Lululemon Athletica Inc. - University of Oregon Investment Group

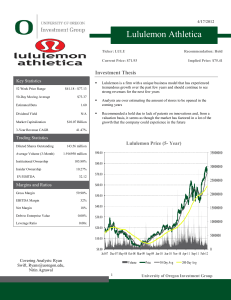

advertisement

May 2, 2014 Consumer Goods Lululemon Athletica Inc. Ticker: LULU Recommendation: Buy Current Price: $45.93 Price Target: $57.13 Investment Thesis Key Statistics 52 Week Price Range 50-Day M oving Average 50.30 1.37 Dividend Yield N/A 3-Year Revenue CAGR Lululemon’s new CEO and management team will provide unprecedented expertise and fundamental understanding of the brand’s mission and image The expansion of the Lululemon Athletcia product line, opening of Men’s only stores and the Ivivva brand will increase the diversification of products, resulting in an enlarged target market Lululemon has extensive plans to tap into global markets, including Asia and Western Europe, to expand their movement beyond the United States, Canada, Australia and New Zealand Lululemon has created a unique following of loyal customers who will continue to promote the Lululemon products and lifestyle due to the mixture of emotional and physical reward $44.32-$82.50 Estimated Beta M arket Capitalization 6.61B 30.80% Trading Statistics Diluted Shares Outstanding 115.10 Average Volume (3-M onth) 3.38M $90.00 105.80% $80.00 14.17% $70.00 12.04 $60.00 Institutional Ownership Insider Ownership One-Year Stock Chart 35000000 30000000 25000000 EV/EBITDA (LTM ) Margins and Ratios Gross M argin (LTM ) 56.00% EBITDA M argin (LTM ) 27.50% $50.00 20000000 $40.00 15000000 $30.00 10000000 $20.00 Net M argin (LTM ) 17.10% 5000000 $10.00 Debt to Enterprise Value 0.00 0 $0.00 Apr-13 Jun-13 Covering Analyst: Nicole Wilson Aug-13 Volume 1 Oct-13 Adj Close Dec-13 50-Day Avg Feb-14 200-Day Avg University of Oregon Investment Group Apr-14 University of Oregon Investment Group May 2, 2014 Business Overview Figure 1: Lululemon Yoga Exhibition Source: Google Images Lululemon Athletica Inc. (LULU) is both a designer and retailer of athletic apparel operating primarily in North America and Australia. Lululemon was founded in 1998 by Dennis Wilson in Vancouver, British Columbia to open a door in the women’s athletic apparel market. The first store was built to act as a community hub where people could interact and share physical and mental aspects of living a healthy lifestyle. This idea resonated with the public and as of February 2, 2014, Lululemon had 254 stores located in Canada, the United States, Australia and New Zealand. Female athletic wear has been the primary focus; however, the company has expanded its product offerings into everyday causal wear, male athletic wear and products for athletic female youth. Lululemon’s ability to promote their core values including developing high quality products, leading a healthy lifestyle and training their employees in self responsibility and goal setting has created a successful business feat. Currently there are 7,622 employees. The objectives of fit, function and performance are at the core of Lululemon’s business. They have managed to generate some of the highest sale productivity in the industry, and will continue to do so with the new management team focused on brand loyalty. The company primarily uses their trademarked fabric, Luon, and have a number of design patents as well. LULU generates its revenue through three different channels: in-store, direct to consumer and a wholesale segment. In-store sales represent the most significant portion of sales. For example, in fiscal 2013, direct to consumer or e-commerce, represented 16.5% of sales and the wholesale channel was approximately 1.4% of net revenue. Strategic Positioning Figure 2: Lululemon Bag Source: Google Images Grassroots Marketing Lululemon captures their consumers by creating an innovative and interactive environment. They believe this grassroots approach successfully increases brand awareness and broadens their appeal simultaneously. LULU’s primary target customers are females who understand the importance of an active, healthy lifestyle. Their marketing is not targeted at elite, intense athletes, but rather focuses on females with a balanced life. Lululemon also embeds the importance of comfort and functionality into the consumer’s minds. Their marketing strategy is based on a community approach by building brand awareness. Specifically, LULU hosts community events and creating in-store community boards such as free yoga classes. An example of a community event is the SeaWheeze half-marathon, which sold over 10,000 spots in 66 minutes. SeaWheeze takes place in Vancouver, Canada and it is important to recognize that 45% of the guests registering were from outside of Canada. Building Ambassaor and Employee Relations The company is also centered on training and personal growth of the employees. With interactive stores like Lululemon, it is important to encourage the employees to grow professionally and personally. Rather than generic sales associates, in-store employees are known as “educators”. These educators are trained to recognize each individual’s needs and provide them with the proper fit and function accordingly. UOIG 2 University of Oregon Investment Group Figure 3: Lululemon Store May 2, 2014 Asides from educators, Lululemon has adopted an ambassador program. LULU employs extensive research in each of their communities and reaches out to influential individuals. Typically these individuals are yoga instructors or fitness personnel with a high demand and they model Lululemons activewear during their sessions. Additionally, the