S-MNST - University of Virginia

advertisement

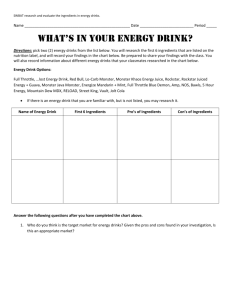

MCINTIRE INVESTMENT INSTITUTE AT THE UNIVERSITY OF VIRGINIA Zixing Chen, Chuxi Sun| 7 February 2013 1 McIntire Investment Institute AGENDA BUSINESS OVERVIEW THESIS POINTS MARKET MISCONCEPTIONS VAR RISKS RECOMMENDATION 2 McIntire Investment Institute COMPANY OVERVIEW • Founded in 1935 and Southern California-based, Hansen Natural Soda (HANS) changed its company’s name and symbol to Monster 1 Beverage Company (MNST) on January 5, 2012 • Develops, markets, and distributes energy drinks, fruit drinks, iced teas, 2 and still water both in the U.S. and overseas • #2 energy drink behind Red Bull 3 • Operates in two segments: Direct Store Delivery (95.3%), whose principal products comprise energy drinks, and Warehouse (4.7%), whose principal products comprise juice based and soda beverages 4 • Promotes its products through the sponsorship of over 200 athletes 3 McIntire Investment Institute STOCK OVERVIEW (NASDAQ: MNST) Monster Beverage Corporation (MNST) Price: 48.33 Market Cap: 8.28B 4 P/E (ttm): 26.55 52wk Range: 39.99-83.96 EPS (ttm): 1.82 Avg Vol: 1,788,000 McIntire Investment Institute THESIS POINTS q Decelerating margins growth rate q Overhyped acquisition rumors q Limitations of well-defined consumer marketing q Perceived health concerns and international expansion uncertainties 5 McIntire Investment Institute CONCENTRATED PRODUCT PORTFOLIO • Product concentration and lack of innovation • Vulnerability to market saturation • No real clear differentiation between the products or their target markets among its nearly 30 different flavors 6 McIntire Investment Institute ENERGY DRINK MARKET LOSING MOMENTUM Energy Drinks’ YoY Growth (2001-2011) • Energy drinks’ YoY growth shows signs of deceleration • MNST’s 11.2% YoY growth in the past 4 weeks is off the pace of 14.3% YoY sales growth (ttm) o Monster Beverage Corp 19.6% → 10.5 % o Red Bull 15.9% → 18.1% o Rock Star 2.4% → 2.5% o Coca-Cola Co. 7.4% → 6.6% o Pepsi Co. -12.6% → -17.8% 7 McIntire Investment Institute MISCONCEPTION #1 ENERGY DRINKS’ PROFITABILITY GROWTH IS EXPLOSIVE “The U.S. energy drink market has reached a saturation point much quicker than expected.” - Jonas Feliciano, Beverage Analyst at Euromonitor International 8 McIntire Investment Institute INVENTORY GROWTH SURPASSING REVENUE GROWTH • Inventory growth surpasses revenue growth • Wasted stale inventory hurts profitability • 4th quarter's revenues continuously follow a downward trend o Less winter sports and sponsored games 9 McIntire Investment Institute 3/4 MISSED ESP PROJECTIONS Monster Beverage Corp. YoY Revenue Growth • Growth is slowing down • MNST continuously missed analysts' EPS expectations in the last four questers 10 McIntire Investment Institute STAGNANT MARGINS AND WEAK OPERATING CASH FLOW 27.49% 17.12% • Stagnant operating margin caused by high raw materials costs and increased international expenditures 11 McIntire Investment Institute UNJUSTIFIED PREMIUM VALUATION Ticker P/E P/S P/B P/FCF D/E EPS DPS 15.55 1.58 4.06 37.50 1.19 2.92 KO 19.45 3.52 5.05 54.16 0.99 1.92 MNST 26.15 4.08 9.71 28.93 0 1.82 PEP 19.32 1.71 5.24 51.79 1.30 3.75 • MNST is currently trading at 26.6x earnings, 5.8x sales, and 17.4x EBITDA • A 25.3% growth rate in the past 5 years suggests unrealistic expectations for growth and outperformance 12 McIntire Investment Institute MISCONCEPTION #2 MNST IS THE NEW SBUX • Highly developed brand, logo, copyrights, and trademarks • Physical stores, service, customized products • Product diversification with the recent acquisition of Evolution Fresh Juice 13 • Markets its products primarily directly to retailers • No patents • Pre-packaged products • Dependence on suppliers for manufacturing and packaging products McIntire Investment Institute THESIS POINTS q Decelerating margins growth rate q Overhyped acquisition rumors q Limitations of well-defined consumer marketing q Perceived health concern and international expansion