Introduction to Working Capital

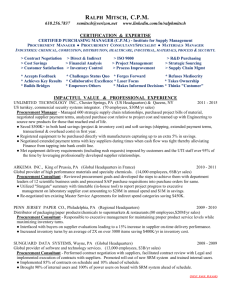

advertisement

CAVENDI MANAGEMENT INSIGHT INTRODUCTION TO WORKING CAPITAL This paper is an introduction to working capital management and aims at providing the reader with a detailed guide to effective management of working capital. Throughout this paper Cavendi takes a holistic approach to working capital management and emphasizes the importance of a strong cash-oriented culture. This paper also shares Cavendi’s insights to common pitfalls and mistakes as well as offering the reader some hands-on advice and techniques in managing working capital. Table Of Contents INTRODUCTION TO WORKING CAPITAL 5 WHY DO COMPANIES NEED TO MANAGE WORKING CAPITAL? 6 COMPONENTS OF WORKING CAPITAL 8 Revenue management – “A sale is a gift until it’s paid” 9 Expenditure management – “A supplier invoice is not a burden until it is overdue” 11 Supply Chain Management – “Inventory is a cost until delivery” 13 Culture management – “Culture eats strategy for breakfast” 16 CONCLUSION17 ABOUT THE AUTHORS 4 18 INTRODUCTION TO WORKING CAPITAL Introduction to Working Capital Capital is what makes or breaks a business, and no business can run successfully without enough capital to cover both short- and long-term needs. Maintaining sufficient levels of short-term capital is a constantly ongoing challenge, and in today’s turbulent financial markets and uncertain business climate external financing has become both harder and more costly to obtain. Companies are therefore increasingly shifting away from traditional sources of external financing and turning their eyes towards their own organizations for ways of improving liquidity. One efficient but often overlooked way of doing so is to reduce the amount of capital tied-up in operations, that is, to improve the working capital management of the company. Working capital is a financial metric of operating liquidity which describes the amount of cash tied up in operations and defines the short term condition of a company. A positive working capital position is required for the continuous running of a company’s operations, i.e. to pay short term debt obligations and to cover operational expenses. A company with a negative working capital balance is unable to cover its short-term liabilities with its current assets. Working capital is calculated with the following formula: Working Capital = Current Assets1 - Current Liabilities2 The above formula includes three important balance sheet accounts which all have a direct impact on the business, namely accounts receivable (A/R), accounts payable (A/P) and inventory. These accounts are often referred to as the three areas of working capital. ●● Accounts Receivable – Money owed to the company for products/services that have been delivered to customers but not yet paid for. ●● Inventory – The raw materials, work-in-progress goods and finished goods that are ready or will be ready for sale. Inventory represents a key asset to most businesses as the turnover of inventory is a primary source of revenue generation and subsequently earnings for the shareholders/owners of the company. ●● Accounts Payable – Money owed to suppliers for goods and services that the company has purchased on credit. Clearly, the importance of the above components differs between companies and industries, and whereas for example retailers and manufacturers often have large inventories of finished goods, work-in-progress (WIP) and raw materials, banks and insurance companies do not hold any traditional inventory. However, regulation requires both banks and insurance companies to maintain certain reserve levels. In addition to the required reserves, these types of businesses typically hold major positions of liquid assets and large portfolios of interest-bearing investments in which deposits and premiums received from customers are invested. The uncertainty of cash 1 2 Current Assets = Cash, Accounts Receivable (A/R) and Inventory Current Liabilities = Short term debt, Accounts Payable (A/P), Accrued Liabilities and Other Debts CAVENDI MANAGEMENT INSIGHT 5 flows also varies significantly between industries, and many retailers have little to worry about when it comes to accounts receivables as the customer pays on site at the time of purchase. On the other hand, banks and insurance companies are privileged by the fact that they receive deposits and premiums before having to make any payments, but are also subject to unpredictable cash outflows when customers decide to withdraw their funds or when insurance claims come in. Why do companies need to manage Working Capital? Just as the importance of the working capital components depends on the nature of a company, so does the optimal level of working capital. Even in a given industry, companies may have very different working capital needs, and it is therefore impossible to determine an overall optimal working capital level without considering a company’s specific situation. “Just as the importance of the working capital components differ between companies and industries, so does the optimal level of working capital.” The appropriate level of working capital depends on both macro factors, such as the market conditions in which a company operates, and micro factors, such as the set-up of the value chain within the company. As working capital spans over a wide range of different business activities, the parameters in the equation must be set in relation to the overall strategy and business model to determine the optimal level of working capital. For example retailers with a fast turnover of cash, or insurance companies that receive cash (premiums) before having to settle possible claims, have much lower working capital requirements than manufacturing companies that can experience substantial material and labor costs long before receiving payment. 