143 factory leased stores located in North America; 169

Coach-operated department store shop-in-shops, retail stores, and factory stores in Japan; and 66 Coach-operated department store shop-in-shops, retail stores, and factory stores in Hong Kong, Macau, and mainland China. The company was founded in 1941 and is headquartered in New York, New York.” (Company descriptions taken from Yahoo Finance)

Other Considerations

Aside from the aforementioned firms, other companies that were considered for the comparables analysis included Nike, Whole Foods Markets, Saks, Bebe, and

Liz Claiborne. Nike was considered because it has also begun targeting women through its Nike Women campaign and has created similar products (Dri-Fit

Training Capris) while also operating in the same industry as Lululemon.

However, because the company is not growing as rapidly and has lower margins, it is trading at a lower multiple and would not be appropriate to include in the analysis.

Whole Foods Markets was considered because it can be considered a play on the alternative lifestyle market, and thus could be an indicator of the potential growth within this segment of the population that Lululemon is trying to target.

UOIG 10

University of Oregon Investment Group 4/17/2012

However, because it operates in the retail of food, it’s EBIT and EBITDA margins as well as its growth rates were not comparable.

Finally, Saks, Liz Clairborne, and Bebe were considered because they are higher-end brands that are often frequented by women, and, in the case of Bebe, an indirect competitor to Lululemon through particular product lines. However, these firms simply did not have the requisite growth and margins needed to be truly comparable to Lululemon.

Discounted Cash Flow Analysis

Company

Under Armour

TIFFANY

DECKERS

COACH

Lululemon

Average

EV/EBITDA

25.71

10.39

30.90

13.95

26.14

21.42

COGS

Cost of goods sold was also projected using a “cost per square foot” metric and was initially increased in the first two years, but brought back down slightly due to economies of scale in the long run.

Beta

For computing the betas, the Vasicek 5 year monthly and 1 year weekly betas were calculated along with the Hamada 5 year monthly and 1 year weekly betas.

The Vasicek was used in order to adjust for variances within the industry, which are important in an industry like retail where companies can have a wide variety of expected returns and volatility levels. The Hamada beta was used to compare

Lululemons beta to the equity beta of its competitors as it adjusts for capital structure.

Revenue Model

In order to construct the revenue model, the total number of stores, was estimated using historical data and management guidance. From there, the total square footage can also be computed once the average store size was figured out. For the projection years, it was assumed that the store size would not increase because Lululemon’s small store size is actually vital to its commitment to providing an overall shopping experience for its consumers. Sales per square foot were assumed to increase due to managements comments that existing stores have excess capacity for future growth.

Exit Multiple

For an exit multiple we used EV/EBITDA as it is most commonly used. In order to calculate the exit multiple we took an average of the trailing twelve months

EV/EBITDA for Lululemon and the companies used in the comparables analysis. We obtained a multiple of 21.42x EBITDA.

Recommendation

Lululemon is growing rapidly and has a unique business model that will help it see solid increases in revenues for the next few years. However, based on our discounted cash flow and comparables analysis there does not appear to be a significant undervaluation. Therefore, LULU is a HOLD for all portfolios.

UOIG 11

University of Oregon Investment Group

Appendix 1 – Comparables Analysis

Comparables Analysis

($ in millions)

Stock Characteristics

Current Price

50 Day Moving Average

200 Day Moving Average

Beta

Size

Short-Term Debt

Long-Term Debt

Cash and Cash Equivalent

Non-Controlling Interest

Preferred Stock

Diluted Basic Shares

Market Capitalization

Enterprise Value

Profitability Margins

Gross Margin

EBIT Margin

EBITDA Margin

Net Margin

Credit Metrics

Interest Expense

Debt/EV

Leverage Ratio

Interest Coverage Ratio

Operating Results

Revenue

Gross Profit

EBIT

EBITDA

Net Income

Valuation

EV/Revenue

EV/Gross Profit

EV/EBIT

EV/EBITDA

EV/Net Income

$48.57

0.08

0.97

1262.28

$4,481.39

3,242.06

1,382.76

1,509.47

950.97

7.71x

14.91x

35.49x

32.21x

52.47x

Max

$96.21

$95.82

$86.66

$1.85

173.80

538.40

1,085.60

5.49

0.00

296.09

21,048.91

19,987.31

72.3%

30.9%

33.7%

21.2%

$0.00

0.00

0.00

0.00

$1,000.84

569.27

160.70

197.00

96.92

2.46x

4.17x

12.65x

10.49x

20.40x

Min

$67.56

$66.05

$60.24

$0.77

Weight Avg.

