MultiAlpha North America Equity (A)

Monthly Report - 31 December 2012

Accumulation Shares

Investment Aims

Fund Details

The Sub-Fund seeks long-term capital growth by

investing at least two thirds of its total non-cash

assets in a well-diversified portfolio of investments

in equity and equity equivalent securities of

companies which have their registered office in,

and with an official listing on a major stock

exchange or other Regulated Market in North

America as well as those companies which carry

out a preponderant part of their business activities

in the North America. The Sub-Fund uses a

multi-manager approach, relying upon one or

more sub-advisers to manage portions of the

Sub-Fund's portfolio. The Sub-Fund may invest no

more than 10% in total in UCITS and UCIs.

Financial derivative instruments may be used for

hedging

and

efficient

portfolio

management

purposes.

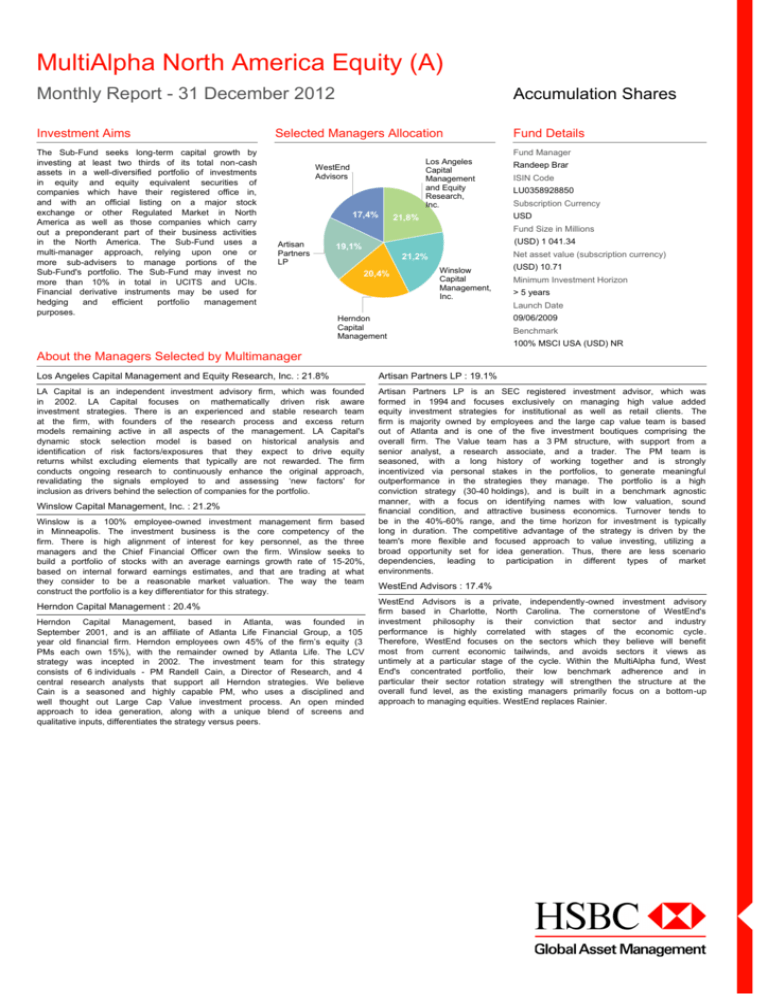

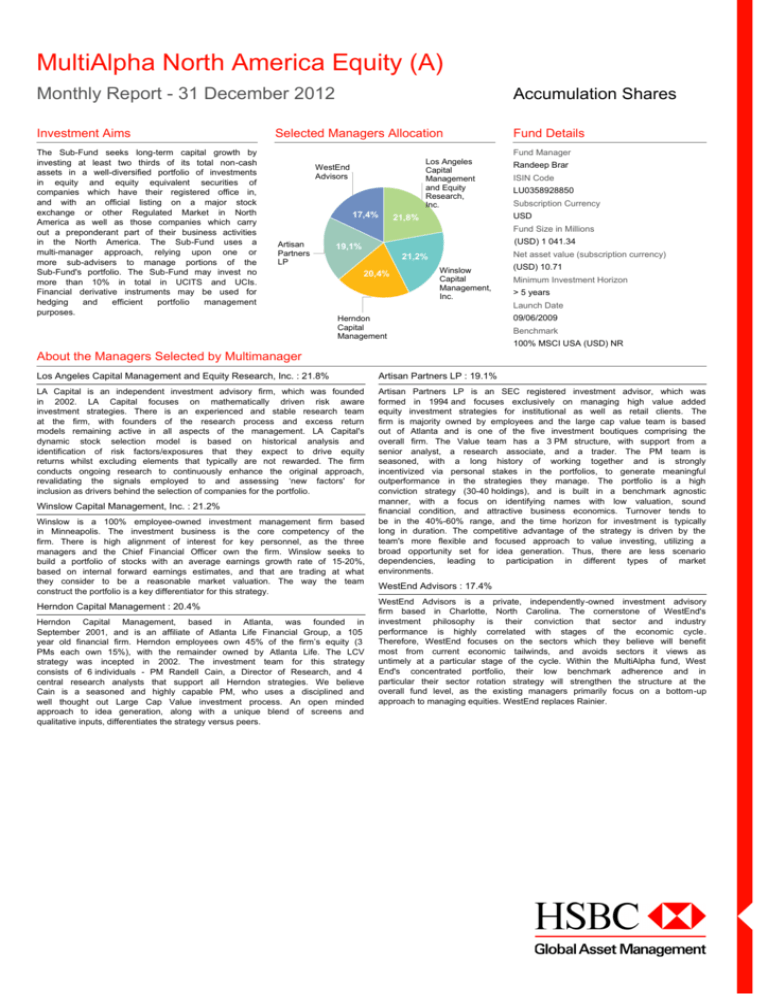

Selected Managers Allocation

Fund Manager

Los Angeles

Capital

Management

and Equity

Research,

Inc.

WestEnd

Advisors

17,4%

Randeep Brar

ISIN Code

LU0358928850

Subscription Currency

USD

21,8%

Fund Size in Millions

Artisan

Partners

LP

(USD) 1 041.34

19,1%

Net asset value (subscription currency)

21,2%

20,4%

Winslow

Capital

Management,

Inc.

Herndon

Capital

Management

(USD) 10.71

Minimum Investment Horizon

> 5 years

Launch Date

09/06/2009

Benchmark

100% MSCI USA (USD) NR

About the Managers Selected by Multimanager

Los Angeles Capital Management and Equity Research, Inc. : 21.8%

Artisan Partners LP : 19.1%

LA Capital is an independent investment advisory firm, which was founded

in 2002. LA Capital focuses on mathematically driven risk aware

investment strategies. There is an experienced and stable research team