ambassadors serve as product testers for the company. Vertical Retail Lululemon is exclusively sold through the company’s own stores, high-end lifestyle centers and yoga studios. Unlike other larger athletic wear companies such as Under Armour who sell their products in large department stores, Lululemon has stayed true to its boutique approach. The boutique approach not only controls the brand image, but also allows the company to achieve higher profit margins. The vertical retail strategy allows for direct interaction, direct feedback from the customers. Business Growth Strategies Source: Google Images Lululemon has a variety of growth strategies including growing North American store base, expanding beyond North America, further developing the ecommerce sales channel and broadening the product lines. Grow North American Store Base According to management, Canada is already built out for female’s stores. However, they will continue to open up more ivivva branded stores. In the US, management believes that as of 2014, female stores are two-thirds of the way built out, but they will continue to open more male stores and ivivva stores. The combination of female, male and young girls’ stores makes Lululemon an attractive brand across a variety of demographics. Figure 4: Store Openings Source: UOIG Spreads Expand Beyond North America As of February 2014, Lululemon operated 29 stores outside of North America, in Australia and New Zealand. The company just hired a general manager in Asia, Ken Lee, who is responsible for finding ideal locations for the company to open stores in Asia. In other regions such as the Middle East, where the market is complex, they are looking to hire partners who are experts in such areas. Potdevin is pushing the strategy of building deep, local knowledge in these markets before opening stores. This is certainly beneficial for LULU in the long run, but leaves investors today with intensified speculation of the company’s future success. A perfect example of launching a store outside of the North America, is LULU’s opening of their first store in Europe during Q1 of this year. Prior to the opening, Lululemon had representatives celebrating with the community for several weeks, including hosting yoga at the Royal Opera house. 9,700 people starting lining up for the event before it started and the guests who didn’t get spots were directed towards complementary yoga classes throughout the City of London. The example of consumers’ enthusiasm towards the company displays inevitable demand for more stores in the future. Develop the E-Commerce Sales Channel Lululemon is also going to extend their e-commerce offerings. The e-commerce website was launched in 2009 and management believes there remains lots of room for improvement, both on the retail side of the business and in regards to differentiating the consumer online experience. UOIG 3 University of Oregon Investment Group Figure 5: Store Diversification May 2, 2014 Broaden the Product Lines Historically, Lululemon has been focused on designing and providing female active wear. As previously mentioned, they have most recently tapped into other target markets. Rather than being complacent with their female attire, management is focused on expanding into product categories such as swim, tennis and golf. The company also wants to extend the usage of their products beyond yoga, running and general fitness. The company is channeling energy towards growing the men’s business. Currently, men’s products are offered in most stores, but in 2014 they are opening three locations that are fully dedicated to men’s clothing in Vancouver, Miami and Santa Monica. Management is optimistic that these stores will thrive and provide reasoning to expand locations in the future. Ivivva, or the female youth line, is also a bright spot for the business. In 2014, the company ended with 12 stores and are intending to add up to 10 more by the end of the year. This line of business will continue to expand for many years. Industry Source: LULU 10-K Figure 6: Revenue Projections Women’s Retail Industry competition is expected to rise in women’s retail due to the increase in internet retailers. According to Ibisworld, revenue growth is expected to be strong in 2014 and 2015 as women continue to stock their wardrobes with items did not purchase during the recession. The demand for high-end retail is on a continuous upward trend, which is very helpful for Lululemon. Gym, Health and Fitness The benefits of a healthy lifestyle have been heavily publicized over the past few years. During the five years to 2019, the industry will benefit from an increase in per capita disposable income. The increase in spending coupled with continued consumer awareness regarding the health benefits of exercise, will drive revenue growth. Revenue is anticipated to grow at an annualized rate of about 2.8%. Time Spent on Leisure and Sports The time spent on leisure and sports influence the industry demand. The more time available for leisure, the more likely people will allocate time for exercise. The link between leisure time and demand relates to health and fitness awareness. Exercise clubs are typically used by individuals within the age range of 20-64. The number of adults who will fall into this age category is expected to increase slowly during 2014, which will help the industry. Macro factors Source: UOIG Spreads Per Capita Disposable Income Retail stores rely heavily on the income of their consumer. As