$80.03

$80.52

$77.89

$1.46

0.00

0.00

175.38

0.00

0.00

52.81

5,070.39

5,085.49

48.4%

10.9%

13.4%

6.6%

37.67

185.76

428.43

1.10

0.00

136.77

10,052.94

9,849.04

55.5%

18.6%

21.3%

12.2%

$11.30

0.03

0.56

276.49

$2,489.40

1,499.58

539.59

614.43

357.17

4.24x

7.90x

25.18x

21.51x

39.31x

4/17/2012

Multiple

EV/Revenue

EV/Gross Profit

EV/EBIT

EV/EBITDA

EV/Net Income

Price Target

Current Price

Overvalued

$2.05

0.02

0.42

34.44

$2,557.81

1,432.00

496.88

584.33

320.52

3.96x

6.65x

23.05x

19.53x

35.59x

Median

$70.10

$72.46

$75.80

$1.58

3.84

103.40

352.90

0.00

0.00

141.06

9,537.51

9,543.45

54.2%

20.1%

23.1%

13.4%

Analysis Ticker UA TIF DECK

$0.00

0.00

0.00

0

$1,000.84

569.27

286.96

317.22

184.96

7.71x

13.55x

26.88x

24.32x

41.71x

LULU

$71.95

$73.40

$60.24

1.60

Under Armour

40.00%

$96.21

$95.82

$83.25

1.50

0.00

0.00

409.44

4.81

0.00

113.31

8,119.21

7,714.58

56.9%

28.7%

31.7%

18.5%

6.88

183.61

175.38

0.00

0.00

52.81

5,070.39

5,085.49

48.4%

10.9%

13.4%

6.6%

TIFFANY

20.00%

$68.26

$68.69

$68.34

1.85

DECKERS

20.00%

$67.56

$66.05

$86.66

0.77

$3.84

0.04

0.97

51.29

$1,472.68

712.84

160.70

197.00

96.92

3.45x

7.13x

31.65x

25.81x

52.47x

$48.57

0.08

0.83

17.59

$3,642.94

2,151.15

708.43

854.36

439.19

173.80

538.40

442.20

0.00

0.00

128.42

8,691.48

8,961.48

59.0%

19.4%

23.5%

12.1%

2.46x

4.17x

12.65x

10.49x

20.40x

$0.25

0.00

0.00

1262.28

$1,377.28

679.00

285.33

314.31

201.86

0.00

0.00

263.61

5.49

0.00

153.69

10,383.54

10,125.42

49.3%

20.7%

22.8%

14.7%

7.35x

14.91x

35.49x

32.21x

50.16x

COH

COACH

20.00%

$71.93

$76.22

$67.96

1.66

0.80

23.20

1,085.60

0.00

0.00

296.09

21,048.91

19,987.31

72.3%

30.9%

33.7%

21.2%

$0.00

0.00

0.02

0

$4,481.39

3,242.06

1,382.76

1,509.47

950.97

4.46x

6.17x

14.45x

13.24x

21.02x

40.98

Weight

20.00%

43.27

67.33

0.00%

40.00%

63.80

67.73

60.65

72.1

18.88%

40.00%

0.00%

UOIG 12

University of Oregon Investment Group

Appendix 2 – Discounted Cash Flows Analysis

Discounted Cash Flow Analysis

($ in millions)

Total Revenue

% YoY Growth

Cost of Goods Sold

% Revenue

Gross Profit

Gross Margin

Selling General and Administrative Expense

% Revenue

Depreciation and Amortization

% Revenue

Provision for Impairment and Lease Exit Costs

% Revenue

Earnings Before Interest & Taxes

% Revenue

Other Income (expense)

