IRA Insights

Do contribution deadlines lead to poor

investment decisions?

IRA insights

35%

30

25

January–April

0

January–April

5

January–April

10

January–April

15

January–April

20

January–April

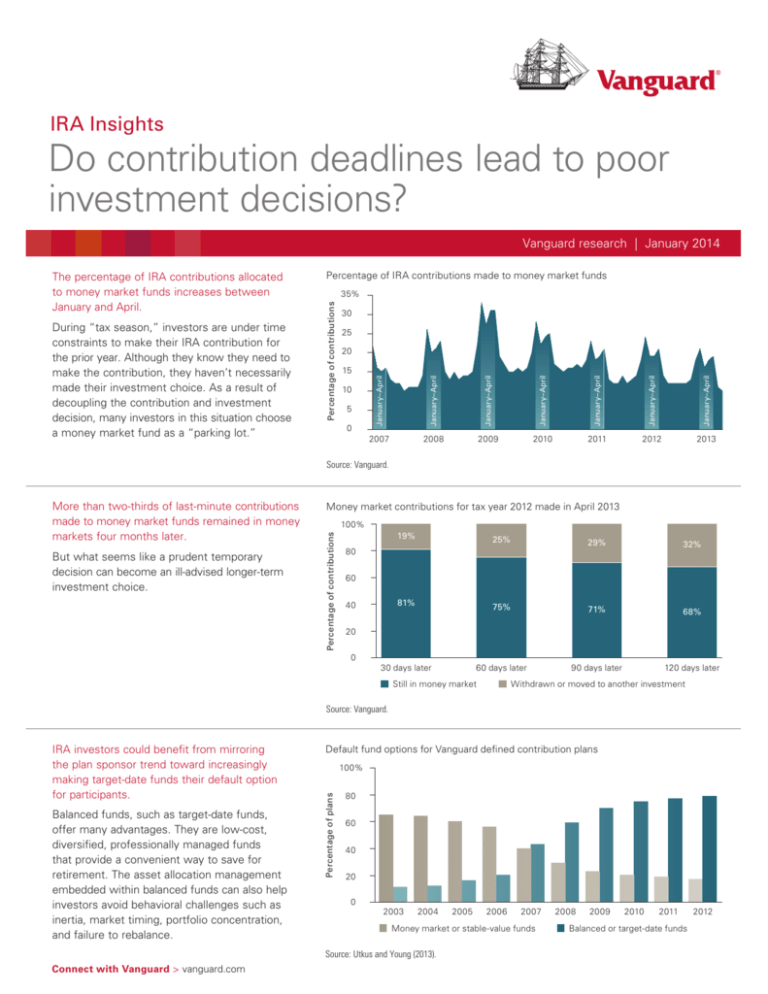

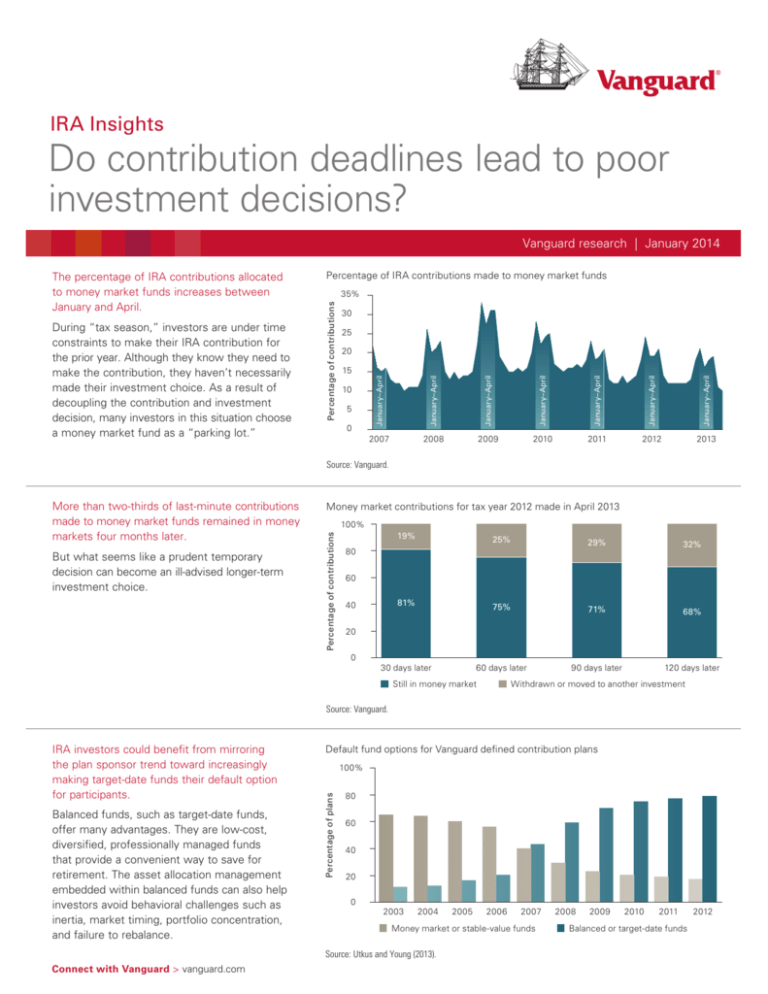

During “tax season,” investors are under time

constraints to make their IRA contribution for

the prior year. Although they know they need to

make the contribution, they haven’t necessarily

made their investment choice. As a result of

decoupling the contribution and investment

decision, many investors in this situation choose

a money market fund as a “parking lot.”

Percentage of IRA contributions made to money market funds

January–April

The percentage of IRA contributions allocated

to money market funds increases between

January and April.

Vanguard research | January 2014

Percentage of contributions

2007

2008

2009

2010

2011

2012

2013

Source: Vanguard.

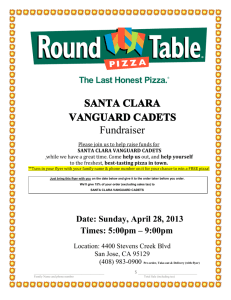

But what seems like a prudent temporary

decision can become an ill-advised longer-term

investment choice.

Money market contributions for tax year 2012 made in April 2013

100%

Percentage of contributions

More than two-thirds of last-minute contributions

made to money market funds remained in money

markets four months later.

19%

25%

29%

32%

81%

75%

71%

68%

30 days later

60 days later

90 days later

120 days later

80

60

40

20

0

Still in money market

Withdrawn or moved to another investment

Source: Vanguard.

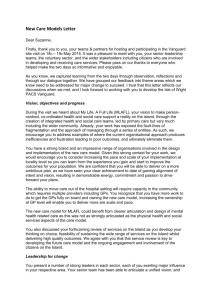

Balanced funds, such as target-date funds,

offer many advantages. They are low-cost,

diversified, professionally managed funds

that provide a convenient way to save for

retirement. The asset allocation management

embedded within balanced funds can also help

investors avoid behavioral challenges such as

inertia, market timing, portfolio concentration,

and failure to rebalance.

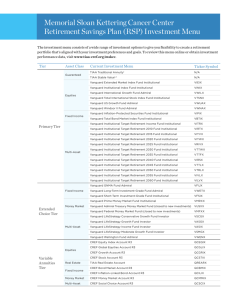

Default fund options for Vanguard defined contribution plans

