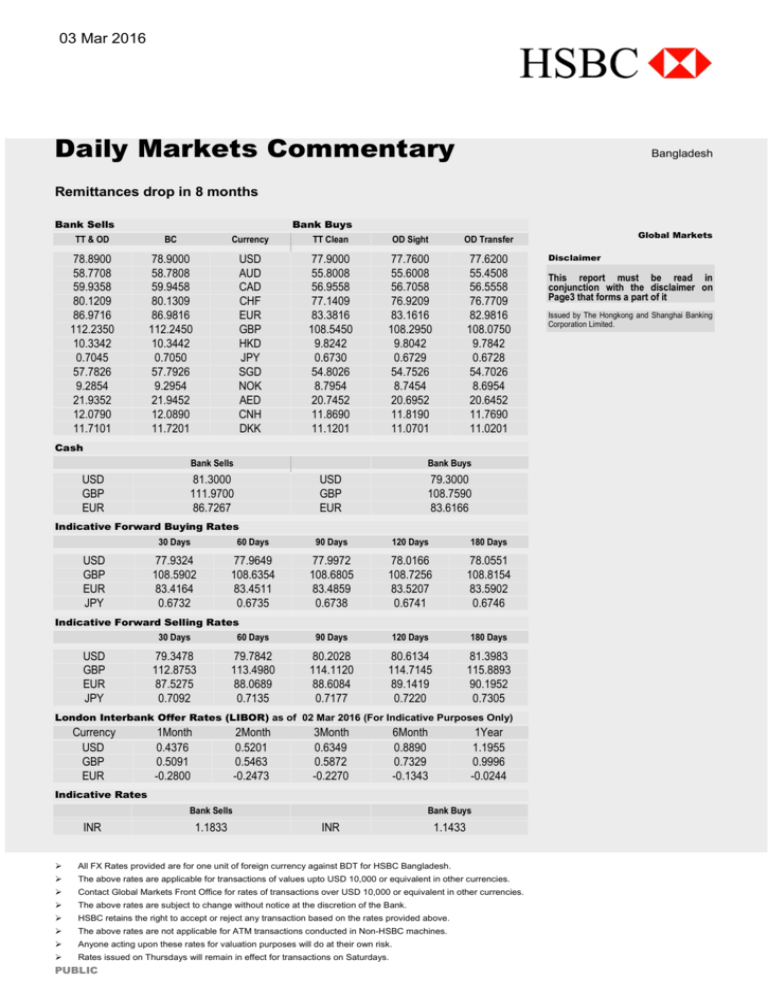

03 Mar 2016

Daily Markets Commentary

Bangladesh

Remittances drop in 8 months

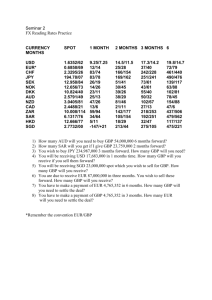

Bank Sells

Bank Buys

TT & OD

BC

Currency

TT Clean

OD Sight

OD Transfer

78.8900

58.7708

59.9358

80.1209

86.9716

112.2350

10.3342

0.7045

57.7826

9.2854

21.9352

12.0790

11.7101

78.9000

58.7808

59.9458

80.1309

86.9816

112.2450

10.3442

0.7050

57.7926

9.2954

21.9452

12.0890

11.7201

USD

AUD

CAD

CHF

EUR

GBP

HKD

JPY

SGD

NOK

AED

CNH

DKK

77.9000

55.8008

56.9558

77.1409

83.3816

108.5450

9.8242

0.6730

54.8026

8.7954

20.7452

11.8690

11.1201

77.7600

55.6008

56.7058

76.9209

83.1616

108.2950

9.8042

0.6729

54.7526

8.7454

20.6952

11.8190

11.0701

77.6200

55.4508

56.5558

76.7709

82.9816

108.0750

9.7842

0.6728

54.7026

8.6954

20.6452

11.7690

11.0201

Cash

Bank Sells

USD

GBP

EUR

Bank Buys

81.3000

111.9700

86.7267

USD

GBP

EUR

79.3000

108.7590

83.6166

Indicative Forward Buying Rates

USD

GBP

EUR

JPY

30 Days

60 Days

90 Days

120 Days

180 Days

77.9324

108.5902

83.4164

0.6732

77.9649

108.6354

83.4511

0.6735

77.9972

108.6805

83.4859

0.6738

78.0166

108.7256

83.5207

0.6741

78.0551

108.8154

83.5902

0.6746

Indicative Forward Selling Rates

USD

GBP

EUR

JPY

30 Days

60 Days

90 Days

120 Days

180 Days

79.3478

112.8753

87.5275

0.7092

79.7842

113.4980

88.0689

0.7135

80.2028

114.1120

88.6084

0.7177

80.6134

114.7145

89.1419

0.7220

81.3983

115.8893

90.1952

0.7305

London Interbank Offer Rates (LIBOR) as of 02 Mar 2016 (For Indicative Purposes Only)

