A Study Of Financial Analysis Of MRF Ltd.

advertisement

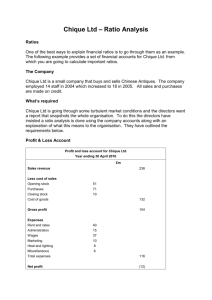

A Study of Financial Analysis of MRF Ltd. Pramod Prabhakar Kamble* Abstract : Finance is considered as life blood of business enterprise. Finance is one of the basic foundations of all kinds of economic activities. The success and survival of any organization depends upon how efficiently it is able to raise funds as and when needed and their proper utilization. The object of the present study is to analysis the financial performance of MRF Limited, India. The financial analyses help to understand how management is efficient in procuring and utilizing the funds. An attempt is made in the present study to analyze whether an entity is stable, solvent, liquid, or profitable enough to be invested in. MRF limited is leading company in Tyre Manufacturing sector. The finding of the study helps the prospective investors in taking investment decision. Keywords: financial analysis, MRF Ltd Tyre sector, ratio analysis Introduction: Indian tyre industry has shown a decent growth over past few years. At present there were 39 tyre manufacturing companies operating its business through its 60 plants in India. The industry reported a turnover of Rs.43,000 crores and export of Rs. 4,800 crores during the financial year 2011-12. The top 10 tyre companies accounted 95% turnover. MRF Ltd, originally known as Madras Rubber Factory is leading tyre manufacturing company in India was established in the year 1946 by K M Mammen Mappillai, The company is primarily engaged in the manufacture of rubber products, such as tyres, tubes, flaps, tread rubber and conveyor belt.MRF is the first Indian company which exports tyres to USA in 1967, Now it exports to more than 65 countries in USA, Europe, Middle East Japan and Asia Pacific.The manufacturing units of the company are located at Tiruvottiyur and Arakonam in Tamil Nadu, Kottayam in Kerala, Ponda in Goa, Medak in Andhra Pradesh and Union Territory of Pondicherry. __________________________________ *Assistant Professor, Department of Commerce, Sahakarbhushion S.K.Patil College,Kurundwad, Tal.:Shirol, Dist.: Kolhapur, E-Mail: pp6.k@rediffmail.com Objectives: 1. 2. 3. 4. To analysis profitability of MRF Ltd. To analysis liquidity of the MRF Ltd. To analysis operational efficiency To study the growth of the company. Statement of Problem: The present study is entitled as “A Study of Financial Analysis of MRF Ltd.,” The study is basically of diagnostic nature to measure the various facts of financial management viz.: 1liquidity, profitability, efficiency etc. Scope of the Study The scope of the present study is confined to financial analysis of MRF Ltd, India. The emphasis is given to analysis financial performance in terms of liquidity, profitability, leverage and efficiency. The period covered in the study is of last 10 years. The study is limited to MRF Limited, India only. Research Methodology The present study, entitled as “Study of Financial Analysis of MRF Ltd” is a case study. The present study is mainly based on the secondary data which is collected from the published annual reports of the MRF Ltd., books, journals and various websites. For the purpose of financial analysis financial ratios have been employed. Data Analysis In the present study an efforts have been made to analysis financial position of the concern by careful study of revenues, sales, profits, net worth and other elements from the financial statements and financial ratio analysis. The relation between two or more accounting figures/groups is called a financial ratio. A financial ratio helps to express the relationship between two accounting figures in such a way that users can draw conclusions about the performance, strengths and weakness of a firm TEN YEARS FINANCIAL SUMMARY (Rs. in Crore) 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 13444.75 13054.03 10637.03 8080.45 6141.94 5715.52 5036.75 4233.66 3437.13 2989.43 37.40 39.73 33.14 29.13 34.40 40.83 24.17 27.07 44.96 58.54 13482.15 13093.76 10670.17 8109.58 6176.34 5756.35 5060.92 4260.73 3482.09 3047.97 Profit Before Taxation 1226.80 833.12 893.65 534.66 398.48 211.39 260.96 99.81 55.34 42.90 Provision for Taxation 424.59 260.76 274.23 180.68 145.45 66.83 89.18 19.90 15.03 14.10 Profit after Taxation 802.21 572.36 619.42 353.98 253.03 144.56 171.78 79.91 40.31 28.80 4.24 4.24 4.24 4.24 4.24 4.24 4.24 4.24 4.24 4.24 3640.90 2853.56 2293.53 1686.44 1357.18 1116.55 981.91 820.05 749.81 719.17 Sales Other Income Total Income Share Capital Reserves Net Worth Fixed Assets Gross 3645.14 2857.80 2297.77 1690.68 1361.42 1120.79 986.15 824.29 754.05 723.41 5834.14 5477.16 4967.07 3865.62 3020.57 2866.24 2289.77 1955.99 1787.85 1534.47 As shown in above table MRF Ltd. has shown tremendous growth in the last 10 years. Let see these in the chart to have clear idea of growth 1. Sales 2009 13444.75 2008 8080.45 6141.94 2005 5036.75 2004 5715.52 4000 3437.13 6000 2989.43 8000 4233.66 10000 2012 2013 10637.03 14000 12000 13054.03 Sales 2000 0 2006 2007 2010 2011 As shows in the above chart the sales of Mrf Ltd have continuously increased in the last 10 years. At the end of 2004 it was Rs. 2989.43 crores which went to Rs. 13444.75 crore in 2013. In terms of percentages it has increased 450% approximately during the last 10 years. 