MultiAlpha North America Equity (A)

Monthly Report - 29 May 2015

Distribution Shares

Investment Aims

Fund Details

The Sub-Fund seeks long-term capital growth by

investing at least two thirds of its total non-cash assets

in a well-diversified portfolio of investments in equity

and equity equivalent securities of companies which

have their registered office in, and with an official listing

on a major stock exchange or other Regulated Market

in North America as well as those companies which

carry out a preponderant part of their business

activities in the North America. The Sub-Fund uses a

multi-manager approach, relying upon one or more

sub-advisers to manage portions of the Sub-Fund's

portfolio. The Sub-Fund may invest no more than 10%

in total in UCITS and UCIs. Financial derivative

instruments may be used for hedging and efficient

portfolio management purposes.

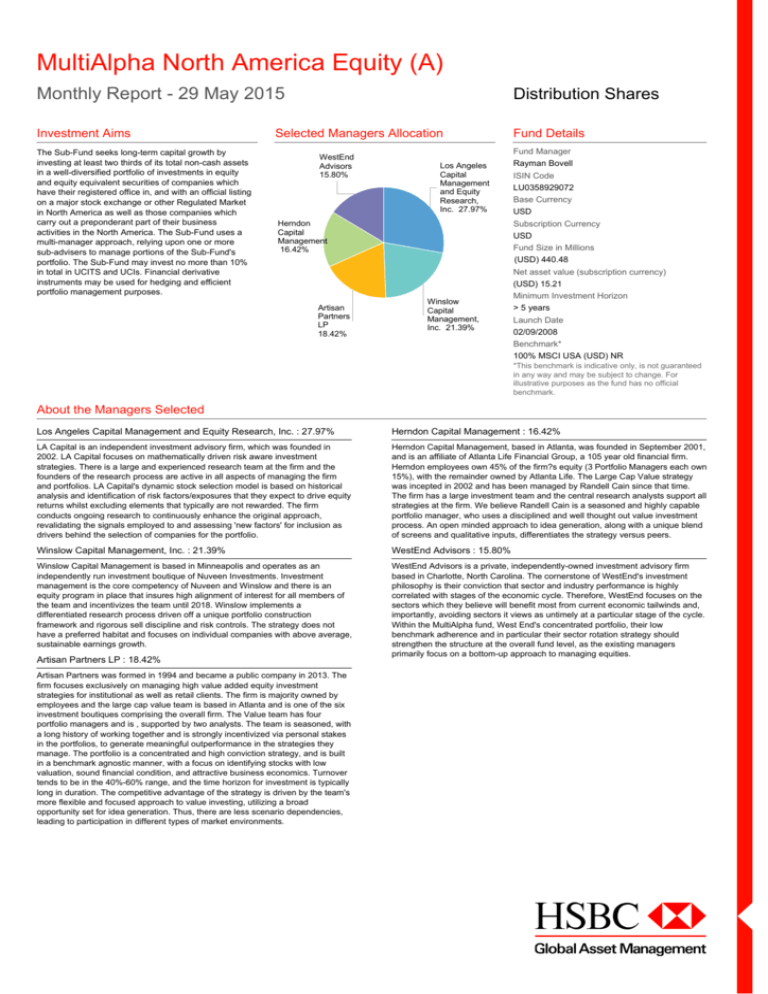

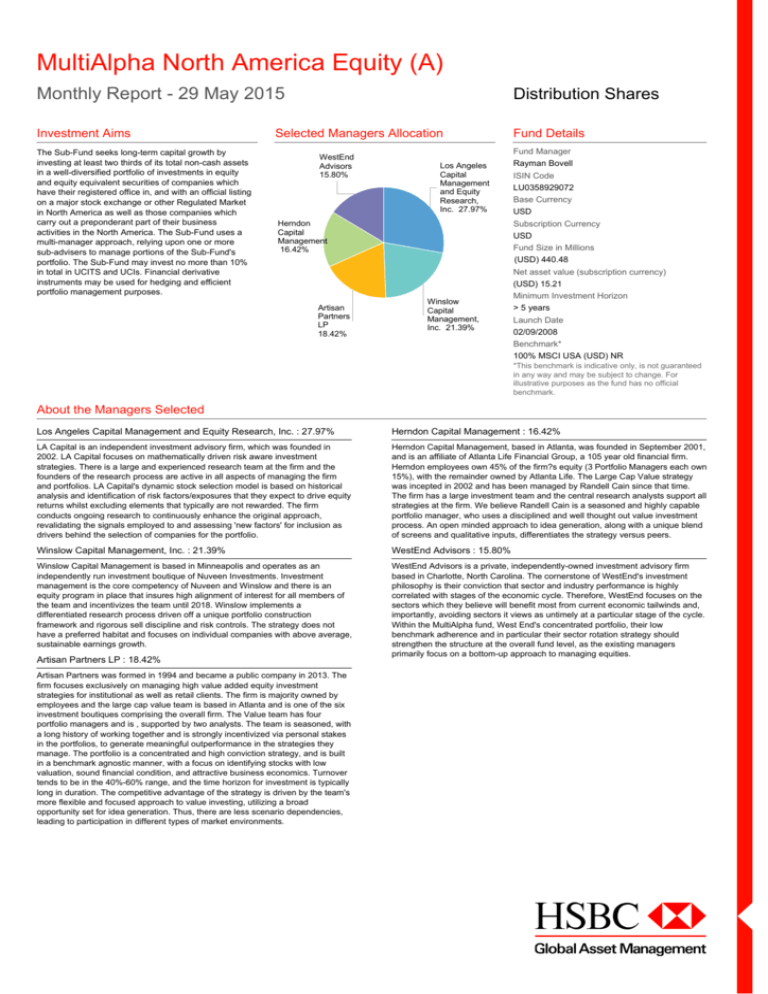

Selected Managers Allocation

WestEnd

Advisors

15.80%

Los Angeles

Capital

Management

and Equity

Research,

Inc. 27.97%

Herndon

Capital

Management

16.42%

Artisan

Partners

LP

18.42%

Winslow

Capital

Management,

Inc. 21.39%

Fund Manager

Rayman Bovell

ISIN Code

LU0358929072

Base Currency

USD

Subscription Currency

USD

Fund Size in Millions

(USD) 440.48

Net asset value (subscription currency)

(USD) 15.21

Minimum Investment Horizon

> 5 years

Launch Date

02/09/2008

Benchmark*

100% MSCI USA (USD) NR

*This benchmark is indicative only, is not guaranteed

in any way and may be subject to change. For

illustrative purposes as the fund has no official

benchmark.

About the Managers Selected

Los Angeles Capital Management and Equity Research, Inc. : 27.97%

Herndon Capital Management : 16.42%

LA Capital is an independent investment advisory firm, which was founded in

2002. LA Capital focuses on mathematically driven risk aware investment

strategies. There is a large and experienced research team at the firm and the

founders of the research process are active in all aspects of managing the firm

and portfolios. LA Capital's dynamic stock selection model is based on historical

analysis and identification of risk factors/exposures that they expect to drive equity

returns whilst excluding elements that typically are not rewarded. The firm

conducts ongoing research to continuously enhance the original approach,

