February 04, 2016

ConocoPhillips

(COP – NYSE)

$35.32

Note: More details to come; changes are highlighted. Except where highlighted, no other sections of this report have been

updated.

Reason for Report: Flash Update: 4Q15 and FY15 Earnings Update

Prev. Ed.: Dec 28, 2015; 4Q15 Earnings Update (broker material considered till Nov 3, 2015)

Flash News Update [Note: earnings update in progress; final report to follow]

On Feb 4, 2016, ConocoPhillips (COP) reported fourth-quarter 2015 loss per share of $0.90, wider

than the Zacks Consensus Estimate of $0.64 loss per share. Year-ago quarterly adjusted profit was

$0.60 per share.

Revenues in the reported quarter decreased to $6,766 million from the year-ago level of $11,851

million. Moreover, revenues missed the Zacks Consensus Estimate of $8,173 million.

Exploration and Production

Daily production, from continuing operation, averaged 1.599 million barrels of oil equivalent (MMBOE)

in the quarter, up from 1.589 MMBOE in the year-ago quarter. Growth was primarily backed by new

production from major projects and development programs, as well as an improved well performance.

This was partially offset by normal field decline.

Price Realization

Average realized price for oil was $40.35 per barrel compared with $71.31 in the year-earlier quarter.

Natural gas liquids were sold at $16.42 per barrel, way below the year-ago level of $31.07 per barrel.

The price for natural gas was $3.36 per thousand cubic feet compared with $5.98 in fourth-quarter

2014.

Financials

As of Dec 31, 2015, the company had total cash and cash equivalents of $2,368 million and $40,082

million in debt, with a debt-to-capitalization ratio of 38%. In the fourth quarter, cash from continuing

operating activities was $1.6 billion. Excluding a $0.2 billion change in operating working capital,

ConocoPhillips generated $1.8 billion in cash from operations. In addition, the company funded $2.1

billion in capital expenditures and investments, received proceeds from asset dispositions of $1.6

billion, and paid dividends of $0.9 billion.

Guidance

For the first quarter of 2016, the company projects production of 1,540 to 1,580 MBOED.

MORE DETAILS WILL COME IN THE IMMINENT EDITIONS OF ZACKS RD REPORTS ON COP.

© Copyright 2016, Zacks Investment Research. All Rights Reserved.

Portfolio Manager Executive Summary [Note:

changed]

only highlighted material has been

ConocoPhillips (COP) is a domestic, integrated oil and gas company. The company is engaged in

worldwide exploration and production (E&P).

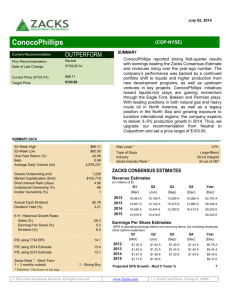

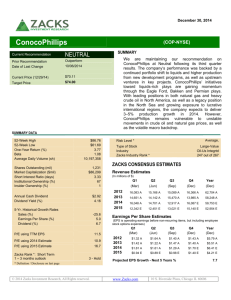

Of the 14 firms in the Digest group covering the stock, seven rated it positive, six rated it neutral and

one rendered a negative rating. Target prices range from a low of $45.00 (20.7% downside from the

current price) to a high of $77.00 (35.7% upside from the current price) with the average being $59.40.

The following is a summarized opinion of the diverse brokerage viewpoints:

Positive or equivalent (50.0%; 7/14 firms): The firms believe that ConocoPhillips has successfully

executed its strategy since the spin-off of its downstream business – Phillips 66 – two years ago. The

company’s production volumes have been encouraging and costs have also been lowered. The

company’s strong balance sheets as well as dividend yields that are higher than their peer average are

expected to lead to multiple expansions.

The firms expect ConocoPhillips’ strong fundamentals to provide a sound background for growth.

Moreover, the company’s move to sell off some of its international assets for a greater focus on the

North American ones should considerably reduce its risk profile. Also, the move to shift to betteryielding oil projects from the weak natural gas market should bring good news for the company.

