The Fund @ Sprott

advertisement

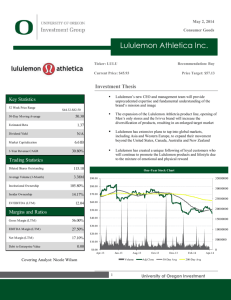

The Fund @ Sprott Equity Research Lululemon Buy, Current: $65.38 , Target: $68.49 November 5, 2012 5-Year Performance 300 250 200 150 100 50 Oct-12 Apr-12 Oct-11 Apr-11 Oct-10 Apr-10 Oct-09 Apr-09 0 Oct-08 yklopt@gmail.com http://fund.ssb.carleton.ca $140 $120 $100 $80 $60 $40 $20 $0 Oct-07 Sector Analyst Price per Share BCom Candidate 2014 Finance and IS Apr-08 Yanina Klopotovskaya Source: Bloomberg Investment Thesis No debt, no sweat The company is indicated itself as a strong performer through rapid growth, superb product offering and brand loyalty. The stock has boosted significantly since IPO and the company still operates with no debt. The excessive cash holding is allowing the company to support their growth strategy Q2 beats estimates, Promising outlook Robust top line growth from the Q2 2012, significant comparable-store sales increase and surge of EPS. Company’ strategic initiatives with the recent e-commerce launch will also boost both top and bottom line. Compare to its competitors, Lululemon has more growth catalysts. Valuation looks chic Lululemon Athletica currently trades at a significant premium compare to its peer. With eh main competitor Nike and Under Armour, Lululemon is substation in forward P/E, P/B and attractive PEG. Lululemon being fairly new in the market, already generates highest sales per square feet. The company’s premium warrants a long-term earnings growth above the industry average. More optimistic consumers Improvement in consumer sentiment, disposable income and unemployment rate which directly benefits revenue growth. Lululemon mainly targets high-end customers who possess the highest purchasing power throughout the recession (if a double-dip would occur) The Fund @ Sprott | Equity Research Company Overview With IPO in 2007, Lululemon Athletic Inc is a designer and retailer of yoga inspired athletic apparel, accessories and outwear for women and men. Mostly operating in North America, Lululemon is premium active wear brand with its competitive strength of its distinct retail experience. The products are mostly sold at company-owned store and new e-commerce channel. Over the last 5 years, the revenue has quadrupled from $58.861 to $282.634 Million. In the second quarter of 2012, net revenue has increased by 33% to $282.6 Million from $212.3 million in the fiscal 2011 and the average growth of revenue for the past 5 years is approximately 47.82%. Comparable stores sales rates for the first two quarter of 2012 increased by 20% which is a good signal of sales growth and indicator that revenue is generated from store productivity. Diluted earnings per share for the last quarter was $0.39 on net income of $57.2 Million - up from $0.26 of $38.4million of net income last year. The Companies future growth strategy include expansion in North American Continent, increase of customers base through e-commerce, focusing on brand awareness, introduction of new production and expansion beyond North America. Figure 1: Revenue by Product Segment Figure 2: Revenue by Geographic Region Revenue Decomposition by Location 2009-2011 120.00% 100.00% 80.00% 60.00% 40.00% 20.00% 0.00% Others Canada USA 2009 2010 2011 Fiscal year Source: Bloomberg, Student Estimates Source: Bloomberg, Student Estimates Macro Drivers Lululemon is part of consumer discretionary sector of special apparel. Economical uncertainty has direct effect on consumer discretionary spending and demand for retail sector. Most of Lululemon products are considered discretionary items for consumers and consumer spending on such items is affected by general economic conditions. Consumer outlook of economic conditions, fear of recession, consumer credit availability, unemployment level, tax rates and cost of consumer credits are the major factors that affect consumer confidence. These unfavourable economic conditions may delay and reduce purchase of Lululemon products, however is slowly recovering for foreseeable future. Through 2011, growth in the retail sector was slow because of the decreased consumer spending. Page 2 The Fund @ Sprott | Equity Research Furthermore the company is sensitive to economic cycles and any related fluctuations in consumer demand. As a whole, the sector is elastics therefore depend on the consumer’s confidence, CPI and disposable income. Consumer confidence has reached the 5 