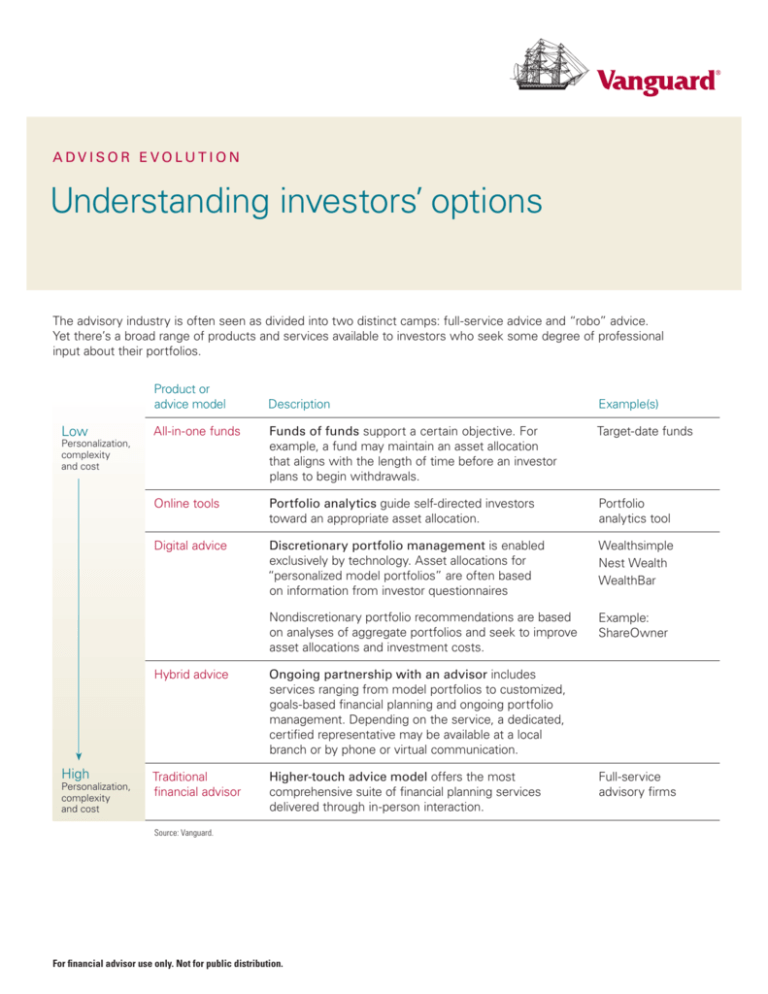

ADVISOR EVOLUTION

Understanding investors’ options

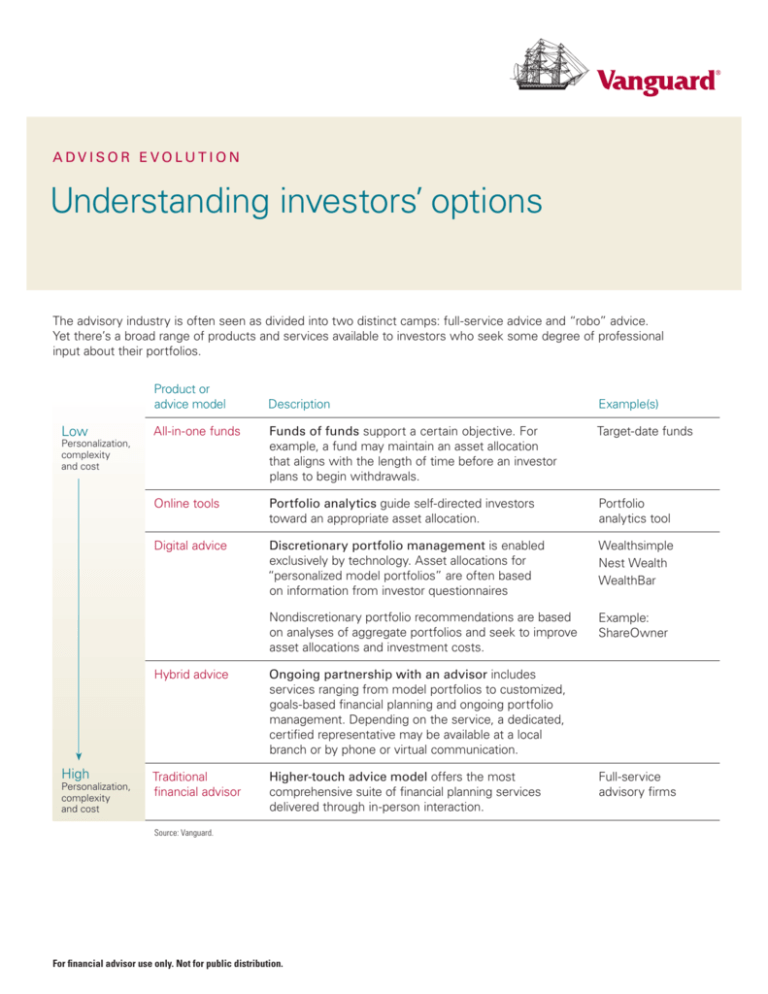

The advisory industry is often seen as divided into two distinct camps: full-service advice and “robo” advice.

Yet there’s a broad range of products and services available to investors who seek some degree of professional

input about their portfolios.

Product or

advice model

Low

Personalization,

complexity

and cost

High

Personalization,

complexity

and cost

Description

Example(s)

All-in-one funds

Funds of funds support a certain objective. For

example, a fund may maintain an asset allocation

that aligns with the length of time before an investor

plans to begin withdrawals.

Target-date funds

Online tools

Portfolio analytics guide self-directed investors

toward an appropriate asset allocation.

Portfolio

analytics tool

Digital advice

Discretionary portfolio management is enabled

exclusively by technology. Asset allocations for

“personalized model portfolios” are often based

on information from investor questionnaires

Wealthsimple

Nest Wealth

WealthBar

Nondiscretionary portfolio recommendations are based

on analyses of aggregate portfolios and seek to improve

asset allocations and investment costs.

Example:

ShareOwner

Hybrid advice

Ongoing partnership with an advisor includes

services ranging from model portfolios to customized,

goals-based financial planning and ongoing portfolio

management. Depending on the service, a dedicated,

certified representative may be available at a local

branch or by phone or virtual communication.

Traditional

financial advisor

Higher-touch advice model offers the most

