20 leverage as risk - Waikato Management School

advertisement

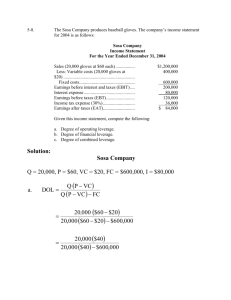

- . 20 LEVERAGE AS RISK Introduction Risk Recalled - Business Risk - Operating Risk - Financial Risk Structural Leverage - Operating Leverage - Financial Leverage - Combined Leverage Restructuring Summary Introduction With a good understanding of accounting - used for external reporting and for internal management - as well as finance - used for investing and financing decisions - the financial manager maintains control of the financial ‘strings’ of the company. The nature of a business is that the internal environment is controlled to provide, as far as possible, a good platform from which to deal with the external environment. The sales force is directed to maximise the level of sales, the production process is controlled to enable the proper quality product to be produced, the service department is controlled in order to provide good customer relations. In the interests of control, the financial manager must determine the financial movements of the firm in order for there to be appropriate levels of debt and equity. For example, sufficient monies must be available for seasonal working capital needs, investment decisions must recognise profitability. Organisational systems providing internal controls, external reports, investment analysis and financing information can lead one to believe that achieving a proper mix and appropriate control is possible. If this were true then there would be some ideal level of debt for the firm and there would also be some ideal level of fixed costs and variable costs. Control of these - . 412 Financial Management and Decision Making two financial aspects of the firm have a major impact on profitability. The goal of maximising shareholders’ wealth requires that these issues be considered when managing the finances of a company. Yet the achievement of a proper balance between financial and operating leverage can only take place following consideration of risk. Risk can take many forms. The external environment has changing needs, tastes, demands, regulations, interest rates and so forth. This chapter reviews risk as seen specifically from a financial point of view, and operating and financial leverage are discussed. The extent to which management can control these types of risk is also examined. Risk Recalled Risk has been formally defined as the measure of the variability of returns, calculated by the standard deviation of the returns. If a company’s earnings before interest and taxes (EBIT) never vary by more than 3% from one year to the next, it would be considered less risky by definition, than a company whose EBIT varied by as much as 25% from year to year. This definition of risk is, however, too restricted in scope and can be better seen as having three major components business risk, operating risk and financial risk. Business Risk This is often defined as the variability of EBIT. Given the strict definition of risk as the variability of returns, this is correct. However, the concept of business risk extends beyond the purely financial dimensions of the business. While EBIT measures the returns from company operations, those returns vary as a result of many external and internal elements. Some external causes that may affect EBIT include a shrinking (or increasing) market demand for the product, an increase (decrease) in the number and quality of the competitors, and changes in government regulation. Factors within the internal cost structure of the firm that will impact on EBIT include cost of goods sold, variable and direct labour, variable and direct overheads. In other words, the internal influences on EBIT are more within the control of the firm than external influences. Therefore, business risk is considered to be not solely the variability of EBIT, but also the risk of various influences within the firm’s internal cost structure as well as the changing elements in the particular business’external environment. Operating Risk This is part of the internal cost structure of the firm. The earlier discussion of Cost-Volume-Profit illustrated that any two firms in the same business, that is, operating in the same external environment, can have totally different levels of fixed costs. In order to break even, the fixed costs must be covered by a contribution margin. Two firms operating in the same external environment having different fixed costs will then have different EBITs for the same sales level. Generally, the firm with high fixed costs will require a higher sales level to breakeven - implying higher operating risk - than the firm with lower fixed costs. The relationship between fixed costs, variable costs and the sales price the market will permit, all directly affect the variability of EBIT for the firm. The financial - . Chapter 20: Leverage as Risk 413 manager must understand that the internal cost structure of the firm brings with it an associated level of operating risk that is only altered when the level of fixed costs or the sales price (which is often set by the market place) changes. Financial Risk Financial risk refers to the amount of the firm’s assets financed by debt as opposed to equity. Earlier discussion has shown that the return on shareholders’ funds (equity) is the same as the return on total assets when the firm is completely or 100% financed by equity. As the firm incurs some debt, the return on equity