6 INTRODUCTION TO WORKING CAPITAL Even though a positive working capital balance is extremely important too high working capital levels can indicate that a company has serious problems in its value chain. A company with a large amount of capital tied up in operations may have to either borrow or attract additional capital from external shareholders. A major challenge for many businesses is therefore to find a balance, and there are generally numerous benefits to gain from a working capital reduction. Such benefits include better growth prospects, higher profitability due to lower provisions for bad debt and/ or slow moving inventory, and a reduction of interest bearing loans. All these benefits serve to increase a company’s overall competitiveness and thus improve its long-term position in the market. Intuitively, keeping working capital levels at the bare minimum may seem like a good idea. So why would a company decide to hold cash? In his publication “The General Theory of Employment, Interest, & Money”, recognized economist John Maynard Keynes suggests three main motives for a company to hold cash, and these motives provide a good explanation as to why a company decides to maintain a higher level of working capital: ●● The Transaction motive (the income & business motive) – Cash is held in the company to pay for purchased goods and/or services. ●● The Precautionary motive – Cash is held to provide for eventualities or opportunities that require sudden expenses. ●● The Speculative motive – Cash is invested in for example stocks and bonds to provide a return for investors. The first motive is primarily a practical reason for holding cash, whereas the latter two offers a more strategic view on why a company may decide to keep cash. With these three motives in mind, all companies must determine their appropriate target levels of working capital, and in doing so, they are managing their working capital. To illustrate the importance of working capital management, consider the working capital position of a company as if it was an individual on a weight-loss program. At the start of the program, the performance is weak and the health is not very good. As the program proceeds and the person loses some weight, the performance level rises and he or she becomes healthier. If the person keeps on working hard, at some point he or she is bound to reach the optimum weight where he or she performs at the highest level and lives a very healthy life. At this point, the individual needs to get off the weight-loss program and instead work to maintain his or her current weight. If the person loses any more weight beyond this point, the performance level will start to decline again and the health will be negatively affected. He or she may for example start suffering from malnutrition. Clearly, neither too much nor too little weight is good, but what is the optimum weight? Setting one optimum weight for everyone is impossible since it depends on a number of factors such as gender, age, length etc. CAVENDI MANAGEMENT INSIGHT 7 Components of Working Capital Accounts receivables, accounts payables and inventory together make up the well-known cash conversion cycle (CCC) which represents the amount of time that each net input dollar is tied up in the production and sales process before being converted into cash. The CCC is a commonly CCC used measure of working capital management efficiency as it considers all three areas of working capital management. That is, the CCC considers the time needed to sell inventory, the time needed to collect receivables, and the amount of time that a company is afforded to pay its bills without incurring penalties. CCC= DIO+DSO-DPO Where: ●● DIO represents days inventory outstanding = (inventory/cost of sales) x 365 ●● DSO represents days sales outstanding = (accounts receivables/total sales) x 365 ●● DPO represents days payable outstanding = (accounts payables/cost of sales) x 365 The shorter CCC the better and, generally, a short cycle is often a sign of good working capital management. A single CCC number is not particularly useful on its own, but should rather be used as a way of measuring performance over time and to compare a company to its competitors and industry averages. From the CCC formula it is clear how all three areas of working capital are interconnected, and improvements in any of the components will lead to a shorter CCC. However, the interconnection between the components of the CCC also means that it is often not possible to change one area without affecting the other areas. Improved working capital management