BNY MELLON GLOBAL FUNDS, PLC

AS AT 31 JANUARY 2016

BNY MELLON PAN EUROPEAN EQUITY

FUND

INVESTMENT MANAGER

Newton Investment Management:

Newton pursues a distinctive global

thematic investment approach and

provides added value from

extensive proprietary research.

INVESTMENT OBJECTIVE

Long-term capital growth by investing in shares (i.e. equities)

and similar investments of companies listed or located in

Europe including the UK.

GENERAL INFORMATION

Total net assets (million)

Benchmark

Sector

Fund type

Fund domicile

Fund manager

Base currency

Fund launch

Financial year end

EUR 45.57

FTSEurofirst 300 TR

Lipper Global - Equity Europe

ICVC

Ireland

Paul Markham

EUR

23 Nov 2000

31 Dec

USD A SHARE CLASS DETAILS

Inception date

Min. initial investment

Annual mgmt charge

Max. initial charge

ISIN

Bloomberg

NAV

10 Dec 2001

USD 5,000

2.00%

5.00%

IE0004148163

MELUGA1

USD 1.6722

FUND STATISTICS - 3 YEARS

Jensen Alpha

Beta

Correlation

Annualised Information Ratio

Annualised Sharpe Ratio

Annualised Tracking Error

R²

Annualised Standard Deviation

Maximum Drawdown

VaR Normal 95%

-0.10

0.82

0.96

-0.30

-0.07

4.21

0.92

11.85

-18.71

-5.70

IMPORTANT INFORMATION FOR HONG KONG INVESTORS

The Fund may invest in emerging markets. Emerging markets have additional risks associated with less

developed market infrastructures, may be more susceptible to political and economic risks, and tend to be

more volatile and less liquid.

The Fund can invest in overseas securities which means the Fund is exposed to changes in currency rates

which could affect the value of the Fund

The Fund may use financial derivatives instruments for efficient portfolio management purposes.

Derivatives involve a level of risk.

Investment in the Fund may decline in value and investors may potentially sustain a total loss of their

investment in the Fund.

Investors should not rely solely on this document to make investment decision. Please read the offering

documents carefully for further details including risk factors.

