Ratio - Teachmebusiness.co.uk

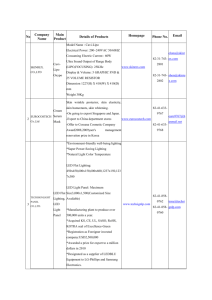

advertisement

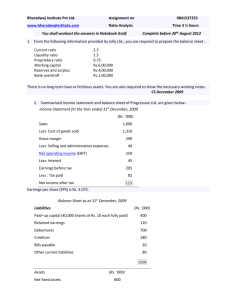

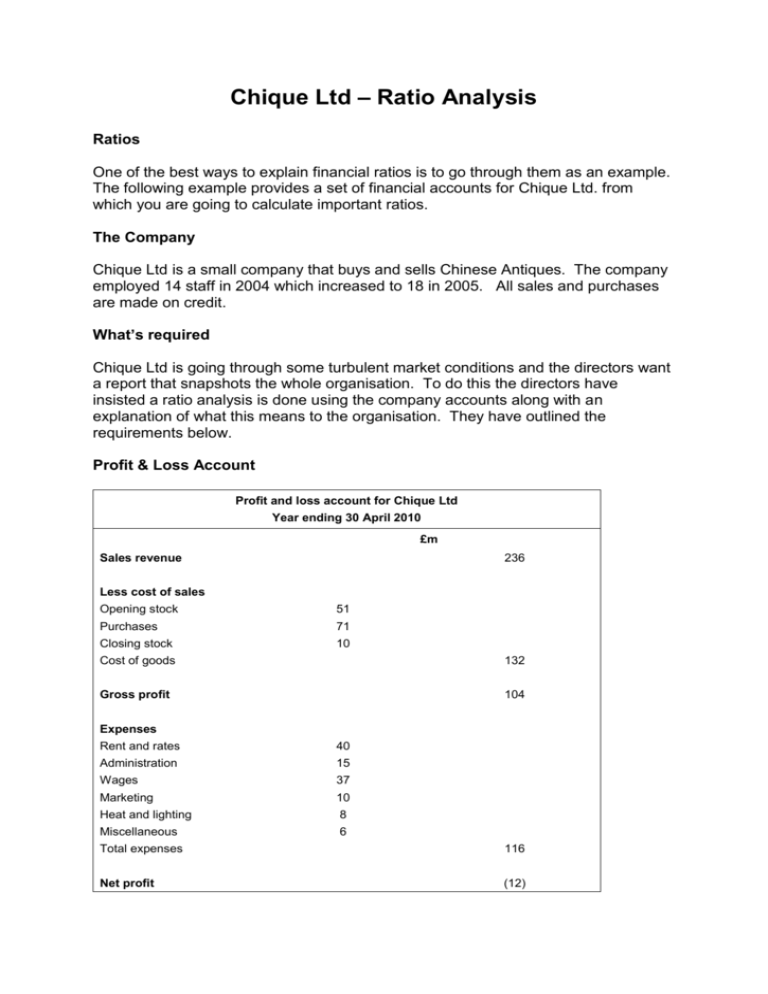

Chique Ltd – Ratio Analysis Ratios One of the best ways to explain financial ratios is to go through them as an example. The following example provides a set of financial accounts for Chique Ltd. from which you are going to calculate important ratios. The Company Chique Ltd is a small company that buys and sells Chinese Antiques. The company employed 14 staff in 2004 which increased to 18 in 2005. All sales and purchases are made on credit. What’s required Chique Ltd is going through some turbulent market conditions and the directors want a report that snapshots the whole organisation. To do this the directors have insisted a ratio analysis is done using the company accounts along with an explanation of what this means to the organisation. They have outlined the requirements below. Profit & Loss Account Profit and loss account for Chique Ltd Year ending 30 April 2010 £m Sales revenue 236 Less cost of sales Opening stock 51 Purchases 71 Closing stock 10 Cost of goods 132 Gross profit 104 Expenses Rent and rates 40 Administration 15 Wages 37 Marketing 10 Heat and lighting 8 Miscellaneous 6 Total expenses 116 Net profit (12) Balance Sheet Balance sheet for Chique Ltd on 30 April 2010 £m Fixed Assets Premises 12 Fixtures and fittings 8 Machinery 10 Vehicles 5 35 Current Assets Stock 10 Debtors 53 Cash in bank 49 Cash in hand 14 126 Current Liabilities Overdraft 29 Creditors 20 49 Working capital 77 Long term liabilities Bank loan 1 1 Assets employed 112 Financed by: Shares 61 Retained profit 51 Capital employed 112 Task 1 Using the profit and loss account and the balance sheet for Chique Ltd that you completed in Activity sheets 8 and 9, help the owner of the business interpret the results by completing the table below. Ratio Liquidity Current ratio Acid test Calculation Interpretation Profitability Gross profit percentage Net profit percentage Return on capital employed Performance (efficiency) Stock turnover Debtors’ collection period Asset turnover Task 2 Now you have calculated the ratios for Chique Ltd you are required to explaining the meaning and findings of each of these ratios. Answer the points below about each ratio category. a. Liquidity. What does the ratio show? What is the significance of this? What level of risk is Chique Ltd. under (hi or low) are how does this ratio demonstrate this. Make suggestions as to how Chique Ltd might improve its liquidity. b. Profitability. What does each of the ratios mean about the profitability of Chique Ltd. What is the relationship between gross and net profit ratios i.e. how could a price cut, reduce gross profit yet increase net profit? Why is ROCE of such importance within business? c. Financial Efficiency. What does each of the ratios mean. Explain how the company can improve each one and what the costs might of this. What is the problem of aged debtors and aged stock? Task 3 Write a short recommendation section to the board of directors of Chique Ltd. on what the company should be doing both in the short and long term to help all aspects outlined above.