% Revenue

Earnings Before Taxes

% Revenue

Less Taxes (Benefits)

Tax Rate

Net Income From Continuing Operations

% Revenue

Net Income Attributable To Non-Controlling Interest

% Revenue

Net Loss from Discontued Operations

% Revenue

Net Income

Net Margin

Add Back: Depreciation and Amortization

Add Back: Interest Expense*(1-Tax Rate)

Operating Cash Flow

% Revenue

Current Assets

% Revenue

Current Liabilities

% Revenue

Net Working Capital

% Revenue

Change in Working Capital

Capital Expenditures

% Revenue

Acquisitions

% Revenue

Unlevered Free Cash Flow

Discounted Free Cash Flow

EBITDA

EBITDA Margin

(.47%)

$30.84

11.43%

8.29

0.00

$39.13

14.50%

99.82

36.98%

36.14

13.39%

19.48%

20.46

38.92%

32.12

11.90%

0.00

0.00%

($1.27)

3.07%

0.00

0.00%

$51.55

19.10%

1.03

.38%

52.58

$63.68

23.59%

2007A

269.94

-

116.72

43.24%

$153.22

56.76%

93.38

34.59%

8.29

30.01

11.12%

0.00

0.00%

9.12

59.8

22.17%

2008A 2009A

353.49

452.90

2010A 2011A

711.70

1000.84

30.95% 28.12% 57.14% 40.63%

158.60

208.98

292.14

401.31

44.87% 46.14% 41.05% 40.10%

$194.89

$243.92

$419.56

$599.53

55.13% 53.86% 58.95% 59.90%

118.10

136.16

212.78

282.31

33.41% 30.06% 29.90% 28.21%

15.82

20.83

24.61

30.26

4.48% 4.60%

4.41

0.38

3.46%

1.72

3.02%

0.00

1.25% 0.08% 0.24% 0.52%

$56.56

$86.55

$180.441

$286.96

16.00% 19.11% 25.35% 28.67%

0.82

0.16

2.89

2.50

.23%

57.39

.04%

86.71

.41%

183.33

.25%

289.46

16.23% 19.15% 25.76% 28.92%

16.88

28.43

61.08

104.49

29.42% 32.79% 33.32% 36.10%

40.50

58.28

122.25

184.96

11.46% 12.87% 17.18% 18.48%

0.00

0.00

0.35

0.90

0.00% 0.00%

($1.14) -

.05%

-

.09%

-

(.32%) 0.00% 0.00% 0.00%

$39.36

$58.28

$121.897

$184.06

11.14% 12.87% 17.13% 18.39%

15.82

20.83

24.61

30.26

0.00

0.00

0.00

0.00

$55.19

$79.11

$146.51

$214.32

15.61% 17.47% 20.59% 21.41%

121.10

220.94

395.69

535.45

34.26% 48.78% 55.60% 53.50%

45.34

58.68

85.36

103.44

12.83% 12.96% 11.99% 10.34%

$75.76

$162.26

$310.32

$432.01

21.43% 35.83% 43.60% 43.16%

12.09

42.80

86.50

15.50

148.06

43.90

121.69

122.31

12.11% 3.42%

0.00

0.00

0.00% 0.00%

0.30

(22.88)

6.17%

0.00

0.00%

12.22%

0.00

0.00%

(45.45) (29.68)