at the firm, with founders of the research process and excess return

models remaining active in all aspects of the management. LA Capital's

dynamic stock selection model is based on historical analysis and

identification of risk factors/exposures that they expect to drive equity

returns whilst excluding elements that typically are not rewarded. The firm

conducts ongoing research to continuously enhance the original approach,

revalidating the signals employed to and assessing ‘new factors' for

inclusion as drivers behind the selection of companies for the portfolio.

Artisan Partners LP is an SEC registered investment advisor, which was

formed in 1994 and focuses exclusively on managing high value added

equity investment strategies for institutional as well as retail clients. The

firm is majority owned by employees and the large cap value team is based

out of Atlanta and is one of the five investment boutiques comprising the

overall firm. The Value team has a 3 PM structure, with support from a

senior analyst, a research associate, and a trader. The PM team is

seasoned, with a long history of working together and is strongly

incentivized via personal stakes in the portfolios, to generate meaningful

outperformance in the strategies they manage. The portfolio is a high

conviction strategy (30-40 holdings), and is built in a benchmark agnostic

manner, with a focus on identifying names with low valuation, sound

financial condition, and attractive business economics. Turnover tends to

be in the 40%-60% range, and the time horizon for investment is typically

long in duration. The competitive advantage of the strategy is driven by the

team's more flexible and focused approach to value investing, utilizing a

broad opportunity set for idea generation. Thus, there are less scenario

dependencies, leading to participation in different types of market

environments.

