Section 5

advertisement

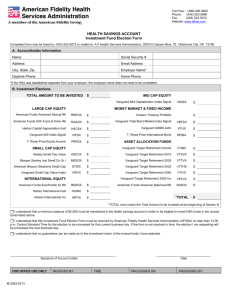

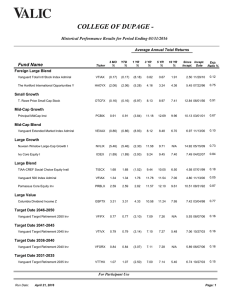

Male Investors vs. Female Investors Studies show men and women could learn from the other’s approach ILLUSTRATION: JOHN KUCZALA FOR THE WALL STREET JOURNAL By GEORGETTE JASEN May 3, 2015 11:16 p.m. ET When it comes to investing, men sometimes have their ways of doing things, and women have different ways. And each could learn from the other. Broad generalizations, of course, are inherently risky. And nobody would suggest that gender drives investment success. Nonetheless, financial institutions and academics who have studied the respective investing habits of men and women do agree: Men are generally more confident about investing, while women are more goal-directed and trade less. 1 The point of such studies isn’t to crown one sex or the other as the savvier investor, but to better understand where the strengths of each lie. “We should focus on the behaviors that empower individuals to do what’s in their best interest,” says Michael Liersch, head of behavioral finance at Bank of America Corp.’s Merrill Lynch Wealth Management unit and author of a report on women and investing. Data from various studies point to clear differences not only in the investing habits of men and women but in their retirement planning as well. Women, for instance, are more likely than men to choose the target-date funds offered in employer-sponsored retirement accounts. Men tend to invest more in other options on the menu, including stock funds. Their overall stock exposure is about the same, on average, 74% for men and 73% for women in 2014, according to data from mutual-fund firm Vanguard Group. But target-date funds gradually reduce stockholdings as retirement approaches, something financial advisers generally recommend. 2 ENLARGE Men also tend to trade more, which can be a disadvantage. In 2014, according to Vanguard, 11% of men made an exchange among mutual funds in their accounts, compared with 7% of women. By trading less often, women are less likely to trade at the wrong time, explains Jean Young, senior research analyst at Vanguard. Different horizons The studies show that women might have a lot to teach in other areas, as well. They are more likely than men to participate in employer-sponsored retirement plans (73% at the end of last year, compared with 66% for men in Vanguard plans) and save a greater percentage of income (7% compared with 6.8% for men, according to the Vanguard data). “Women have a longer time horizon, they have a goal in mind and they are more willing to seek professional advice,” says Rosanne Rogé, a financial planner in Bohemia, N.Y., whose clients 3 include men and women. “It’s the men who ask to keep some money on the side to manage on their own; they want to shoot the lights out.” (Investing skills aside, women do often end up with a smaller nest egg at the end of their working lives, but for a simple reason: They earn less in their jobs. “It ends up being a wage story,” Ms. Young says. “Men save more because they earn more.”) Despite the conventional wisdom that aversion to risk—and stocks—hinders what women can earn on their investments, studies show that their returns are similar to those of men over time. Vanguard, record-keeper for more than 5,000 defined-contribution retirement plans, found that women earned an average annual total return of 9.7% for the five years through 2014, compared with 10.1% for men. ILLUSTRATION: JOHN KUCZALA FOR THE WALL STREET JOURNAL Confidence game And here is the paradox: Since women are so strong in their belief about the value of saving, why is there also evidence that they don’t seem to trust themselves in the same way when it comes to investing? Financial experts say this is a main difference between men and women when it comes to financial matters. The Merrill report from Mr. Liersch, based on data from 11,500 investment personality assessments completed by Merrill clients, found that 55% of the women questioned agreed or strongly agreed with the statement, “I know less than the average investor about financial markets and investing in general,” compared with just 27% of the men. Reluctance to invest more aggressively is especially evident when women have money to invest outside of an employer-sponsored retirement plan, says Kristen Robinson, a senior vice president at mutual-fund company Fidelity Investments. “They put it into a savings account,” she says. 4 In a 2013 study of couples in a committed relationship, Fidelity found that women tend to have a much lower risk tolerance than men—only 4% of women were willing to invest a substantial amount to achieve potentially higher returns, even if it meant possibly losing some or all of an initial investment, compared with 15% of men. Other studies of men’s and women’s investment behaviors reach similar conclusions. A survey by BlackRock Inc. found that women have a greater portion of their portfolios in cash and that few are willing to increase risk to seek higher returns. Merrill research found that more than half the women questioned feared losing principal, and more than a third expressed concern about not having access to cash when they need it. Yet women are more likely to seek professional advice, which can be an advantage. “They want to make sure they understand the purpose of a strategy and how it will help them reach their goals,” Mr. Liersch says. “These are questions every investor should be asking.” Who’s the ‘do-it-yourselfer’? When Fidelity analyzed data from 13 million participants in corporate retirement plans, it found that 42% of women used professionally managed accounts, compared with 36% of men—the other 64% of men were designated “do-it-yourselfers.” Other Fidelity research shows that 92% of women want to learn more about financial planning and 83% want to get more involved with their finances within the next year. By learning from each other’s best habits, investors of both sexes could benefit. “You can be overconfident, you can be underconfident,” says Mr. Liersch. “Regardless of how you feel, a dialogue can get you to a better place.” Ms. Jasen is a writer in New York. She can be reached atreports@wsj.com. 5