per capita income increases in the next upcoming years, there will be higher revenues in the industry. Consumer Spending Consumer spending has a direct relation to revenue for the industry. An increase in spending widens the customer base for the companies within the industry. Generally, spending is normally tied with overall economic health and our economy is gaining strength. UOIG 4 University of Oregon Investment Group May 2, 2014 Consumer Confidence Index As the economy continues to recover, consumers will feel safer spending money and start to save less. Consumer sentiment is expected to increase in 2014, lower again in 2015, and have a steady rise into the forseeable future. Figure 7: Consumer Confidence Index Competition 22 12 2 06 07 08 09 10 11 12 13 14 15 16 -8 17 18 19 This company operates in a highly competitive environment. Aspects that apparel companies compete on are price, preference, product life expectancy, style and fit. It is very easy to manufacture yoga pants; however, it is extremely difficult to create a brand that resonates with the public. Capitalizing on a brand identity prevents other forces from entering into the competitive market space. Branding is a complex process, as it is a combination of attributes that create value for the customers. The tangible and intangible aspects of a brand name can take years to build as well as extreme effort and financing to maintain. For example, it took Nike about 15 years to successfully build its brand name. -18 -28 -38 -48 Source: IBISworld Direct competitors include Lucy Activewear, Lorna Jane and Title Nine, all of which are not publically traded companies. Under Armour, Nike and Gap also offer similar products. Although there are a variety of similar product offerings, Lululemon has differentiated itself by offering a unique customer experience and creating an innovative, community-based approach. For example, as part of the fitting process, Lululemon provides hemming and altering as a complimentary service. Nike, Under Armour and Gap all run their sizes as XS, S, M, L whereas LULU sells sizes similar to pants sizing like 0,2,4,6,8 etc. The altering services coupled with the different sizing techniques provide a very special, interactive experience. Figure 8: Store Projections Management and Employee Relations Lululemon has added two significant, expert members to their management team this year. Working together, these individuals will lead the company to expand their business and continue to maintain an esteemed brand image. Given LULU’s performance in 2013, it is exciting to see the turnaround the management team has in mind for the upcoming years. Source: UOIG Spreads Laurent Potdevin- Chief Executive Officer Potdevin was elected CEO of Lululemon in November of 2013 due to his expertise in the retail industry. Prior to Lululemon, he served as President of TOMS Shoes and he helped build a strong management team, led global expansion and broadened their brand identity. Before TOMS Potdevin was CEO of Burton Snowboards, another brand focused on customer service and experience. Potdevin’s expertise coupled with his passion for athletics makes him a promising fit and upside catalyst looking into the future. John Currie- Executive Vice President and Chief Financial Officer In January of 2007, John Currie joined the Lululemon team as both Executive Vice President and Chief Financial Officer. In addition to working for LULU, Currie served as the CFO for Intrawest Corporation and financial positions within the BCE group. It is important to recognize that like Potdevin, Currie provides legitimate experience with expanding global business. UOIG 5 University of Oregon Investment Group May 2, 2014 Tara Poseley- Chief Product Officer Joining the management team in October of 2013, Poseley also adds a new energy to Lululemon. After 25 years of experience in the retail industry, she offers expertise in strategic product development and merchandising and brand management. Prior to Lululemon, she was CEO of Kmart Apparel and Interim President at Bebe Stores, President of Disney Stores North America and CEO of Design Within Reach. Additionally, Poseley spent about 15 years working for Gap, Inc. which is a direct competitor for Lululemon. Only to enhance her fit with the company, it’s important to note that she is an avid yoga practice and telemark skier. Figure 9: COGS Projections Management Guidance Laurent Potsdevin joined Lululemon as CEO in January of 2014. Rather than providing investors with numerical guidance, he takes the stance of reassuring and embedding Lululemon’s mission of fit, function and performance to the public. Perhaps he uses this strategy because in the past, the stock has reacted very sensitively to lowered guidance. He has only been CEO for three months and will eventually have to provide investors with more concrete guidance. Source: UOIG Spreads In regards to the 2014 year, they expect revenue to fall within 1.77-1.82 billion dollars. The gross margin will remain in the low 50’s due to the rebalancing of product assortment to meet guest demands, a product development engine for global business and a foreign exchange impact from a weaker Canadian dollar. Management also expects the capital expenditures to fall between 110 and 115 million. Recent News “Lululemon Sees Holiday Quarter Profit Improve” March 27, 2014 Ben Rubin, from the Wallstreet Journal, wrote about Luluemon’s improved profits over the holiday season. The article discusses the