Winslow Capital Management, Inc. : 21.2%

Winslow is a 100% employee-owned investment management firm based

in Minneapolis. The investment business is the core competency of the

firm. There is high alignment of interest for key personnel, as the three

managers and the Chief Financial Officer own the firm. Winslow seeks to

build a portfolio of stocks with an average earnings growth rate of 15-20%,

based on internal forward earnings estimates, and that are trading at what

they consider to be a reasonable market valuation. The way the team

construct the portfolio is a key differentiator for this strategy.

Herndon Capital Management : 20.4%

Herndon Capital Management, based in Atlanta, was founded in

September 2001, and is an affiliate of Atlanta Life Financial Group, a 105

year old financial firm. Herndon employees own 45% of the firm’s equity (3

PMs each own 15%), with the remainder owned by Atlanta Life. The LCV

strategy was incepted in 2002. The investment team for this strategy

consists of 6 individuals - PM Randell Cain, a Director of Research, and 4

central research analysts that support all Herndon strategies. We believe

Cain is a seasoned and highly capable PM, who uses a disciplined and

well thought out Large Cap Value investment process. An open minded

approach to idea generation, along with a unique blend of screens and

qualitative inputs, differentiates the strategy versus peers.

WestEnd Advisors : 17.4%

WestEnd Advisors is a private, independently-owned investment advisory

firm based in Charlotte, North Carolina. The cornerstone of WestEnd's

investment philosophy is their conviction that sector and industry

performance is highly correlated with stages of the economic cycle.

Therefore, WestEnd focuses on the sectors which they believe will benefit

most from current economic tailwinds, and avoids sectors it views as

untimely at a particular stage of the cycle. Within the MultiAlpha fund, West

End's concentrated portfolio, their low benchmark adherence and in

particular their sector rotation strategy will strengthen the structure at the

overall fund level, as the existing managers primarily focus on a bottom-up

approach to managing equities. WestEnd replaces Rainier.

3

MultiAlpha North America Equity (A)

Monthly Report - 31 December 2012

Accumulation Shares

Net Cumulated performance (USD) & Risk Ratio

About the Multimanager team

The Multimanager team within HSBC is a

specialist multimanager function, providing

multimanager solutions to clients globally.

HSBC has one of the largest multimanager

teams in the world, comprising more than

45 investment

professionals

(including

a

dedicated

property

multi-manager

team)

based in 11 locations around the world. The

global reach of the team locations adds

value through highly localised and expert

manager

insight

and

allows

the

Multimanager team to leverage their local

market

knowledge

when

building

truly

global solutions for clients.

1 month

3 months

2 012

1 year

3 years

Inception

30/11/2012 28/09/2012 30/12/2011 30/12/2011 31/12/2009 09/06/2009

31/12/2012 31/12/2012 31/12/2012 31/12/2012 31/12/2012 31/12/2012

0.64%

-0.68%

12.10%

12.10%

23.66%

44.93%

Portfolio

0.87%

-0.44%

15.33%

15.33%

34.17%

60.09%

Benchmark

-0.23%

-0.24%

-3.23%

-3.23%

-10.51%

-15.16%

Excess Return

Fund's volatility

11.44%

17.53%

17.77%

Benchmark's volatility

11.52%

17.25%

17.24%

Tracking error

1.67%

1.73%

1.90%

Information ratio

-1.67

-1.56

-1.46

The above performance figures refers to the past and are not a reliable indicator of future returns.