increases. However, having a significant amount of debt subjects the shareholder to the risk of having to pay all of EBIT out in interest expense. The return on equity (ROE) can be determined by multiplying the return on assets (ROA) by assets/equity, called the financial leverage multiplier (FLM). For example, two identical companies achieve identical returns on assets over time. If firm A has a high FLM while firm B has a low FLM, the resulting ROEs of firm A will be much more variable than the ROEs of firm B. Increased variability - or risk - of the ROE due to the financial structure of the firm is called financial risk. Structural Leverage When managing the risk profile of a company, business risk, operating risk and financial risk must all be considered. Control of business risk involves dealing with both the external environment and the internal cost structure. Operating risk is largely determined when a level of fixed costs is agreed upon. Financial risk can only be changed by adjusting the amounts of debt and equity being used in financing the firm’s assets. It becomes clear that the task of risk control must take a longer term view rather than shorter term since changes in external environmental factors, the cost structure, fixed costs and FLM, all happen slowly. Once established and understood, these factors which make up the risk profile of the company do not leave the financial manager with ready tools to change them, particularly in the short term. These elements of the firm’s risk profile therefore become part of the structural leverage of the firm. The causes and effects of operating and financial leverage are discussed below. Operating Leverage Operating leverage is the percentage change in EBIT as a result of a percentage change in sales volume. All of the assumptions of the cost- volume-profit relationships are made. Specifically, it is assumed that fixed costs remain constant within the relevant range of sales levels. Therefore, looking at a degree of operating leverage (DOL) we are assuming a base level of sales as a starting point. In this way we can relate relative amounts of leverage across different firms or in different branches or divisions. This measure of leverage can also be used to analyze various fixed cost levels for operations. - . 414 Financial Management and Decision Making Example Joe’s Super Widgits (JSW) present and predicted Income Statements are: Present Predicted (base level) Sales (at $4/unit) $400,000 $480,000 Variable Costs (at $2.50/unit) 250,000 300,000 Revenue before Fixed Costs 150,000 180,000 Fixed Costs 120,000 120,000 EBIT $ 30,000 $ 60,000 To determine JSW’s degree of operating leverage at the base sales level of $400,000 we need to calculate the percentage change in EBIT and divide that result by the percentage change in sales. This will measure how much EBIT changes (expressed as a percentage) in relation to sales changes (also expressed as a percentage). Percentage change in EBIT = = Percentage change in sales = = $60,000 - $30,000 $30,000 1 or 100% $480,000 - $400,000 $400,000 .2 or 20% Thus, the DOL at this base sales level is: 100% or 5 20% Knowing the DOL, it is possible to predict EBIT for any change in sales level from the base level. Example JSW’s sales actually drop by 10% in the coming period. The resulting drop in EBIT will be 5 x 10% or 50%. This is checked by calculating JSW’s Income Statement for the new sales level. Sales Variable costs Revenue before Fixed Costs Fixed Costs EBIT $360,000 225,000 135,000 120,000 $ 15,000 The $15,000 of EBIT is indeed 50% of the EBIT at the base level of sales. At the same time, a percentage change in sales times the DOL will yield the resulting percentage change in EBIT. - . Chapter 20: Leverage as Risk 415 This method of determining the DOL requires that two comparative financial statements be used, but there are two alternative formulae for DOL which do not. Each of these formulae is algebraically derived from the original. (i) DOL = Quantity x (Sales Price - Variable Cost) Quantity x (Sales Price - Variable Cost) - Fixed Cost For JSW, we can use this formula to find the DOL: DOL = 100,000 x ($4.00 - $2.50) 100,000 x ($4.00 - $2.50) - $120,000 = $150,000 or 5 $30,000 Alternatively, having only an Income Statement that separates fixed from variable costs, DOL can be calculated as: (ii) DOL = Revenue before Fixed Costs EBIT and for JSW this gives: DOL = $150,000 or 5 $30,000 When considering the acquisition of a large machine, a new building or any purchase which will alter the firm’s fixed costs, the implications of the resulting operating risk due to operating leverage must be considered. Financial Leverage Operating leverage relates a percentage change in sales to a percentage change in EBIT. On the other hand, financial leverage is the percentage change in earnings per share (EPS) as a result of a percentage change in EBIT. Financial leverage is therefore linked to a base level of EBIT. The degree of financial leverage (DFL) is: DFL = Example Percentage change in EPS Percentage change in EBIT JSW now wonders how much of the firm should be financed by debt. Assume JSW has $250,000 in total assets and a 45% tax rate. The base sales level of $400,000 resulting in EBIT of $30,000 is known. Three options can be considered. Option 1 Option 2 Option 3 - no debt, 2,500 shares - $50,000 debt at 10% interest, 2,000 shares - $125,000 debt at 10% interest, 1,250 shares In each of these cases a share is worth $100. - . 