negative PR and quality control issues have caused a series of problems in the last year. Despite the issues, the company has managed to improve their profit margins. Figure 10: DCF Considerations Considerations Avg. Industry Debt / Equity Implied Price 5.07% Avg. Industry Tax Rate 32.19% Current Reinvestment Rate 45.47% Reinvestment Rate in Year 2020E 15.01% Implied Return on Capital in Perpetuity 19.99% Terminal Value as a % of Total 40.7% Implied 2015E EBITDA Multiple 11.5x Implied Multiple in Year 2024E 1.9x Free Cash Flow Growth Rate in Year 2024E 8% Source: UOIG Spreads “Lululemon Shareholder Suit See- Through Pants TerminalOver Growth Rate Tossed” April 18, 2014 Bob Van Voris from Bloomberg writes about the dismissal of claims that shareholders lost $2 billion because the athletic-wear company misled them about quality problems with its products. The claims have been dropped because investors failed to show that statements about product quality were false and misleading. Catalysts Upside The Ivivva and men’s only stores will further develop brand recognition and loyalty amongst a larger target market Unique grassroots marketing strategies will continue to differentiate this company from its competitors UOIG 6 University of Oregon Investment Group Figure 11: Comparable Weightings Multiple EV/Revenue EV/Gross Profit EV/EBIT EV/EBITDA EV/(EBITDA-Capex) Market Cap/Net Income = P/E Price Target Current Price Undervalued Implied Price Weight 42.12 0.00% 48.34 0.00% 82.93 0.00% 76.04 70.00% 85.95 20.00% 87.95 10.00% $79.21 45.93 72.47% May 2, 2014 Other companies, such as Nike, are increasing the prices of their yoga pants diminishing price as a competitive advantage Potdevin, Currie and Poseley will leverage their prior experience in managing a global brand for the best interest of Lululemon’s image Downside More issues around PR will negatively affect the stock prices If Lululemon’s customers do not like their new products, the harm would be very detrimental to the business The highly competitive market and the size and resources of some competitors may allow them to compete more effectively The company’s inability to successful open new stores in ideal locations will hinder the ability to capitalize on the grassroots marketing efforts Source: UOIG Spreads Comparable Analysis The valuation methods for the consumer goods sector are generally EV/EBITDA and the PE ratio. The EV/EBIDTA was weighed 70% because it ignores the different taxations of the comparable companies. EV/(EBITDACapex) was also used because this industry spends a substantial amount on capital expenditures to extend their business. Lastly, P/E was weighted at 10%. This sector is also very cyclical, so the earnings are volatile. Despite being a common metric for the industry, it implies an extreme undervaluation so it was weighed minimally. Figure 12: Under Amour Logo It is difficult to find comparables for a company like Lululemon, which operates in a specific niche. With their plans to expand overseas, it made it slightly easier to find comparable companies. The comparables were chosen based on product offering, geographic locations and growth rates. Under Armour, Inc. (UA)- 40% Source: Google Images Under Armour Inc. (UA) distributes performance apparel, footwear and accessories for men, women and youth and is headquartered in Baltimore, Maryland. The company provides its apparel in compression, fitted and loose types for both hot and cold weather and for the following activities: football, baseball, lacrosse, softball and soccer cleats, slides, running, and hunting boots. Their revenue is generated primarily from the wholesale of products and through a direct consumer sales channel, which includes brand store and websites. A large majority of their sales are within North America, but the company is continuing to expand into other markets. UA is a good comparable to Lululemon because the majority of their revenue, 94.1%, is derived from North America. They sell their products through independent distributors in Australia and New Zealand as well. In 2011, they opened their first store in China and Lululemon also intends to tap into Asian markets. Under Armour has a large product mix, and their female line is targeted specifically at intense athletes. UOIG 7 University of Oregon Investment Group May 2, 2014 The Gap, Inc. (GPS)-20% Figure 13: Gap Logo The Gap (GPS) operates as an apparel retail company worldwide founded in 1969 in San Francisco. It provides apparel, accessories and personal care products for men, women and children under the Gap Inc., Banana Republic, Old Navy, Piperlime, Athleta and Intermix brands. Amongst its variety of product offerings are active apparel for women, accessories for sports and fitness activities and crossover apparel for casualwear. GPS has franchise stores in Asia, Australia, Eastern Europe, Latin America, the Middle East and Africa. As of March 2014, Gap has 3,100 company-operated stores in 350 franchise stores throughout 90 countries. They have about 137,000 employees. Lululemon competes more directly with the Athleta brand that was acquired by Gap in 2008 and there are currently 65 Athleta stores. Athleta offers functional apparel, footwear and accessories across a wide variety of sports and fitness activities. Additionally, in 1998 GapBody was launched in Gap stores and includes active wear for women. All of these products are available globally. Source: Google Images Figure 14: Nike Logo Gap was founded about 