Currency

USD

GBP

EUR

1Month

0.4376

0.5091

-0.2800

2Month

0.5201

0.5463

-0.2473

3Month

0.6349

0.5872

-0.2270

6Month

0.8890

0.7329

-0.1343

1Year

1.1955

0.9996

-0.0244

Indicative Rates

Bank Sells

INR

1.1833

Bank Buys

INR

1.1433

Ø

All FX Rates provided are for one unit of foreign currency against BDT for HSBC Bangladesh.

Ø

The above rates are applicable for transactions of values upto USD 10,000 or equivalent in other currencies.

Ø

Contact Global Markets Front Office for rates of transactions over USD 10,000 or equivalent in other currencies.

Ø

The above rates are subject to change without notice at the discretion of the Bank.

Ø

HSBC retains the right to accept or reject any transaction based on the rates provided above.

Ø

The above rates are not applicable for ATM transactions conducted in Non-HSBC machines.

Ø

Anyone acting upon these rates for valuation purposes will do at their own risk.

Ø

Rates issued on Thursdays will remain in effect for transactions on Saturdays.

PUBLIC

Global Markets

Disclaimer

This report must be read in

conjunction with the disclaimer on

Page3 that forms a part of it

Issued by The Hongkong and Shanghai Banking

Corporation Limited.

ad

Daily Markets Commentary

Domestic market

4 USDBDT rate remains stable as sufficient liquidity is available in the market as per demand.

4 Overnight call money deals trading mostly within the range of 2.50 - 3.50%.

International Market

4 FX Market Update: The greenback was back versus yen after losing grip of a two-week

high. The euro drifted up from a one-month trough. While the ADP National Employment

Report pointed to a healthy outcome for Friday's non-farm payrolls, a Federal Reserve

survey found that economic conditions varied considerably across regions and within

sectors. The mixed picture remains a headache for Fed policymakers face when they next

meet to decide the path of interest rates on March 15-16. The Australian dollar started trade

in Asia on Thursday near its 2016 peak, having soared on the back of surprisingly strong

local data just as the greenback, euro and yen settled into a holding pattern.

[Source: Reuters]

Corporate and Economic News

4 Remittances drop in 8 months: Remittance inflow decreased by 1.15% to USD 9.8 billion

in eight months of the financial year of 2015-16 compared with that in the same period of

FY15, according to the Bangladesh Bank data released on Wednesday. The remittance

inflow figure was USD 9.9 billion in the July-February period of FY15. Experts said the fall

might put an adverse impact on the country’s gross domestic product. Former interim

administration adviser Mirza Azizul Islam told New Age on Wednesday that it was a matter of

concern that the country’s inward remittance was on the decline for the last few months. He

said, ‘The economies of Arabian countries, which are our main manpower export

destinations, are now facing crisis that has put an adverse impact on the country’s inward

remittance.’ Besides, an anti-immigration sentiment is building up in whole Europe, forcing

Bangladeshi nationals to leave the countries of the continent, he said.

[http://newagebd.net/207951/remittances-drop-8-months/]

