ADVISOR INSIGHTS

Client segmentation

key to building scale

Russell High Speed Strategic Planning Program

As the financial advisory industry evolves from investment management to wealth

management, assets under management (AUM) is becoming only one metric for measuring

advisor success. Recurring revenue, efficient client service models, and the consistency in how

portfolios are designed for each client segment are all given more importance in determining

the true value of an advisor’s business.

Russell Advisory Services (RAS) works with advisors to help them build their businesses

through a more efficient process, improved client relationships and better time management.

Russell Investments believes an advisor’s time is best spent with his or her clients. By

strategically segmenting clients based on unique factors such as revenue and age, advisors

can provide unique service models to impact their efficiency and, ultimately, client satisfaction.

As part of RAS, Russell Investments offers the High Speed Strategic Planning (HSSP)

program, which is a year-long business planning and coaching program that teaches advisors

field-proven strategies which can yield remarkable results. The program helps advisors set

goals for their business and determine the strategies needed to achieve them.

Russell Investments examined annual data obtained from 41 advisory businesses from our

HSSP sessions, to determine the value of an advisor’s business, including recurring revenue

per client, revenue per decile, return on assets and revenue per client age segment1.

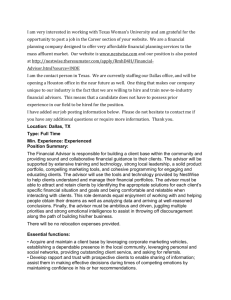

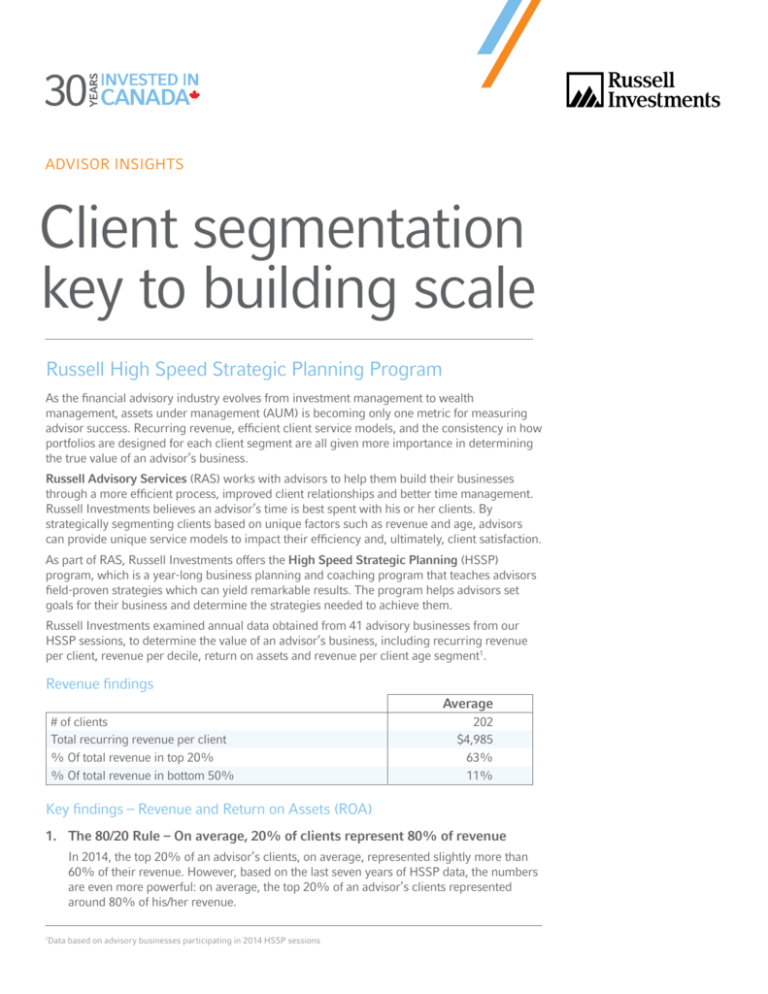

Revenue findings

Average

# of clients

Total recurring revenue per client

% Of total revenue in top 20%

% Of total revenue in bottom 50%

202

$4,985

63%

11%

Key findings – Revenue and Return on Assets (ROA)

1. The 80/20 Rule – On average, 20% of clients represent 80% of revenue

In 2014, the top 20% of an advisor’s clients, on average, represented slightly more than

60% of their revenue. However, based on the last seven years of HSSP data, the numbers

are even more powerful: on average, the top 20% of an advisor’s clients represented

around 80% of his/her revenue.

Data based on advisory businesses participating in 2014 HSSP sessions

1

Client segmentation key to building scale

2. The bottom 50% of clients represent a marginal portion of revenue

Data extracted from the last seven years of HSSP sessions show that the bottom 50%

of an advisor’s clients (based on AUM) typically represent less than 15% of his or her

revenue. In 2014, average revenue for the bottom 50% of an advisor’s book was only

11% – with one advisor who memorably had half his book represent only 2% of his

revenue spread over 55 clients.