416 Financial Management and Decision Making Completing the Income Statements for JSW at the base level of sales and EBIT for each of these options gives: EBIT Interest expense Earnings Before Tax Tax at 45% Earnings After Tax Total shares Earnings per share Option 1 30,000 0 30,000 13,500 16,500 2,500 $6.60 Option 2 30,000 5,000 25,000 11,250 13,750 2,000 $6.875 Option 3 30,000 12,500 17,500 7,875 9,625 1,250 $7.70 Now completing the Income Statements for JSW at the proposed new sales level of $480,000 with an EBIT of $60,000 gives: EBIT Interest expense Earnings Before Tax Tax at 45% Earnings After Tax Total shares Earnings per share Option 1 60,000 0 60,000 27,000 33,000 2,500 $13.20 Option 2 60,000 5,000 55,000 24,750 30,250 2,000 $15.125 Option 3 60,000 12,500 47,500 21,375 26,125 1,250 $20.90 Using the EBIT of $30,000 as the base, the degree of financial leverage is: DFL $30,000 = % change in EPS % change in EBIT Option 1 DFL = (13.20 - 6.60)/6.60 (60,000 - 30,000)/30,000 = 100% or 1 100% Option 2 DFL = (15.125 - 6.875)/6.875 (60,000 - 30,000)/30,000 = 120% or 1.2 100% Option 3 DFL = (20.90 - 7.70)/7.70 (60,000 - 30,000)/30,000 = 171% or 1.71 100% If we can assume that there is a constant tax rate, then an algebraically equivalent formula for calculating the DFL is: DFL = EBIT EBIT - Interest Expense Checking this formula in the JSW example: Option 1 $30,000 $30,000 - 0 = 1 - . Chapter 20: Leverage as Risk Option 2 $30,000 $30,000 - $5,000 = 1.2 Option 3 $30,000 $30,000 - $12,500 = 1.71 417 We now know how much EPS will change, expressed as a percentage, for a given change in EBIT for each of the three financing plans. If option 2 is chosen, and if EBIT then drops by 40%, this would mean that EPS would drop by 48% (1.2 x 40%). Combined Leverage Operating leverage relates a percentage change in sales to a percentage change in EBIT. Financial leverage relates a percentage change in EBIT to a percentage change in EPS. Combined leverage then, is the percentage change in EPS that results from a percentage change in sales. % Change in Sales x DOL % Change in EBIT x DFL = % Change in EBIT = % Change in EPS Therefore: % Change in Sales x DCL = % Change in EPS where DCL = Degree of Combined Leverage. There are three ways to calculate the degree of combined leverage. (i) % change in EPS % change in Sales (ii) DCL = DOL x DFL (iii) DCL = Quantity x (Sales price - Variable Cost) Quantity x (Sales price - V.C.) - Fixed Cost - Interest Example DCL = If we assume that JSW chooses to use financing option 2, then what would be the percentage change in EPS if there was a 20% increase in sales? At the base sales level of $400,000, EPS in option 2 would be $6.875. At $480,000 in sales, EPS would be $15.125. Using the above three formulae to determine the DCL gives: (i) DCL = ($15.125 - $6.875)/$6.875 = 120% or 6 ($480,000 - $400,000)/$400,000 20% (ii) DCL = 5 x 1.2 or 6 (iii) DCL = 100,000 x ($4.00 - $2.50) 100,000 x ($4.00 - $2.50) - $120,000 - $5,000 = $150,000 or 6 $25,000 - . 418 Financial Management and Decision Making Knowing the DCL, a change in EPS can be projected given a particular change in sales. For example, JSW sales drop by 15% instead of rising by 20% resulting in an EPS fall of 90% (-15% x 6). The combination of fixed costs (operating leverage) and debt (financial leverage) serves to magnify the variability of returns or risk to the shareholders. If JSW selects option 3: DCL = 5 x 1.71 = 8.55 and a 15% drop in sales would then result in a drop in EPS of 128.25% (15 x 8.55). In other words, JSW shareholders would suffer a considerable loss. Restructuring The restructuring of operating leverage is often a byproduct of the capital budgeting investment decisions in the company. To reduce (increase) fixed costs the entire firm’s strategic marketing and future planning must be considered. The financial manager will surely be a participant in these decisions, but will seldom be able to unilaterally change the fixed cost structure. Swapping debt for equity, or equity for debt, also involves far-reaching business policy decisions. If the firm has large amounts of debt, the financial risk is high. Yet with a high debt level, the company is less likely to be taken over by unwanted investors. Turning debt into equity is often undertaken when the company management feels the share price is ‘high’. There is also a need to have contingent borrowing power for unforeseen investments. If debt levels are already at the sustainable risk levels, this contingent ability is lost. Thus, it is clear that the financial manager’s control of financial risk is limited by several other very important business policy issues and considerations. Summary Variability of corporate returns is highlighted by combining operating and financial leverage in a single measure. It is possible to determine the amount that EBIT will change for a given change in sales by calculating the degree of operating leverage (DOL). Having higher fixed costs will increase the DOL, and thus increase the operating leverage of the firm. The relationship between a change in EBIT and the resulting change in EPS can be calculated to give the degree of financial leverage (DFL). The amount of debt being used to carry the company’s assets causes financial leverage. Large amounts of debt increase the variability of EPS. It is possible to determine the amount of change that will occur in EPS with a given change in the level of