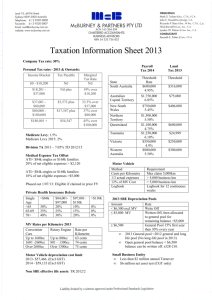

Taxation Information Sheet for 2013-2014

advertisement

CUSTOMER SERVICE CENTRE Call : 08 8300 0000 Email : customerservice@business-sa.com www.business-sa.com Taxation Information Sheet for 2013-2014 Business SA provides the following information as a guide only. This information represents taxation dates and amounts applicable in 2013-2014, as set by the Australian Taxation Office (ATO). For specific taxation advice, Business SA recommends that businesses consult a professional tax adviser, or for confirmation of any information contained within, contact the ATO. Company Tax Rate : 30% Medicare Levy : 1.5% Fringe Benefits Tax Resident Personal Tax Rates Income Bracket $0 - $18,200 Tax Payable Nil $18,201 - $37,000 Nil plus $37,001 - $80,000 $3,572 plus $80,001 - $180,000 $17,547 plus $180,001+ $54,547 plus Marginal Tax Rate Nil 19% of excess over $18,200 32.5% of excess over $37,000 37% of excess over $80,000 45% of excess over $180,000 Payroll Tax Thresholds and Rates as at 1 July 2013 South Australia Annual Thresholds $600,000 4.95% Australian Capital Territory $1,750,000 6.85% New South Wales $750,000 5.45% Northern Territory $1,500,000 5.50% Queensland $1,100,000 4.75% Tasmania $1,250,000 6.10% Victoria $550,000 4.90% Western Australia $750,000 5.50% State Rate Tax Rate 46.5% Interest Rate 6.45% Gross Up Factors 1.8692 - where no input-tax credits claimable on benefits 2.0647 - where input-tax credits claimable on benefits 1.8692 - for reportable fringe benefits and payroll tax calculations Car Parking Threshold $8.03 Record Keeping Exemption Threshold $7,779 Deemed Depreciation Rate - Cars 25% Reportable Fringe Benefits Threshold $2,000 (Taxable Value) Where FBT liability is greater than $3,000 Paid in quarterly instalments with BAS Balance due 21 May 2013 Where FBT liability is less than $3,000 Paid annually Due 21 May 2013 Motor Vehicles Depreciation Cost Limit $57,466 Luxury Car Tax Threshold $60,316 Fuel Efficient Car Limit $75,375 Luxury Car Tax Rate 33% Rates Per Kilometre Per Vehicle 2012-2013 Statutory Rate for Motor Vehicles (Kilometres Per Annum) Existing Contracts Maximum claim 5,000 kilometres per annum Conventional Cars (Engine Capacity) Rotary Driven Cars (Engine Capacity) Rate Per Kilometre New Contracts entered into after 10 May 2011 From 10 May 2011 From 1 April 2012 From 1 April 2013 Less than 15,000 26% 20% 20% 20% 15,000 - 24,999 20% 20% 20% 20% Up to 1600 cc Up to 800 cc 63 cents 1601 - 2600 cc 801 - 1300 cc 74 cents 25,000 - 40,000 11% 14% 17% 20% Over 2600 cc Over 1300 cc 75 cents More than 40,000 7% 10% 13% 17% Copyright and Disclaimer This information sheet has been prepared as information for the members of Business SA. This information sheet is covered by copyright and may not be reproduced, either wholly or partially, in any way or form or by any means without the written permission of Business SA. While every effort has been made to ensure that the information contained in this information sheet is free from error and/or omissions, no responsibility can be accepted by Business SA, its employees or any other person involved in the preparation of this information sheet for any claim which may arise from any person acting on information contained herein. CUSTOMER SERVICE CENTRE Call : 08 8300 0000 Email : customerservice@business-sa.com www.business-sa.com Superannuation Guarantee (SG) Levy Business Activity Statement (BAS) Due Dates Minimum rate Maximum salary base Age limit 9.25% $48,040 per quarter No Limit Quarter Ending Due Date for SG Contributions Document Due Dates Monthly BAS * 21st of the month following the period 30/09/2013 28/10/2013 Quarterly BAS # 28th October, February, April and July 31/12/2013 28/01/2014 31/03/2014 28/04/2014 PAYG Payment Summaries 14th July to recipients (payees) 14th August reconciliation to ATO 30/06/2014 28/07/2014 * Superannuation Contributions Concessional Limits from 1 July 2013 Aged 60 years or under in 2013-14 Aged 60 years or over in 2013-14 $25,000 $35,000 Employment Termination Payments (ETPs) Payment Type Bona Fide Redundancy $9,246 + $4,624 per year of completed service Balance Assessable Amount Maximum Tax Rate including Medicare Levy Nil As per ETPs Employment Termination Payments (Life) Pre-1/7/83 Component Post-30/6/83 Component * BAS remittance includes GST, PAYG withholding, PAYG instalment, FBT instalment, Fuel Tax credit. Nil # Tax Planning Opportunities Tax planning involves arranging affairs in order to comply with the income tax legislation at the lowest possible cost. The following list is by no means exhaustive but provides a number of items for consideration. - Prepayment of deductible expenditure. Payment of superannuation contributions by 30 June. Recognition of expense in the appropriate year. Bring forward planned deductible expenditure. Prepayment of interest. Write-off bad debts. Review valuation of stock. Review register of depreciable assets. Consider deductibility of bonuses and other accruals. Recognition of income in the appropriate year. Timing of capital gains and losses. The Small Business Tax Concessions 100% Under Preservation Age - $0 - $180,000 * - amount over $180,000 * 31.5% 46.5% Over Preservation Age - first $0 - $180,000 * - amount over $180,000 * 16.5% 46.5% Or $180,000 whole of income cap minus other taxable income. Small business taxpayers* may be able to access the following tax concessions. These may result in reduced compliance costs and/or concessional treatment for tax purposes. - Preservation Age Before 1 July 1960 55 1 July 1960 to 30 June 1961 56 1 July 1961 to 30 June 1962 57 1 July 1962 to 30 June 1963 58 1 July 1963 to 20 June 1964 59 1 July 1964 and later 60 Simplified trading stock rules. Immediate write-off of assets, costing greater than $6,500. Immediate deductions for certain prepaid business expenses. Capital Gains Tax - Preservation Age Date of Birth For businesses with turnover greater than $20 million or those registered for monthly remittance. Includes PAYG withholding where withholding deductions are less than $25,000 per annum. - * 15 year asset exemption 50% active asset reduction Retirement exemption Roll-over provisions Accelerated initial deduction for motor vehicles acquired in 2013-2014 and later years. Accounting for GST on a cash basis. Fringe Benefits Tax car parking exemption. Small business taxpayers are generally those with aggregated annual turnover of less than $2 million. Copyright and Disclaimer This information sheet has been prepared as information for the members of Business SA. This information sheet is covered by copyright and may not be reproduced, either wholly or partially, in any way or form or by any means without the written permission of Business SA. While every effort has been made to ensure that the information contained in this information sheet is free from error and/or omissions, no responsibility can be accepted by Business SA, its employees or any other person involved in the preparation of this information sheet for any claim which may arise from any person acting on information contained herein.

![[Insert DD Month YYYY] [Insert Client Name] [Insert Client Position](http://s3.studylib.net/store/data/008488936_1-121cf5059279ce132a8f8386cf17364b-300x300.png)