revalidating the signals employed to and assessing 'new factors' for inclusion as

drivers behind the selection of companies for the portfolio.

Herndon Capital Management, based in Atlanta, was founded in September 2001,

and is an affiliate of Atlanta Life Financial Group, a 105 year old financial firm.

Herndon employees own 45% of the firm?s equity (3 Portfolio Managers each own

15%), with the remainder owned by Atlanta Life. The Large Cap Value strategy

was incepted in 2002 and has been managed by Randell Cain since that time.

The firm has a large investment team and the central research analysts support all

strategies at the firm. We believe Randell Cain is a seasoned and highly capable

portfolio manager, who uses a disciplined and well thought out value investment

process. An open minded approach to idea generation, along with a unique blend

of screens and qualitative inputs, differentiates the strategy versus peers.

Winslow Capital Management, Inc. : 21.39%

WestEnd Advisors : 15.80%

Winslow Capital Management is based in Minneapolis and operates as an

independently run investment boutique of Nuveen Investments. Investment

management is the core competency of Nuveen and Winslow and there is an

equity program in place that insures high alignment of interest for all members of

the team and incentivizes the team until 2018. Winslow implements a

differentiated research process driven off a unique portfolio construction

framework and rigorous sell discipline and risk controls. The strategy does not

have a preferred habitat and focuses on individual companies with above average,

sustainable earnings growth.

WestEnd Advisors is a private, independently-owned investment advisory firm

based in Charlotte, North Carolina. The cornerstone of WestEnd's investment

philosophy is their conviction that sector and industry performance is highly

correlated with stages of the economic cycle. Therefore, WestEnd focuses on the

sectors which they believe will benefit most from current economic tailwinds and,

importantly, avoiding sectors it views as untimely at a particular stage of the cycle.

Within the MultiAlpha fund, West End's concentrated portfolio, their low

benchmark adherence and in particular their sector rotation strategy should

strengthen the structure at the overall fund level, as the existing managers

primarily focus on a bottom-up approach to managing equities.

