JOHNS HOPKINS UNIVERSITY

advertisement

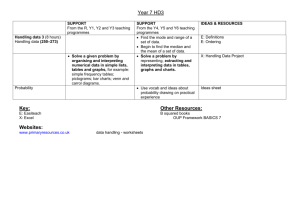

JOHNS HOPKINS UNIVERSITY CENTER FOR LEADERSHIP EDUCATION THE WILLIAM P. CAREY PROGRAM IN ENTREPRENEURSHIP AND MANAGEMENT FINANCIAL ACCOUNTING, 660.203.02, SPRING 2010 TTH 10:30-11:45am Shaffer 2 INSTRUCTOR: Annette Leps, CPA, MBA Center for Leadership Education Rm. 102, Whitehead Hall, x 7113 Email: aleps@jhu.edu Office Hours: MON 11AM to Noon TUES 1:30 to 2:30 PM WED Noon to 1PM & by appointment COURSE ASST: Megan Wei (megan.wei@jhu.edu) Office Hours: TBA COURSE DESCRIPTION: The course in Financial Accounting is designed for anyone who could be called upon to analyze and/or communicate financial results and/or make effective financial decisions in a for-profit business setting. No prior accounting knowledge or skill is required for successful completion of this course. Because accounting is described as the language of business, this course emphasizes the vocabulary, methods, and processes by which all business transactions are communicated. The accounting cycle, basic business transactions, internal controls, and preparation and understanding of financial statements including balance sheets, statements of income and cash flows are covered. REQUIRED TEXT: Libby, Libby & Short, Financial Accounting, 6th edition, 2009, McGraw-Hill/Irwin. ISBN 978-0-07352688-1. COURSE OBJECTIVES: This course seeks to provide the undergraduate business student with a foundation in financial accounting. Upon completion of this course, the student will be fully capable of analyzing basic financial statements. Specifically, a student who successfully completes this course should be capable of analyzing: a. Business transactions for proper accounting b. The accounting cycle c. Elements of profit and loss d. Financial assets, e. Inventories f. Plant assets g. Liabilities h. Changes in equity i. Cash flows STUDENT RESPONSIBILITIES & CLASS POLICIES: (1) This is a rigorous course. As such, class attendance is vital to the successful completion of this course. Students are expected to come to class having read the chapter material referenced. (2) Students are expected to take all examinations and to complete all assignments on the required dates. Conflicts or other issues must be brought to the attention of the instructor before the scheduled test time. Make-up exams may be arranged only at the discretion of the instructor and the Department. (3) Short in-class and take home quizzes covering lectures and homework materials will be given over the course of the semester. There will be no opportunity for students to make up missed quizzes. However, the two lowest quiz grades will not be used in the grade calculation. (4) This course is on WebCT. The site will be used to deliver homework solutions, special instructional information, course announcements, and other items of student interest. Please monitor the course site regularly. Individual grades will be posted on WebCT and any discrepancies must be brought to the attention of the CA for resolution before April 29, 2010. (5) It is the responsibility of the student to obtain notes and assignments from colleagues for any classes that were missed. (6) Non-graphing, non-programmable calculators are permissible for use during all exams and quizzes. (7) Calculators and the American Eagle 2006 Annual Report should be brought to class. The American Eagle Annual Report should be downloaded from the web (http://phx.corporateir.net/phoenix.zhtml?c=81256&p=irol-reportsannual) if not purchased with the textbook. (8) No Senior Options will be offered. COLLEGE POLICY REGARDING STUDENT DISABILITIES: If you have a disability that requires special testing accommodations or other classroom modifications, please present a letter from Dr. Richard Sanders (Director of Academic Advising in Arts & Sciences) stating the disability and the exact accommodations needed. I will