2

PUBLIC

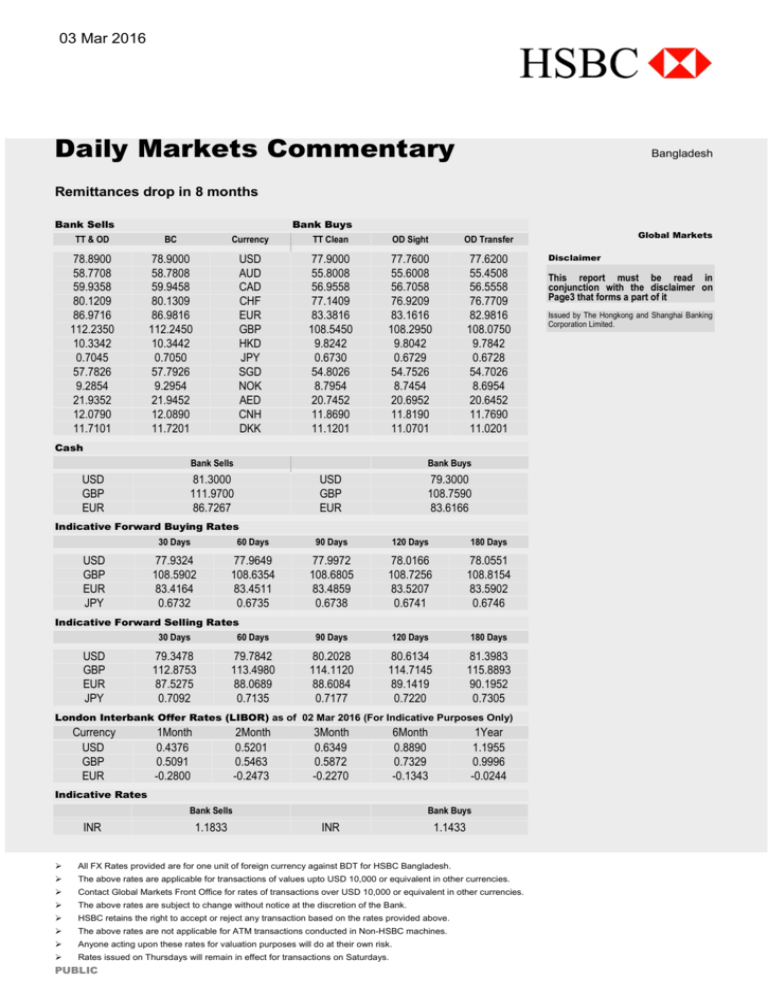

Market Snapshot

International Commodity Prices

ê

ê

é

ê

é

é

ê

ê

Brent Crude Oil ($ per bbl)

Natural Gas ($ per mm btu)

Gold (SPOT,$ per Troy oz)

Corn (¢ / bushel)

Soybeans (¢ / bushel )

Wheat (¢ / bushel)

Cotton (¢ / pound)

Sugar #11 (cents per pound)

34.72

1.67

1,239.90

355.50

861.50

450.00

55.93

12.94

Central Bank Policy Rates

Australia

Canada

Eurozone

Japan

Switzerland

England

US

2.00%

0.50%

0.05%

0.00-0.10%

- 0.75%

0.50%

0.25-0.50%

International Stock Market

FTSE 100 Index

Nikkei 225 Index

6,147.06 ê

16,895.08 é

DowJones Industrial Average

16,899.32 é

Local Stock Market

Dhaka Stock Exchange

DSEX Index

Chittagong Stock Exchange

CSE All Share Price Index

(CASPI)

Source: Websites

4,462.18 ê

13,772.38 ê

ad

Daily Markets Commentary

Disclaimers

This document is issued by The Hongkong and Shanghai Banking Corporation Limited (HSBC). The

information contained herein is derived from sources we believe to be reliable, but which we have

not independently verified. HSBC makes no representation or warranty (express or implied) of any

nature nor is any responsibility of any kind accepted with respect to the completeness or accuracy

of any information, projection, representation or warranty (expressed or implied) in, or omission

from, this document. No liability is accepted whatsoever for any direct, indirect or consequential loss

arising from the use of this document. Any information (including market date, prices, values or

levels) contained here are indicative only and any examples given are for the purposes of illustration

only and may vary in accordance with changes in market conditions. The opinions in this document

constitute our present judgment, which is subject to change without notice. We are no not obliged to

enter into any actual trade with you based on the any information contained herein. This document

does not constitute an offer or solicitation for, or advice that you should enter into, the purchase or

sale of any security, commodity or other investment product or investment agreement, or any other

contract, agreement or structure whatsoever and is intended for institutional customers and is not

intended for the use of private customers. The document is intended to be distributed in its entirety.

No consideration or advice has been given to the particular investment objectives, financial situation

or particular needs of any recipient, you should conduct relevant due diligence and analysis, and

seek necessary independent professional advice. Unless governing law permits otherwise, you

must contact a HSBC Group member in your home jurisdiction if you wish to use HSBC Group

services in effecting a transaction in any investment mentioned in this document. This document,

which is not for public circulation, must not be copied, transferred or the content disclosed, to any

third party and is not intended for use by any person other than the intended recipient or the

intended recipient's professional advisers for the purposes of advising the intended recipient

hereon.

Copyright. The Hongkong and Shanghai Banking Corporation Limited 2014. ALL RIGHTS

RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or

transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or

otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation

Limited.

3

PUBLIC

The Hongkong and Shanghai

Banking Corporation Limited

Management Office

Level 4, Shanta Western Tower, 186 Bir

Uttam Mir Shawkat Ali Road, Tejgaon I/A

Dhaka-1208, Bangladesh

Tel: +880 2 887 8872-73

Fax:+880 2 887 8865

Website: HSBC Markets BD