Artisan Partners LP : 18.42%

Artisan Partners was formed in 1994 and became a public company in 2013. The

firm focuses exclusively on managing high value added equity investment

strategies for institutional as well as retail clients. The firm is majority owned by

employees and the large cap value team is based in Atlanta and is one of the six

investment boutiques comprising the overall firm. The Value team has four

portfolio managers and is , supported by two analysts. The team is seasoned, with

a long history of working together and is strongly incentivized via personal stakes

in the portfolios, to generate meaningful outperformance in the strategies they

manage. The portfolio is a concentrated and high conviction strategy, and is built

in a benchmark agnostic manner, with a focus on identifying stocks with low

valuation, sound financial condition, and attractive business economics. Turnover

tends to be in the 40%-60% range, and the time horizon for investment is typically

long in duration. The competitive advantage of the strategy is driven by the team's

more flexible and focused approach to value investing, utilizing a broad

opportunity set for idea generation. Thus, there are less scenario dependencies,

leading to participation in different types of market environments.

3

MultiAlpha North America Equity (A)

Monthly Report - 29 May 2015

Distribution Shares

Net Cumulated performance (USD) & Risk Ratio

About MultiAlpha

1 month

3 months

2 015

1 year

3 years

5 years

Inception

30/04/2015 27/02/2015 31/12/2014 30/05/2014 31/05/2012 28/05/2010 02/09/2008

29/05/2015 29/05/2015 29/05/2015 29/05/2015 29/05/2015 29/05/2015 29/05/2015

0.54%

-0.88%

3.06%

7.33%

52.73%

81.77%

53.49%

Portfolio

1.27%

0.64%

3.41%

11.37%

68.74%

109.75%

84.24%

Benchmark

-0.73%

-1.52%

-0.35%

-4.04%

-16.01%

-27.98%

-30.75%

Excess Return

Fund's volatility

11.75%

10.96%

14.54%

20.52%

Benchmark's volatility

11.77%

10.89%

14.39%

20.49%

Tracking error

1.84%

1.68%

1.72%

2.28%

Information ratio

-2.01

-2.01

-1.66

-1.18

The above performance figures refers to the past and are not a reliable indicator of future returns.

Top 10 holdings

Industry Sectors

Weight

1

Holdings

APPLE INC

USD

Information Technology

4.30%

2

EXPRESS SCRIPTS INC

USD

Health Care

1.94%

3

GILEAD SCIENCES INC

USD

Health Care

1.74%

4

CVS HEALTH CORP

USD

Consumer Discretionary

1.57%

5

ORACLE CORP / USD

USD

Information Technology

1.45%

6

CELGENE CORP

USD

Health Care

1.44%

7

WALT DISNEY CO ( THE )

USD

Consumer Discretionary

1.43%

8

TJX COMPANIES INC

USD

Consumer Staples

1.33%

9

NIKE INC CLASS B

USD

Consumer Staples

1.30%

USD

Information Technology

10 EMC CORP

Currency

Total Top 10 Holdings

Source : MSCI & HSBC Global Asset Management (France) as at end of May 2015

The MultiAlpha Fund range is the global flagship

product range offered by our specialist team

within HSBC. Our global teams seek to identify

and combine specialist managers within each

asset class. We search for managers who can

demonstrate an edge in either the information

they possess about the asset class and/or the

more powerful and insightful analytical process

they utilise in the management of their strategies.

This is done using a global process which relies

on well organised research and decision making,

informed by the sensible application of a range of

mathematical tools. The managers selected will

be those who are considered to have a clearly

identifiable skill or skills which gives them an

advantage over other managers in their chosen

specialist field of expertise. Those chosen and

their weights in a MultiAlpha portfolio will be a

reflection of our assessment of the performance

attributable to their skill and how the portfolio

they manage is best combined with the other

managers who we have selected in an effort to

smooth out 'peaks and troughs' in performance

that typically occur in individual approaches.