years high, currently at 83, has a positive correlation the apparel store sales (figure3). US employment rate decreased to 8 percent as more jobs are added yet it remains significant above pre-recession levels and higher than 5 year average. Unemployment has an inverse relations with store sales, thus the current shift in the unemployment should positively influence apparel store sales (figure 4). Consumer debt level could be another indicator of the discretionary spending. By recent trends, the consumer debt is declining, however still remains high compared to the historical norms (consumer focused on paying off the debt). Credit availability is another good indicator of consumer spending (correlation of 0.16). Credit standards capture the movements in credit availability, thus a tightening of the standards should result in a decline spending, however it has been increasing since late 2010. Overall the credit standards can provide a signal about the other economical disturbances. Since the apparel industry is directly tied to consumer spending from economic outlook it is also related to GDP. IMF projected 1.3% GDP growth for advanced economies and 5.9% for emerging and developing economies. Since US and Europe accounts for such a large portion of the apparel industry, GDP growth with projected increase in consumer spending produces an approximate growth of 3.1% for the apparel manufacturing and distribution companies in 2012. Following the US Presidential election 2012, the fiscal cliff is scheduled to come into affect on January 1, 2013 could lead to re-entrance into recession causing unemployment rate to increase and real GDP to decline during the first half of 2013 and as noted by financial services US economy might not reach its full potential until 2018 . Figure 3: Consumer Confidence/Retail Sales Figure 5: Apparel CPI/Disposible Income Figure 4: Unemployment/Sales Figure 6: Credit Availability s Consumer Spending Page 3 The Fund @ Sprott | Equity Research Industry Dynamics The industry operates in two main categories: Branded and Basic. The branded apparel companies change premium price for their merchandise and focus on creating a perception of brand value in order to maintain customer loyalty and generate demands for specific products while wholesales do not have the freedom and pricing power in term of revenue per unit. There are several factors that affect the retail industry in specific: input costs, technological trends, gross margin and inventory turnover Input costs: Cotton price is an important factor for Lululemon and other apparel companies in the industry. In this industry, cotton accounts for 62% of the cost of goods sold. In Q2 2011, price of cotton has reached its peak at 225 cents per pound but has been adjusting, currently trading at 90 cents per pound (60% decrease). The falling price of cotton should improve gross margins (Gross margins of LLL over the last 5 years) FY 2007 53.7% 2008 50.7% Gross margin 2009 2010 49.3% 55.5% 2011 56.9% Gasoline prices have risen 19% this year can bring an impact for retail companies transportation costs. For companies such as Lululemon where most of manufacturing is outside of North American continent, this change should be taken into account. Employees wages are attributed to be the second highest expense for apparel companies, therefore any changes to minimum wages should be monitored as these changes affect gross margins. E-commerce Trend: E-commerce activities are increasing and are becoming an important trend in the retail industry. An average shopping is predicted to spend around $1,738 annually by 2016, compared to $1,207 in 2011. All the major key player in the appeal industry have online shopping available and on average generate 4.6% of their revenue through e-commerce which has the ability to 20-30% as mobile computing continues to revolutionize consumer behavior. From 2011, the e-commerce sales went up 17.6%, therefore it is imperative for the retails to consider technology, web site design and incentives to encourage people about inline shopping. Inventory Turnover/Gross margins: Ability to effectively manage inventory along with attractive product offering and effective brand management is a key success factor within this industry. Inventory turnover is an important aspect for branded companies because of the seasonality and style demand. The average inventory for the top 10 brands