Mutual Funds May 2013

advertisement

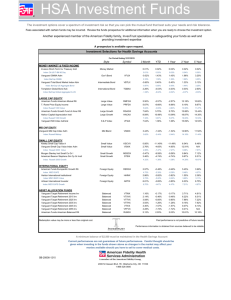

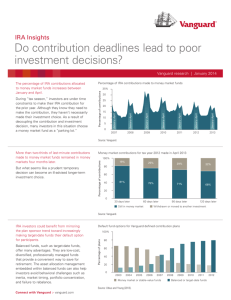

Financial Planning for Women, May 2013 Dr. Jean Lown, FCHD Dept., USU Advanced Family Finance Students: Erica Abbott Chelsie Jenkins • You can invest with small $ amounts • Even small $ grow to BIG $$$ with time • It’s easy to get started • Delaying is CO$TLY! • Your financial security is in your hands◦ Shift to “retirement self-reliance” (CFP Elizabeth Jetton) 2 • Today is the first day of the rest of your life • Regret has no place in planning for the future! 3 Investing in an IRA is the first step to turning your retirement dreams into reality! • Tax-advantaged investing ◦ Account growth is not taxed while it is growing ◦ When withdrawn $ may or may not be taxed depending on whether it is a Traditional or Roth • Must have earned income (or spouse with earned income) ◦ Contribute up to $5,500/year ◦ + extra $1,000 for age 50+ 5 • Contributions are not deductible • $ grows tax-free • $ not taxed when withdrawn in retirement ◦ after age 59 ½ • Traditional IRA offers upfront tax deduction but Roth is better option 6 • Higher risk (volatility) = higher potential returns • Historic average annual rates of return ◦ Stocks: 8-9% (but can be VERY volatile) ◦ Bonds: 4-5% ◦ Cash equivalents: 3% • Inflation averages 3.1%/year ◦ So cash gets you nowhere after taxes ◦ CDs are no way to invest for long term goals 7 • For much more detail on IRAs: FPW website: www.usu.edu/fpw click on: “past presentations” ◦ IRAs March 2006 ◦ IRAs convert to Roth Nov. 2009 8 • A company pools money from many investors to buy a variety of securities (stocks, bonds, etc.) ◦ Each investor owns a pro-rata share of diverse portfolio ◦ Easy to match your investment objective ◦ Easy to purchase/sell shares • Professional management 9 What is your favorite cookie? Chocolate chip? ◦ Stocks Peanut butter? ◦ Bonds Oatmeal raisin? ◦ Stocks & bonds Other flavors… 10 11 • Diversification ◦ Across asset classes (stocks, bonds, cash) ◦ Within asset classes (US & international securities; small, medium & large companies) • Never know which asset category will perform best in future • Callan Table: http://www.callan.com/research/download/?file=periodi c%2ffree%2f548.pdf 12 • ALL funds charge management fees (expense ratios) ◦ % of fund assets (~.10% - 2.0%) ◦ Subtracted from fund assets before gains are distributed to investors • Compare Expense Ratios (%) ◦ Lower is better! 13 • Load funds charge commissions ◦ ~5% of every dollar you invest, every time you invest • Financial salespersons sell load funds • No-load (no commission) funds ◦ Sold directly to investor (avoid middleman) web sites 800 phone number mail 14 Index Simply follows selected index (i.e., S&P 500, DJIA) Buy & hold Low management fees Low turnover Actively Managed Higher management fees Higher turnover = higher trading costs Heavily advertised for beating its index… in a selected year 15 • No guaranteed rate of return • Returns follow market ups & downs 16 • “Past performance is no guarantee of future returns.” • Very difficult to beat “the market” in any 1 year & even harder to do consistently • The only thing you know about the future is the expense ratio. 17 • Most funds require a minimum opening deposit of $1,000-$3,000 • Lower subsequent investments once in the door 18 • Funds charge investors fees & expenses • A high cost fund must outperform a low-cost fund to generate the same returns • Even small differences in fees can translate into large differences in returns • FINRA Fund Analyzer ◦ http://apps.finra.org/fundanalyzer/1/fa.aspx 19 • • • • • • • Invest $10,000 8% annual return before expenses annual fund expenses of 1.5% after 20 years: $ But if fund expenses = 0.5% then you would have $ 18% more $! 