100%

Percentage of plans

IRA investors could benefit from mirroring

the plan sponsor trend toward increasingly

making target-date funds their default option

for participants.

80

60

40

20

0

2003

2004

Source: Utkus and Young (2013).

Connect with Vanguard >

vanguard.com

2005

2006

2007

Money market or stable-value funds

2008

2009

2010

2011

Balanced or target-date funds

2012

Reference

Utkus, Stephen P., and Jean A. Young, 2013. How America

Saves 2013: A Report on Vanguard 2012 Defined Contribution

Plan Data. Valley Forge, Pa.: The Vanguard Group.

Connect with Vanguard® > vanguard.com > research@vanguard.com

Vanguard research authors

Stephen M. Weber, CFP ®

Maria A. Bruno, CFP ®

The authors would like to acknowledge John Rykaczewski in Vanguard’s Client Insight group

for providing the IRA contribution data used in this analysis.

Investments in Target Retirement Funds are subject to the risks of their underlying funds.

The year in the Fund name refers to the approximate year (the target date) when an

investor in the Fund would retire and leave the work force. The Fund will gradually shift

its emphasis from more aggressive investments to more conservative ones based on its

target date. An investment in the Target Retirement Fund is not guaranteed at any time,

including on or after the target date.

An investment in a money market fund is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other government agency. Although a money market fund seeks

to preserve the value of your investment at $1 per share, it is possible to lose money by

investing in such a fund.

Vanguard Research

For more information about Vanguard funds, visit vanguard.com, or call 800-662-2739,

to obtain a prospectus. Investment objectives, risks, charges, expenses, and other

important information about a fund are contained in the prospectus; read and consider

it carefully before investing.

© 2014 The Vanguard Group, Inc.

All rights reserved. Vanguard

Marketing Corporation, Distributor.

P.O. Box 2600

Valley Forge, PA 19482-2600

ISGIRA1 012014