TABLE OF CONTENTS - Nashbrook Partners Limited

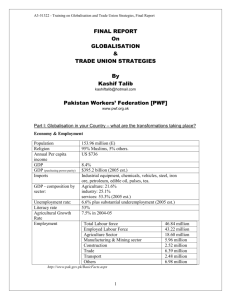

advertisement