20 21 • Index fund • Target retirement date fund • Diversified “Fund of Funds” • Buy and hold all the securities (or representative sample) that comprise the chosen index • Follow ups and downs of selected index ◦ Can be very volatile • Very low expense ratios due to low management costs • Common indexes: ◦ S&P 500 ◦ Dow Jones Wilshire Total US stock index ◦ Various international stock or bond indexes • Objective – Track the Dow Jones US Total Stock Market index ◦ Very diversified among US companies ◦ Expect high volatility! • $100 Initial investment /$1 subsequent • 0.09% expense ratio (ultra low!) • http://www.schwab.com/public/schwab_oldpublicsite/research_strateg ies/mutual_funds/summary/schwab/at_a_glance.html?&ticker_sym_nm =SWTSX&schwabplan1=&type= 24 Vanguard Target Retirement 2045 Fund VTIVX By Chelsie Jenkins • Diversified portfolio of stocks, bonds & cash • “Fund of funds” ◦ Composed of multiple funds from same ‘family’ • Target date: year investor plans to retire ◦ 5 year increments: 2025, 2030, 2035, etc. • Assets are automatically re-allocated • Allocation gradually changes from aggressive to conservative as retirement nears 27 Income Fund Mid-Cap Fund Bond Fund Growth Fund Large Cap Fund 500 Index Fund 29 • Diversified among 3+ index MFs: ◦ ◦ ◦ ◦ US stocks: total stock market index fund International stocks: total international stock Bonds: total bond market index fund Additional funds as retirement nears • $1,000 minimum initial; $100 subsequent* • 0.18% expense ratio • https://personal.vanguard.com/us/funds/vanguard/TargetRetirementList automatic investments: waives $20 annual fee <$10,000 & min. subsequent investment 30 • Vanguard Total Stock Market Index • Vanguard Total International Stock Index • Vanguard Total Bond Market II Index • Expense ratio is 0.18% • $20 annual account service fee if balance is less than $10,000 ◦ Fee waived with automatic monthly deposit • $1,000 minimum initial deposit • $100 minimum subsequent ◦ BUT… no minimum subsequent amount with automatic plan • Based on sound investment principles ◦ Asset allocation ◦ Diversification ◦ Automatic rebalancing ◦ Become more conservative as retirement nears • Little account maintenance required ◦ Set up automatic deposits 35 • 4 min. video • https://personal.vanguard.com/us/funds/vanguard/Ta rgetRetirementList 36 • • • • • • Fund of Funds: 11 actively managed funds Broad diversification Stable asset allocation: 60% stocks/ 40% bonds $1,000 minimum initial; $100 subsequent 0.34% expense ratio https://personal.vanguard.com/us/funds/snapshot?FundId= 0056&FundIntExt=INT 37 • If you can afford $1,000 & like TDR fund: ◦ Vanguard Target Retirement Fund • To start with low minimum ($100): ◦ Schwab Total Stock Market Index Fund • For broadest diversification: ◦ Vanguard Star • See previous May FPW presentations for more fund recommendations: http://www.usu.edu/fpw/schedule/powerpoints.htm 38 • Consider a Mother’s Day Gift ◦ Give mom an IRA for Mother’s Day! Lasts longer than flowers Less fattening than chocolate ◦ If mom is not earning but Dad is, she is eligible for a spousal IRA 39 • Starting at age 27 Laura invested $5,000/yr. @ 8% for only 10 years • Starting at age 37 Jane invested $5,000/yr. @ 8% for 20 years • Age 67: ◦ Laura has $778,000 (invested $50,000) ◦ Jane has $494,000 (invested $100,000) ◦ Difference = $234,000! 40 • June 13: Preparing to buy your first home ◦ Preliminary steps to get your finances in order • July 11: 529 college savings • August: on vacation • Sept. 11: Social Security- when to claim ◦ Financial planner Suzanne Dalebout 41 • Blog replace the newsletter ◦ http://fpwusu.blogspot.com/ • Facebook: https://www.facebook.com/FinancialPlanningforWomen ?fref=ts 42