45 years ago, but is still an important comparable for Lululemon because their Athleta brand is growing quickly. In 2013, they opened 30 stores. Nike Inc. (NKE)-20% Headquarted in our beloved Beaverton, Nike Inc.is involved in the development, marketing and sale of athletic apparel, equipment and accessories for men, women and kids worldwide. Nike operates in seven categories, including running, basketball, football, mens training, womens training, NIKE sportswear and action sports. The products are designed for athletic use, although many users wear Nike for recreational reasons. Nike also owns Converse and Hurley brands. They have about 645 Direct to Consumer stores and widely distribute their products by internet websites and other retail stores. Nike’s business model is far more complex and versatile than Lululemons. They have successfully branded the iconic ‘sport’ image throughout the world. That being said, they do offer products that directly align similarly with Lululemon, both in style and in price. No one is in the position to hinder Nike’s growing legacy, but Lululemon is penetrating one of Nike’s niche markets. Source: Google Images Figure 15: Abercrombie Logo Abercrombie and Fitch (ANF)-20% Abercrombie and Fitch was incorporated in Delaware in 1996. This retailer sells a wide variety of products including casual sportswear, personal care products, and accessories for men, women and kids under the Abercrombie & Fitch, abercrombie kids, and Hollister brands. ANF has 843 stores in the United States and 163 stores outside of the United States. ANF was chosen as a comparable due do its market capitalization, business model and somewhat similar growth rates. Abercrombie and Fitch held their initial public offering in 1996 and investors have endured a wild ride. Discounted Cash Flow Analysis Revenue Model Revenue is projected on a per store basis. Historically, stores have been growing more than 20% a year and the growth is trended down substantially in the revenue model. The revenue model is broken up into three geographic segments: Source: Google Images UOIG 8 University of Oregon Investment Group May 2, 2014 United States, Canada and Outside of North America. Lululemon has focused primarily on North America, but has consistently opened stores in New Zealand and Australia. Figure 16: Beta Calculations Beta SE Weighting Three Year Daily 1.37 0.00 100.00% Three Year Weekly 1.38 0.05 0.00% 5 Year Monthly 1.53 0.12 0.00% 1 Year Daily 1.48 0.22 0.00% Lululemon Athletica Inc. Beta The Stores Breakdown illustrates the reasoning behind the projections. There are three categories of stores including Lululemon Athletica, ivivva, and a Men’s line. Lululemon is primarily focusing on Western Europe and Asia for store openings in the next few years. After that, further expansion into South America and Eastern Europe is possible. Looking forward, the stores were projected based on a mixture of management guidance and trends. Revenue was projected using the same-store sales method. Seasonal and geographic variations are removed from the measurement because this valuation collects and average. Lululemon has not operated any outlet stores, so the ability to project same-store sales is simple. 1.37 Source: UOIG Spreads Beta The beta is weighed 100% with 3 year daily regressions off the S&P 500. There is no margin of error. I believe a beta of 1.37 accurately represents the risk associated with this company. Figure 17: Sensitivity Analysis Undervalued/(Overvalued) Adjusted Beta Terminal Growth Rate 0 2.0% 2.5% 3.0% 3.5% 4.0% 1.17 20.22% 23.82% 27.93% 32.65% 38.14% 1.27 10.39% 13.30% 16.59% 20.33% 24.62% 1.37 1.86% 4.23% 6.89% 9.89% 13.30% 1.47 (5.61%) (3.66%) (1.48%) 0.95% 3.69% 1.57 (12.19%) (10.57%) (8.78%) (6.79%) (4.57%) Source: UOIG Spreads Implied Price WACC Selling, Administrative and Other Expenses Their SG&A consist of marketing costs, accounting costs, information technology costs, human resource costs, professional fees, corporate facility costs etc. SG&A is projected to increase due to the anticipated growth of the corporate staff and store-level associates. Depreciation & Amortization Depreciation and Amortization relates to leasehold improvements, furniture and fixtures, computer hardware and software and equipment in the stores. It was projected as a percentage of revenue because it has historically remained steady. There was no direct correlation between D&A costs and Cap-Ex in a year, so the percentage of revenue method is appropriate. Figure 18: Sensitivity Analysis 50 2.0% Terminal Growth Rate 2.5% 3.5% 3.00% 4.0% 10.34% 49.48 50.86 52.43 54.23 56.31 10.84% 48.34 49.58 50.96 52.54 54.35 11.34% 11.84% 47.33 48.44 49.67 51.07 52.65 46.43 47.42 48.53 49.77 51.17 12.34% 45.60 46.51 47.51 48.62 49.87 Source: UOIG Spreads Cost of Goods Sold COGS includes the purchased merchandise, delivery, costs of the distribution centers, costs of occupancy related to store operations and the cost of production, merchandize and design. As Lululemon enters the Asian marketplace, it is likely that their COGS will decrease as a percentage of revenue due to a decrease in inventory delivery and wage labor. Furthermore, the ivivva line requires less material because the sizes are substantially smaller. Capital Expenditures These costs are related to opening stores and ongoing store refurbishment. Management providedUndervalued/(Overvalued) specific guidance for capital expenditures in the Terminal Growth Rate upcoming fiscal year. Beyond that, capital expenditures are projected out to increase, but decrease as a percentage of revenue into the future. Unfortunately, there was no correlation between the amount of capital expenditures and store opening historically. Tax Rate The company’s tax rate has been fluctuating significantly in the previous years. Due the expectation of selling products abroad, the tax rate slightly decreases over time. UOIG 9 University of Oregon Investment Group May 2, 2014 Terminal Growth Rate The free cash flow was growing at about 8% in the terminal so I used a 3% an intermediate growth rate in compliance with group standards. Recommendation Figure 19: Implied Price Lululemon has captured a large pool of loyal customers and is in the midst of an Final Implied Price DCF Price Target Weight enormous expansion. 