therefore requires an integrated effort in all three areas simultaneously. “The interconnection between the components of the Cash Conversion Cycle also means that it is often not possible to change one area without affecting the other areas. Improved working capital management therefore requires an integrated effort in all three areas simultaneously.” Successful management of working capital requires effective management of all three areas of working capital; Revenue Management (AR), Expenditure management (AP) and Supply Chain Management (Inventory), but more importantly Cavendi emphasizes the importance of a strong and cash focused corporate culture that supports and is fully aligned with the working capital strategy. Whereas a working capital reduction provides a one-off cash injection, it can also produce several ongoing benefits such as better growth prospects, reductions of interest bearing loans and lower provisions for bad debt and slow moving inventory. Many organizations do however only realize the one-off benefit, and to take advantage of the long-term gains from a working capital 8 INTRODUCTION TO WORKING CAPITAL reduction, a strong and cash focused corporate culture is required in order to sustain the working capital reduction over time. Revenue management – “A sale is a gift until it’s paid” Revenue management, also known as the customer to cash process, describes the flow from opportunity management to the point when money is collected for goods/services delivered. An inefficient customer to cash process negatively affects the inflow of money as it delays, and sometimes even prevents, a company from getting paid for goods/services delivered to customers. In the long-run, such issues can force a company to borrow additional capital to avoid defaulting “Successful management of the customer to cash process requires time-to-cash focus and close collaboration throughout the entire organization” on its day-to-day operational expenses. Moreover, it can also result in a situation where the growth prospects and overall profitability are held back. If swift actions are not taken to improve the management of working capital, such issues may negatively affect the company’s ability to compete in the market. Successful management of the customer to cash process requires time-to-cash focus and close collaboration throughout the entire organization, and especially between sales, order fulfillment and finance. Revenue management – Customer to cash process Sales Order Fulfillment Finance Sales in Revenue Management The first step in the customer to cash process is the pre-sales activities that include the opportunity management and customer negotiations. During this phase, sales will together with the customer define the terms and conditions that should include guidelines for pricing, delivery, billing and payment terms. The agreed contents of the terms and conditions are vital if a company is to be able to deliver goods/services in line with agreements and to later be able to collect cash efficiently. It is therefore highly important that sales focuses on ensuring that contracts include the appropriate terms and conditions and that these are fully aligned with the company’s strategic “A common problem is that sales staff is often measured on net sales, and if the incentive model related to net sales targets is not correctly designed, it can lead to a situation where too much focus is placed on “sealing the deal” rather than ensuring a comprehensive contract, in the end causing a lot of trouble for both order fulfillment and finance.” CAVENDI MANAGEMENT INSIGHT 9 goals. A common problem is that sales staff is often measured on net sales, and if the incentive model related to net sales targets is not correctly designed, it can lead to a situation where too “A good way of ensuring that sales staff works towards efficient order processing, billing and collection is to redesign the incentive system and delay the commission from booked order until after the customer payment has been received.” much focus is placed on “sealing the deal” rather than ensuring a comprehensive contract, in the end causing a lot of trouble for both order fulfillment and finance. A good way of ensuring that sales staff works towards efficient order processing, billing and collection is to redesign the incentive system and delay the commission from booked order until after the customer payment has been received. Order fulfillment in Revenue Management The units within order-fulfillment are responsible for producing and delivering the goods/services that have been sold by the sales force. The clock starts ticking as soon as an order has been booked, and the longer it takes for a company to process an order, the longer it is going to take before the company gets paid. In other words, the longer the time between order booking and completed delivery, the lower the margins will become. Consequently, focus must be placed on ensuring that both the produced goods/services and the delivery are in line with the agreed terms and conditions so that the process can be completed as quickly as possible. The process should not be considered complete until the goods/services have been billed. Efficiency and