do my best to accommodate you in any way. Please do not be shy about coming forward. ACADEMIC ETHICS The strength of the university depends on academic and personal integrity. In this course you must be honest and truthful. Ethical violations include cheating on exams, plagiarism, reuse of assignments, improper use of the Internet and electronic devices, unauthorized collaboration, alteration of graded assignments, forgery and falsification, lying, facilitating academic dishonesty, and unfair competition. Report any violations you witness to the instructor. You may consult the Associate Dean of Student Affairs and/or chairman of the Ethics Board beforehand. See the guides on “Academic Ethics for Undergraduates and Ethics Board Website (http://ethicsjhu.edu) for more information. EVALUATIONS: A 90-100 B 80-89 C 70-79 D 60-69 F Below 60 Pluses and minuses will be used at the discretion of the instructor. GRADING: Test 1 Test 2 Test 3 Final Exam Class attendance, participation, & homework quizzes Total 20% 20% 20% 30% 10% 100% SECOND CHANCE POLICY: The material for the course builds on itself; therefore, it is important to master the material from the earlier chapters to be able to understand the content of the later chapters. Given this situation, if your final exam grade is higher than your lowest test grade, the final exam grade will substitute for that test grade. In other words, the final would be weighted 50%. The weights of other tests, class participation, attendance, and homework quizzes would remain the same. The Instructor reserves the right to change topics and assignments as needed depending upon class progress. JOHNS HOPKINS UNIVERSITY FINANCIAL ACCOUNTING Date 1/26 1/28 2/2 2/4 2/9 2/11 2/16 2/18 2/23 2/25 3/2 3/4 3/9 3/11 3/16 and 3/18 3/23 3/25 Subject Ch. Exercises Financial Statements & Business Decisions Financial Statements & Business Decisions 1 E1-3 1 E1-6, E1-7, P1-1 Investing & Financing Decisions & the Balance Sheet Investing & Financing Decisions & the Balance Sheet 2 M2-4, M2-6, E2-3, P2-1, M2-3, M2-5 2 E2-5, E2-12, P2-2, M2-1, M2-2 Operating Decisions & the Income Statement Operating Decisions & the Income Statement 3 E3-2, E3-3, E3-4, E3-5 3/4 E3-6, E3-7, P3-1, P3-7 Adjustments, Financial Statements, & the Quality of Earnings Adjustments, Financial Statements, & the Quality of Earnings 4 M4-4, M4-5, M4-6, M4-7, E4-6, E4-7 4 E4-8, P4-2, E4-17, E4-18, E4-19 Communication & Interpreting Accounting Information TEST #1 (THROUGH CH.4) 5 E5-1, E5-2, E5-5, E5-6, E5-11, P5-8 Reporting & Interpreting Sales Revenue, Receivables, & Cash Reporting & Interpreting Sales Revenue, Receivables, & Cash 6 E6-1, E6-2, E6-6, E6-7 6 E6-8, E6-14, AP6-1, AP6-3 Reporting & Interpreting Costs of Goods Sold & Inventory Reporting & Interpreting Costs of Goods Sold & Inventory 7 M7-5, E7-1, E7-5, E7-9, AP7-1, M7-7, M7-8 E7-4, E7-7, E7-12,E7-14, M7-9, E7-18, E7-19 7 SPRING BREAK Reporting & Interpreting Property, Plant, & Equipment, Natural Resources, & Intangibles TEST #2 (THROUGH CH. 7) 8 M8-4, M8-5, M8-6, E8-1, E8-8, E8-2, E8-10 3/30 4/1 Reporting & Interpreting Property, Plant, & Equipment, Natural Resources, & Intangibles Reporting & Interpreting Liabilities 4/6 Reporting & Interpreting Liabilities 4/8 Reporting & Interpreting Bonds 9/10 4/13 4/15 Reporting & Interpreting Bonds Reporting & Interpreting Bonds 10 10 M10-2, M10-3, M10-6, E10-5, E10-12 M10-4, M10-5, M10-7, E10-13, E10-15, E10-16, P10-2, AP10-7 4/20 Reporting & Interpreting Owners’ Equity TEST #3 (THROUGH CH. 10) 11 M11-9, M11-10, E11-8, E11-9, E11-13, E11-21 Reporting & Interpreting Owners’ Equity Statement of Cash Flows 11 E11-18, P11-2 13 E13-1, M13-1, E13-6, E13-8, E13-13, E13-14 4/22 4/27 4/29 5/11 9am to noon CUMULATIVE FINAL EXAM 8 E8-11, E8-13, E8-16 9, p.726 E9-2, E9-4, E9-6, E9-15, E9-16, E9-18, E9-19 9 M9-7, M9-8, M9-9, M9-10, M9-11, AP9-6 E10-1, M10-2, M10-3, M10-6, E10-5, E10-12