Chapter 3 Outline

advertisement

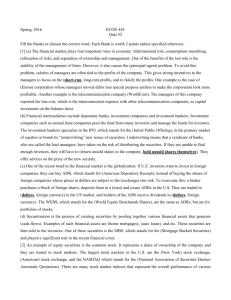

Honors Finance and Investments Chapter 3 I. Securities Markets A. Primary Function 1. 2. 3. 4. II. Market Makers A. Broker 1. B. Securities Dealer 1. 2. C. Market Makers 1. D. Specialist 1. a) NYSE b) American Stock Exchange E. Bid and Ask Prices 1. 2. Bid = 3. Ask = 4. : willing to purchase at $20 and sell at $21 5. F. Round Lot 1. Normal unit trading in a security 2. G. Odd Lot 1. Unit of trading that is less than a round lot 2. H. Spread 1. 2. The actual value of the security is the bid price, but you pay the ask price III.Securities Exchanges A. Over-the-counter markets 1. NASDAQ a) B. NYSE (or another organized exchange) 1. Must continue to: a) b) c) d) 2. The exchange may delist the securities if the firm is unable to maintain these requirements C. Ticker Tape 1. YTD % CHG a) 2. HI LO a) 3. STOCK a) 4. SYM a) 5. DIV a) 6. YLD % a) b) 7. PE a) 8. VOL 100s a) 9. LAST a) 10. NET CHG a) IV. The Mechanics of Investing in Securities A. Place a purchase order with a broker B. The broker then contacts the securities dealer C. Types of Orders 1. Market Order a) 2. Limit Orders a) Day Order (1) b) Good-Til-Canceled Order (1) D. Confirmation Statement 1. 2. 3. 4. 5. Amount due (includes transaction fees) a) Commission (1) (2) 6. Must pay within three business days a) Settlement date b) (t+3) E. Margin 1. 2. 3. Margin = Equity/Total value of the portfolio a) Own stock worth $10,000 b) You paid $8,000 in cash c) You borrowed $2,000 from broker d) Margin = 80% F. Margin Requirement 1. 2. Interest on amount borrowed a) 3. Must payback initial borrowed amount no matter what happens to the stock price 4. G. Financial Leverage 1. V. Delivery of Securities A. 1. Mandatory 2. Street Name a) 3. Broker is the custodian 4. Broker sends monthly statement to investor a) b) c) d) 5. Advantages a) b) Do not have to store documents c) 6. Disadvantages a) b) All documentation sent from company will be delivered to brokerage firm (1) (2) B. Take delivery VI. Short Sale A. Long Position 1. B. Short Position 1. 2. Borrow stock and sell it, if price declines, buy back stock and pay off loan 3. Contract for future delivery VII. Measures of Securities Prices A. B. 1. nation - Largest, most well known companies in Alcoa American Express Boeing Bank of America Caterpillar Cisco Systems Chevron DuPont Walt Disney General Electric Home Depot Hewlett Packard IBM Intel Johnson and Johnson JP Morgan Kraft Coca Cola McDonalds 3M Merck Microsoft Pfizer Proctor Gamble AT&T Travelers United Tech Verizon Wal-Mart Exxon C. D. NYSE Composite Index E. F. How are indexes calculated? 1. Simple Averages a) 2. Weighted Averages a) VIII. Foreign Securities A. London, Paris, Tokyo Exchanges 1. B. American Brokers that have access to foreign exchanges C. American Depository Receipts (ADRs) 1. 2. 3. 4. 5. 6. 7. D. Foreign Bonds 1. Bonds issued by foreign firms 2. Bonds issued by foreign governments 3. Bonds issued in foreign countries by American Firms a) Firms can sell bonds in local currency b) (1) Bonds sold in a foreign country but denominated in the currency of the issuing firm (2) Dollars IX. Competition in the Securities Market A. 1. Theory that securities prices correctly measure the current value of a firms future earnings and dividends