Neutral or equivalent (42.9%; 6/14 firms): Though the firms are encouraged by the company’s new

exploration efforts and the signs of early success, they think it will be at least five to six years for the

recent successes to translate into visible improvement. Hence, even though the firms believe that the

stock will continue to enjoy near-term momentum from further progress in its asset sales program, they

remain on the sidelines and expect it to remain range bound due to the absence of concrete evidence

of improving the return on capital employed (ROCE) percentage trend relative to its peers.

The company’s cash flow deficit issue remains a headwind for 2015. Though the situation is expected

to improve in due course, given the company’s production growth and oil and gas prices, these firms do

not expect operating cash flow to cover the company’s annual expenditures and dividend payments.

Despite ConocoPhillips’ possibility of unlocking significant value post the spin-off of its downstream

business, the firms remain cautious of the fact that it is now more susceptible to the volatile oil and

natural gas prices.

December 28, 2015

Zacks Investment Research

Page 2

www.zackspro.com

Overview [Note: only highlighted material has been changed]

Key Positive Arguments

ConocoPhillips has completed the spin-off of its

refining business into a new listed entity – Phillips

66. This transaction has permitted recognition of

both the new companies as the largest in their

sub-sectors, as measured by throughput,

production, reserves and market capitalization.

Improving balance sheet.

Oil and gas mix likely to become more balanced.

Strong management team.

Expanding U.S. and international upstream

investments.

The company prioritizes growth of reserves and

production.

Commodity prices expected to remain strong over

the next couple of years.

Key Negative Arguments

Above-average earnings sensitivity to crude oil

price changes.

Lack of hedging.

Volatility in global commodity prices.

A sizable portfolio of mature OECD assets require

significant maintenance (North Sea) and

unscheduled downtime.

Volatile oil and gas prices.

Geopolitical risks associated with international

operations, especially in Russia.

Poor execution of its restructuring strategy.

ConocoPhillips is based in Houston, TX. Its main activities include exploration and production of crude

oil with operations and activities in 27 countries that include the U.S., Canada, the U.K./Norway, China,

Australia, offshore Timor-Leste, Indonesia, Libya, Nigeria, Algeria, Russia and Qatar. As of the end of

2014, the company had estimated proved reserves of 8.9 billion oil equivalent barrels (BOE).

Production from continuing operations, excluding Libya, averaged 1,532 MBOED in 2014. The

company’s reserve replacement ratio in 2014 was 124%.

In May 2012, ConocoPhillips completed the spin-off of its refining/sales business into an independent

and publicly-traded company Phillips 66. The move has resulted in the creation of the largest refining

company in the U.S. (with a capacity of 2.2 million barrels per day) and the largest exploration and

production player based on oil and gas reserves.

The new downstream company, Phillips 66, is headquartered in Houston, TX. In addition to the refining,

marketing and transportation businesses, Phillips 66 includes most of the Midstream and Chemicals

segments as well as power generation and certain technology operations included in the Emerging

Businesses segment. This has created an integrated downstream company.

Further information on ConocoPhillips is available at its website www.conocophillips.com.

ConocoPhillips operates on a calendar-year basis.

December 28, 2015

Long-Term Growth [Note: only highlighted material has been changed]

The firms believe that the company’s Exploration and Production segment has outlined strategic plans

to advance an asset portfolio toward future opportunities and is rich in resources. With leading positions

in both natural gas and heavy crude oil in North America, a legacy of successful North Sea operations

and strong growth in Russia and Caspian regions, the Middle East, and the Asia Pacific regions, the

company expects to replace reserves and sustain production growth at a rate of approximately 2% over

the long term. Management expects new growth opportunities as ConocoPhillips pursues focused

Zacks Investment Research

Page 3

www.zackspro.com

exploration and business development in several prospective areas globally and works to rebuild its

exploration portfolio.

The company continues to focus on creating shareholder value through operational excellence, strong

project execution, cost restraint, capital discipline, and financial optimization. Overall, the company

remains committed to its policy of using excess cash flow to repurchase shares.

A number of acquisitions and investments have contributed to the ConocoPhillips portfolio over the last

decade, but some of those acquisitions (in particular Burlington Resources) resulted in lagging returns,

relative to the peer group. The firms are of the opinion that the company’s portfolio restructuring would

significantly improve its balance sheet and support an improvement in ROCE metrics to near peer

group averages. The company’s exploration initiatives toward liquids rich plays such as Eagle Ford,

Bakken, and North Barnett shale plays have been gaining momentum.