72.4

107.4

205.1

317.2

20.48% 23.71% 28.81% 31.70%

4/17/2012

2012E

1370.91

36.98%

433.20

2013E

1699.20

23.95%

599.85

2014E

2081.37

22.49%

760.60

2015E 2016E

2334.69

2546.93

12.17%

851.47

9.09%

923.27

31.60% 35.30% 36.54% 36.47% 36.25%

$937.71

$1,099.35

$1,320.77

$1,483.22

$1,623.67

68.40%

383.85

64.70%

475.78

63.46%

582.78

63.53%

653.71

63.75%

713.14

28.00%

43.67

28.00%

57.22

28.00%

70.90

28.00%

82.70

28.00%

83.00

32.51%

198.85

36.00%

353.51

20.80%

1.70

.10%

-

3.37%

8.90

0.52%

$557.45

32.81%

5.10

.30%

552.35

0.00%

$353.51

20.80%

57.22

0.00

$410.73

24.17%

778.63

45.82%

193.54

11.39%

36.43%

182.29

36.50%

317.13

23.13%

1.37

.10%

-

3.19%

7.18

0.52%

$503.00

36.69%

3.58

.26%

499.42

0.00%

$317.13

23.13%

43.67

0.00

$360.80

26.32%

679.57

49.57%

154.50

11.27%

31.21%

233.83

36.00%

415.69

19.97%

2.08

.10%

-

3.41%

10.90

0.52%

$656.18

31.53%

6.66

.32%

649.52

0.00%

$415.69

19.97%

70.90

0.00

$486.60

23.38%

768.46

36.92%

239.77

11.52%

31.12%

261.59

36.00%

465.05

19.92%

2.33

.10%

-

3.54%

12.23

3.26%

13.34

0.52% 0.52%

$734.57

$814.18

31.46%

7.94

.34%

726.64

31.97%

8.66

.34%

805.52

31.63%

289.99

36.00%

515.54

20.24%

2.55

.10%

-

0.00% 0.00%

$465.05

$515.54

19.92%

82.70

20.24%

83.00

0.00

0.00

$547.75

$598.54

23.46%

761.70

23.50%

809.40

32.63%

271.88

11.65%

31.78%

296.97

11.66%

$525.07

38.30%

93.06

74.00

5.40%

0.00

0.00%

193.74

170.75

$585.09

34.43%

60.02

78.00

4.59%

0.00

0.00%

272.71

211.81

$528.69

25.40%

-56.41

91.20

4.38%

0.00

0.00%

451.80

309.26

$489.82

$512.43

20.98% 20.12%

-38.86

92.07

22.60

98.58

3.94%

0.00

0.00%

494.54

298.33

3.87%

0.00

0.00%

477.35

253.78

546.7

39.88%

614.7

36.17%

727.1

34.93%

817.3

35.01%

897.2

35.23%

UOIG 13

Total Stores

Canada

Change in #

% Growth

United States

Change in #

% Growth

Australia

Change in #

% Growth

New Zealand

Change in #

% Growth

Japan

Change in #

% Growth

Hong Kong

Change in #

% Growth

Other International

Change in #

% Growth

Total

Estimating Total Revenue

Sales Per Square Foot

% Growth

Total Square Footage

Average Store Size

Total Revenue

University of Oregon Investment Group

Appendix 3 – Revenue Model

4/17/2012

2007A

37

30

0

0

4

0

0

2008A

42

5

13.51%

61

31

103.33%

0

0

-

0

0

-

0

-4

-100.00%

0

0.00%

-

0

0.00

-

103

2009A

44

2

4.76%

66

5

8.20%

0

0

-

0

0

-

0

0

-

0

0.00%

-

0

0.00

-

110

2010A

44

0

0.00%

78

12

18.18%

11

11

-

0

0

-

0

0

-

0

0.00%

-

0

0.00

-

133

2011A

47

3

6.82%

108

30

38.46%

18

7

63.64%

1

1

-

0

0

-

0

0.00%

-

0

0.00

-

174

2012E

55

8

17.02%

138

30

27.78%

21

3

16.67%

2

2

100.00%

0

0

-

1

100.00%

-

0

0.00

-

217

2013E

63

8

14.55%

168

30

21.74%

23

2

9.52%

3

1

50.00%

0

0

-

2

100.00%

100.00%

1

1.00

-

260

2014E

72

9

14.29%

198

30

17.86%

24

1

4.35%

5

2

66.67%

0

0

-

3

100.00%

50.00%

2

1.00

-

304

2015E

79

7

9.72%

223

25

12.63%

25

1

4.17%

6

1

20.00%

0

0

-

3

0.00%

0.00%

5

3.00

-

341

8.97%

26

1

4.00%

6

0

0.00%

0

0

2016E

85

6

7.59%

243

20

-

3

0.00%

0.00%

9

4.00

-

372 71

2007A

1700

161,595.88

2276.00

274,713,000.00

2008A

1450

-14.71%

243,784.83

2366.84

353,488,000.00

2009A

1318

-9.10%

343,625.19

3123.87

452,898,000.00

2010A

1726

30.96%

412,342.99

3100.32

711,704,000.00

2011A

2004

16.11%

541,504.41

3112.09

1,000,839,000.00

2012E

2030

1.30%

675,324.46

3112.09

1,370,908,658.02

2013E

2100

3.45%

809,144.52

3112.09

1,699,203,485.23

2014E

2200

4.76%

946,076.67

3112.09

2,081,368,664.70

2015E

2200

0.00%

1,061,224.15

3112.09

2,334,693,140.33

2016E

2200

0.00%

1,157,697.48

3112.09

2,546,934,456.00

UOIG 14

University of Oregon Investment Group

Appendix 4 – Working Capital Model

Working Capital Model

($ in millions)