quality are therefore two key words in the order fulfillment process, and while the order fulfillment processes must be efficient, the quality of sold goods/services must meet the agreed terms and conditions to avoid time consuming and costly customer disputes. “Efficiency and quality are two key words in the order fulfillment process, and while the order fulfillment processes must be efficient, the quality of sold goods/services must meet the agreed terms and conditions to avoid time consuming and costly customer disputes.” Finance in Revenue Management The finance department works to secure on-time customer payments, and their ability to do so is largely dependent on the work performed by the sales and order fulfillment teams. On-time payments are very important in efficient working capital management, and without customer payments, all work performed within Sales and Order Fulfillment has been in vain. An effective way to gain control of the A/R ledger and detect bottlenecks further upstream in the customer to cash process is to adopt a proactive cash collection (PCC) approach. The PCC concept is a 10 INTRODUCTION TO WORKING CAPITAL structured approach for driving collection activities while at the same time achieving an increased control of the A/R ledger. Collectors follow up invoices on line item level with the intention of identifying missing details and resolving issues and disputes before the invoices fall due. “The PCC concept is a structured approach for driving collection activities while at the same time achieving an increased control of the A/R ledger.” By assigning reason codes to each line item it is possible to systematically address the root causes behind outstanding A/R, which in turn provides valuable data and arguments for driving further working capital improvements. Moreover, as the name of the concept suggests, collectors work proactively and thereby the need for ad-hoc collection races is substantially reduced. Expenditure management – “A supplier invoice is not a burden until it is overdue” Expenditure management, also known as the purchase to pay process, refers to the business processes that cover activities of requesting, purchasing, receiving, paying for and accounting for goods/services. In many companies, particularly amongst manufacturers, procurement costs account for a sizeable share of total costs. Efficient management of the purchase to pay process can therefore have a significant impact on the profitability of a firm, and in many cases, a full review of sourcing processes can cut purchasing costs substantially. Whereas increasing sales and cutting production costs are common approaches to improving profitability, the cost structure of many companies implies that a reduction in procurement costs may be the most efficient strategy. Such improvements do however not come easy, as company structure and culture often hide significant inefficiencies and many issues can be traced to an absence of process ownership. Improvements can often be made through clear allocation of responsibility and a centralization of the procurement process. “Company structure and culture often hide significant inefficiencies, and many issues can be traced to an absence of process ownership. Improvements can often be made through clear allocation of responsibility and a centralization of the procurement process.” An optimization of the purchase to pay process thus requires organization-wide effort, but most importantly, sales, procurement and finance functions must work closely together to ensure a functional process. Expenditure management – Purchase to pay process Sales Procurement CAVENDI MANAGEMENT INSIGHT Finance 11 Sales in Expenditure Management The procurement process starts when the sales staff negotiates the delivery terms with customers. Timing is of great importance, and sales staff must carefully work to balance promised delivery times with the time required for procurement to order and receive the goods from the most “Timing is of great importance, and sales staff must carefully work to balance promised delivery times with the time required for procurement to order and receive the goods from the most appropriate supplier.” appropriate supplier. In doing so, clear communication between sales and the procurement team is highly important in order to avoid over-optimistic delivery times that may force the procurement team to use less preferable suppliers due to shorter delivery times. Once terms have been agreed “Focusing on the right items is utterly important and too much focus is often placed on small purchases at the expense of efficiency in the process of purchasing more expensive items.” and an order has been booked, sales must ensure that the procurement team is given as clear and specific information as possible about the products required for purchase. Procurement in Expenditure Management The sourcing and procurement functions are together responsible for securing cost efficient purchases. Fragmentation of the procurement process is a common problem as both the range and frequency of purchases is too diverse, leading to both duplication of efforts and unnecessarily high procurement costs. Moreover, when too many employees are involved in