2. Profit Before Taxation 1226.8 Profit Before Taxation 2004 2005 2006 211.39 99.81 200 55.34 400 42.9 600 260.96 800 2007 2008 398.48 1000 534.66 1200 833.12 893.65 1400 0 2009 2010 2011 2012 2013 Profit before taxation of MRF Ltd. has increased exceptionally well during the last 10 years. It was Rs. 42.90 crore in 2004 which is reached to 1226.80 crore in 2013. 3. Net Worth 3645.14 Net Worth 754.05 824.29 2004 2005 2006 1500 1000 1690.68 986.15 723.41 2000 1120.79 2500 1361.42 3000 2857.8 3500 2297.77 4000 500 0 2007 2008 2009 2010 2011 2012 2013 The net worth has increased from 723.41 crore to 3645.14 crores during the last 10 years. The rate of increased is 504% approximately. 4. Reserves 981.91 1116.55 2004 2005 2006 2007 2008 3640.9 2853.56 1686.44 820.05 1000 749.81 2000 719.17 3000 1357.18 4000 2293.53 Reserves 0 2009 2010 2011 2012 2013 As shown in the above chart the reserve of MRF Ltd. has shown increasing trend during the last 10 years. It was 3640.90 in 2013 as against 719.17 crore in 2004. Share Holding Pattern in % Promoter DEC' 13 SEP' 13 JUN' 13 MAR' 13 27.32 27.30 27.27 27.21 FII DII Others 5.57 10.92 56.19 4.54 11.03 57.13 4.60 10.85 57.28 4.33 10.74 57.72 Source: www.moneycontrol.com RATIO ANALYSIS: A financial ratio helps to express the relationship between two accounting figures in such a way that users can draw conclusions about the performance, strengths and weakness of a firm.It is an important tool of financial analysis. There are various types of ratios. These ratios can be grouped into various classes according to financial activity or function be evaluated. In view of the requirement of various interest groups, in the present study the ratios are classified into following important categories: A) LIQUIDITY RATIOS Liquidity means ability of the business to meet its short term obligations, usually a period of one year. Liquidity is a prerequisite for the survival of the firm. The short term creditors of the firm are interested in the short term solvency or liquidity of a firm. But liquidity implies, from the view point of utilization of the funds of the firm, that the funds are ideal or they earn a very little. A proper balance between two contradictory requirements, that is, liquidity and profitability, is required for efficient financial management. The liquidity ratios measure the ability of a firm to meet its short term obligations and reflect the short term financial strength/solvency of a firm. The liquidity position of the MRF Ltd., Current Ratio, Quick Ratio, Debt Equity Ratio and Long Term Debt Equity Ratio has been calculated as follows: Liquidity And Solvency Ratios Sep 2013 Sep 2012 Current Ratio 2.01 1.80 Quick Ratio 1.24 1.00 Total Debt Equity 0.44 0.60 Interest Cover 7.26 6.25 Source :Annual Report of MRF Ltd and www. money.livemint.com 1) CURRENT RATIO Current ratio is the ratio of current liabilities and current assets. A current ratio measure the ability of the firm to meet its current liabilities. It indicates the rupee of current assets available for each rupee of current liability. A current ratio of 2:1 has been considered satisfactory. Generally the level of current ratio may vary from industry to industry depending on specific industry characteristics. As shows in the table above the current ration of MRF Ltd is 2.01 :1 at the end of last financial year as against 1.80:01 of previous year. It shows the company has kept the current assts level optimally. It has positive impact on the profitability. However the current ratio below 1 is not satisfactory for short term solvency position. Further it is not mush fluctuated during the last five years. It say the company has stick with its policy of working capital management. 2) QUICK RATIO The quick ratio indicates the relation of quick assets with current liabilities. Quick or liquid assets include all current assets except stock and prepaid expenses. Quick ratio measures the extent to which liquid resources are immediately available to meet current obligations. This ratio is a better test of financial strength as it gives no consideration to inventory which may be very slow. Generally, a quick ratio of 1:1 is considered to represent a satisfactory current financial condition. The table above indicates the quick ratio if MRF Ltd. is 1.24:1 as against 1:1. It means the company has enough liquid asset to meet short term liabilities. The short term liquidity position of the concern is satisfactory. 