in the apparel industry is 3.99 per years. Figure 7: Gross margin/Inventory Turnover Figure 8: E-commerce Trends Page 3 The Fund @ Sprott | Equity Research Company Specifics Lululemon does not own nor operates any manufacturing facilities. The fabric used is manufactured by a limited number of pre-approved suppliers, approximately 45 manufacturers. The manufacturing is allocated in such way that a single manufacturer doesn’t produce more than 36% of products offered. This mix is appropriate to diversity the risk of dependency on one supplier. In 2011, approximately 49% of products were produced in China, 41% in South East Asia and 3% in Canada, reminding in US, Peru, Israel, Egypt and other countries. The company is planning to support future growth through manufacturers outside of North America, however if practical, the company is indenting to continue production in US and Canada as it could ensure quicker respond to changing trends and increasing demand. Lululemon apparel is considered one the most fashionable accessory in the retail with its own cult. The company is relying on the grassroots marketing and has done impressively well compare to its major competitors that spend large amount on advertising. Compare to its competitors, Lululemon retains more of its profit from sales and sell their products only through the corporate owned stores. Over the last few years the company has picked up growth momentum and is currently working on new ways to expand the business, Lululemon is expanding its clothing like to men, which now makes up 15% of total sales and the company has recently launched a dance-apparel line for teenager ivivva athletica. Growth in these segments along with the expansion overseas should move the stock higher. Compare to its competitors in the market, Lululemon has more growth catalysts. Figure 9: Market Share of Main Business Line Figure 10: LLL vs S&P 500 vs S&P Retail Blue—LLL Green—S&P Retail/TSX Red—S&P500 /TSX Source: Bloomberg Source: Bloomberg Inter brand’s Top 10 Canadian Brands for 2012 The list is based on the companies with the biggest “brand value” or the economic performance of a company that can be attribute to its marketing and branding power. The larger companies tend to make the list but relatively smaller companies such as Lululemon can gain presentence through exceptional marketing (figure 7) Current enterprise value is $9.305 Billion. Lululemon ranks number 7 among the top Canadian brand and the first in the retail industry which a high brand recognition for the company (Appendix) Page 5 The Fund @ Sprott | Equity Research Competitive Positioning The market for athletic apparel is highly competitive Competition is in the industry is based on the brand image, product quality, innovation style, channel distribution and price. Lululemon has a market capitalization of 10.201 Billion, Lululemon is still in growth phases however the company is starting to pick up pace. In 2011, when the company has reached net revenue of $1 Billion, the profits increased by 34% and same store slates went up by 26%. Lululemon’s direct competitors include UnderArmour, Nike, Adidas and indirect competitors include The Gap, American Apparel and Urban Outfitters. Lululemon remains the only stand alone company that specifically targets women in the athletic category. Figure 9: Chart Displaying Growth Prospects Under Armour Inc Under Armour Inc is involved in designing, developing, marketing and distributing apparel, footwear and accessories for men, women and youth worldwide. The company has a much broader ranger of products than Lululemon for various sports and weather conditions. The company mostly operates through whole sales channels which ranges from retails to leagues and department stores. Under Armour’s market capitalization is half of Lululemon, however the company has 25,000 retail stores worldwide and is ranked as the 21st company by highest sales per Square foot of $780/sqft., while Lululemon Athletica is ranked 4th with an approximately sales of $1800/sqft. Under Armour remains successful due to its innovative products and current aggressive move into the footwear business to be competing with the sport performance of Nike. The company spends over $8 million on advertising and celebrity endorsements. The company has experience inventory problems when in Q2 2012, the inventory growth outpaced revenue growth Nike continues to