Total Revenue

Current Assets

Cash & Cash Equivalents

% of Revenue

Cash per store opened

Accounts Receivable

% of Revenue

Inventory

Days Inventory Outstanding

% of Revenue

Prepaid Expenses

% of Revenue

Assets of Discontinued Operations

% of Revenue

Total Current Assets

% of Revenue

Long Term Assets

Net PP&E Beginning

Capital Expenditures

Cap Ex per Store

Depreciation and Amortization

Net PP&E Ending

Total Current Assets & Net PP&E

% of Revenue

Current Liabilities

Accounts Payable

% of Revenue

Accrued Charges

% of Revenue

Income Taxes Payable

% of Revenue

Unredeemed Gift Card Liability

% of Revenue

Other Current Liabilities

% of Revenue

Liabilities of Discontinued Operations

% of Revenue

Total Current Liabilities

% of Revenue

4/17/2012

2007A

$274.71

2008A

$353.49

2009A

$452.90

2010A

$711.70

2011A

$1,000.84

2012E

$1,370.91

2013E

$1,699.20

2014E

$2,081.37

2015E

$2,334.69

2016E

$2,546.93

52.54

19.13%

1.64

4.30

1.57%

37.93

118.61

13.81%

2.52

0.92%

2.52

0.92%

99.816775

36.33%

56.80

16.07%

8.11

4.03

1.14%

52.05

120.12

14.72%

4.11

1.16%

4.11

1.16%

121.099

34.26%

159.57

35.23%

6.94

8.24

1.82%

44.07

76.97

9.73%

4.53

1.00%

4.53

1.00%

220.939

48.78%

316.29

44.44%

7.71

9.12

1.28%

57.47

71.80

8.07%

6.41

0.90%

6.41

0.90%

395.687

55.60%

409.44

40.91%

9.52

5.20

0.52%

104.10

94.94

494.50

36.07%

11.50

9.60

0.70%

150.80

127.06

528.00

31.07%

12.00

16.99

1.00%

203.90

124.07

462.50

22.22%

12.50

20.81

1.00%

249.76

119.86

418.50

17.93%

13.50

23.35

1.00%

280.16

120.43

435.00

17.08%

14.50

25.47

1.00%

305.63

120.83

10.40%

8.36

0.83%

8.36

11.00%

13.71

1.00%

10.97

12.00%

16.99

1.00%

12.74

12.00%

20.81

1.00%

14.57

12.00%

23.35

1.00%

16.34

12.00%

25.47

1.00%

17.83

0.83% 0.80% 0.75% 0.70% 0.70% 0.70%

535.45 679.5726688 778.6325141 768.4611937 761.6998916

809.399365

53.50% 49.57% 45.82% 36.92% 32.63% 31.78%

18.18

30.013

$ 0.42

8.29

43.6

143.42

15.87%

43.60

41.045

$ 0.40

15.82

61.7

182.76

17.44%

61.66

15.497

$ 0.14

20.83

61.6

282.53

13.60%

61.59

30.357

$ 0.23

24.61

71.0

466.64

9.97%

70.95

122.311

$ 0.36

30.26

163.01

698.46

16.29%

163.01

74

$ 0.20

43.67

280.68

960.25

20.47%

280.68

78

$ 0.30

57.22

301.45

1080.09

17.74%

301.45

91.2

$ 0.30

70.90

321.75

1090.21

15.46%

321.75

92.07

$ 0.27

82.70

331.12

1092.82

14.18%

331.12

98.58

$ 0.27

83.00

346.70

1156.10

13.61%

2.95%

0.78

0.28%

0.90

0.33%

36.14

13.16%

5.40

1.96%

15.23

5.55%

5.72

2.08%

8.11