the purchasing process, the firm fails to leverage its full purchasing power with its suppliers, and can thereby miss out on the opportunity to negotiate professionally. To avoid these problems, the whole process should preferably be centralized under a function that administers all purchases. In many organizations this function is split into two separate functions i.e. sourcing and procurement. Sourcing is then responsible for the more strategic activities such as finding new suppliers, getting and evaluating RFQ’s as well as negotiating and agreeing on terms and conditions with suppliers. The procurement function is responsible for placing purchase orders with suppliers and following up with suppliers until the goods/materials have been delivered. Procurement is therefore a repetitive process as opposed to sourcing which is a one-off activity. When these functions have been centralized and purchasing responsibility has been clearly allocated, the company is in a position to conduct a strategic sourcing review where the aim is to identify the best suppliers in each class rather than the best of existing suppliers. The use of reliable suppliers with whom desirable agreements are in place is vital to ensure on-time delivery and preferable pricing. Furthermore, focusing on the right items is utterly important and too much focus is often placed on small purchases at the expense of efficiency in the process of purchasing more expensive items. In 12 INTRODUCTION TO WORKING CAPITAL many businesses, the majority of individual purchases constitute small money items but this may only be equivalent to a few percent of the overall procurement costs. Efficient handling of small purchases is therefore a key factor in reducing overall procurement costs as it allows procurement staff to focus on the items and suppliers that account for a great majority of the company’s total purchasing costs. Finance in Expenditure Management Once a deal has been concluded, the timing of supplier payments is key to efficient payment processes. Whereas holding back payments too long can ruin the customer-supplier relationship, paying suppliers too early is never good from a working capital perspective as the money can be used for other purposes until paid out. Payment errors occur for a number of reasons, but by rationalizing the purchasing process and limiting the number of suppliers, there is less scope for errors. “Payment errors occur for a number of reasons, but by rationalizing the purchasing process and limiting the number of suppliers, there is less scope for errors.” In addition, as more framework agreements and contracts are introduced, flexible payment terms are preferable i.e. for example if the payment terms include a discount for quick payments, a company can choose between conserving cash or paying less depending on the state of its own balance sheet. Supply Chain Management – “Inventory is a cost until delivery” Supply Chain Management in a broader sense describes the oversight of materials, information, and finances as they move in a process from supplier to manufacturer to wholesaler to retailer to consumer. With respect to working capital management, supply chain management largely focuses on inventory management. Excess inventory is a commonly overlooked source of cash, and it often accounts for a large portion of the savings from a working capital optimization. Many organizations struggle because capital is tied up in materials and processes that produce goods for which there is little or no market at all. “Excess inventory is a commonly overlooked source of cash, and it often accounts for a large portion of the savings from a working capital optimization.” On the other hand, failing to meet customer expectations on product availability is also harmful to business, and efficient inventory management is therefore a tough balancing act between minimizing inventory levels without failing to respond to customer demand. Only by streamlining CAVENDI MANAGEMENT INSIGHT 13 processes within the company, as well as processes involving external suppliers and customers, firms can successfully satisfy customer demand while minimizing inventory levels. Sales, procurement, production and delivery are the main business functions involved in the supply chain management and good supply chain management requires close collaboration between these areas. Supply Chain Management – Forecast to fulfilment process Sales Procurement Order fulfillment Sales in Supply Chain Management Any effort to improve inventory management has to start with a critical evaluation of the product portfolio. Sales are often the drivers of a wide product portfolio in order to satisfy every possible customer demand, which can result in large stocks of slow moving products. Efficient management “Any effort to improve inventory management has to start with a critical evaluation of the product portfolio” of the product portfolio therefore requires regular and critical reviews to identify slow moving items and to tighten the assortment. Sales must understand the consequences of a large product portfolio and work towards a portfolio consisting of only fast-moving products. When an appropriate product portfolio has been