uncertainties 14 McIntire Investment Institute IS MONSTER FACING A BUYOUT? • Rumors of a possible takeover has been spread around since 2007 • HANS’s price peaked but soon slumped over the next 4 quarters 15 McIntire Investment Institute IS MONSTER FACING A BUYOUT? • Similarly, MNST’s price peaked in Jun 2012 but fell significantly in the following two quarters MNST’S Share Price, 2011-2013 16 McIntire Investment Institute RISKS OF ACQUISITION • MNST went up 63% in value during 2012. While MNST’s size (especially by book value) makes it an attractive buyout candidate, a close to $10 billion acquisition cost would make this deal the most expensive one in the industry’s history • FDA Investigation and increased calls in Congress can inspire regulatory action and would make a buyout highly unlikely to occur in the next 3 months 17 McIntire Investment Institute THESIS POINTS q Decelerating margins growth rate q Overhyped acquisition rumors q Limitations of well-defined consumer marketing q Perceived health concern and international expansion uncertainties 18 McIntire Investment Institute HIGH MARKET COMPETITION 19 McIntire Investment Institute LIMITED CORE DEMOGRAPHICS Age and market discrimination continue to be a problem for the energy drink market. Current Advertising: • Sports, parties • Selling Lifestyle • Premium access • Celebrities endorsement 20 Targeted Audience: • Athletes • Male, aged 14-26 • Extreme sport fans, gamers, hip Challenges: • Missing new markets • No use of mainstream media • No top-of-mind awareness • Stigma attached to energy drinks McIntire Investment Institute MISCONCEPTION #3 MNST RUNS HIGHLY SUCCESSFUL MARKETING CAMPAIGNS • Red Bull currently spends approximately 30% of their worldwide sales on marketing and advertising which equates to $600 million • Red Bull created the nontraditional content marketing strategy since early 1980s and has long been in the game of marketing to extreme sports 21 • Monster promotion spending climbed to 23 %, or approximately $105 million, in 2012 • Monster entered the market after Red Bull, discounted their product, and adopted similar marketing strategy McIntire Investment Institute RED BULL: EXPLORING HUMAN POTENTIAL 22 McIntire Investment Institute MONSTER: SHEDDING THE BAD BOY IMAGE 23 McIntire Investment Institute THESIS POINTS q Decelerating margins growth rate q Overhyped acquisition rumors q Limitations of well-defined consumer marketing q Perceived health concern and international expansion uncertainties 24 McIntire Investment Institute CONTINUED HEALTH AND SAFETY CONCERNS Energy Drink-Related Emergency Department (ED) Visits • In recent years, energy drinks have caused more and more ED visits • FDA routinely attempts to push for tighter restrictions on the marketing of energy drinks to children and teens • Negative effect on consumer perception outweighs potential for increased government regulation 25 McIntire Investment Institute CONTINUED HEALTH AND SAFETY CONCERNS • On Oct 22nd, 2012, FDA started investigating reports of five deaths that might be associated with Monster Energy Drinks. • This news caused a 13% drop in the Monster’s share price. MNST’S Share Price, Oct 22nd, 2012 26 McIntire Investment Institute CONTINUED HEALTH AND SAFETY CONCERNS • Although the FDA have terminated the investigation, it still kept an close eye on the company’s performance and health issues that were possibly caused by energy drinks. • The company need to resolve these health concerns to bring back positive investor sentiment. 