comprehensive suite of financial planning services

delivered through in-person interaction.

Source: Vanguard.

For financial advisor use only. Not for public distribution.

Full-service

advisory firms

Differentiate from digital advice:

Personalized service, strong client relationships

High

High

Comprehensive

planning and

wealth

management

Additional

planning:

Estate, tax,

insurance

Immunity

to digital

advice

Personalization

and depth of

relationship

Primarily

investment

management

Investment

management

only

Low

Commodity

Pricing

Premium

Low

Source: Vanguard.

Connect with Vanguard ® > vanguardcanada.ca > 888-293-6728

Vanguard Investments Canada Inc.

This material is for informational purposes only. This material is not intended to be relied upon as research,

investment, or tax advice and is not an implied or express recommendation, offer or solicitation to buy or sell

any security or to adopt any particular investment or portfolio strategy. Any views and opinions expressed do

not take into account the particular investment objectives, needs, restrictions and circumstances of a specific

investor and, thus, should not be used as the basis of any specific investment recommendation. Please consult

your financial and/or tax advisor for financial and/or tax information applicable to your specific situation.

Information, figures and charts are summarized for illustrative purposes only and are subject to change

without notice.

For financial advisor use only. Not for public distribution.

155 Wellington Street West

Suite 3720

Toronto, ON M5V 3H1

© 2015 Vanguard Investments Canada Inc.

All rights reserved.

FAEVOSA 112015