KUWAIT

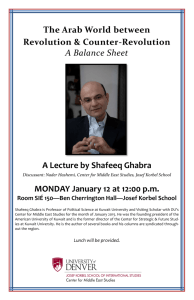

advertisement

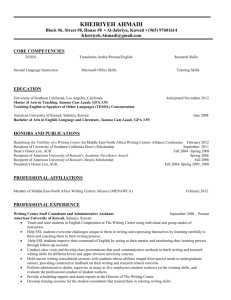

KUWAIT Economic Freedom Score 25 World Rank: 74 Regional Rank: 7 Least free 0 uwait’s economic freedom score is 62.5, making its econoK my the 74th freest in the 2015 Index. Its score is 0.2 point better than last year, reflecting improvements in the manage- 50 75 Most 100 free 62.5 Freedom Trend 66 ment of government spending, business freedom, monetary freedom, and labor freedom that offset declines in property rights, freedom from corruption, and trade freedom. Kuwait is ranked 7th out of 15 countries in the Middle East/North Africa region, and its overall score is slightly above the regional and world averages. Over the past five years, economic freedom in Kuwait has declined by 2.4 points. Score declines have occurred in six of the 10 economic freedoms, led by deteriorations in the control of government spending, business freedom, and trade freedom. High oil revenues have excused policymakers from making tough choices to liberalize the economy, including privatizing some state-owned enterprises. Structural reforms remain critically necessary to spur dynamic growth and ensure longterm economic development. While Kuwait continues to benefit from an open trading regime that attracts investment flows, rising protectionism must be controlled in order to maintain international trade linkages. BACKGROUND: Kuwait, one of the richest Arab nations, is a constitutional monarchy ruled by the al-Sabah dynasty. During the Arab Spring of 2011, young activists called for political reforms, and residents unlawfully in the country demanded citizenship and jobs. After Islamists scored major gains in parliamentary elections in February 2012, Amir Sabah al-Ahmad al-Jabr al-Sabah annulled the results and changed the election laws. This sparked protests and triggered a boycott of the new election in December. The results of that election were annulled by the Constitutional Court, and in new balloting held in July 2013, pro-government Sunni candidates achieved a significant majority. Kuwait controls roughly 6 percent of the world’s oil reserves. The oil and gas sector accounts for nearly 50 percent of GDP and 95 percent of export revenues. How Do We Measure Economic Freedom? See page 475 for an explanation of the methodology or visit the Index Web site at heritage.org/index. 65 64 63 62 61 2011 2012 2013 2014 2015 Country Comparisons Country 62.5 World Average 60.4 Regional Average 61.6 Free Economies 84.6 0 20 40 60 80 100 Quick Facts Population: 3.9 million GDP (PPP): $154.5 billion 0.8% growth in 2013 5-year compound annual growth 0.6% $39,706 per capita Unemployment: 3.1% Inflation (CPI): 2.7% FDI Inflow: $2.3 billion Public Debt: 5.3% of GDP 2013 data unless otherwise noted. Data compiled as of September 2014. 275 KUWAIT (continued) THE TEN ECONOMIC FREEDOMS Score RULE OF LAW Country World Average Property Rights 45.0 Freedom from Corruption 43.0 0 20 40 60 80 Rank 1–Year Change 66th 69th –5.0 –0.7 100 Five opposition members of parliament resigned in May 2014 after they were denied a request to question the prime minister about corruption. There are occasional accusations of attempted bribery in the government’s lengthy procurement process. The legal framework is not well developed, and the rule of law remains weak. Foreigners face difficulties enforcing contract provisions in the local courts. Fiscal Freedom 97.7 GOVERNMENT Government Spending 61.1 SIZE 7th 109th 0 20 40 60 80 0 +5.5 100 Kuwait has no individual income tax. Foreign-owned companies are subject to a 15 percent tax. Taxes make up a small portion of government revenue, with most financing coming from oil and gas windfalls. Overall tax revenue is less than 1 percent of domestic output. Public expenditures equal 36 percent of domestic production, and government debt amounts to 5 percent of gross domestic product. REGULATORY EFFICIENCY Business Freedom 58.6 Labor Freedom 64.2 Monetary Freedom 74.0 118th 79th 121st 0 20 40 60 80 +0.9 +0.6 +0.8 100 Progress in improving Kuwait’s regulatory framework has been uneven. Incorporating a business still takes more than 30 days, and bureaucratic hurdles continue to add to the cost of business. Overall labor regulations lack flexibility. The government has an extensive system of subsidies and price controls through state-owned utilities and enterprises, although diesel fuel subsidies were cut in 2014. OPEN MARKETS Trade Freedom 76.2 Investment Freedom 55.0 Financial Freedom 50.0 94th 96th 70th 0 20 40 60 80 –0.5 0 0 100 Kuwait’s average tariff rate is 4.4 percent. Government procurement may favor domestic firms, and imports of books and media deemed detrimental to public morals are not allowed. The relatively well-developed financial system offers a wide range of services. Restrictions on foreign banks include a ban on competing in the retail sector. Foreign banks are limited to providing investment banking services. Long-Term Score Change (since 1996) RULE OF LAW Property Rights Freedom from Corruption 276 –45.0 –27.0 GOVERNMENT SIZE Fiscal Freedom Government Spending –2.2 +50.2 REGULATORY EFFICIENCY OPEN MARKETS Business Freedom –26.4 Labor Freedom –16.0 Monetary Freedom –7.7 Trade Freedom –0.8 Investment Freedom +25.0 Financial Freedom 0 2015 Index of Economic Freedom