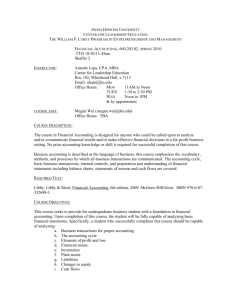

ACCT S170 - Yale Summer Session

advertisement

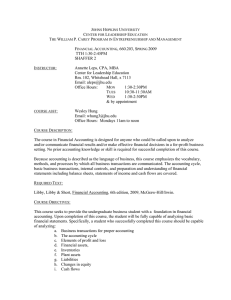

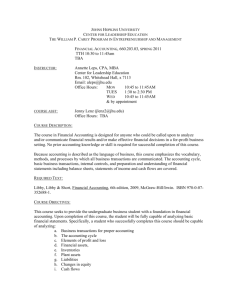

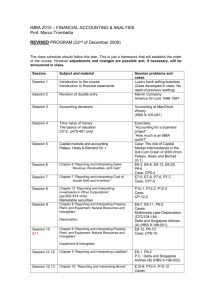

Yale Summer Session Summer 2013 – Session A ACCT S170: Financial Accounting Monday to Friday: 10:00 a.m. to 11:15 a.m. Instructor: Nancy Fallon, PhD Home Phone: 203-433-4375 Cell Phone: 203-824-3213 E-Mail: nfallon@albertus.edu Office Hours: 15 minutes before or after class or by appointment Course Description: This is an introductory course in Financial Accounting. The objective of this course is to introduce you to the techniques used in preparing financial statements and to help you become an informed user of financial reports. The course will cover the preparation, interpretation, and analysis of the earnings statement; the statement of financial position; and the statement of cash flows. Expectations of Students: 1. Students are expected to attend all class sessions and participate in all class discussions. 2. Students should come to class prepared. All students must bring a calculator and pencil to class. 3. Students are expected to read course materials for the assigned date. 4. Students are expected to turn in all work on time. Assignments will be due at the beginning of class unless otherwise specified. Late assignments will only be accepted if arrangements are made with the instructor. 5. If a class period is missed, it is the student’s responsibility to find out what material was covered, what assignments were given, etc. 6. Make-up exams will not be given. Students are expected to be present for all exams. The instructor must be notified in advance if a student is not able to take the exam because of an emergency. Documentation will be required. Students are expected to be prepared for the exam and to bring appropriate materials. 7. Students are encouraged to give constructive feedback on the course at any time. Required Materials: Libby, Libby & Short. (2011). Financial Accounting (7th edition). New York, NY: McGrawHill Irwin. (978-0-07-811102-0). Requirements and Grading: Problem Assignments…………………………………………………. 20% Team Project ………………………………………………………….. 20% Examinations (3)………………………………………………………. 60% Class Schedule: (Due to unforeseen circumstances, it may be necessary to alter the outlined schedule of activities during the session. Any such changes will be clearly communicated to the class.) Date Topic June 3 Introduction June 4 Chapter 1: Financial Statements and Business Decisions In Class: E2-2 Assignment Due: Read Chapter 1 E1-4, E1-8, E1-12, E1-14 June 5 Chapter 2: Investing and Financing Decisions and the Balance Sheet In Class: E2-11, E2-12 Assignment Due: Read Chapter 2 E2-1, E2-2 (Journal Entries) June 6 Chapter 2: Investing and Financing Decisions and the Balance Sheet In Class: Complete P2-3 Assignment Due: P2-3 -Journal Entries June 7 Chapter 3: Operating Decisions and the Income Statement In Class: E3-7, P3-6 Assignment Due: Read Chapter 3 E3-3, E3-4 June 10 Chapter 3: Operating Decisions and the Income Statement Chapter 4: Adjustments, Financial Statements, and the Quality of Earnings In Class: E4-3, E4-4 Assignment Due: Complete P3-6 June 11 Chapter 4: Adjustments, Financial Statements, and the Quality of Earnings In Class: P4-2 Assignment Due: Read Chapter 4 E4-6, E4-7 June 12 Examination 1: Chapters 1 -4 June 13 Chapter 4: Adjustments, Financial Statements, and the Quality of Earnings In Class: Complete COMP4-2 Assignment Due: COMP 4-2 (1 & 2) June 14 Chapter 5: Communicating and Interpreting Accounting Information In Class: P5-3, P5-4 Assignment Due: Read Chapter 5 P5-1, P5-2 June 17 Chapter 13: Statement of Cash Flows In Class: P13-1 Assignment