The restructuring/asset sales have removed much of the negative investor sentiment issuing from past

acquisitions and flat upstream production profile at ConocoPhillips. The firms remain concerned as to

whether the company can generate improved returns and modest upstream volume growth over the

longer term from a lower base following its restructuring.

Again, some firms remain positive on the outlook for the new ConocoPhillips post split as it holds the

promise of significant value being unlocked. The idea behind the spin-off was to create value for

shareholders by taking advantage of the volatility in the refining business. The creation of two separate

companies is believed to be beneficial since the separate entities will get to pursue greater

opportunities in their respective market segments without the constraints of the parent company. It will

also better serve the needs of both investor groups. Hence, they believe that this move will allow

ConocoPhillips to narrow the returns gap, which has historically lagged its peers.

Following the separation, the firms contend that ConocoPhillips is the largest U.S. E&P company in

terms of market capitalization and total oil and gas production, with the highest dividend yield among

independent E&Ps. Its business strategy is based on growing annual production and unit margins by 3–

5%, while maximizing cash return to shareholders through annual dividend growth and opportunistic

share repurchases.

December 28, 2015

Target Price/Valuation [Note: only highlighted material has been changed]

Provided below is the summary of valuation and ratings as compiled by the Zacks Digest:

Rating Distribution

Positive

50.0%↑

Neutral

42.9%↓

Negative

7.1%

Average Target Price

$59.40↓

Digest High

$77.00 ↑

Digest Low

$45.00↓

No. of Firms with Target Price/Total

10/14

The general risks to the price target include a heavy exposure to North American natural gas prices,

volatile commodity prices and inability to meet growth objectives, cost reductions, and financial targets.

Zacks Investment Research

Page 4

www.zackspro.com

Recent Events [Note: only highlighted material has been changed]

On Dec 10, 2015, ConocoPhillips released its capital spending budget and operating plan for 2016.

The company’s 2016 capital budget of $7.7 billion is 25% below the expected 2015 capital spending

and 55% lower than that of 2014. Of the total budget, about $1.2 billion or 16% is apportioned for base

maintenance and corporate expenditures, $3.0 billion or 39% has been allocated for development

drilling programs, $2.1 billion or 27% has been set aside for major projects. The remaining $1.4 billion

or 18% is to be used for exploration and appraisal.

The majority of capital will be used for the development of U.S. oil fields, mainly shale formations in

Texas and North Dakota as well as for the Gulf of Mexico and Alaska. ConocoPhillips also intends to

allot drilling capital to Malaysia, China, the North Sea and Canada.

The drastic fall in oil prices has hurt all segments of the economy including oil producers, rig owners

and even steelmakers. The surplus of crude from the Middle East, Russia and the U.S. shale fields has

resulted in a supply glut that lowered oil prices since mid-2014, thereby shrinking cash flow across the

industry as well as prompting job cuts and project terminations. Under such circumstances,

ConocoPhillips posted its sharpest quarterly loss since 2008 in the period ended Sep 30, 2015.

Per a statement issued by the company, it expects to divest assets worth $1.7 billion by the end of Mar

2016. Most of the assets to be sold are gas fields. ConocoPhillips has already sold assets worth about

$600 million during the first nine months of this year. Production from these assets accounts for over 70

thousand barrels of oil equivalent per day (MBOED) of 2015 production.

The company projects a production growth of 1–3% for 2016, excluding the impact of asset sales and

supply disruptions in Libya. ConocoPhillips anticipates growth mainly from the start up of an Australian

gas-export project as well as continued ramp up of oil sands production in Canada and Alaska.

Operating costs for 2016 are projected at $7.7 billion compared with $10.5 billion in 2014. After

adjustment of $0.8 billion for special items, operating costs are up by $2 billion as against $9.7 billion of

adjusted operating costs for 2014. It is, however, $0.5 billion below the projected 2015 adjusted

operating costs of $8.2 billion.

On Oct 28, 2015, ConocoPhillips reported 3Q15 financial results. The highlights are as follow:

Total revenue was $7,507 million as against $12,917 million in 3Q14.

Adjusted net loss was $466.0 million as against adjusted net income $1.6 billion in 3Q14.