2.62%

0.69

0.20%

-

0.00%

45.34

12.83%

5.27

1.49%

27.97

7.91%

2.13

0.60%

9.28

2.58%

0.38

0.08%

-

0.00%

58.68

12.96%

11.03

2.43%

27.83

6.15%

7.74

1.71%

11.70

6.66

0.94%

42.14

5.92%

18.40

2.59%

18.17

2.55%

-

0.00%

-

0.00%

85.36

11.99%

14.54

1.45%

57.41

5.74%

8.72

0.87%

22.77

2.28%

-

0.00%

-

0.00%

103.44

10.34%

20.56

1.50%

$78.14

5.70%

21.52

1.57%

34.27

2.50%

-

0.00%

-

0.00%

154.50

11.27%

25.83

1.52%

$98.55

5.80%

26.68

1.57%

42.48

2.50%

-

0.00%

-

0.00%

193.54

11.39%

32.26

1.55%

$122.80

5.90%

32.68

1.57%

52.03

2.50%

-

0.00%

-

0.00%

239.77

11.52%

36.77

1.58%

$140.08

6.00%

36.65

1.57%

58.37

2.50%

-

0.00%

-

0.00%

271.88

11.65%

40.50

1.59%

$152.82

6.00%

39.99

1.57%

63.67

2.50%

-

0.00%

-

0.00%

296.97

11.66%

UOIG 15

University of Oregon Investment Group

Appendix 5 – Discounted Cash Flows Analysis Assumptions

4/17/2012

Discounted Free Cash Flow Assumptions

Tax Rate

Risk Free Rate

36.50%

2.00%

Beta

Market Risk Premium

% Equity

% Debt

Cost of Debt

CAPM

WACC

Terminal Value

PV of Terminal Value

Total Debt

Cash & Cash Equivalents

Market Capitalization

Fully Diluted Shares

Vasicek 5 Year Monthly

Beta

2.13

SD

1.64

7.00%

100.00%

0.00%

0.00%

13.47%

13.47%

2,497

1,327

0

409

8,152

113

Exit Multiple Calculation

Terminal Year EBITDA

Exit Multiple

Terminal Value

897.18

21.22

19034.47

Discount Period

Discount Factor

5

1.880953

Discounted Terminal Value 10119.59

Present Value of FCF

Enterprise Value

Outstanding Shares

Implied Price

Current Price

Company

Under Armour

1243.93

7714.58

113.31

79.06355

TIFFANY

DECKERS

COACH

Lululemon

72.03

Average

EV/EBITDA

25.81

10.49

32.21

13.24

24.32

21.22

Vasicek 1 Year Weekly

Hamada 5 Year Monthly

Hamada 1 Year Weekly

LULU Beta

1.54

1.29

1.60

1.6383676

Weighting

25.00%

25.00%

25.00%

25.00%

Comps

DCF

Target Price

Current Price

Undervalued

Implied Price Weight

60.19

30%

81.93

70%

75.41

72.03

4.70%

UOIG 16

University of Oregon Investment Group

Appendix 6 –COGS Model

4/17/2012

Estimating COGS

Cost Per Square Foot

Total COGS

2007A

722.32

116,723,746

2008A

650.57

158,598,050

2009A

608.16

208,980,000

2010A

708.50

292,143,000

2011A

800.00

433,203,526

2012E

888.24

599,851,507

2013E

940.00

760,595,846

2014E

900.00

851,468,999

2015E

870.00

923,265,015

2016E

850.00

984,042,858

Appendix 7 – Sources

SEC Filings

Company Investor Relations page

Company presentations

Earnings call

IBIS World

Factset

UOIG 17