dominant the shoe segment of the sport apparel with its tech tie-in innovative lines such as Nike + Fuel Band. Nike Nike has been in the industry for 48 years and is global leader in marketing and selling of sport footwear, equipment and accessories. The company sells products through various means – retail stores, internet and mix of independent distributors in 190 countries around the world. Page 6 The Fund @ Sprott | Equity Research The company mainly focuses on seven categories: Running, Basketball, and Football, Women/Men’s training, Nike Sportwear and action sports. Beside these main categories, Nike designs for kids and other recreational sports. Nike generates over half of its revenue from footwear sales following by the equipment and apparel. The company has experience growth mainly in North America, China and Emerging market regions over the last 3 years. (figure 9) Adidas Adidas Group is multinational corporation, present in the industry for as long as Nike is the largest sportwear manufacturer in Europe and second biggest in the world. Adidas Group consists of Reebok sportwear, TaylorMade-Adidas golf and Rockport. The top three market where Adidas had a substantial growth was North America (15%), Russia/ CIS (26%) and China (23%). Like Nike, Adidas is involved with major international sport events that that have affect the company’s sales (FIFA world cup(2010), Olympic games (2012) UEFA (2012)). Currently with the steady gross margin of 47.5% and operating margin of 7.5-8%, the company is striving to achieve 11% and generate sales of 17 Billion Euros by 2015. Due to the economic crisis in Europe where Adidas own the most market share, the performance was slow, since the beginning of this year Adidas is sustaining positive momentum. Adidas had the highest share price and declared dividend of 1 euro.. Figure 10: Adidas Sales by Region Figure 9: Nike Sales by Region Source: Bloomberg Source: Bloomberg The company is planning to launch 21 products in Q3 is projecting to moderately increase its operating working capital of 20.8%, increase capital expenditure to 400-450 million Euros but further reduced its gross borrowings to maintain net borrowing/EBIDTA ratio below 2. The EPS can be expected to increase at the rate 10-15% equivalent to 3.52-3.68 Euros. The GAP Since Gap’s acquisition of Athleta, the company has been able to extend its position in women’s sports clothing beyond its Gap Body Division. The company operates under 5 divisions: Page 6 The Fund @ Sprott | Equity Research Gap North America, Banana Republic North America, Old Navy north America, International and Gap Inc Direct. The most revenue is generated through the Old Navy division following Gap North America and Banana Republic. Like Lululemon, Athleta which is the 1/3 of Lululemon size is now trying to offer yoga classes and sponsor local instructors with their products in order to position themselves in the market. Gap’s yoga upstarts making inroad, and is choosing the same location as Lululemon as it is opening new stores across US. Yet, there is a major indifferent in companies strategy – Lululemon competes as a luxury brand while The Gap’s Athleta’s market segment consists mainly of families and young customer. The Gap will not be able to position itself in the same division as Lululemon as the company is bind chain stores and already established image. Competitors Stores Lululemon UnderArmour 189 25,000 retail stores American Apperal Adidas The Gap Urban Outfitters Nike Industry Average 273 2401 (597 Reebok) 3248 142 338 Figure 11: Comparative Revenue Growth Inventory turnover 4.85 2.85 Sales/sq ft Quick Ratio B $1800/sqft $790/sqft 6.01 1.84 1.11 1.18 1.46 2.98 5.51 5.41 4.31 4.27 n/a n/a $335 $575 $1880 $400 0.31 0.8 0.94 1.38 1.77 1.14 1.33 0.9 1.06 1.06 1.16 1.11 Figure 12: Comparative P/E For more comparative analysis of competitors— Net Sales, ROE, D/E, PEG, EPS and Profit Margin (appendix figure 2) Page 6 The Fund @ Sprott | Equity Research Financial Statement Analysis Income Statement Since 2009, the revenue has doubled and the company reached 1 Billion in Revenue in 2011. A significant amount of revenue was recognized in the 4th quarter due to the increasing sales during the holiday season. In fiscal 2009, 2010, 2011, the company has recognized 39%, 36%, 37% respectively of full year gross profit in the last quarter. With the improvements of consumer confidence and