sales by using the degree of combined leverage (DCL). The DCL is simply the DOL times the DFL and helps in understanding the causes of return variability. - . Chapter 20: Leverage as Risk 419 Returning to the question of controlling risk. Business risk has external and internal causes. It is often beyond the scope of management to control external factors causing variability in company earnings. Control of the internal effects on variability can be viewed as controlling fixed costs and interest expense. Yet once a company is established with a level of fixed costs and a level of debt, changing the resulting combined leverage is a long term and slow process. For example, if JSW decided to purchase a new super-duper widget making machine which increases fixed costs by $50,000 per year, the resulting increase in operating leverage can only be reduced by selling the machine or lowering other fixed costs. If the firm financed this new machine by increasing the amount of debt to total assets, then the resulting increase in financial leverage can only be reduced by reducing debt and increasing equity. The process of restructuring fixed and financial costs involves more than just financial decision making. The overall direction of the firm, its understanding of how it fits into the market place and where its future lies, will all be factors in deciding on the ‘proper’ levels of fixed costs, financial costs and ultimately, business risk. Glossary of Key Terms Business Risk The variability of earnings before interest and tax (EBIT). Combined Leverage The percentage change in earnings per share (EPS) that results from a percentage change in sales. Financial Leverage The percentage change in EPS as a result of a percentage change in EBIT. Financial Risk The variability in EPS under different capital structures for a given change in EBIT. Operating Leverage The percentage change in EBIT as a result of a percentage change in sales. Operating Risk The variability of EBIT under different fixed cost/variable cost combinations, for a given change in sales. Selected Reading Keown, A.J., Scott, D.F., Martin, J.D., and Petty, J.W., Basic Financial Management, Third Edition, Prentice-Hall, 1985. - . 420 Financial Management and Decision Making Questions 20.1 Compare and contrast business risk, operating risk, and financial risk. 20.2 Examine the financial statements of a publicly listed company to determine its structural financial leverage. What does this amount of leverage imply about its prospects for profitability? 20.3 Alison’s Shirt Manufacturing Company has the following present and predicted Income Statement: Sales (at $15/shirt) Variable costs (at $9/shirt) Revenue Before Fixed Costs Fixed Costs EBIT Interest Expense Profit Before Tax Present $630,000 378,000 252,000 200,000 52,000 45,000 $ 7,000 Predicted $787,500 472,500 315,000 200,000 115,000 45,000 $ 70,000 Required: a. Using three different formulae, calculate the degree of operating leverage at the sales level of $630,000 and show that all three approaches have the same result. b. Determine the degree of financial leverage. c. Determine the degree of combined leverage. d. Explain the significant increase in profits before tax in terms of the operating and financial structure of the company. e. What would be the EBIT and Profit Before Tax if sales dropped to $510,000? 20.4 Discuss the risks faced by Alison’s Shirt Manufacturing Company in Question 20.3. Can these risks be altered and under what circumstances? 20.5 In terms of both units and dollars, what is the breakeven level for Alison’s Shirt Manufacturing Company in Question 20.3? 20.6 Auckland Boat Builders Ltd has an average selling price of its boats of $600,000. The associated variable costs are $418,000 per unit. Fixed costs for the firm average $2,000,000 per year. - . Chapter 20: Leverage as Risk 421 Required: a. How many boats must be sold each year for the firm to break even? b. What is the degree of operating leverage for a production and sales level of 18 boats? c. What will be the resulting effect upon earnings before interest and tax if sales drop by 20% from the volume in (b) above? 20.7 If a firm has a degree of combined leverage of 4.0 and a degree of operating leverage of 1.6, what is the degree of financial leverage? 20.8 Johnny’s Appleseed Company has developed the following Income Statement. It represents the results of operations which ended yesterday: Sales Variable Costs Contribution Margin Fixed Costs Interest expense Profit Before Tax $(000s) 28,000 17,818 10,182 2,000 7,000 1,182 Required: a. What is the degree of operating leverage? b. What is the degree of financial leverage? c. What is the degree of combined leverage? d. What is the dollar amount of sales needed to break even? e. How much would profits increase if sales increased by 12%? 20.9 You are given the following information about the Anderson Company: Per unit selling price Per unit variable cost Fixed operating expenses Interest expense Tax rate $2.60 $1.85 $190,000 $18,000 nil Required: a. What is the level of sales required for EBIT to equal zero? b. What is the level of sales required for net income to equal zero? c. Compute the DOL, DFL and DCL at the following sales levels: 300,000 units, 400,000 units, 1,000,000 units. d. Discuss the changes you would make to the structure of the company if you had just signed a contract to sell 1,000,000 units? - . 422 Financial Management and Decision Making