Fringe Benefits Tax (FBT)

advertisement

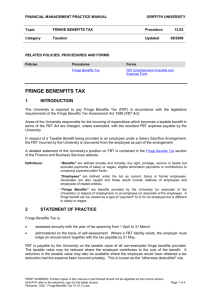

February 2015 Fringe Benefits Tax (FBT) Home The Fringe Benefits Tax (FBT) year ends the 31st March and now is the time to ensure that you are on top of your FBT obligations. FBT is payable by any business that provides benefits other than cash salary or wages to employees or their associates, and includes company directors. Benefits can be provided directly by an employer, an employer’s associate, or a third party by arrangement with an employer. Our Firm How does it work? Our Services Knowledge Bank FBT is separate from income tax and is based on the taxable value of the various fringe benefits provided. Careers FBT categories Contact Us The following categories of fringe benefits apply, with specific valuation properties applicable to each category: Car fringe benefits Car parking fringe benefits Entertainment fringe benefits Expense payment fringe benefits Loan fringe benefits Debt waiver fringe benefits Housing fringe benefits Board fringe benefits Airline transport fringe benefits Living-away-from-home allowance fringe benefits Property fringe benefits Residual fringe benefits Calculating your FBT liability Armidale ph: 6773 8400 Coonabarabran ph: 6842 0000 Gunnedah ph: 6743 0800 Narrabri ph: 6743 0800 Tamworth ph: 6763 0100 The taxable value of benefits provided is calculated on the GST-inclusive cost to the employer, less any employee contributions made. The taxable value is then grossed up according to whether the employer is eligible to an input tax credit when the fringe benefit is acquired (using a gross-up rate of either 2.0802 if entitled to input tax credits or 1.8868 if not entitled). FBT then applies at the top marginal rate of tax, which is currently 47%. A deduction is generally available for the value of benefits provided, and for any FBT liability paid during the financial year. Reducing FBT There are several ways to reduce FBT liabilities. Examples include replacing fringe benefits with a cash salary, providing benefits that your employees would otherwise be entitled to claim as an income tax deduction if they had paid for the benefits themselves, or providing benefits that are exempt from FBT. Another common method of reducing FBT obligations is through employee contributions. February 2015 Payment summary disclosure Where the taxable value of benefits provided to an employee exceeds a total of $2,000 in any FBT year, the grossed-up value must be disclosed on the employee’s payment summary. Regardless of the particular circumstances the lower 1.8868 rate is to be used when calculating the reportable amount. Home Our Firm Our Services Knowledge Bank Careers Contact Us Salary packaging opportunities Not all benefits provided by employers to their employees are taxable. There are several ‘exempt’ benefits that may allow salary packaging opportunities. Examples of exempt benefits include: Car benefits where the vehicle is either a taxi, panel van or utility and an employee’s private use is limited to travel between home and work, incidental travel during the course of performing work, and minor, infrequent and irregular non-work related travel. Purchases of certain work-related items primarily for an employee’s use in the workplace, including portable electronic devices (mobile phones, laptops, tablets etc). However, the exemption is subject to a limit of one item of each type per employee, per year. In-house benefits up to $1,000 per year (e.g. child care facilities). Housing benefits provided in remote areas (subject to a number of conditions). Relocation expenses arising from employees moving as a result of taking on a new job. Minor and infrequent benefits that might be regarded as a ‘perk’ (e.g. staff awards). There is also a small window of opportunity for high income earners to avoid the budget repair levy which applies during the 2015, 2016 and 2017 financial years, where an individual’s taxable income exceeds $180,000. The FBT rate is affected by the 2% levy, however it does not apply until the 1st April 2015. Therefore, high income earners can effectively avoid the levy by salary packaging fully taxable fringe benefits before the 31st March 2015. Further information Armidale ph: 6773 8400 Coonabarabran ph: 6842 0000 The 2015 FBT returns are due for lodgement on the 21st May 2015. Please ensure that all relevant documentation, including log books, are up to date by the 31st March 2015. For more information or assistance in regards to your fringe benefits tax obligations, please contact your local Forsyths office. The Forsyths Team Gunnedah ph: 6743 0800 Narrabri ph: 6743 0800 Tamworth ph: 6763 0100 This document has been prepared for general information only and is not intended as personal advice. Any statements of law or proposals are based on Forsyths' interpretation as at the date of issue. Accounting & business services are provided by Forsyths Business Services Pty Ltd ABN 66 182 781 401, liability is limited under a scheme approved under Professional Standards Legislation. Financial advice provided by Forsyths Financial Services Pty Ltd, ABN 89 103 898 988 AFSL no. 259938 does not take into account your individual financial objectives, financial situation or needs. You should consider these before making a financial decision. We recommend you consult a licensed financial adviser who will assist you. You should also obtain a copy of and consider the product disclosure statement for any financial product mentioned before making any decision to acquire that product.