2013 was a treacherous year for this company due to a 47.88 60.00% 17% product recall, an inappropriate PR comment and the addition of a new Forward Comparables Analysis 79.21 40.00% management team. Let the other investors dwell in the past. This is an Price Target 60.41 exceptional brand with incredibly strong brand loyalty. Let’s support the growth and international expansion. Both the Discounted Cash Flow Analysis and Comparable Analysis show an undervaluation. Given a price target of $60.91 and an undervaluation of 31.53%, LULU is given a rating of outperform for the Svigals and Tall-Firs portfolios. Current Price Undervalued 45.93 31.53% Source: UOIG Spreads UOIG 10 University of Oregon Investment Group May 2, 2014 Appendix 1 – Comparable Analysis Comparables Analysis LULU Lululemon Athletica Inc. ($ in millions) Stock Characteristics Current Price Beta Max $72.52 1.85 Min $36.96 0.67 Size Short-Term Debt Long-Term Debt Cash and Cash Equivalent Non-Controlling Interest Preferred Stock Diluted Basic Shares Market Capitalization Enterprise Value 178.00 1,369.00 3,337.00 0.00 0.00 878.10 64,894.00 61,192.00 0.00 0.00 347.50 0.00 0.00 73.40 2,722.00 2,317.00 25.00 180.73 698.65 0.00 0.00 173.60 11,322.00 11,128.00 Growth Expectations % Revenue Growth 2014E % Revenue Growth 2015E % EBITDA Growth 2014E % EBITDA Growth 2015E % EPS Growth 2014E % EPS Growth 2015E 23.63% 22.34% 27.10% 24.10% 23.50% 25.40% -3.50% 1.30% 4.70% 7.90% 8.00% 12.50% Profitability Margins Gross Margin EBIT Margin EBITDA Margin Net Margin 62.30% 24.40% 27.50% 17.08% Credit Metrics Interest Expense Debt/EV Leverage Ratio Operating Results Revenue Gross Profit EBIT EBITDA Net Income Capital Expenditures Multiples EV/Revenue EV/Gross Profit EV/EBIT EV/EBITDA EV/(EBITDA-Capex) Market Cap/Net Income = P/E Median Weight Avg. $45.93 $48.71 1.37 1.15 UA Under Armour Inc GPS NKE The Gap, Inc. Nike, Inc. ANF Abercrombie & Fitch Co. $45.93 1.37 40.00% $47.21 0.88 20.00% $39.63 1.48 20.00% $72.52 0.67 20.00% $36.96 1.85 85.59 571.13 1,124.62 0.00 0.00 349.14 21,488.00 20,554.20 0.00 0.00 698.65 0.00 0.00 115.41 5,300.78 4,602.13 104.97 47.95 347.50 0.00 0.00 173.60 11,322.00 11,128.00 25.00 1,369.00 991.00 0.00 0.00 447.00 17,180.00 17,006.00 178.00 1,210.00 3,337.00 0.00 0.00 878.10 64,894.00 61,192.00 15.00 180.73 600.12 0.00 0.00 73.40 2,722.00 2,317.00 8.70% 9.40% 10.00% 12.60% 14.20% 15.80% 11.25% 12.08% 15.38% 15.94% 18.32% 19.52% 15.04% 14.45% 14.30% 14.04% 14.20% 14.33% 23.63% 22.34% 27.10% 24.10% 23.50% 25.40% 3.80% 5.00% 4.70% 7.90% 8.00% 12.50% 8.70% 9.40% 10.00% 12.60% 13.60% 15.80% -3.50% 1.30% 8.00% 11.00% 23.00% 18.50% 39.05% 6.82% 12.44% 4.48% 49.01% 12.81% 15.23% 7.88% 48.81% 11.15% 14.35% 7.26% 0.56 0.24 0.28 0.17 0.49 0.11 0.14 0.07 0.39 0.13 0.16 0.08 0.45 0.13 0.15 0.10 0.62 0.07 0.12 0.04 $61.00 0.08 0.51 $0.00 0.00 0.00 $11.15 0.02 0.38 $24.69 0.04 0.40 $0.00 0.00 0.00 $3.14 0.01 0.38 $61.00 0.08 0.51 $45.00 0.02 0.30 $11.15 0.08 0.40 $30,103.00 $13,443.00 $3,959.00 $4,586.00 $2,995.00 $856.00 $1,830.57 $1,021.46 $271.00 $398.00 $178.00 $112.00 $1,830.57 $1,021.46 $446.66 $503.41 $312.66 $112.00 $2,883.00 $1,413.00 $331.00 $398.00 $202.00 $136.00 $16,454.00 $6,425.00 $2,108.00 $2,711.00 $1,296.00 $711.00 $30,103.00 $13,443.00 $3,959.00 $4,586.00 $2,995.00 $856.00 $3,971.00 $2,474.00 $271.00 $494.00 $178.00 $202.00 3.86x 7.88x 33.62x 27.96x 42.47x 56.05x 0.58x 0.94x 8.07x 4.69x 7.93x 13.26x 1.03x 2.65x 8.07x 6.27x 8.50x 13.26x 2.03x 4.55x 15.46x 13.34x 16.41x 21.67x 0.58x 0.94x 8.55x 4.69x 7.93x 15.29x $3,971.00 $11,258.80 $2,474.00 $5,033.60 $446.66 $1,400.00 $503.41 $1,717.40 $312.66 $974.60 $202.00 $408.20 #NUM! 0 2.03x 2.27x 4.51x 4.78x 10.30x 19.86x 9.14x 16.05x 11.76x 23.56x 16.95x 32.46x Multiple EV/Revenue EV/Gross Profit EV/EBIT EV/EBITDA EV/(EBITDA-Capex) Market Cap/Net Income = P/E Price Target Current Price Undervalued 2.51x 3.86x 4.51x 7.88x 10.30x 33.62x 9.14x 27.96x 11.76x 42.47x 16.95x 56.05x Implied Price Weight 42.12 0.00% 48.34 0.00% 82.93 0.00% 76.04 70.00% 85.95 20.00% 87.95 10.00% $79.21 45.93 72.47% UOIG 11 University of Oregon Investment Group May 2, 2014 Appendix 2 – Discounted Cash Flows Valuation Discounted Cash Flow Analysis ($ in millions) Total Revenue 2010A 452.9 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 711.7 1001.8 1370.4 1591.2 1830.6 2095.1 2340.3 2590.8 2862.3 3257.4 3626.4 3814.6 3959.1 57.1% 40.8% 36.8% 16.1% 15.0% 14.5% 11.7% 10.7% 10.5% 13.8% 11.3% 5.2% 3.8% 4.4% 209.0 205.2 401.2 564.5 702.0 809.1 923.9 1030.9 1140.0 1258.0 1430.0 1590.2 1670.8 1732.1 1806.2 % Revenue 46.1% 28.8% 40.0% 41.2% 44.1% 44.2% 44.1% 44.1% 44.0% 44.0% 43.9% 43.9% 43.8% 43.8% 43.7% Gross Profit $243.9 $506.5 $600.6 $805.8 $889.1 $1,021.5 $1,171.2 $1,309.4 $1,450.9 $1,604.3 $1,827.4 $2,036.2 $2,143.8 $2,227.0 $2,327.0 Gross Margin 53.9% 71.2% 60.0% 58.8% 55.9% 55.8% 55.9% 56.0% 56.0% 56.1% 56.1% 56.2% 56.2% 56.3% 56.3% 136.2 212.8 282.3 386.4 448.7 518.1 597.1 664.1 728.7 797.9 899.9 992.7 1034.7 1064.0 1100.5 30.1% 29.9% 28.2% 28.2% 28.2% 28.3% 28.5% 28.4% 28.1% 27.9% 27.6% 27.4% 27.1% 26.9% 26.6% 20.8 24.6 30.3 43.0 49.1 56.7 65.2 73.4 81.9 91.2 104.6 117.4 124.5 130.2 136.9 4.6% 3.5% 3.0% 3.1% 3.1% 3.1% 3.1% 3.1% 3.2% 3.2% 3.2% 3.2% 3.3% 3.3% 3.3% $1,089.6 % YoY Growth Cost of Goods Sold Selling General and Administrative Expense % Revenue Depreciation and Amortization % Revenue Earnings Before Interest & Taxes 4133.2 $86.9 $269.1 $288.1 $376.4 $391.4 $446.7 $508.8 $571.9 $640.3 $715.2 $822.9 $926.1 $984.6 $1,032.8 19.2% 37.8% 28.8% 27.5% 24.6% 24.4% 24.3% 24.4% 24.7% 25.0% 25.3% 25.5% 25.8% 26.1% 26.4% 86.9 269.1 288.1 376.4 391.4 446.7 508.8 571.9 640.3 715.2 822.9 926.1 984.6 1,032.8 1,089.6 19.2% 37.8% 28.8% 27.5% 24.6% 24.4% 24.3% 24.4% 24.7% 25.0% 25.3% 25.5% 25.8% 26.1% 26.4% 28.5 61.1 104.5 110.0 117.6 134.0 151.4 168.7 187.3 207.4 236.6 263.9 278.2 289.2 302.4 32.8% 22.7% 36.3% 29.2% 30.0% 30.0% 29.8% 29.5% 29.3% 29.0% 28.8% 28.5% 28.3% 28.0% 27.8% Net Income $58.5 $208.0 $183.6 $266.5 $273.8 $312.7 $357.5 $403.2 $453.0 $507.8 $586.3 $662.2 $706.5 $743.6 $787.2 Net Margin 12.9% 29.2% 18.3% 19.4% 17.2% 17.1% 17.1% 17.2% 17.5% 17.7% 18.0% 18.3% 18.5% 18.8% 19.0% 20.8 24.6 30.3 43.0 49.1 56.7 65.2 73.4 81.9 91.2 104.6 117.4 124.5 130.2 136.9 $79.3 $232.6 $213.8 $309.5 $322.8 $369.4 $422.7 $476.6 $534.9 $599.0 $691.0 $779.6 $830.9 $873.8 $924.2 17.5% 32.7% 21.3% 22.6% 20.3% 20.2% 20.2% 20.4% 20.6% 20.9% 21.2% 21.5% 21.8% 22.1% 22.4% % Revenue Earnings Before Taxes % Revenue Less Taxes (Benefits) Tax Rate Add Back: Depreciation and Amortization Operating Cash Flow % Revenue Current Assets % Revenue Current Liabilities 56.8 73.0 117.7 196.9 244.2 275.5 310.1 342.9 375.7 410.7 462.6 509.5 530.2 544.4 562.1 12.5% 10.3% 11.7% 14.4% 15.3% 15.1% 14.8% 14.7% 14.5% 14.4% 14.2% 14.1% 13.9% 13.8% 13.6% 58.7 85.4 103.4 133.4 113.5 151.8 178.1 206.2 236.3 269.9 317.3 363.0 393.7 420.9 452.2 13.0% 12.0% 10.3% 9.7% 7.1% 8.3% 8.5% 8.8% 9.1% 9.4% 9.7% 10.0% 10.3% 10.6% 10.9% Net Working Capital ($1.8) ($12.4) $14.2 $63.5 $130.7 $123.7 $132.0 $136.7 $139.4 $140.8 $145.3 $146.5 $136.6 $123.5 $109.9 % Revenue (.4%) (1.7%) 1.4% 4.6% 8.2% 6.8% 6.3% 5.8% 5.4% 4.9% 4.5% 4.0% 3.6% 3.1% 2.7% ($10.5) $26.6 $49.3 $67.2 ($6.9) $8.2 $4.7 $2.7 $1.4 $4.5 $1.2 ($9.9) ($13.0) ($13.6) % Revenue Change in Working Capital Capital Expenditures % Revenue Acquisitions % Revenue Unlevered Free Cash Flow Discounted Free Cash Flow 15.5 30.4 116.7 93.2 106.4 112.0 136.2 175.5 220.2 234.7 250.8 264.7 270.8 273.2 268.7 3.4% 4.3% 11.6% 6.8% 6.7% 6.1% 6.5% 7.5% 8.5% 8.2% 7.7% 7.3% 7.1% 6.9% 6.5% 0.0 12.5 5.7 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0% 1.8% 0.6% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 63.8 200.3 64.9 166.9 149.3 264.3 278.2 296.4 312.0 362.9 435.7 513.6 570.0 613.7 669.1 239.0 227.4 219.1 208.4 219.2 237.9 253.6 254.5 247.7 244.1 UOIG 12 University of Oregon Investment Group May 2, 2014 Appendix 3 – Revenue Model Revenue Model ($ in millions) United States 2010A 2011A 181.2 % Growth % of Total Revenue 40.0% number of stores 70 % Growth revenue per store Canada 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E 327.4 531.0 835.9 1050.2 1217.7 1376.0 1535.1 1657.5 1768.5 1900.8 1988.4 2090.4 2114.7 80.7% 62.2% 57.4% 25.6% 16.0% 13.0% 11.6% 8.0% 6.7% 7.5% 4.6% 5.1% 1.2% 2164.8 2.4% 46.0% 53.0% 61.0% 66.0% 66.5% 65.7% 65.6% 64.0% 61.8% 58.4% 54.8% 54.8% 53.4% 52.4% 78 108 135 171 198 215 238 255 270 288 299 312 318 328 11.4% 38.5% 25.0% 26.7% 15.8% 8.6% 10.7% 7.1% 5.9% 6.7% 3.8% 4.3% 1.9% 3.1% 2.6 4.2 4.9 6.2 6.1 6.2 6.4 6.5 6.5 6.6 6.6 6.7 6.7 6.7 6.6 271.3 370.1 430.8 465.9 461.4 527.0 578.5 603.0 637.0 662.4 697.5 714.4 716.1 717.6 709.8 % Growth 36.4% 16.4% 8.2% (1.0%) 14.2% 9.8% 4.2% 5.6% 4.0% 5.3% 2.4% .2% .2% (1.1%) 59.9% 52.0% 43.0% 34.0% 29.0% 28.8% 27.6% 25.8% 24.6% 23.1% 21.4% 19.7% 18.8% 18.1% 17.2% number of stores 44 45 47 51 54 62 65 67 70 72 75 76 77 78 78 revenue per store 6.2 8.2 9.2 9.1 8.5 8.5 8.9 9.0 9.1 9.2 9.3 9.4 9.3 9.2 9.1 Outside North America 4.5 % of Total Revenue 14.2 40.1 68.5 79.6 85.9 140.6 202.2 296.3 431.4 659.1 923.6 1008.1 1126.8 1258.6 214.3% 181.5% 71.0% 16.1% 7.9% 63.7% 43.8% 46.5% 45.6% 52.8% 40.1% 9.1% 11.8% 11.7% 1.0% 2.0% 4.0% 5.0% 5.0% 4.7% 6.7% 8.6% 11.4% 15.1% 20.2% 25.5% 26.4% 28.5% 30.5% 9 11 19 25 29 31 43 60 83 106 130 172 186 206 228 0.5 1.3 2.1 2.7 2.7 2.8 3.3 3.4 3.6 4.1 5.1 5.4 5.4 5.5 5.5 457.0 711.7 1001.8 1370.4 1591.2 1830.6 2095.1 2340.3 2590.8 2862.3 3257.4 3626.4 3814.6 3959.1 4133.2 55.7% 40.8% 36.8% 16.1% 15.0% 14.5% 11.7% 10.7% 10.5% 13.8% 11.3% 5.2% 3.8% 4.4% 134 174 211 254 291 323 365 408 448 493 547 575 602 634 8.9% 29.9% 21.3% 20.4% 14.6% 11.0% 13.0% 11.8% 9.8% 10.0% 11.0% 5.1% 4.7% 5.3% % Growth % of Total Revenue number of stores revenue per store Total Revenue % Growth Total Stores 123 % Growth Store Breakdown 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E United States Lululemon Athletica 70 78 108 132 162 179 186 198 207 218 230 237 246 248 252 Ivivva 0 0 0 3 9 17 25 33 39 41 44 47 50 53 57 Men's 0 0 0 0 0 2 4 7 9 11 14 15 16 17 19 Total 70 78 108 135 171 198 215 238 255 270 288 299 312 318 328 Canada Lululemon Athletica 45 45 47 48 53 55 56 57 58 