This has implications for advisors who market themselves as focusing on high net worth

individuals. If the majority of their business is below the minimum requirement and their

biggest clients are getting less time and less service effort than their smaller clients, the impact

on their brand could be significant.

Russell Investments’ recommendations: A revenue-based segmentation approach to

clients can bring an advisory business scale, efficiency and client satisfaction. When taking on

any and all clients, advisors eventually face capacity constraints as smaller clients draw upon the

resources required to support larger, more profitable clients. An advisor’s top clients should not

have to inadvertently pay more (either in terms of fees or in lack of service) to subsidize clients

who represent a lower revenue segment. Russell Investments suggests focusing on segmenting

clients according to revenue (both current and future projected) and then creating service models

to support the various segments. After developing appropriate service models, an advisor should

then develop internal workflows to support each segment’s unique client-servicing requirements.

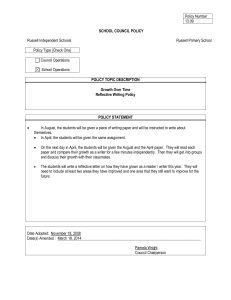

PROPORTION OF AGE AND REVENUE IN ADVISORY BOOKS

% of Clients > 71 Years

% of Clients 60 - 70 Years

% of Clients 50 - 60 Years

% of Clients 40 - 50 Years

% of Clients 30 - 40 Years

0%

5%

10%

15%

20%

Average % of Recurring Revenue

25%

30%

35%

Average % of Clients

Data based on 41 advisory businesses participating in HSSP sessions during 2014

3. 80% of clients in a typical advisor’s business are over the age of 50 and

represent more than 85% of recurring revenue

It is no surprise that the average age of clients in an advisor’s book mirrors the age of the

advisor. If the advisor is between 45-55 years of age, the average age of his clients is also

45-55 years. When we compiled the data from 41 advisor books, we found that 80% of

clients in the average advisor’s business is over the age of 50 and represents 85.1% of

recurring revenue.

4. Opportunities for recurring revenue is greatest with clients between the

ages of 50-60

When we look at the average percentage of recurring revenue in different age brackets,

the greatest amount of revenue to be gained is still from clients above 50—especially in

the 50-60 age range. In recent years, many advisors have begun to focus on millennials,

but the assets within that demographic don’t seem to justify the additional cost of bringing

on another associate.

Client segmentation key to building scale

5. Segmenting by client age can enhance profitability and client servicing

Advisors often adopt a generalist rather than a specialist mindset. Our research shows

the most successful advisors are those who focus on a target demographic and a narrow

clientele type. The fear of potentially missing out on possible assets is the number one

reason why advisors do not become specialists in their field.

Russell Investments’ recommendations: Instead of grasping at possible future

opportunities, advisors should focus on their most profitable age demographic and fine-tune

their business strategy to gain the most momentum within specific target markets. By focusing

on targeting clients within specific age groups, while implementing client service models to

support these demographics, an advisor has the potential for increased referrals.

Conclusion

The data derived from the HSSP program can help advisors understand how important it is to

segment clients by revenue and age in order to establish an efficient client-service model with

a focus on specific client types.

In the HSSP program, Russell Investments focuses on key strategies that can raise the value of

an advisor’s business:

››

››

››

››

››

››

Identify where the value lies in your client base

Create a clear client-service model for each client segment

Establish and implement a profound service level for top clients

Fully engage clients in your service model to provide a referable base

Clarify your target market

Brand your business to focus on that target market

Russell Investments has a heritage of providing more than investment solutions to wealth

advisors. We dedicate resources to bring value to advisors by helping their businesses grow

and become more successful. Considering the actions advisors need to take to improve their

business is easy, implementing and acting on them is hard. We work with advisors across

Canada on a daily basis to help them adapt to an ever-changing environment and position

themselves for success in the long term.

By building client relationships to an expert level and engaging clients through a profound service

level, an advisor’s business can shift from stagnation to regularly receive client referrals.

For more information please call 1-888-509-1792 or visit us at www.russell.com/ca

Important information

Nothing in this publication is intended to constitute legal, tax securities or investment advice, nor an opinion regarding the

appropriateness of any investment, nor a solicitation of any type. This information is made available on an “as is” basis. Russell

Investments Canada Limited does not make any warranty or representation regarding the information.

Russell Investments Canada Limited is a wholly owned subsidiary of Frank Russell Company and was established in 1985. Russell

Investments Canada Limited and its affiliates, including Frank Russell Company, are collectively known as “Russell Investments”.

Russell Investments, is a trade name and registered trademark of Frank Russell Company, a Washington USA corporation, which

operates through subsidiaries worldwide and is part of the London Stock Exchange Group. It is used under a license by Russell

Investments Canada Limited.

Copyright © Russell Investments Canada Limited 2015. All rights reserved.

Date of first publication: October 2015

RETAIL-2015-09-03-1421 [EXP-09-2016]