Diluted loss per share was $0.38 compared with earnings per share (EPS) of $1.29 in 3Q14.

Revenue [Note: only highlighted material has been changed]

ConocoPhillips deals in oil and gas exploration and production activities worldwide.

Note: The company restated its revenue and EPS figures starting 1Q11 to reflect the downstream

business as discontinued operations.

Zacks Investment Research

Page 5

www.zackspro.com

Per the Zacks Digest model, total revenue of $7,507 million in 3Q15 plunged 41.9% from $12,917

million in 3Q14 and 13.3% from $8,660 million in 2Q15.

Provided below is a summary of quarterly and forward revenue estimates:

3Q14A

2Q15A

3Q15A

4Q15E

2014A

2015E

2016E

2017E

Digest High

$12,917.0

$8,660.0

$7,507.0

$8,677.3

$55,517.0

$33,531.0

$52,605.0

$58,675.0

Digest Low

$12,917.0

$8,660.0

$7,507.0

$8,677.3

$55,517.0

$32,161.6

$37,377.1

$58,675.0

Digest Average

$12,917.0

$8,660.0

$7,507.0

$8,677.3

$55,517.0

$32,846.3

$44,991.1

$58,675.0

Y-o-Y Growth

-16.5%

-41.1%

-41.9%

-26.8%

-4.7%

-40.8%

37.0%

30.4%↑

Q-o-Q Growth

-12.1%

8.2%

-13.3%

15.6%

Revenue ($ M)

Note: Blank cells indicate that none of the brokers provided the figures.

Exploration & Production (E&P)

Daily production, from continuing operation, averaged 1.554 million barrels of oil equivalent (MMBOE)

in the quarter, up from 1.495 MMBOE in the year-ago quarter. Growth was primarily backed by new

production from major projects and development programs, partially offset by normal field decline and

downtime.

Average realized price for oil was $46.41 per barrel compared with $96.67 in the year-earlier quarter.

Natural gas liquids were sold at $15.54 per barrel, way below the year-ago level of $37.66 per barrel.

The price for natural gas was $3.87 per thousand cubic feet compared with $5.91 in 3Q14.

Reserve Replacement

At the end of 2014, the company had estimated proven reserves of 8.9 billion BOE, flat annually.

The company’s organic reserve replacement was 124% for 2014. Reserve additions were primarily

from its Canadian oil sands operations (Foster Creek, Narrows Lake, Surmont and across western

Canada), liquids-rich U.S. shales (Eagle Ford and Bakken), the Asia Pacific (LNG and oil) and Middle

East.

Guidance

For 2015, ConocoPhillips expects 3–4% production growth. For the 4Q15, production from continuing

operations is expected at 1,585–1,625 MBOED.

The company reduced 2015 capital expenditures guidance to $10.2 billion from the earlier guidance of

$11.5 billion. The company also reduced 2015 operating cost guidance to $8.2 billion from the earlier

guidance of $9.2 billion.

Outlook

In terms of scale, the firms believe that ConocoPhillips’ E&P will dominate its peers. It is also pursuing a

different strategy of shrinking its upstream business via asset sales, which defer growth. In North

America, it is focusing on its liquid plays in Canadian SAGD, the Eagle Ford, Bakken and Permian

basins instead of investing in its gas-prone acreage. ConocoPhillips is also poised to benefit from the

Christina Lake Phase E and Ekofisk South growth projects that have already started production, in

Zacks Investment Research

Page 6

www.zackspro.com

addition to several other in-line projects to draw first oil. The bullish firms expect the company to meet

its 3–5% production growth target as new projects come online.

However, some firms believe that though the company’s cash flow situation has improved, its near-term

prospects look bleak.

Margins [Note: only highlighted material has been changed]

Per the Zacks Digest model, adjusted net loss in 3Q15 was $1,056 million, which plunged 164% year

over year (y-o-y) and 543.6% sequentially. The company reported net loss of $466 million that

plummeted 129.1% y-o-y.