spending, the fourth quarter gross profits are expected to be as high or even higher than previous year. The working capital will also be affect by the seasonality of the business. The inventory, accounts payable, accrued expense are expected to be higher as the company is preparing for the holiday selling season. Since Lululemon products are primarily sold though corporate owned stores, there are no backlog. The company has also experiencing an increase in the e-commerce revenue which was launched in 2009, currently makes up 12.5 % of the revenue. During the 4th quarter, the EPS can be expected to increase as it has almost doubled during the 4th quarter for the past 2 fiscal years. Historical EPS in quarters Fiscal 2011 th rd nd Fiscal 2010 st th rd 4 quarter 3 quarter 2 quarter 1 quarter 4 quarter 3 quarter 2nd quarter 1st quarter $0.51 $0.27 $0.26 $0.23 $0.38 $0.18 $0.15 $0.14 Figure 11: Income Statement Forecast 2009 453 2010 2011 2012E 1,420 2013E 1,820 2014E 2,227 2015E 2,800 2016E 3,330 CV 3,700 28.92% 30.09% 35.67% 37.27% 44.32% 39.81% 38.59% 122 185 286 480 616 1,018 925 992 12.87% 17.17% 18.47% 20.11% 26.37% 27.68% 36.35% 27.77% 26.82% $0.41 $0.86 $1.29 $1.98 $3.32 $4.24 $6.97 $6.30 $6.73 Source: Bloomberg, Student Estimates 712 1,001 Total Revenue Operating Margin 19.14% 25.75% Net Income 58 Profit Margin EPS Balance Sheet The primary source of liquidity for the company is the cash and cash equivalents. As of second quarter 2012, the company is holding $444.3 million in cash and cash equivalent, roughly 1.5 times more compared to same period of time of last year, which amounted $264.7. Overall the company has been avoiding significant levels cash and carries no debt. Even though cash increase can be viewed as risk aversion, it should not hinder stores’ growth and in fact the excess cash of Lululemon Canada can be reserved for any unexpected costs. With the cash available on hand available the company could focus on priming future locations, brand awareness initiatives, improvement of distribution system and employee training . Following cash and cash equivalents which make up the majority of current assets, PPE is accounted for 22% of assets and has doubled from FY 2011. The company opened 15 stores this year throughout this year (15 more is planned). The company mostly consists of equity , the current liabilities include accrued liability, compensation and income tax payable. Figure 12: Balance Sheet Forecast Current Assets Current Liabilities Pension Liabilities 2009 216 2010 389 2011 527 2012E 783 2013E 1,266 2014E 1,905 2015E 2,939 2016E 3,903 CV 4,964 48 67 81 105 145 200 263 343 435 0 0 0 0 0 0 0 0 0 Long-Term Debt 0 Total Equity 233 0 0 0 0 0 0 0 0 390 601 916 1,465 2,206 3,356 4,524 Page 7 5,756 Source: Bloomberg, Student Estimates The Fund @ Sprott | Equity Research Cash Flow Statement The company is generating most of its Cash flow from Operating Cash Flows. Most of operating activities account for inventory (14% of total assets), employee salary (2861 employees) and raw material and shipping. Since the company does not own any of the store it operates under lease. This approach lets the company to minimize its capital investments, The lease accounts for 15% of cost of goods sold and based on the current rate is estimated to be $118.6Million through 2014. Company specific marco economical risk to cash flows is currency fluctuation.Because of significant portion of Lululemon sales generate in Canada, fluctuations in foreign currency exchange has a negative effect in operations. When Canadian dollar weakens against the U.S dollar, it would cause a negative impact on the Canadian operating results. In FY 2011, the exchange rate has increase therefore benefitted the company. A 10% depreciation in relative value of the Canadian dollar would result in approximately $15.4 million loss in income from operations and same depreciation in the Australia dollar can result in $0.4 Million loss. Historically, Lululemon has not engaged in any hedging activities therefore no future hedging activities are foreseeable to mitigate the foreign exchange risks. Figure 13: Cash Flow Forecast Cash from Operations Cash from Investing Cash from Financing Net Change in Cash Ending Cash Balance 2009 2010 2011 118 180 194 -16 -43 -112 -3 14 15 103 157 93 Source: Bloomberg, 160 316Student Estimates 409 2012E 282 -90 14 208 617 2013E 521 -120 18 421 1,038 2014E 673 -140 22 557 1,595 2015E 1,090 -190 26 928 2,523 2016E 993 -220 30 805 3,328 CV 1,098 -250 35 885 4,213 Valuation Discounted Cash Flow The company is expected to continue to grow by expanding its stores through North America and Australia. Capital expenditure for 2012 is expected to range between 85-90 million, including $30 million for approximately 37 stores and the remaining distributed to store renovations, information technology enhancement and other corporate activities. The company have not paid any dividends and has stated that it doesn not intend to announce dividends for the foreseeable future. Most of the cash will still be retained for operations and expansion of the business. Since IPO, Lululemon stock is up 568 percent while Nike is 92% and Under Armour us 44%., therefore the company is certainly in the growth stage. Figure 14: DCF Calculation Net Income Add: Depreciation Expense Add: Net Debt Issued Less: Capital Expenditures Less: Change in Non-Cash WC 2012E 286 35 0 -90 -48 2013E 480 51 0 -120 -22 2014E 616 70 0 -140 -27 2015E 1,018 100 0 -190 -44 2016E 925 128 0 -220 -78 CV 992 170 0 -250 -85 FCFE per Year FCFE Discounted 182 0 389 347 519 412 884 626 755 476 828 7,750 PV - Future Cash Flows Base Year Cash Shares Outstanding 9,611 617 144 DCF Value Per Share $71.08 Assump- WACC 11.53% Ke 12.20% Page 8 Kd 0.66% CV Growth 4.50% The Fund @ Sprott | Equity Research Investment Recommendation Buy, Price Target $68.49 Investment Positives — For the consecutive two years, the US apparel industry experienced revenue growth and is projected to growth at 3.2% through 2016) — Improvement in consumer sentiment, disposable income, and unemployment will lead to more discretionary spending — Highest sales per square foot not only among competitors but in the industry-4.5 times more efficient that the industry average and ranked 4 th among US top retails per square foot — Since IPO, the stock has boosted significantly compare to competitors — New development of direct to consumer sales channel – addition of e-commerce customers supplementing store base growth — No debt issued by the company – low risk of default — Expanding line beyond women’s yoga apparel and targeting a larger segment Strong credibility and authenticity of the brand — The cost of cotton- primary raw material of the apparel is decreasing thus increasing companies gross margins — Placed as a luxury good within the industry therefore more likely to remain stable during the recession and posses highest purchase power Investment Negatives — Ability to successfully maintain the brand value and reputation — Economic downturn - industry will mostly affect consumer discretionary spending and demand for the products — Inability to accurately forecast customer demand and maintain inventory — Limited control over third party suppliers — New competitors Overall, I feel that the positives of investing right now outweigh the negatives of investing and that is why my final recommending is a Buy. The company has shown great ability to grow and strongly positioned itself in the market. Disclaimer This report was written by a student currently enrolled in a program at the Sprott School of Business. The purpose of this report is to demonstrate the investment analysis skills of Sprott students. The analyst is not a registered investment advisor, broker or an officially licensed financial professional. The investment opinion contained in this report does not represent an offer or solicitation to buy or sell any securities. This report is written solely for the consideration of this student managed investment fund and should not be used by individuals to make personal investment decisions. Unless otherwise noted, facts and figures included in this report are from publicly available sources. We cannot guarantee that the information in this report is 100 percent accurate, although we believe it to be from reliable sources. Information contained in this report is only believed to be accurate as of the day it was published, and it is subject to change without notice. It cannot be guaranteed that the faculty or students do not have an investment position in the securities mentioned in this report. Page 11 The Fund @ Sprott | Equity Research Appendix A Pro-forma Financial Statements Figure A1: Income Statement Page 12 The Fund @ Sprott | Equity Research Figure A2: Common Size Income Statement Page 13 The Fund @ Sprott | Equity Research Figure A3: Balance Sheet Lululemon Athletica Inc Balance Sheet - USD Millions 200 9 201 0 20 11 2012 E 2013 E 2014 E 2015 E 2016 E CV 160 316 409 617 1,01 3 1,53 1 2,38 1 3,16 1 4,02 3 8 9 5 9 9 13 17 24 30 44 5 0 0 58 6 0 0 104 8 0 0 147 10 0 0 216 389 527 783 230 14 0 0 1,26 6 340 21 0 0 1,90 5 514 28 0 0 2,93 9 680 38 0 0 3,90 3 865 47 0 0 4,96 4 Property, Plant and Equipment (Net) 62 71 163 217 300 420 590 775 999 Goodwill and Intagible Defered income taxes Other non-current assets 8 15 6 0 27 8 4 0 32 9 4 0 307 499 735 39 9 5 0 1,05 3 56 15 5 0 1,64 2 79 22 5 0 2,43 1 104 30 5 0 3,66 8 135 40 5 0 4,85 7 160 50 5 0 6,17 8 Accounts Payable 12 7 15 20 35 55 83 110 140 Accrued Liabilities Current Portion of Long-Term Debt Accrued compensation and related expenses Income Tax Payble 18 0 11 8 25 0 17 18 35 0 23 9 45 0 29 11 60 0 35 15 82 0 41 22 104 0 48 28 142 0 54 37 184 0 61 50 Current Liabilities 48 67 81 105 145 200 263 343 435 Long-Term Debt Pension & Post-Retire. Benefits Unredeemed gift card liability Other non-current assets 0 0 11 14 0 0 18 15 0 0 23 25 0 0 27 30 0 0 31 35 0 0 35 39 0 0 39 44 0 0 43 49 0 0 45 54 Total Liabilities 73 100 128 162 211 274 345 435 533 Equity: Common Stock 1 1 1 1 68 190 374 653 1 1,12 8 1 1,73 8 1 2,75 0 1 3,66 9 159 180 206 240 307 425 550 777 1 4,65 6 1,00 0 6 20 22 22 233 390 601 916 30 1,46 5 42 2,20 6 55 3,35 6 77 100 4,52 5,75 4 14 6 Page 0 4 5 306 495 735 5 1,08 3 5 1,68 1 5 2,48 5 5 3,70 6 5 4,96 3 Assets: Cash and Equivalents Accounts Receivable (avr of 4 yrs = 1.775% of TA) Inventories Prepaid expenses and other Current Assets Other Current Assets 0 Current Assets 0 Total Assets Liabilities: Retained Earnings Additiona paid-in capital Accum. Other comprehensive income Total Equity Non-Controlling Interest Total Liabilities and Equity 5 6,29 4 The Fund @ Sprott | Equity Research Figure A4: Common Size Balance Sheet Lululemon Athletica Inc Common Size Balance Sheet 2009 2010 2011 2012 E 2013E 2014E 2015 E 2016 E CV 52% 3% 14% 1% 0% 0% 63% 2% 12% 1% 0% 0% 56% 1% 14% 1% 0% 0% 59% 1% 14% 1% 0% 0% 62% 1% 14% 1% 0% 0% 63% 1% 14% 1% 0% 0% 65% 0% 14% 1% 0% 0% 65% 0% 14% 1% 0% 0% 65% 0% 14% 1% 0% 0% Current Assets 70% 78% 72% 74% 77% 78% 80% 80% 80% Property, Plant and Equipment (Net) Goodwill and Intagible Defered income taxes Other non-current assets 20% 3% 5% 2% 0% 22% 4% 1% 1% 0% 21% 4% 1% 0% 0% 18% 3% 1% 0% 0% 17% 3% 1% 0% 0% 16% 3% 1% 0% 0% 16% 3% 1% 0% 0% 16% 3% 1% 0% 0% 100% 14% 5% 2% 1% 0% 100 % 100% 100% 100% 100% 100% 100% 100% 4% 6% 0% 3% 3% 1% 5% 0% 3% 4% 2% 5% 0% 3% 1% 2% 4% 0% 3% 1% 2% 4% 0% 2% 1% 2% 3% 0% 2% 1% 2% 3% 0% 1% 1% 2% 3% 0% 1% 1% 2% 3% 0% 1% 1% 16% 13% 11% 10% 9% 8% 7% 7% 7% 0% 0% 4% 4% 0% 0% 4% 3% 0% 0% 3% 3% 0% 0% 3% 3% 0% 0% 2% 2% 0% 0% 1% 2% 0% 0% 1% 1% 0% 0% 1% 1% 0% 0% 1% 1% Total Liabilities 24% 20% 17% 15% 13% 11% 9% 9% 9% Equity: Common Stock Retained Earnings Additiona paid-in capital Accum. Other comprehensive income 0% 22% 52% 2% 0% 38% 36% 4% 0% 51% 28% 3% 0% 62% 23% 2% 0% 69% 19% 2% 0% 71% 17% 2% 0% 75% 15% 1% 0% 76% 16% 2% 0% 75% 16% 2% Total Equity 76% 78% 82% 87% 89% 91% 91% 93% 93% 0% 1% 1% 0% 0% 0% 0% 0% 0% 100% 99% 100% 103% 102% 102% 101% 102% Page 15 102% Assets: Cash and Equivalents Accounts Receivable (avr of 4 yrs = 1.775% of TA) Inventories Prepaid expenses and other Current Assets Other Current Assets 0 0 Total Assets Liabilities: Accounts Payable Accrued Liabilities Current Portion of Long-Term Debt Accrued compensation and related expenses Income Tax Payble Current Liabilities Long-Term Debt Pension & Post-Retire. Benefits Unredeemed gift card liability Other non-current assets Non-Controlling Interest Total Liabilities and Equity The Fund @ Sprott | Equity Research Figure A5: Cash Flow Statement Lululemon Athletica Inc Cash Flow Statement - USD Millions 200 9 201 0 201 1 2012 E 2013 E 2014 E 2015 E 2016 E CV 58 122 185 286 480 616 1,018 925 992 21 0 -31 6 0 -2 0 25 0 -24 7 2 -1 -2 30 12 -14 10 0 -2 0 35 61 49 12 0 -2 0 51 108 46 14 0 -2 0 70 174 66 16 0 -2 0 100 296 122 18 0 -2 0 128 399 103 20 0 -2 0 170 507 108 22 0 -2 0 118 180 194 281 497 634 1,012 968 1,074 -15 -1 0 -30 0 -12 -90 0 0 -120 0 0 -140 0 0 -190 0 0 -220 0 0 -250 0 0 -16 -43 107 0 -6 112 -90 -120 -140 -190 -220 -250 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 -4 -3 0 0 0 6 8 14 0 0 0 10 6 15 0 0 -6 14 6 14 0 0 -6 18 6 18 0 0 -6 22 6 22 0 0 -6 26 6 26 0 0 -6 30 