Top 10 holdings

Industry Sectors

Weight

1

Holdings

APPLE INC

USD

Information Technology

3.14%

2

IBM CORP

USD

Information Technology

2.18%

3

ORACLE CORP / USD

USD

Information Technology

1.68%

4

QUALCOMM INC

USD

Information Technology

1.58%

5

COACH INC

USD

Consumer Staples

1.47%

6

GOOGLE INC

USD

Information Technology

1.35%

7

CELGENE CORP

USD

Health Care

1.33%

8

MICROSOFT CORP

USD

Information Technology

1.30%

9

EXXON MOBIL CORP

USD

Energy

1.19%

USD

Energy

10 APACHE CORP

Currency

1.18%

Total Top 10 Holdings

Source : MSCI & HSBC Global Asset Management (France) as at end of December 2012

16.41%

Industry Sector Allocation

Industry Sector

Portfolio

Benchmark*

Spread

Information Technology

23.25%

18.97%

4.28%

Consumer Staples

15.05%

13.56%

1.49%

Financials

13.53%

15.15%

-1.62%

Health Care

11.57%

11.88%

-0.31%

Energy

10.56%

10.91%

-0.35%

Consumer Discretionary

10.14%

9.10%

1.04%

Industrials

7.98%

10.22%

-2.24%

Materials

4.62%

3.60%

1.02%

Telecommunication Services

2.94%

3.24%

-0.30%

Utilities

0.36%

3.37%

Source : MSCI & HSBC Global Asset Management (France) as at end of December 2012

-3.00%

Country Allocation

Portfolio

Benchmark*

Spread

96.14%

98.11%

-1.97%

United Kingdom

1.15%

0.13%

1.02%

South Korea

0.96%

0.00%

0.96%

Switzerland

0.55%

0.43%

0.12%

Ireland

0.46%

0.75%

-0.29%

Cayman Islands

0.38%

0.12%

0.26%

Hong-Kong

0.18%

0.00%

0.18%

Canada

0.17%

0.08%

0.09%

The Bermuda Islands

0.00%

0.18%

-0.18%

Sweden

0.00%

0.05%

-0.05%

Other

0.00%

0.15%

-0.15%

Country

United-States

About MultiAlpha

The MultiAlpha Fund range is the global

flagship product range offered by the

specialist multimanager team within HSBC.

Our global teams seek to identify and

combine specialist managers within each

asset class. We search for managers who

can demonstrate an edge in either the

information they possess about the asset

class and/or the

more

powerful

and

insightful analytical process they utilise in

the management of their strategies. This is

done using a global process which relies on

well

organised

research

and

decision

making,

informed

by

the

sensible

application of a range of mathematical

tools. The managers selected will be those

who are considered to have a clearly

identifiable skill or skills which gives them

an advantage over other managers in their

chosen specialist field of expertise. Those

chosen and their weights in a MultiAlpha

portfolio will be a reflection of our teams

assessment of the performance attributable

to their skill and how the portfolio they

manage is best combined with the other

managers who we have selected in an

effort to smooth out 'peaks and troughs' in

performance

that

typically

occur

in

individual approaches.

Source : MSCI & HSBC Global Asset Management (France) as at end of December 2012

* 100% MSCI USA (USD) NR

3

MultiAlpha North America Equity (A)

Monthly Report - 31 December 2012

Accumulation Shares

Contact Us

Fund Manager Biography

For further information on HSBC Global Asset Management, HSBC Multimanager or any of our funds

performance and prices, please visit

www.assetmanagement.hsbc.com

Randeep Brar

HISF helpdesk + 971 566 032 085 or email us at adviser.services@hsbc.com

Randeep Brar (New York) is responsible for

managing the Multimanager team in New

York and joined HSBC Global Asset

Management in 2007, and has been in the

industry since 1994. Randeep's current role

includes

both

research

and

portfolio

management responsibilities, across broad

US equity and fixed income asset classes

covered by the Multimanager team.

Please note: To help improve our service and in the interest of security we may monitor on a random

basis and/or record your telephone calls with us. Alternatively, contact your local sales and client services

representatives.

To place a deal, please contact:

Luxembourg

RBC Dexia Investors Services Bank S.A.

Fax: +352 2460 9500

Tel: +352 2605 9553

Initial orders can only be processed once the transfer agency have received and authorised the original

completed application form, together with a certified copy of identification, and only after cleared funds

have been received. (Details of suitable identification documents are given within the application form).

Please note that should there be any documents or signatures missing, this will cause a delay in an

investment being made. All subsequent subscriptions will also be made upon receipt of cleared funds.

Head of Multimanager team, HSBC US

Prior

to

joining

HSBC

Global

Asset

management, Randeep led small cap and

mid cap portfolio management and research

with-in the SEI Investments, manager of

manager program, where he worked since

2001 in

a

variety

of

senior

research

positions. Previous to that, Randeep was

Associate

Director

Research

at

Barra

Rogers Casey, which he joined in 1994 and

held roles with-in investment consulting and

equity manager research.

Randeep holds a BE in engineering from

Punjab University, India and is a CFA

charterholder and also holds the CAIA

designation.