established, the next step is to forecast future demand, and since both procurement and production are based on expected future demand, accurate forecasting is possibly the most important part of efficient inventory management. Even if the product portfolio only consists of fast-turning products, a company will end up with large inventory if purchases and production levels differ from actual demand. Better forecasts and regular updates on customer demand will bring substantial cost savings throughout the supply chain by reducing inventory and also improving the ability to deliver. As forecasts become more accurate, the need for buffers in both inventory and production capacity is reduced and capital can be released for other purposes. Sales staff should be responsible for providing the data used in forecasting and demand planning, but depending on the grounds on which they are evaluated they may be inclined to over- or underestimate these figures. Designing the incentive system to reward forecasting accuracy is therefore a good starting point. “Efficient management of the product portfolio requires regular and critical reviews to identify slow moving items and to tighten the assortment.” Procurement in Supply Chain Management Purchasing efficiency is a major contributor to efficient inventory management and the procurement team is responsible for purchasing the materials and products required to fulfill 14 INTRODUCTION TO WORKING CAPITAL customer orders. The objective is to always have an item in stock the moment it is required without maintaining excessive inventory levels. Consequently, the reliability of sales forecasts and production plans is of greatest importance and no purchasing efforts are likely to be very efficient without close collaboration between procurement and other internal departments. However, even if the internal flow of information is well-functioning, problems with external suppliers can distort procurement efforts and lead to build up of excessive inventory. A common problem is the use of suppliers with unreliable or constantly changing lead-times that force a company to maintain a safety buffer to avoid falling short of customer demand. Some suppliers even purposely change their lead times to create artificial demand, hence using reliable suppliers is vital. Many suppliers also offer discounts for large volume purchases, but cost savings on purchases will not have the desired effect on the bottom line unless there is a demand for the product. Instead, there is a significant risk that the company will end up with large stocks of slow-moving products and materials. “Even if the internal flow of information is well-functioning, problems with external suppliers can distort procurement efforts and lead to build up of excessive inventory.” Production in Supply Chain Management Once the product portfolio has been tuned, expected demand has been predicted, and material has been purchased, efficient production processes are required to optimize inventory levels. Efficient production processes should be organized to constantly meet demand with minimal spare capacity. High production set-up costs are often offset by long production runs, but also tend to result in high inventory levels. Large raw material stocks and long production lead times can lead to forecasting errors and changes in demand that distort inventory planning. In general, the “In general, adopting a just-in-time planning philosophy and moving from push concepts towards demand driven pull systems are often successful recipes for improvements in production processes.” objective of production process optimization is to minimize both finished goods stock and inventory consisting of materials and work-in-progress. The former can be achieved by satisfying demand with minimal spare capacity and making as much as possible to order, and by doing so, sales desire for a wide product portfolio can be satisfied. Materials and work-in-progress inventory on the other hand can be reduced by removing non-value adding time and excessive inventory between production steps, as well as by standardizing components and customizing products as late in the production process as possible. In general, adopting a just-in-time planning philosophy and moving from push concepts towards demand driven pull systems are often successful recipes for improvements in production processes. Moreover, a continuous monitoring of the costs of CAVENDI MANAGEMENT INSIGHT 15 internal production against those of buying sourcing from external suppliers will help the company reduce the range of products manufactured in-house and allow manufacturing to focus on the products that give the company a competitive lead in the market. Delivery in Supply Chain Management When goods are ready for delivery, the objective should be to minimize delivery costs without falling short of customer expectations on price, quality and service levels. The number and location of distribution points is a common driver of unnecessarily high order fulfillment costs, and firms often face a trade-off between cost and service, as a large number of distribution points means that customer demand can be satisfied quicker. However, historical decisions can mean