Plan sponsor update with Chris McIsaac

Chris McIsaac: Hello, and welcome to Vanguard’s plan sponsor update. I’m Chris McIsaac.

But in the next few minutes, I’ll touch on some of the major changes in store for 2014. Let

me start by taking you on a quick tour of our two new buildings that will help us serve you

even better in the years ahead.

Why did we move into this new space? A couple of reasons. First, it will allow for better

collaboration among the client teams that serve you. Second, we’re building a Client Center.

This will be an interactive space where you and your Vanguard team can meet to discuss

strategies to strengthen your plan. We hope you come visit us soon and see it for yourself.

And throughout 2014 our significant investment to the Plan Sponsor Bridge will empower

you with the data, insight, and tools you need to manage your plans. The new Bridge will

put essential resources at your fingertips.

Your participants also have a lot to look forward to in the coming year. For one, we’ve

entered into a new partnership with HelloWallet. For adopting sponsors, this web and

mobile application gives your participants personalized guidance on spending, saving,

debt, and benefit decisions. For you, HelloWallet can enable you to measure and improve

compensation and benefit-program outcomes.

For the growing number of employees approaching and in retirement, two new services can

help them translate their balance into a retirement income stream. Vanguard’s retirement

income modeler helps participants analyze their finances from a variety of perspectives so

that they can determine a prudent withdrawal strategy. Later this year we’ll enhance this

capability into a free, ongoing installment service for retirees so they can set up systematic

withdrawals from the plan.

The second service is called Income+. It can help retired participants with their investment

and withdrawal strategies so that they can enjoy a steady stream of income in their

retirement.

You’ll also continue to see upgrades in our web and mobile capabilities. Vanguard offered

mobile app transactions before any other retirement provider. And now, according to our

research, monthly app visits are tripling each year—and they increased by nearly 150%

over the past six months.

Amid all the innovations for you and your participants, our funds continued to serve you well.

In 2013, you helped make us the number-one provider of target-date funds.

(continued on next page)

Meet the contributor

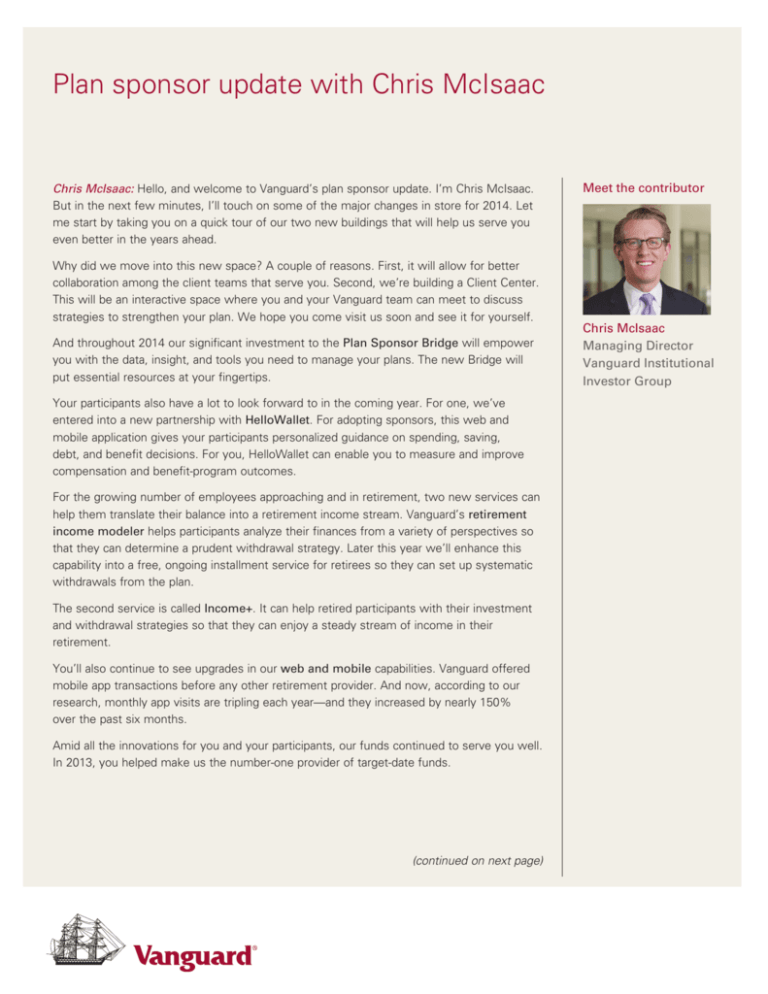

Chris McIsaac

Managing Director

Vanguard Institutional

Investor Group

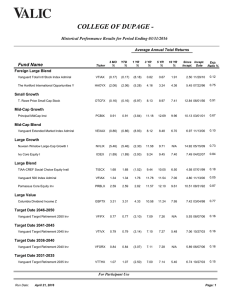

Vanguard Target Retirement Funds continue to grow at a rate that outpaces the industry.

More than 40% of last year’s target-date industry cash flow went into our Target Retirement

Funds. (Sources: 2013 Morningstar, Pension & Investments, Cerulli, T.Rowe Price, and

JP Morgan SEC filings; Vanguard analysis.)

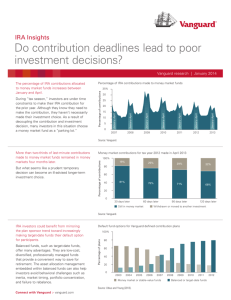

Now, how did these funds benefit your plan and your participants? Our research shows that

participants using Vanguard’s low-cost Target Retirement Funds have more balanced portfolios,

more age-appropriate allocations, and less investing at the extremes than do-it-yourself

investors. (Source: Vanguard, How America Saves 2013.)

And as valued partners, you also play a lead role in some major milestones and client

recognition we’ve received: 2013 saw $138 billion in net cash flow ....our second-best year

ever. Our defined contribution business alone took in a record $22 billion last year, helped

by the 1,200 new plan-sponsor clients who came on board.

Together we’ll find some terrific opportunities in the year ahead to make your retirement

plan even stronger. On behalf of everyone here at Vanguard, we appreciate your ongoing

commitment and partnership. And we thank you very much for watching this update.

Important information

For more information about Vanguard funds, visit institutional.vanguard.com or call 800-523-1036

to obtain a prospectus. Investment objectives, risks, charges, expenses, and other important

information about a fund are contained in the prospectus; read and consider it carefully before

investing.

Investments in Target Retirement Funds are subject to the risks of their underlying funds. The year in the

fund name refers to the approximate year (the target date) when an investor in the fund would retire and

leave the workforce. The fund will gradually shift its emphasis from more aggressive investments to more

conservative ones based on its target date. An investment in a Target Retirement Fund is not guaranteed

at any time, including on or after the target date.

Institutional Investor Group

P.O. Box 2900

Valley Forge, PA 19482-2900

All investing is subject to risk, including the possible loss of the money you invest.

Apple, the Apple logo, iPad, and iPhone are trademarks of Apple Inc., registered in the U.S. and other

countries. App Store is a service mark of Apple Inc.

Android is a trademark of Google Inc.

© 2014 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

Financial Engines is a trademark of Financial Engines, Inc.

CMPLVTR_042014