1.28%

17.77%

Industry Sector Allocation

Industry Sector

Portfolio

Benchmark*

Spread

Information Technology

23.35%

20.10%

3.25%

Health Care

15.57%

14.97%

0.60%

Consumer Staples

12.85%

13.15%

-0.30%

Financials

11.83%

15.48%

-3.65%

Consumer Discretionary

11.20%

9.36%

1.84%

Industrials

8.93%

10.14%

-1.21%

Energy

7.82%

7.96%

-0.14%

Materials

6.15%

3.27%

2.89%

Telecommunication Services

1.85%

2.63%

-0.78%

Utilities

0.46%

2.96%

Source : MSCI & HSBC Global Asset Management (France) as at end of May 2015

-2.50%

Country Allocation

Portfolio

Benchmark*

Spread

United-States

95.24%

98.04%

-2.80%

South Korea

1.18%

0.00%

1.18%

Cayman Islands

0.79%

0.08%

0.70%

Canada

0.67%

0.05%

0.62%

Hong-Kong

0.64%

0.05%

0.59%

France

0.61%

0.00%

0.61%

Ireland

0.31%

0.81%

-0.50%

United Kingdom

0.29%

0.14%

0.15%

Netherlands

0.26%

0.10%

0.16%

Switzerland

0.03%

0.26%

-0.23%

Other

0.00%

0.48%

-0.48%

Country

* Source: MSCI, the MSCI information may only

be used for your internal use, may not be

reproduced or redisseminated in any form and

may not be used as a basis for or a component

of any financial instruments or products or

indices. None of the MSCI information is

intended to constitute investment advice or a

recommendation to make (or refrain from

making) any kind of investment decision and may

not be relied on as such. Historical data and

analysis should not be taken as an indication or

guarantee of any future performance analysis,

forecast or prediction. The MSCI information is

provided on an “as is” basis and the user of this

information assumes the entire risk of any use

made of this information. MSCI, each of its

affiliates and each other person involved in or

related to compiling, computing or creating any

MSCI information (collectively, the “MSCI

Parties”) expressly disclaims all warranties

(including, without limitation, any warranties of

originality, accuracy, completeness, timeliness,

non-infringement, merchantability and fitness for

a particular purpose) with respect to this

information. Without limiting any of the foregoing,

in no event shall any MSCI Party have any

liability for any direct, indirect, special, incidental,

punitive, consequential (including, without

limitation, lost profits) or any other damages.

(www.msci.com)

Source : MSCI & HSBC Global Asset Management (France) as at end of May 2015

* 100% MSCI USA (USD) NR

3

MultiAlpha North America Equity (A)

Monthly Report - 29 May 2015

Distribution Shares

Important Information

Fund Manager Biography

The HSBC MultiAlpha funds are sub-funds of the HSBC International Select Fund, a Luxembourg domiciled SICAV.

The Investment Adviser to the funds is HSBC Asset Management (France), who in turn appoints sub-advisers to

manager portion of the fund's portfolio. As with any investment where the underlying investments are stocks and

shares, the price of shares in HSBC International Select Fund and any income from it can go down as well as up, is not

guaranteed, and you may not get back the amount of your original investment. Where overseas investments are held,

the rate of exchange may cause the value of such investments to go down as well as up. You should view this

investment as medium to long term, and should plan to keep it for at least five years. Any decision to invest in the

HSBC International Select Fund should be based on the content of the Prospectus, simplified prospectus and most

recent annual and semi-annual reports, which can be obtained upon request free of charge from HSBC Fund

Administration (Jersey) Limited, HSBC House, Esplanade, St Helier, Jersey JE1 1HS, Channel Islands. Investors and

potential investors should refer to the Prospectus for general risk factors and the Simplified Prospectus for specific risk

factors. If you undertake Investment Business with any non-UK members of the HSBC Group you will be excluded from

the benefit of the rules and regulations made under the UK's Financial Services and Markets Act 2000, including the

UK Financial Services Compensation Scheme.

Rayman Bovell

Issued by HSBC Global Asset Management (International) Limited. HSBC Global Asset Management (International)

Limited is registered in Jersey under registration number 29656 registered office HSBC House, Esplanade, St Helier,

Jersey JE4 8WP. HSBC Global Asset Management (International) Limited is regulated by the Jersey Financial

Services Commission for Investment Business and is licensed by the Guernsey Financial Services Commission for

Collective Investments and Investment Business. HSBC Bank plc acts as settlement agent to HSBC Global Asset

Management (International) Limited. Approved for issue in the UK by HSBC Global Asset Management (UK) Limited

authorised and regulated by the Financial Conduct Authority. Copyright © HSBC Global Asset Management (UK)

Limited 2015. All rights reserved.

Head of Wealth Portfolio Management

Mr. Bovell manages the Wealth Portfolio

Management Team in New York and Toronto

and joined HSBC Global Asset Management

(USA) Inc. in 2008 after having worked in the

industry since 2001. Mr. Bovell?s current role

includes research, portfolio management and

asset allocation responsibilities across broad

equity and fixed income asset classes covered

by the Wealth Portfolio Management team.

Prior to joining HSBC, Mr. Bovell was an Analyst

at Merrill Lynch and was responsible for

researching US equity managers, where he

worked since 2005. Previous to that he worked at

Lehman Brothers as a Financial Adviser, where

he joined in 2001. Mr. Bovell started his career as

a Technical Specialist at Pfizer and manufactured

oral and intravenous products.

Mr. Bovell holds a Bachelors of Science degree

from Columbia University in Chemical

Engineering and an MBA from the Ross School of

Business at the University of Michigan. He is a

Chartered Financial Analyst and a member of the

New York Society of Security Analysts and the

CFA Institute. Mr. Bovell leads the Investment

Committee for Columbia Engineering Alumni

Association.

3