Provided below is a summary of margins as compiled by Zacks Digest:

Margins

3Q14A

2Q15A

3Q15A

4Q15E

2014A

2015E

2016E

2017E

EBITDA Margin

38.1%

31.3%

21.5%

22.3%

36.1%

26.5%

31.6%↑

30.5%↑

Net Margin

12.8%

-1.9%

-14.1%

-3.1%

10.5%

-3.7%

3.5%↑

8.3%

Exploration & Production (E&P)

The segment explores, produces, and markets crude oil, natural gas, and natural gas liquids. It also

mines deposits of oil sands in Canada to extract bitumen and upgrade it into a synthetic crude oil.

In 3Q15, the Digest average segment earnings in Alaska were $63 million compared with $473 in

3Q14. During the quarter, earnings from Europe were $3 million compared with $213 million in the

prior-year period. Earnings from the Asia Pacific and Middle East were $302 million as against $719

million in the year-ago period. The company reported loss of $463 million in the Lower 48 that

compared unfavorably with earnings of $182.9 million in 3Q14. ConocoPhillips reported loss of $118

million in Canada that compared unfavorably with earnings of $260 million in 3Q14.

Outlook

Some of the firms believe that major capital project start-ups at Surmount 2 and APLNG and further

ramp up of Foster Creek/Christina Lake should contribute substantially to margin expansion. It also

expects production growth of 1% in 2016 but production is expected to flatten by 2017 if capex is

restricted below $10 billion.

The Zacks Digest model forecasts a net loss of $886.1 million for 2015, while income of $1,553.0

million for 2016 and $4,856.5 million in 2017. It reflects a y-o-y decrease of 113.4% in 2015 while y-o-y

growth of 275.3% in 2016 and 212.7% in 2017, respectively.

Please refer to the Zacks Research Digest spreadsheet of COP for more details.

Zacks Investment Research

Page 7

www.zackspro.com

Earnings per Share [Note: only highlighted material has been changed]

The Zacks Digest average adjusted loss per share was $0.38 in 3Q15, down 129.1% from 3Q14 and

667.4% from 2Q15.

The Zacks Digest average shares outstanding in 3Q15 were 1,242.1 million compared with 1,247.3

million in 3Q14 and 1,241 in 2Q15.

Provided below is a summary of EPS as compiled by the Zacks Digest model:

EPS in US$

3Q14A

2Q15A

3Q15A

4Q15E

2014A

2015E

2016E

2017E

Digest High

$1.30

$0.07

($0.38)

($0.12)

$5.32

($0.61)

$1.78

$3.89

Digest Low

$1.29

$0.06

($0.38)

($0.23)

$5.30

($0.72)

$0.71↑

$3.89

Digest Average

Zacks Consensus

$1.29

$0.07

($0.38)

($0.18)

$5.31

($0.66)

$1.09

$3.89

Y-o-Y Growth

-12.0%

-95.9%

-129.1%

-129.5%

-6.7%

-112.4%

264.6%

258.0%↑

Q-o-Q Growth

-19.7%

137.1%

-667.4%

53.1%

Outlook

Most of the firms have lowered their earnings estimates for 2015 and 2016 due to low oil price and

lower-than-expected production stemming from lesser capital spending.

The Digest model forecasts loss of $0.66 per share in 2015 and EPS of $1.09 in 2016 and $3.89 in

2017, with a y-o-y decrease of 112.4% in 2015 and a y-o-y increase of 264.6% in 2016 and 258% in

2017, respectively.

2015 forecasts (three firms in total) range from -$0.61 to -$0.72; the average is -$0.66.

2016 forecasts (three firms in total) range from $0.71 to $1.78; the average is $1.09.

2017 forecasts (one firm in total) at $3.89.

The Zacks Digest model forecasts shares outstanding of 1,246.5 million for 2015, 1,245.5 million for

2016 and 1,248.6 million for 2017.

For 2015, the firms expect EPS to decrease following a decline in net income. However, in 2016 and

2017, the firms expect EPS to increase following an improvement in net income.

Please refer to the Zacks Research Digest spreadsheet of COP for further details on EPS estimates.

Zacks Investment Research

Page 8

www.zackspro.com

Analyst

Copy Editor

Content Ed.

Nilendu Saha

Lead Analyst

Nilendu Saha

QCA

Nilanjan Choudhury

No. of brokers reported/Total

brokers

Reason for Update

Flash

Zacks Investment Research

Page 9

www.zackspro.com