PineBridge Global Dynamic Asset Allocation Fund

advertisement

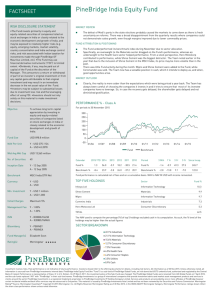

PineBridge Global Dynamic Asset Allocation Fund Alt ern ativ es Q4 2015 y Equit EQUITIES | FIXED INCOME | MULTI-ASSET Fixed e Incom Important Note The Fund adopts an asset allocation strategy, varying from time to time the combination of developed countries and emerging market equity securities, debt and money market securities, collective investment schemes and the other types of investments in order to complement the Manager’s forward views. The Fund may be exposed to additional risks (e.g. asset allocation, emerging markets, equity, fixed income, collective investment schemes, market volatility risks, currency, country selection/concentration, investment in Russia, Eurozone debt crisis and sovereign debt risks, etc.) The Fund may use financial derivative instruments (“FDI”) for efficient portfolio management (including hedging) and for investment purposes but will not extensively use for any purpose. Dividends, if any, may be paid out of capital of the Fund at the discretion of the Manager. This amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment and may result in an immediate decrease in the net asset value of the Fund. Investors may be subject to substantial losses due to investment loss risk and the leveraging effect of using FDI. Investors should not rely solely on this material to make investment decisions. Why PineBridge Global Dynamic Asset Allocation Strategy? Equity-like return with lower volatility Through investing across assets with different growth and volatility characteristics, the Strategy aims to deliver equity-like return by capturing short-term market opportunities and long-term fundamental trends, whilst manage downside risk during times of market stress. Risks and Return of the Strategy and Different Asset Classes over the past 10 Years1 Return (Annualized) US Equities US Bonds 4 Global Balanced Global Equities Global Bonds 2 Multiple sources of return by investing across different assets with an aim to achieve outperformance Unconstrained and flexible allocation of assets to mitigate risk in difficult market conditions A global team of dedicated 18 multi-asset experts with an average of 15 years’ experience, backed by over 220 investment professionals across Equity, Fixed Income and Alternatives3 % 8 6 Fund Highlights Emerging Markets Equities Award-winning team in managing multi-asset strategy 0 Having launched for over a decade, the Strategy is now managed by a global team of 18 dedicated multi-asset professionals 3. The Team’s intermediate-term and fundamental-driven investment approach is well recognised in the industry. Volatility (Annualized Standard Deviation) Source: eVestment Alliance, as of 31 December 2015. Dynamic asset allocation to navigate up and down market Our benchmark-unconstrained approach allows us to dynamically adjust the asset allocation to capture multiple sources of growth potential and manage volatility in different market conditions. Institutional Investor U.S. Investment Management Awards 2015 Global Balanced/Tactical Asset Allocation Manager of the Year4 Asset Type Traditional Equities Traditional Fixed Income Strategic Asset/Alternatives (e.g. private equity, real estate and infrastructure) Cash Global Investor Investment Excellence Awards 2014 Global Multi-Asset Manager of the Year5 % of allocation 0–75% 0–75% 0–25% 0–45% The listed % of asset allocation is indicative and may subject to change. Composition of PineBridge Global Dynamic Asset Allocation Strategy (January 2007–December 2015)2 Benchmark Fund of The Year Awards 2015 Manager Awards – Investment Manager of the Year (MPF), Best-In-Class in Aggressive Allocation7 Percentage of Share 100% 80% 60% 40% 20% 0% Bloomberg Businessweek (Chinese edition) Top Fund Awards 2015 Outstanding Performer (MPF) Since Inception Date in Aggressive Allocation6 06 12 2007 06 12 2008 Equity 06 12 2009 06 12 2010 06 12 2011 Fixed Income 06 12 2012 06 12 2013 Alternatives Source: PineBridge Investments, as of 31 December 2015. 06 12 2014 06 12 2015 Cash PineBridge Global Dynamic Asset Allocation Fund Objective To seek long-term capital appreciation by identifying new and changing worldwide economic and investment trends and investing in assets in developed countries and Emerging Markets Primary Benchmark8 40% Citigroup WorldBIG Non MBS / 60% MSCI World DTR Net (See footnote) Secondary Benchmark9 LIBOR + 5% over rolling 5 year period Inception Date 9 December 2003 (Class A) Fund Size USD 688.3 million No. of Securities 1,806 NAV Per Unit USD 19.8013 (Class A) Min. Investment USD 1,000 Management Fee 1.30% p.a. (Class A) ISIN IE0034235295 Strategy Allocation* Equity - 63.4% 20.8% 20.1% 6.9% 6.4% 4.5% 4.3% 0.3% 0.1% Europe ex-UK Equity Japan Equity US Sm Cap Equity US Value Equity India Equity Mexico Equity EM Asia Equity Other Equity Fixed Income - 17.7% Bank Loans High Yield Bonds EM Sovereign Debt Contingent Convertibles US Corporate Credit Alternatives - 9.6% 3.6% 2.0% 2.0% 2.0% Parity Bond Infrastructure Commodities Private Equity Others - 9.3% 9.3% Bloomberg PBIBALA Domicile/Dealing Ireland/Daily Fund Managers Michael Kelly | Joined 1999 Managing Director, Global Head of Multi-Asset Cash and Equivalents *The Fund offers investors globally a convenient way to access PineBridge’s Global Dynamic Asset Allocation (GDAA) strategy. As of 31 December 2013, this Fund was configured for Diversified Growth by naming it - Global Dynamic Asset Allocation, adding instruments (Derivatives, Absolute Return, Real Estate/Property, Infrastructure, Commodity, Currency and Dynamic Futures