27 McIntire Investment Institute UNCERTAINTIES IN GEOGRAPHICAL EXPANSION • Competitors like Coke, Pepsi, Red Bull, and Starbucks all have established a substantial international presence Global Share of Energy Drink Market • Globally speaking, the Red Bull has almost half of the market share, especially in some Asian countries where Monster have not entered • Concentrated product portfolio might be a significant weakness 28 McIntire Investment Institute UNCERTAINTIES IN GEOGRAPHICAL EXPANSION • High shipping expenses and other cost pressures outside the U.S. threaten profit margins and operating performance o Example: product damage associated with the rollout into Japan and South Korea hurt Monster's international margins in Q2 of 2012 • Red Bull is banned in some countries due to the ingredient Taurine such as Denmark, France, and Norway. And Taurine is a key ingredient for energy drinks. Therefore, it is reasonable to say that Monster might face the same situation when it expands to foreign markets 29 McIntire Investment Institute THESIS POINTS q Decelerating margins growth rate q Overhyped acquisition rumors q Limitations of well-defined consumer marketing q Perceived health concern and international expansion uncertainties 30 McIntire Investment Institute VAR Survey: Energy Drink vs. Energy Drinks Alternatives Findings: (Participants are random sampled UVA students ) • Preferences: Coffee drinks > Energy Drinks > Sports Drinks > Soda • 76.5% of participants consume Red Bull most often, 17.6% consume Monster most often, and 5.9% chose Monster XXL as their favorite energy drink • 58.3% of participants drink caffeinated drinks “feel awake in general,” 25% chose “to focus with studying,” and 12.5% of participants “do not drink energy drinks” • 100% of participants are aware that there are health risks associated with energy drinks, while 58.3% of them “try to find healthier alternatives to energy drinks” 31 McIntire Investment Institute VAR “Energy drinks have become increasingly popular these days… but there have been a few complaints toward them… ” - Customer Service at Walmart, Charlottesville 32 McIntire Investment Institute VAR – ONLINE CUSTOMER REVIEWS • “I've been drinking this over a year, until I got arrithmias and anxiety, and panic attacks. It's not worth the risk!” • “Contains the artificial sweetener 'sucralose', which causes me migraines and makes me lethargic. There should be a sucralose warning on the front label!” • “There are always loose cans in the box, there are always dented cans. I refused one delivery due to the cans open and the box soaked, falling apart.” • “Case arrived damaged, only offered a return of item, are they joking?” • “This box was so damaged it lost the box it was mailed in and was leaking from several cans of the product. This was the worst I have ever received a product over the 10 plus years. *Taken from Amazon.com 33 McIntire Investment Institute CATALYSTS • Inflating commodity costs and government oversight limit longterm growth • Lawsuits damage the company’s public image and influence market sentiment • The outlook for MNST’s 10-K is bearish • Too many short, mid, long-term headwinds 34 McIntire Investment Institute RISKS • Development of innovative strategies to differentiate its brand • Successful market penetration and international expansion • Still an appealing buyout target • Relatively strong financial statistics 35 McIntire Investment Institute RECOMMENDATION • Immediately initiate short position at 0.75% 36 McIntire Investment Institute QUESTIONS? 37 McIntire Investment Institute APPENDIX 1 SWOT ANALYSIS Strengths: • Market leadership – S&P 500 • Strong and above-industry-average growth • No long term debt • Strong, fresh, and fashionable brand identity Weaknesses: • Less financial resources than competition • Lack of innovation • Reliant on small product base • Inexperience in the international market • Lack of patent on its recipe means low market barrier 38 Opportunities: • New product Peace Tea adds more revenue stream • Celebrities marketing and advertising • Possibility of being bought out by KO or PEP • Consumer recognition though sponsorship like sport events Threats: • Government regulations • Consumer awareness of health • Frictions preventing its buyout • Consumers not accepting its product in emerging/new markets • Dependence on energy drink segment • Enormous industry product competition • Changes in consumer preferences McIntire Investment Institute