3) TOTAL DEBT–EQUITY RATIO The debt-equity ratio indicates the proportion of borrowed capital to the net worth. Generally 2:1 debtequity is considered to be satisfactory. A very high ratio is unfavorable from firms’ point of view. The debt-equity ratio indicates margin of safety to the creditors against possible losses in the events of liquidation. This ratio is also important for judging the financial policy of the management. An organization having stable profit can afford to operate on a relatively high debt-equity ratio. Too much reliance on external equities may indicate under capitalization where too much reliance on the internal equities may lead to over capitalization. The above table shows the debt equity ratio of MRF Ltd. is 0.44:1 at the end of financial year Sept.2013 and 0.60:1 on the previous year. It indicates that the company is not much relied on borrowed capital to finance its activities. It further strengthens the capital structure of the company. It raises the creditworthiness of the company and it further strengthen the liquidity position of the company B) PROFITABILITY RATIOS The profitability ratios measure the profitability and operational efficiency of the firm. These ratios reflect the final results of business operations. Profitability ratios can be determined on the basis of either sales or investments. The profitability ratios in relation to sales are a) profit margin (gross and net) ratio b) expenses ratio. Profitability in relation to investments is measured by a) return on assets b) return on capital employed C) return on shareholders’ equity. For the present study following profitability ratios has been calculated in order to serve the object: Profitability Ratios Sep '12 Sep '11 Gross Profit Margin(%) 11.89 8.68 Net Profit Margine (%) 5.96 4.38 1892.00 1349.91 ROA(%) 10.37 8.45 ROE(%) 24.67 22.20 ROCE(%) 29.01 23.44 Earnings Per Share 1) GROSS PROFIT MARGIN/ RATIO Gross profit margin is also known as gross margin. It is calculated by dividing gross profit by sales. Gross profit is the result of the relation between prices, sales volume and costs. A change in the gross margin can brought about by change in any of those factors, the gross margin represents the limit beyond which fall in sales prices are outside the tolerance limit. A high ratio of gross profit to sales is the sign of good management as it implies that the cost of production of the firm is relatively low. It may also be indicative of a higher sales price without a corresponding increase in the cost of goods sold. A relatively low gross margin is definitely a danger single, warranting a careful and detailed analysis of the factor responsible for it. Therefore a firm should have a reasonable gross profit margin to ensure adequate coverage for operating expenses of the firm and sufficient return to the owners of the business. There is substantial increase in the gross profit ration of MRF Ltd in the last two years. It was 8.68% in Sept. 2012 which is raised to 11.89% in Sept. 2013. It shows the profitability of the concern has increased. 2) NET PROFIT RATIO MARGIN/RATIO It is also known as net margin. This measures the relationship between net profits and sales. Net profit is that proportion of net sales which is remained to the owners or the shareholders after all costs; charges and expenses including income tax have been deducted. The net profit margin is indicative of management’s ability to operate business with sufficient success not only to recover from revenues of the period, the cost of merchandise or services, the expenses of operating the business (including depreciation) and the cost of borrowed funds, but also leave a margin of reasonable compensation to the owners for proving their capital at risk. The ratio of net profits to sales essentially the cost price effectiveness of the operation. The ratio of net profit margin of MRF Ltd. was 5.96% at the end of last financial year as against 4.38% in the previous year. As compared the other firms in the industry it is much better. 3) EARNING PER SHARE: The market value of the concern is much affected by the earning per Generally with the increase in the earning per share the market value of the share also increases. Hence the shareholders are interested to known earning per share. The earnings per share of MRF Ltd. was Rs.1892 by the end of last financial year. It is much better than the other companies in India. 4) RETURN ON ASSETS Return on the asset is another indicator of the company’s profitability. It calculated by dividing the company’s annual earnings by its total assets. It shows how efficiently the management has used the assets of the company. ROA of MRF Ltd was 10.37% at the end of last financial year as against 8.45% in the previous year. 5) RETURN ON SHAREHOLDERS EQUITY Return on equity measures the profitability of equity funds invested in the firm. This ratio revels how profitability of the owners’ fund have been utilized by the firm. The realization of a satisfactory net income is the major objective of a business and the ratio shows the extent to which this objective is being achieved. If the ratio is higher they feel confident and encouraged to invest in the company. The effect of such high ratio will be reflected in the market price of the shares of the company. The Return on equity of MRF Ltd is 24.67 at the end of last financial year. It was 22.20 at the end of previous financial year. It is profitable and it would possible for the company to raise finance from external sources and even through public deposits. 