exposures) and an absolute return hurdle (LIBOR + 5% over 5 years). Prior to this, the vehicle was a Balanced Fund which consisted of a global equity allocation, a global bond allocation, and very small tactical adjustments between these two sleeves; the vehicle was launched in 1991. Jose R. Aragon | Joined 2003 Portfolio Manager, Global Multi-Asset Hani Redha | Joined 2012 Portfolio Manager, Global Multi-Asset Ten Largest Holdings Paul Mazzacano | Joined 2001 Head of Investment Manager Research ISHARES GLOBAL HIGH YIELD 6.0 PINEBRIDGE INDIA EQUITY FUND 5.2 LYXOR ETF COMMODITIES 2.0 ISHARES CORPORATE BOND 1.9 LAZARD GLOBAL LISTED INFRASTRUCTURE 1.8 ISHARES MSCI EUROPE EX UK 1.5 Agam Sharma | Joined 2013 Portfolio Manager, Global Multi-Asset Performance - Class A (in USD) For periods to 31 December 2015 Global Dynamic Strategy Calendar Year Fund % Peer Group Average % 7.8% 6.0% 1.5% 1.4% 1.0% 10 Global Balanced Strategy 2015 2014 2013 2012 2011 2010 -1.6 3.1 9.2 10.4 -8.1 7.5 -5.9 -3.2 6.3 5.3 -0.6 2.1 Fund performance is calculated net of fees and on a cumulative basis, NAV to NAV in USD with income reinvested. Fund % ISHARES JP MORGAN EMERGING MARKETS 1.5 ISHARES MSCI JAPAN ETF 1.2 UBS IRL ETF PLC MSCI USA 1.0 ISHARES LISTED PRIVATE EQUITY TOTAL 0.7 22.8 The NAV is used to compute the percentage (%) of top 10 holdings excluded cash in its computation. As such, the % level of the holdings may be higher than the actual figures. pinebridge.com.hk All information is as of 31 December 2015 and is sourced from PineBridge Investments internal data, unless otherwise stated. Due to rounding, the total may not be equal to 100%. 1 The performance of the PineBridge Global Dynamic Asset Allocation Strategy refers to the performance of the PineBridge Multi-Asset Composite. The PineBridge Multi-Asset Composite reflects the management of assets by the PineBridge Global Multi-Asset Team with full asset allocation discretion. The inception date of the Composite is 1 January 2005. US Bonds are represented by the US Aggregate Bond Index, US Equities are represented by the S&P 500 Index, Global Bonds are represented by the Citigroup World Government Bond Index (WGBI), Global Balanced is represented by a composite of 60% MSCI All Country World Index (ACWI) and 40% Citigroup WGBI, Global Equities are represented by the MSCI ACWI, Emerging Market Equities are represented by the MSCI Emerging Markets Index. 2 The information for the Representative Account cited is presented as supplemental to the PineBridge Multi-Asset Composite presentation in US Dollars. For illustrative purposes only. 3 Investment professionals include portfolio managers, traders and research analysts. As of 31 December 2015. 4 Institutional Investor U.S. Investment Management Awards 2015, May 2015. (For details, please visit: usinvestmentawards.com) 5 Global Investor Investment Excellence Awards 2014, July 2014. (For details, please visit: pinebridge.com/pdfs/press-release-global-investor-award.pdf) 6 Bloomberg Business Week (Chinese Edition), based on fund performance as of 30 September 2015. 7 Benchmark Fund of the Year Awards 2015, January 2016. (For details, please visit: www.fundawards.asia) 8 Primary Benchmark (“Benchmark”) refers to the Prospectus Benchmark. 9 Regulatory approval received in July 2015 of the updated Prospectus supplement for the sub-fund, (1) over periods of less than 5 years the performance of the sub fund’s portfolio of investments will be measured against the Prospectus Benchmark or (2) over periods of five years or longer, the performance of the sub fund’s portfolio of investments will be measured against the better performing of the Prospectus Benchmark and the Secondary Benchmark. 10 Source: Morningstar, data as of 31 December 2015. Peer Group refers to Morningstar category - Alt-Multi strategy Hong Kong Universe, and the Fund belongs to this category. Investment involves risks. Past performance is not indicative of future performance. Investors should refer to the offering documents for details, including risk factors. PineBridge Global Dynamic Asset Allocation Fund (the “Fund”) was formed as a successor fund to AIG Balanced World Fund plc (the “Company”) following a scheme of amalgamation with the Company and was launched on 7 April 2006. From 1 January 1993 to 31 December 2003, the blended index was composed of 50% JP Morgan Global Government Bond (USD) Index and 50% MSCI World Daily Total Return Net (USD) Index. Since 1 January 2004, the benchmark has been changed to 40% Citigroup World Broad Investment Grade (non-MBS) Index and 60% MSCI World Daily Total Return Net (USD) Index. The Fund is a sub-fund of PineBridge Global Funds, an Irish domiciled UCITS umbrella fund, authorized and regulated by the Central Bank of Ireland. Performance is representative of Class “A” in U.S. Dollars. The PineBridge Global Funds were renamed from AIG Global Funds on 7 April 2010, and the sub-funds replaced “AIG” with “PineBridge” in their sub-fund names. PineBridge Investments is a group of international companies that provide investment advice and market asset management products and services to clients around the world. PineBridge Investments is a registered trademark proprietary to PineBridge Investments IP Holding Company Limited. Services and products are provided by one or more affiliates of PineBridge however certain incidental middle and back office services maybe outsourced to 3rd parties. This material is issued by PineBridge Investments Asia Limited and has not been reviewed by the Securities and Futures Commission (“SFC”) in Hong Kong. The website listed in the material has not been reviewed by SFC in Hong Kong.