Maruti Suzuki India (MARUTI)

advertisement

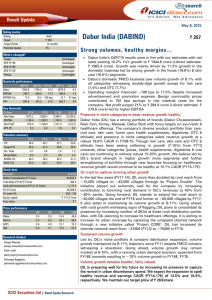

Quick Comment June 11, 2014 Rating matrix Rating Target Target Period Potential Upside : : : : Maruti Suzuki India (MARUTI) Hold | 2375 12 months -4% | 2464 More safeguards for minority shareholders… What’s Changed? Target EPS FY15E EPS FY16E Rating Changed from | 1823 to | 2375 Changed from | 110.8 to | 111.5 Changed from | 130.2 to | 148.4 Unchanged Key Financials | Crore Net Sales EBITDA Net Profit EPS (|) FY13 42,613 4,229.6 2,392.1 79.2 FY14E 42,645 5,095.9 2,783.1 92.1 FY15E 47,424 6,127.1 3,367.0 111.5 FY16E 53,721 7,533.3 4,482.5 148.4 FY13 31.1 30.0 16.5 4.0 12.9 11.9 FY14E 26.7 25.8 13.1 3.5 13.3 13.3 FY15E 22.1 21.3 10.8 3.1 14.1 14.4 FY16E 16.6 16.0 8.3 2.7 16.2 16.5 Valuation summary P/E (x) Target P/E (x) EV/EBITDA (x) P/BV (x) RoNW (%) RoCE (%) Stock data Particular Market Capitalization (| Crore) Total Debt (FY14P) (| Crore) Cash and Investments (FY14P) (| Crore) EV (| Crore) 52 week H/L (|) Equity capital (| crore) Face value (|) Amount | 74432.5 Crore | 1685.2 Crore | 9442 Crore | 66675.7 Crore 2505 / 1215 | 151 Crore |5 Analyst’s name Nishant Vass nishant.vass@icicisecurities.com Venil Shah venil.shah@icicisecurities.com Maruti Suzuki India (MSIL) has outlined the agreement details with Suzuki Motor Corporation (SMC) for the new Gujarat plant, with SMC’s 100% subsidiary, Suzuki Gujarat (SG), undertaking the project. As indicated earlier, MSIL would voluntarily seek minority shareholders’ approval for this arrangement. The additional clarifications by MSIL on the proposed expansion of the Gujarat plant further safeguards minority shareholders’ interest. The key highlights of the meeting were as follows: The entire capex for the Gujarat subsidiary in the initial phase would be ~| 18,500 crore. It would be funded by depreciation and equity brought in by Suzuki Motor Corporation SG would operate on a “no profit, no loss basis” and would have annual price revisions for products. Any profit would be adjusted for the selling price of products MSIL could potentially save ~| 10,500 crore assuming post tax returns on investments of ~8.25% for the 15 year contract period According to legal experts, there would be no significant tax differences between MSIL and SMC In the event of the termination of the contract, MSIL would have the right to assets at the book value Our take on the same We feel MSIL’s management has done well to alleviate some concerns of minority shareholders related to the arrangement. We believe this would reduce the overhang on the stock. Hence, multiples would not face any specific discount due to the same. Along with the same, MSIL remains an attractive play on the discretionary purchase recovery among consumers. It has new products lined up (Celerio, Ciaz, XA alpha) to capture the same. On competitive intensity, we feel MSIL has handled it in an admirable manner. We feel it can possibly maintain the same, going ahead. We have upped our volume estimates (~5%) to ~1.4 million units in FY16E. We feel with strong cash generation, MSIL could increase dividend payouts in the coming years as investments remain modest. We upgrade our target multiple to 16x. Thus, we arrive at a target price of | 2375. However, post the recent rally, we maintain HOLD rating. ANALYST CERTIFICATION We /I, Nishant Vass MBA Venil Shah MBA research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the ICICI Securities Inc. Disclaimer The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities Ltd (I-Sec). I-Sec may be holding a small number of shares/position in the above-referred companies as on date of release of this report. This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ISec and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction. ICICI Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. ICICI Securities and affiliates might have received compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specific transaction. It is confirmed that research analysts and the authors of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of ICICI Securities, which include earnings from Investment Banking and other business. ICICI Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report. It is confirmed that research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member of the companies mentioned in the report. ICICI Securities Ltd | Retail Equity Research