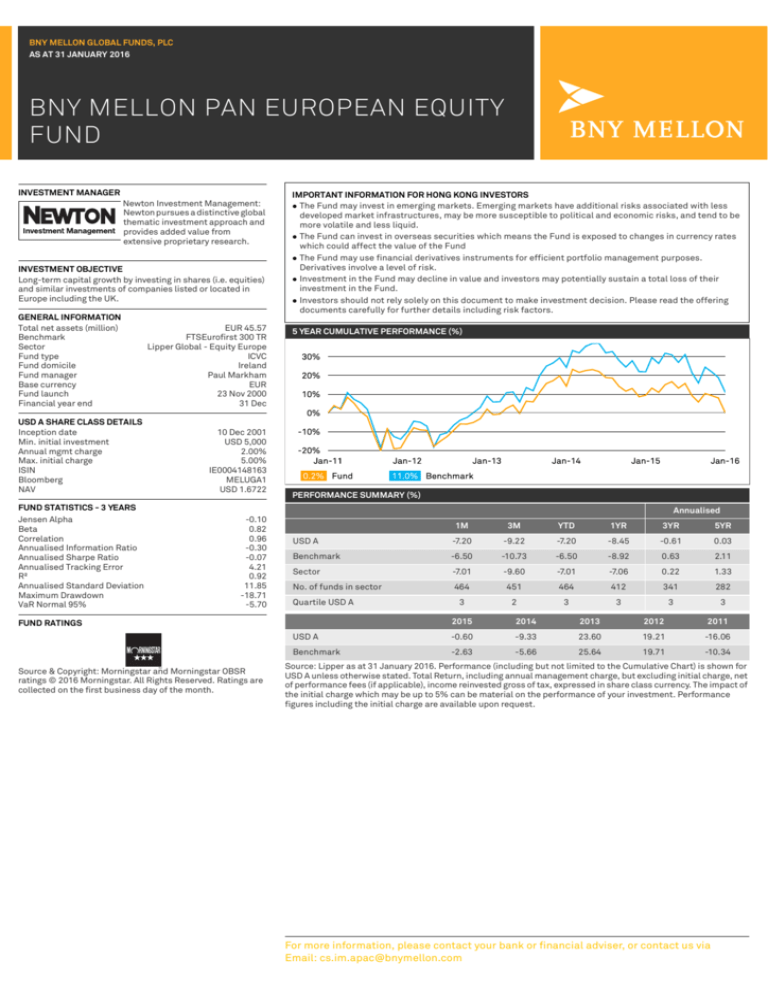

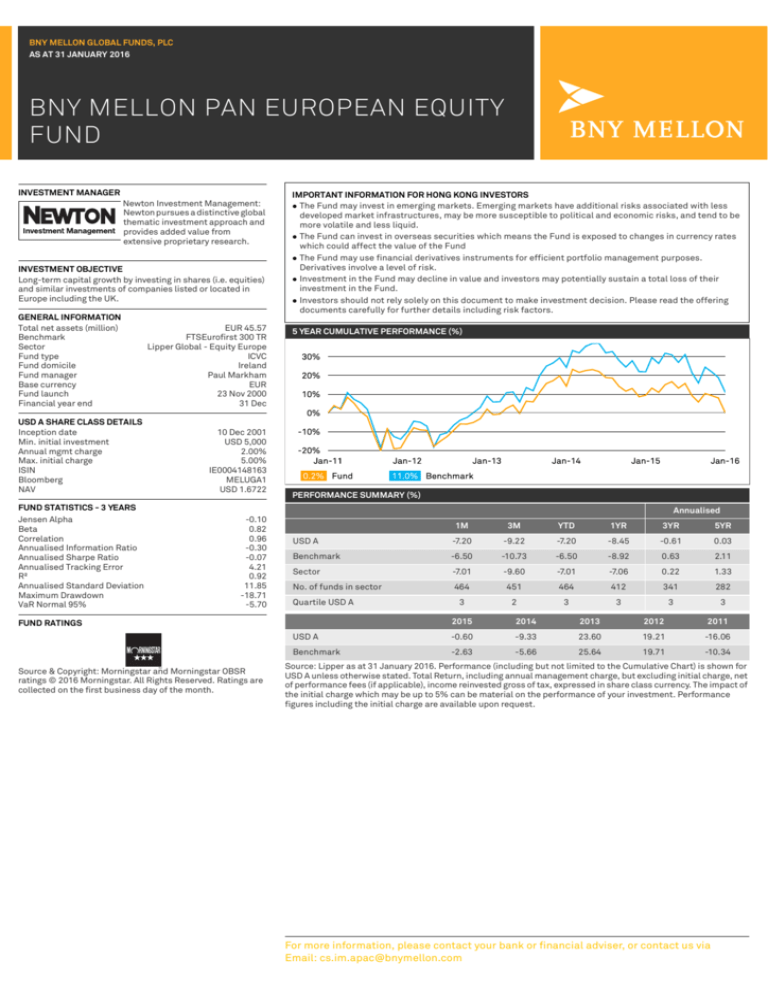

5 YEAR CUMULATIVE PERFORMANCE (%)

PERFORMANCE SUMMARY (%)

Annualised

1M

3M

YTD

1YR

3YR

5YR

USD A

-7.20

-9.22

-7.20

-8.45

-0.61

0.03

Benchmark

-6.50

-10.73

-6.50

-8.92

0.63

2.11

Sector

-7.01

-9.60

-7.01

-7.06

0.22

1.33

No. of funds in sector

464

451

464

412

341

282

3

2

3

3

3

3

Quartile USD A

2015

2014

2013

2012

2011

USD A

-0.60

-9.33

23.60

19.21

-16.06

Benchmark

-2.63

-5.66

25.64

19.71

-10.34

FUND RATINGS

Source & Copyright: Morningstar and Morningstar OBSR

ratings © 2016 Morningstar. All Rights Reserved. Ratings are

collected on the first business day of the month.

Source: Lipper as at 31 January 2016. Performance (including but not limited to the Cumulative Chart) is shown for

USD A unless otherwise stated. Total Return, including annual management charge, but excluding initial charge, net

of performance fees (if applicable), income reinvested gross of tax, expressed in share class currency. The impact of

the initial charge which may be up to 5% can be material on the performance of your investment. Performance

figures including the initial charge are available upon request.

For more information, please contact your bank or financial adviser, or contact us via

Email: cs.im.apac@bnymellon.com

BNY Mellon Pan European Equity Fund: As at 31 January 2016

GEOGRAPHICAL ALLOCATION (%)

INDUSTRIAL ALLOCATION (%)

TOP 10 HOLDINGS (%)

ACTIVE MONEY (%)

Fund

Top overweight

ACTIVE MONEY (%)

Fund

Benchmark

Fund

Benchmark

17.6

7.0

Financials

15.6

21.5

Technology

5.2

3.7

Consumer Goods

17.9

21.2

Health Care

14.5

13.5

Oil & Gas

3.8

6.8

3.5

Basic Materials

4.3

6.1

3.4

Utilities

2.6

4.2

Nestle SA

3.8

Consumer Services

Vodafone Group PLC

3.7

LEG Immobilien AG

3.5

Prudential PLC

Wolters Kluwer NV

Novartis AG

3.3

Bayer AG

3.2

Roche Holdings AG

3.0

Anheuser-Busch InBev NV

2.9

BG Group PLC

2.9

Top underweight

Source: BNY Mellon Investment Management EMEA Limited

Portfolio holdings are subject to change, for information only and are not investment recommendations.

IMPORTANT INFORMATION

This material is for retail investors and is not intended as investment advice. Investment involves risk. Past performance is not a guide to future performance. The offering documents

and the Key Facts Statements (KFS) should be read before an investment is made.

All information has been prepared by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA, formerly named BNY Mellon Asset Management International Limited).

BNYMIM EMEA and its affiliates are not responsible for any subsequent investment advice given based on the information supplied. This document may not be used for the purpose

of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorised. This document should not be published in hard

copy, electronic form, via the web or in any other medium accessible to the public, unless authorised by BNYMIM EMEA to do so. No warranty is given as to the accuracy or

completeness of this information and no liability is accepted for errors or omissions in such information.

The Fund is a sub-fund of BNY Mellon Global Funds, plc (BNY MGF), an open-ended umbrella type investment company with variable capital (ICVC) and segregated liability between

subfunds, incorporated with limited liability under the laws of Ireland. It qualifies and is authorised in Ireland by the Central Bank of Ireland (CB) as an undertaking for collective

investment in transferable securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 (SI. No. 352 of 2011).

ICVC investments should not be regarded as short-term and should normally be held for at least five years. The Fund may not be registered for sale in some markets.

In Hong Kong, this document is issued by BNY Mellon Investment Management Hong Kong Limited which is regulated by the Hong Kong Securities and Futures Commission. This

document has not been reviewed by the Hong Kong Securities and Futures Commission.

BNYMIM EMEA and BNY Mellon Investment Management Hong Kong Limited are ultimately owned by The Bank of New York Mellon Corporation.

AP1056-10-03-2015(13M)