HSBC International Select Funds (HISF) are sub-funds of HSBC International Select Funds, a

Luxembourg based SICAV (Société d’Investissement á Capital Variable) regulated by the CSSF. The

funds mentioned in this document may not be registered for sale or available in all jurisdictions. For

available funds please contact your local HSBC office.

HSBC International Select Funds cannot be sold by anyone in any jurisdiction in which such offer or

solicitation is not lawful or in which the person making such an offer or solicitation is not qualified to do so

or to anyone to whom it is unlawful to make such offer or solicitation. All applications are made on the

basis of the current HSBC International Select Funds Prospectus, simplified prospectus and most recent

annual and semi-annual reports. These can be obtained on request and free of charge from HSBC Global

Asset Management (UK) Limited or the local distributors. The value of investments may go down as well

as up and you may not get back the full amount you invested. Where overseas investments are held the

rate of exchange may cause the value of investments to go down as well as up. Markets in some countries

can be described as ‘emerging markets’. Some of these may involve a higher risk than where an

investment is within a more established market. Where a sub-fund invests predominately in one

geographical area, any decline in economic conditions may affect prices and the value of underlying

investments.

The securities representing interests in the HSBC International Select Funds have not been and will not be

registered under the US Securities Act of 1933 and will not be offered for sale or sold in the United States

of America, its territories or possessions and all areas subject to its jurisdiction, or United States person,

except in a transaction which does not violate the Securities Law of the United States of America.

This document was produced by HSBC Global Asset Management (UK) Limited for distribution in the

Middle East and North Africa region by HSBC Global Asset Management MENA, who are marketing the

product in a sub-distributing capacity on a principal - to - principal basis. HSBC Global Asset Management

MENA, is a unit that is part of HSBC Bank Middle East Limited, PO Box 66, Dubai, UAE, which is

incorporated and regulated by the Jersey Financial Services Commission. Services are subject to the

Bank’s terms and conditions. HSBC Bank Middle East Limited is a member of the HSBC Group. HSBC

Global Asset Management (UK) Limited, 8 Canada Square, Canary Wharf, London, E14 5HQ, UK, is

authorised and regulated in the United Kingdom by the Financial Services Authority and registered as

number 122335.

The information provided has not been prepared taking into account the particular investment objectives,

financial situation and needs of any particular investor. As a result, investors using this information should

assess whether it is appropriate in the light of their own individual circumstances before acting on it. The

information in this document is derived from sources believed to be reliable, but which have not been

independently verified. However, HSBC Bank Middle East Limited makes no guarantee of its accuracy and

completeness and is not responsible for errors of transmission of factual or analytical data, nor shall HSBC

Bank Middle East Limited be liable for damages arising out of any person ’s reliance upon this information.

All charts and graphs are from publicly available sources or proprietary data. The opinions in this

document constitute the present judgment of the issuer, which is subject to change without notice.

This document is neither an offer to sell, purchase or subscribe for any investment nor a solicitation of

such an offer. This document is intended for the use of institutional and professional customers and is not

intended for the use of private customers. This document is intended to be distributed in its entirety. No

consideration has been given to the particular investment objectives, financial situation or particular needs

of any recipient. Any transaction will be subject to HSBC Bank’s Terms of Business.Copyright © HSBC

Global Asset Management (UK) Limited 2012. All rights reserved.

* Source: MSCI. The MSCI information may

only be used for your internal use, may not

be reproduced or redisseminated in any

form and may not be used to create any

financial instruments or products or any

indices. The MSCI information is provided

on an 'as is' basis and the user of this

information assumes the entire risk of any

use it may make or permit to be made of

this information. Neither MSCI, any of its

affiliates or any other person involved in or

related to compiling, computing or creating

the

MSCI

information

(collectively,

the

'MSCI Parties') makes any express or

implied warranties or representations with

respect to such information or the results to

be obtained by the use thereof, and the

MSCI Parties hereby expressly disclaim all

warranties (including, without limitation, all

warranties

of

originality,

accuracy,

completeness,

timeliness,

non-infringement,

merchantability

and

fitness for a particular purpose) with respect

to this information. Without limiting any of

the foregoing, in no event shall any MSCI

Party have any liability for any direct,

indirect,

special,

incidental,

punitive,

consequential

or

any

other

damages

(including, without limitation, lost profits)

even if notified of, or if it might otherwise

have anticipated, the possibility of such

damages.

3