Due: Read Chapter 13 E13-1, E13-6, E13-15 June 18 Work on Team Projects: Part 1 June 19 Chapter 6: Reporting and Interpreting Revenue, Receivables & Cash In Class: E6-8, E6-12 Assignment Due: AP13-1 Read Chapter 6 E6-3 June 20 Chapter 6: Reporting and Interpreting Revenue, Receivables & Cash In class: P6-5, P6-8 Assignment Due: Read Chapter 6 E6-9, E6-13, E6-23 June 21 Chapter 7: Reporting and Interpreting Cost of Good Sold and Inventory In class: P7-1, E7-5 Assignment Due: Read Chapter 7 E7-1, E7-4 June 24 Chapter 7: Reporting and Interpreting Cost of Good Sold and Inventory In Class: P7-2 Assignment Due: E7-9 June 25 Examination 2: Chapters 5, 13, 6, 7 Assignment Due: Team Project Part 1 June 26 Chapter 8: Property, Plant & Equipment, Natural Resources, & Intangibles In Class: E8-8 Assignment Due: Read Chapter 8 E8-1, E8-3 June 27 Chapter 8: Property, Plant & Equipment, Natural Resources, & Intangibles In Class: E8-17, P8-8 Assignment Due: E8-13, E8-16 June 28 Work on Team Projects: Part 2 July 1 Chapter 9: Reporting and Interpreting Liabilities In Class: P9-1, P9-2 Assignment Due: Read Chapter 9 E9-2, E9-4 July 2 Chapter 9: Reporting and Interpreting Liabilities Chapter 11: Reporting and Interpreting Owner’s Equity In Class: E11-2, E11-3, E11-4 Assignment Due: P9-4, P9-7 July 3 Chapter 11: Reporting and Interpreting Owner’s Equity In Class: P11-2, P11-3 Assignment Due: Read Chapter 11 E11-18, E11-22 July 4 Chapter 14: Analyzing Financial Statements In Class: Analyze P14-10 Assignment Due: Read Chapter 14 P14-10 July 5 Final Examination: Chapters 8, 9, 11, 14 Assignment Due: Team Project Part 2 Instructions for Team Project This project will be completed by teams of three students. This project will involve a comparison of public companies in the same industry. You will be examining annual reports of these companies using the concepts we are covering in class. This project will constitute 20% of your final course grade. As a team, you will select an industry to analyze. Use the instructions for CP1-7 on page 41 of the textbook to select the industry. Each member of the team will then select a company within that industry. Each student will acquire the annual report for the company they have chosen. Use the sources listed in the book to access the annual report (or 10-K). Two class sessions have been set aside for working on your team analysis. Prior to these classes, each student should complete the questions provided in each chapter (and listed below) and bring these answers to the team session. Successful completion of the team project is dependent upon each student completing these assignments prior to meeting as a group. Part 1: Chapters 1,2, 3, 4, 5, 13 In-Class Team Session: June 18 Complete the questions from the following problems: CP1-7 CP2-9 CP3-9 CP4-11 CP5-8 CP13-7 Each student should come prepared with the questions answered for their individual company (you do not have to write an individual report as stated in the problems). The team session is to discuss the similarities and differences in your responses and to draw conclusions about the industry. A team report should be compiled (2 to 3 pages typed) and submitted to the instructor by June 25th. Part 2: Chapters 6, 7, 8, 9, 11 In-Class Team Session: June 28 Complete the questions from the following problems: CP6-7 CP7-8 CP8-11 CP9-8 CP11-7 Each student should come prepared with the questions answered for their individual company (you do not have to write an individual report as stated in the problems). The team session is to discuss the similarities and differences in your responses and to draw conclusions about the industry. A team report should be compiled (2 to 3 pages typed) and submitted to the instructor by July 5th.