that a number of distribution points are located in areas that are irrelevant in today’s markets, and these distribution points can often be removed without sacrificing service levels or the ability to deliver. Better use of third party logistics companies (3PL) to handle the full distribution process, from delivery to running the warehouse and determining the levels of stock to be held, can also help companies reduce the number of distribution points without sacrificing service levels. “The number and location of distribution points is a common driver of unnecessarily high order fulfillment costs, and firms often face a trade-off between cost and service.” Culture management – “Culture eats strategy for breakfast” Not even the best and well-intentioned strategy is likely to succeed if it does not correspond to the values of the people in the business. Corporate culture is the collective behavior of people that are part of an organization, and it is formed by the values, visions, norms, language and symbols used by those same people. It is important to understand that articulated values cannot be used to control a business, rather it is the values of employees that drive the business. The wanted corporate values must therefore be internalized by the people in the organization to be effective. Unless that is the case, it doesn’t matter how good a strategy is as the people in the business will always make the difference. “The importance of a strong cash focused culture cannot be stressed enough, and the key is therefore to secure the right mindset and behavior amongst all employees.” The importance of a strong cash focused culture cannot be stressed enough, and the key is therefore to secure the right mindset and behavior amongst all employees. The corporate culture is by far the most difficult organizational attribute to change as it is built on the values, beliefs and behaviors of the people in the business. Hence, prior to any business wide change the corporate 16 INTRODUCTION TO WORKING CAPITAL culture must be thoroughly analyzed in order to understand whether or not the current culture is in line with the wanted changes. The culture should be analyzed and examined on several levels as the different levels will generate different kinds of information and together give a more exhaustive view of the current culture. Conclusion Working capital management is becoming an increasingly important part of successful business management, and in many instances, poor management of working capital can make or break a business. An initiative to reduce working capital can provide companies with a well-needed oneoff cash injection but more importantly, there are several continuous benefits of improved working capital management. Whereas most companies that initiate a working capital optimization project achieve the one-off cash benefit, only those that fully understand the complexity of working capital management and the interdependencies between different business functions are likely to see the long-term gains. From Cavendi’s point of view, successful working capital management requires a holistic approach and integrated effort throughout the entire value chain, and it should therefore be part of the long term corporate strategy. In our view, the key is therefore to design and implement a cash focused corporate culture which encourages a sustained effort to maintain the lower working capital levels. A company that is successful in doing so can most likely significantly improve its bottom line and strengthen its overall market position. Clearly, a sustained working capital improvement can play a significant part in business success, and those companies that are willing to invest both time and effort in working capital management may well become frontrunners in an increasingly competitive world of business. CAVENDI MANAGEMENT INSIGHT 17 About the authors Maria Hjertberg Eckerby is a Senior Consultant at Cavendi Management Consulting specializing in Finance and Business Performance. Maria has several years of experience as a management consultant and has during the last couple of years operated as a project manager for several successful projects, primarily within the Treasury function. These assignments have been complex both in terms of content and structure as they have spanned over several operational functions and different cultures. Maria holds a Master degree in Business Administration with a major in International Business from Uppsala University. Jonas Höijer is a Partner at Cavendi Management Consulting specializing in Finance and Business Performance. Jonas has extensive experience working with large finance transformations, process design and organizational development. He has a long and proven track record of successful projects and he is often engaged as Subject Matter Expert and key note speaker. Jonas holds a degree in Industrial Engineering and Management from the Royal Institute of Technology and an executive MBA from the Stockholm School of Economics. 18 INTRODUCTION TO WORKING CAPITAL CAVENDI MANAGEMENT INSIGHT 19 SÄLJEFFEKTIVITET I B2B ORGANISATIONER Telefon 08-410 829 50 info@cavendi.se www.cavendi.se Besöksadress: Birger Jarlsgatan 32b, 114 29 Stockholm 20