New share offering lululemon prospectus questions

advertisement

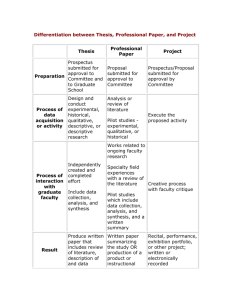

IDC4U NAME: DATE: NEW SHARE OFFERING: LULULEMON Ltd., July 26th 07 Go to www.sedar.com follow links to Lululemon; and then view this companies= public documents; find the final long form, and the supplemented long form PREP prospectus and open (PDF files); note: the supplemented PREP has share listing dollar values – Check it out, you’ll see the difference!. Read the summary of the prospectus – up to page 8! 1. What is prospectus? How many pages are in this prospectus? (Why does it take so long to download!?) 2. Why are the selling price per share, and the number of shares being sold, and the total proceeds that Lululemon hopes to raise not listed in the prospectus, dated July 26th, but listed in the supplemented PREP prospectus date July 27th? 3. Is this an initial public offering or a secondary offering for Lululemon? (How do you know?) What does “There is currently no market through which our common stock may be sold, and purchasers may not be able to resell common stock purchased” indicate about the state of Lululemon in April of 2007? 4. Where will the shares be traded? What is the ticker symbol of Lululemon on each exchange? 5. Prospectus Summary: a) In your own word, describe Lululemon. b) What is crucial to the Lululemon brand? c) How has Lululemon’s financial position grown from 2004 through to the IPO? d) e) What are Lululemon’s competitive strengths ( = Key Success Factors KSF)? Why is the above information listed in the prospectus? 1 IDC4U NAME: DATE: 6. Describe (in your own words at least five of the Arisk factors@ on page 9 of the prospectus? Why are these factors mentioned in the prospectus? 7. What does Lululemon plan to use the proceeds for? (check out the growth strategy of the company). 8. What is Lululemon=s current dividend policy and explain why this is the case? Why would the prospective investor want to know this information? 9. How many firms are in the syndicate underwriting the issue? Why do underwriters form a syndicate? Is this a Afirm commitment@ or Abest efforts@ deal? 10. What is the reason behind the “special note regarding forward-looking statements” on page 9 of the prospectus? (What does pro forma mean?) 11. Management / Executive: a) What other company did Dennis Wilson found? b) You will likely know this brand! How much $$$ does Dennis make? c) Why is information about the executive and board of directors listed in the prospectus? Now Check out the Supplemented PREP prospectus: 12. How many shares, and what type of share is being issued? You must see the final prospectus for this one! 13. What is the stated floatation costs for Lululemon? Why does the underwriting syndicate receive this money? 14. State the number of shares that are available to the underwriters in the over-allotment provision in the prospectus. Why would the underwriters want to exercise the over-allotment? 15. Pre-Reorganization Capitalization: a) Who owned the company before the new issue? b) How was the stock organized, how many shares and what type of share were outstanding before the IPO? 2 IDC4U NAME: DATE: c) How are the new common shares different than the old capital stock? 16. How does the issuing price compare with Lululemon=s current trading price? Would you invest in Lululemon? (Explain your reasoning) 17. What does dilution mean with regard to a new stock offering. How is dilution a bigger concern in a secondary offering? 3 IDC4U NAME: DATE: 4