6) RETURN ON CAPITAL EMPLOYED ROCE indicates how much return/ profits the company earned on the capital employed. It is calculated by dividing earnings before interest and tax by capital employed. A higher ROCE indicates more efficient use of capital. ROCE should be higher than the company’s capital cost; otherwise it indicates that the company is not employing its capital effectively and is not generating shareholder value. ROCE of MRF Ltd. is 29.01% at the end of last financial year. C) EFFICIENCY RATIOS Efficiency ratios analyses how well a company uses its assets and liabilities internally. These ratios are also called turnover ratios or activity ratios because they indicate the speed with which assets are being converted or turned over into sales. Efficiency ratios, thus, involve a relationship between sales and assets. A proper balance between sales and asserts generally reflects that assets are managed well. Several activity ratios can be calculated to judge the effectiveness of asset utilization. For the present study following activity ratios are calculated: . Efficiency Ratios Sept.2013 Sept.2012 Inventory Turnover Ratio 7.49 7.94 Debtors Turnover Ratio 8.65 8.58 Fixed Assets Turnover Ratio 4.04 3.92 Total Assets Turnover Ratio 1.62 1.81 1) INVENTORY TURNOVER RATIO This ratio indicates the efficiency of the firm in producing and selling its products. It is calculated by dividing the cost of goods sold by the average inventory. The inventory or stock turnover ratio measures how quickly inventory is sold. It is the test of efficient inventory management. In general, a high inventory ratio is better than a low ratio. A high ratio implies good inventory management. However, it may be of underinvestment in, or very low level of inventory. Similarly, a very low inventory turnover ratio is dangerous. It signifies excessive inventory or overinvestment in inventory. Thus a firm should have neither too high nor too inventory turnover. Inventory turnover ratio of MRF Ltd. is 7.49:1 at the end of Sept.2013 as compared to 7.94:1 in the previous year. 2) DEBTORS TURNOVER RATIO The debtors’ turnover ratio shows how quickly receivables or debtors are converted into cash. These throw light on the collection and credit policies of the firm. Debtor’s turnover ratio is found out by dividing credit sales by average debtors. At the end of last financial year the debtor’s turnover ratio of MRF Ltd was 8.65:1 and 8.58:1 in previous year. 3) FIXED ASSETS TURNOVER RATIO This ratio helps to know the efficiency of management in using the fixed assets. It is calculated by dividing sales to fixed assets. This ratio is an important measure of the efficiency and profit earning capacity of the business. A high ratio indicates efficiency in utilizing the fixed assets while a low ratio suggest idle capacity and excessive investment in fixed assets. Fixed Asset turnover ratio of MRF Ltd. was 4.04 and 3.92. It means the efficiency of utilizing fixed assets have increased. 4) TOTAL ASSETS TURNOVER RATIO Assets are used to generate sales. Therefore, a firm should manage its assets efficiently to maximize sales. The relationship between sales and total assets is called as total assets turnover ratio. This ratio shows the firm’s ability in generating sales from all financial resources committed to total assets. Total assets include net fixed and current assets. The ratio indicates the sales generated per rupee of investment in total assets. This ratio indicates the efficiency in use of total assets. Higher ratio indicates that more revenue is generated per rupee of total investment in the assets. The total asset turnover ratio of MRF Ltd was 1.61:1 at the end last financial year. Considering the industry standard it is satisfactory. It means the MRF Ltd. has efficiently utilized its assets. Conclusion: MRF tyre is a leading brand in the tyre industry in India. The financial position of MRF Ltd. is sound. The liquidity position, short term solvency position and profitability is satisfactory. The progress made by the company during the last 10 years is exceptionally well. The company is growing speedily. Recently MRF won the silver award and is the only Indian company to win this excellence award. References: Pande I. M. :“Financial Management” , Vikas Publishing House Pvt.Ltd., New Delhi. Pransanna Chandra: “Financial Management”, Tata McGraw Hill Publishing Co. Ltd., Annual Reports of MRF Ltd. www.mrftyres.com www.moneycontrol.com/india/stockpricequote/tyres/mrf/MRF www.money.livemint.com/