6 30 0 0 -6 35 6 35 4 103 6 157 -4 93 2 207 2 396 2 518 2 850 2 780 2 862 57 160 316 409 617 1,013 1,531 2,381 3,161 160 316 409 617 1,013 1,531 2,381 3,161 4,023 Cash From Operating Activities Net Income Add (Deduct) Non-Cash Items: Add: Depreciation Expense Non Cash or Debt Working Capital Change in Non Cash Working Capital Stock based compensation Provision of Impairment and Lease exit costs Derecogmition of unredeemed gift cards liability Gain on investment Cash From Operations Cash From Investing Activities Purchase of propterty and equipment Investment in and advances to franchise Acquistion of franchises Cash From Investing Cash From Financing Activities Additions of Long-Term Debt Reductions of Long-Term Debt Additions of Short-Term Debt Reductions of Short-Term Debt Net Debt Additions (Reductions) Issuance of Common Shares Redemption of Common Shares Cash Dividends Paid Proceeds from exercise of stock options Excess tax benefit from stock based compensation Cash From Financing Foreign Exchange Rate Gain (Loss) Net Change in Cash Cash Balance, Beginning Cash Balance, Ending Page 16 The Fund @ Sprott | Equity Research Appendix B Valuation Charts and Sensitivity Figure B1: Profitability Forecast Figure B2: CAPEX and Financing Source: Bloomberg, Student Estimates Source: Bloomberg, Student Estimates Figure B3: Dividend Sustainability Figure B4: DCF Value Breakdown Source: Bloomberg, Student Estimates Source: Bloomberg, Student Estimates Page 17 The Fund @ Sprott | Equity Research Figure B5: DCF Sensitivities CV Profit Margin Cost of Equity 27% 27% 27% 27% 27% 10.20% $82.90 $82.90 $82.90 $82.90 $82.90 11.20% $70.97 $70.97 $70.97 $70.97 $70.97 12.20% $62.21 $62.21 $62.21 $62.21 $62.21 13.20% $55.53 $55.53 $55.53 $55.53 $55.53 14.20% $50.29 $50.29 $50.29 $50.29 $50.29 CV CAPEX as % of PPE Cost of Equity 25% 25% 25% 25% 25% 10.20% $82.90 $82.90 $82.90 $82.90 $82.90 11.20% $70.97 $70.97 $70.97 $70.97 $70.97 12.20% $62.21 $62.21 $62.21 $62.21 $62.21 13.20% $55.53 $55.53 $55.53 $55.53 $55.53 14.20% $50.29 $50.29 $50.29 $50.29 $50.29 Cost of Equity vs. CV Debt Issuance as % of Total Debt N/A Page 18 The Fund @ Sprott | Equity Research Competitors Net ROE Appendix: Market Competitors Market Net ROE Cap Sales Figure 1: Canadian Inter Brand’s Top 10 Cap Sales LLL 9.65 B 969.54 35.5% LLL 9.65 B M 969.54 35.5% Brand Brand Value M UnderArmour 5.42B 572.62 16.47% Toronto Dominion Bank UnderArmour 5.42B 16.47% M 572.62$9.69 Billion M Reuter Billion American Thomson Ap92.53M 161.43M$9.55-102.30% American Ap92.53M 161.43M -102.30% parel Royal Bank of Canada $7.93 Billion parel * Adidas 16.92B 5.20B $6.4515.28% RIM Billion Adidas * 16.92B 5.20B 29.46% 15.28% The Gap* 16.04B 3.64B The Gap* 16.04B 3.64B 29.46% ScotiaBank 41.25B Billion Nike* 6.74B $3.9721.51% Nike* Tim Horton’s 41.25B 6.74B 21.51% Billion Urban Outfitters 5.12B 687.85M$3.4414.94% Urban Outfitters 5.12B 687.85M 14.94% Lululemon Athletica Billion Industry Average 3.35B Inc. 3.45B $3.245 20.39% IndustryShopper Average 3.35B 3.45B$3.18 Billion 20.39% Drug Mart corp P/E P/E D/E D/E PEG PEG EPS EPS Profit margins Profit margins 41.33 41.33 0.0 0.0 - 1.50 1.50 55.11% 55.11% 1.07 1.07 48.75% 48.75% -0.5 -0.5 52.54% 52.54% 5.00 5.00 2.07 2.07 4.69 4.69 1.27 1.27 1.22 1.22 47.40% 47.40% 41.23% 41.23% 43.53% 43.53% 37.63% 37.63% 47.5% 47.5% Sector - Change in Brand Value 53.17 9.53% 1.97 Financial 53.17 Services 9.53% +45% 1.97 Business Services 607.8% +1% Financial Services +28% 607.8% 16.39 30.03% +7% 1.12 Consumer Electron16.39 30.03% 1.12 16.80 55.69% 1.14 ics 16.80 1.14 55.69% +84% Financial Services 20.80 3.6% 1.47 20.80 3.6% +30% 1.47 Restaurant 0.0% 25.25 1.24 25.25 0.0% 1.24 Retail 17.67% 8.10% +292% 1.13 17.67% 8.10% -7% 1.13 Retail Bell $3.06 Billion Telecom +25% Rogers Communication Inc $3 Billion Telecom +32% Figure 2: Comparative Analysis Competitors Net Sales ROE P/E D/E PEG EPS Profit margins Lululemon Market Cap 9.65 B 969.54M 35.5% 41.33 0.0 1.072 1.50 55.11% Under Armour 5.42B 572.62M 16.47% 53.17 9.53% 1.97 1.07 48.75% American Apparel Adidas * The Gap* Nike* Urban Outfitters Industry Average 92.53M 16.92B 16.04B 41.25B 5.12B 3.35B 161.43M 5.20B 3.64B 6.74B 687.85M 3.45B -102.30% 15.28% 29.46% 21.51% 14.94% 20.39% 0.16 16.39 16.80 20.80 25.25 17.67% 607.8% 30.03% 55.69% 3.6% 0.0% 8.10% 0.5206 1.12 1.14 1.47 1.24 1.13 -0.5 5.00 2.07 4.69 1.27 1.22 52.54% 47.40% 41.23% 43.53% 37.63% 47.5% Page 19