59 60 61 61 61 61 Ivivva 0 0 0 3 4 6 7 7 8 8 9 9 10 11 11 Men's 0 0 0 0 0 1 2 3 4 5 6 6 6 6 6 Total 44 45 47 51 54 62 65 67 70 72 75 76 77 78 78 Lululemon Athletica 9 11 19 25 29 31 39 52 67 84 100 136 145 160 178 Ivivva 0 0 0 0 0 0 2 4 10 15 22 27 31 35 38 Men's 0 0 0 0 0 0 2 4 6 7 8 9 10 11 12 Total 9 11 19 25 29 31 43 60 83 106 130 172 186 206 228 Outside of North America Total Stores % Growth 123 134 174 211 254 291 323 365 408 448 493 547 575 602 634 8.9% 29.9% 21.3% 20.4% 14.6% 11.0% 13.0% 11.8% 9.8% 10.0% 11.0% 5.1% 4.7% 5.3% UOIG 13 University of Oregon Investment Group May 2, 2014 Appendix 4 – Working Capital Model Working Capital Model ($ in millions) Total Revenue Current Assets Accounts Receivable Days Sales Outstanding A/R % of Revenue Inventory Days Inventory Outstanding % of Revenue Prepaid Expenses and Other Current Assets Days Prepaid Expense Outstanding % of Revenue Total Current Assets % of Revenue Long Term Assets Net PP&E Beginning Capital Expenditures Acquisitions Depreciation and Amortization Net PP&E Ending Total Current Assets & Net PP&E % of Revenue Current Liabilities Accounts Payable Days Payable Outstanding % of Revenue Accrued Liabilities Days Charges Outstanding % of Revenue Accrued Compensation and Related Expenses % of Revenue Income Taxes Payable % of Revenue Unredeemed Gift Card Liability % of Revenue Total Current Liabilities % of Revenue 2010A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E $452.9 2011A $711.7 2012A $1,001.8 2013A $1,370.4 2014A $1,591.2 $1,830.6 $2,095.1 $2,340.3 $2,590.8 $2,862.3 $3,257.4 $3,626.4 $3,814.6 $3,959.1 $4,133.2 8.2 6.6 1.8% 44.1 77.0 9.7% 4.5 12.1 1.0% 56.8 12.5% 9.1 4.7 1.3% 57.5 102.2 8.1% 6.4 11.0 0.9% 73.0 10.3% 5.2 1.9 0.5% 104.1 94.7 10.4% 8.4 10.8 0.8% 117.7 11.7% 6.4 1.7 0.5% 155.2 100.4 11.3% 35.3 33.3 2.6% 196.9 14.4% 11.9 2.7 0.7% 186.1 96.8 11.7% 46.2 37.6 2.9% 244.2 15.3% 13.7 2.7 0.8% 210.5 95.0 11.5% 51.3 36.1 2.8% 275.5 15.1% 16.8 2.9 0.8% 235.7 93.1 11.3% 57.6 35.2 2.8% 310.1 14.8% 19.9 3.1 0.9% 259.8 92.0 11.1% 63.2 34.7 2.7% 342.9 14.7% 23.3 3.3 0.9% 283.7 90.8 11.0% 68.7 34.4 2.7% 375.7 14.5% 27.2 3.5 1.0% 309.1 89.7 10.8% 74.4 34.0 2.6% 410.7 14.4% 32.6 3.7 1.0% 346.9 88.5 10.7% 83.1 33.7 2.6% 462.6 14.2% 38.1 3.8 1.1% 380.8 87.4 10.5% 90.7 33.3 2.5% 509.5 14.1% 42.0 4.0 1.1% 394.8 86.3 10.4% 93.5 33.0 2.5% 530.2 13.9% 45.5 4.2 1.2% 403.8 85.1 10.2% 95.0 32.6 2.4% 544.4 13.8% 49.6 4.4 1.2% 415.4 83.9 10.1% 97.1 32.2 2.4% 562.1 13.6% 61.7 15.5 0.0 20.8 61.6 118.4 26.1% 61.6 30.4 12.5 24.6 71.0 143.9 20.2% 71.0 116.7 5.7 30.3 162.9 280.6 28.0% 162.9 93.2 0.0 43.0 214.6 411.5 30.0% 214.6 106.4 0.0 49.1 255.6 499.8 31.4% 255.6 112.0 0.0 56.7 310.9 586.4 32.0% 310.9 136.2 0.0 65.2 381.8 691.9 33.0% 381.8 175.5 0.0 73.4 483.9 826.8 35.3% 483.9 220.2 0.0 81.9 622.2 997.9 38.5% 622.2 234.7 0.0 91.2 765.7 1176.4 41.1% 765.7 250.8 0.0 104.6 911.9 1374.4 42.2% 911.9 264.7 0.0 117.4 1059.2 1568.7 43.3% 1059.2 270.8 0.0 124.5 1205.6 1735.8 45.5% 1205.6 273.2 0.0 130.2 1348.6 1893.0 47.8% 1348.6 268.7 0.0 136.9 1480.3 2042.4 49.4% 11.0 19.3 2.4% 17.6 14.2 3.9% 10.6 2.3% 7.7 1.7% 11.7 2.6% 58.7 13.0% 6.7 11.8 0.9% 25.3 13.0 3.6% 16.9 2.4% 18.4 2.6% 18.2 2.6% 85.4 12.0% 14.5 13.2 1.5% 34.5 12.6 3.4% 22.9 2.3% 8.7 0.9% 22.8 2.3% 103.4 10.3% 1.0 0.7 0.1% 30.0 8.0 2.2% 27.5 2.0% 39.6 2.9% 35.1 2.6% 133.4 9.7% 12.6 6.6 0.8% 42.3 9.7 2.7% 19.4 1.2% 0.8 0.0% 38.3 2.4% 113.5 7.1% 15.7 7.1 0.9% 49.4 9.9 2.7% 23.8 1.3% 18.3 1.0% 44.5 2.4% 151.8 8.3% 18.9 7.4 0.9% 55.5 9.7 2.7% 29.3 1.4% 23.0 1.1% 51.3 2.5% 178.1 8.5% 22.0 7.8 0.9% 63.2 9.9 2.7% 35.1 1.5% 28.1 1.2% 57.8 2.5% 206.2 8.8% 25.4 8.1 1.0% 71.2 10.0 2.8% 41.5 1.6% 33.7 1.3% 64.5 2.5% 236.3 9.1% 29.2 8.5 1.0% 80.1 10.2 2.8% 48.7 1.7% 40.1 1.4% 71.8 2.5% 269.9 9.4% 34.5 8.8 1.1% 92.8 10.4 2.9% 58.6 1.8% 48.9 1.5% 82.4 2.5% 317.3 9.7% 39.9 9.2 1.1% 105.2 10.6 2.9% 68.9 1.9% 58.0 1.6% 91.0 2.5% 363.0 10.0% 43.5 9.5 1.1% 112.5 10.8 3.0% 76.3 2.0% 64.8 1.7% 96.5 2.5% 393.7 10.3% 46.7 9.8 1.2% 118.8 11.0 3.0% 83.1 2.1% 71.3 1.8% 101.0 2.6% 420.9 10.6% 50.4 10.2 1.2% 126.1 11.1 3.1% 90.9 2.2% 78.5 1.9% 106.2 2.6% 452.2 10.9% UOIG 14 University of Oregon Investment Group May 2, 2014 Appendix 5 – Discounted Cash Flows Valuation Assumptions Discounted Free Cash Flow Assumptions Tax Rate Considerations 27.75% Terminal Growth Rate Risk Free Rate 3.00% 2.73% Terminal Value Beta 1.37 PV of Terminal Value Market Risk Premium 2,133 5.75% Sum of PV Free Cash Flows % Equity 3,425 100.00% Firm Value 5,558 % Debt 0.00% Total Debt 0 Cost of Debt 0.00% Cash & Cash Equivalents CAPM 10.61% Market Capitalization WACC 10.61% Fully Diluted Shares Terminal Risk Free Rate Considerations 10,681 698.7 5,558 116 Avg. Industry Debt / Equity 5.07% Avg. Industry Tax Rate 32.19% Current Reinvestment Rate 45.47% Reinvestment Rate in Year 2020E 15.01% Implied Return on Capital in Perpetuity 19.99% Terminal Value as a % of Total 40.7% Implied 2015E EBITDA Multiple 11.5x 3.46% Implied Price 47.88 Implied Multiple in Year 2024E 1.9x Terminal CAPM 11.34% Current Price 45.93 Free Cash Flow Growth Rate in Year 2024E 8% Terminal WACC 11.34% Undervalued 4.24% Intermediate Growth Rate: 2025E 2026E 2027E 2028E 2029E $715.91 $758.87 $796.81 $828.68 $861.83 236.2 226.3 214.9 202.0 190.0 7.0% 6.0% 5.0% 4.0% 4.0% UOIG 15 University of Oregon Investment Group May 2, 2014 Appendix 6- Sources SEC Filings LuluLemon Athletica Investor Relations IBIS World FactSet Yahoo! Finance Lululemon Conference Call Transcripts IBIS World Josh Mazzerella UOIG 16