FACTSHEET

RISK DISCLOSURE STATEMENT

•The Fund invests primarily in equity and

equity-related securities of companies listed on

stock exchanges in India or closely related to the

economic development and growth of India, and

may be exposed to relatively higher risks (e.g.

equity, emerging markets, market volatility,

country concentration and India exchange control

risks, and risk associated with Indian taxation for

investments made through PineBridge GF

Mauritus Limited, etc). •The Fund may use

financial derivative instruments (“FDI”) to limited

extent. •Dividends, if any, may be paid out of

capital of the Fund at the discretion of the

Manager. This amounts to a return or withdrawal

of part of an investor’s original investment or from

any capital gains attributable to that original

investment and may result in an immediate

decrease in the net asset value of the Fund.

•Investors may be subject to substantial losses

due to investment loss risk and the leveraging

effect of using FDI. •Investors should not rely

solely on this material to make investment

decisions.

Objective

Fund Size

To achieve long term capital

appreciation by investing in

equity and equity-related

securities of companies listed

on stock exchanges in India or

closely related to the economic

development and growth of

India.

PineBridge India Equity Fund

MARKET REVIEW

The defeat of Modi's party in the state elections probably caused the markets to come down as there is fresh

uncertainty on reforms. There was a broad disappointment from the quarterly results where companies could

not demonstrate sales growth, even though margins improved due to lower commodity prices.

FUND ATTRIBUTION & POSITIONING

The Fund underperformed its benchmark index during November due to sector allocation.

Specifically, an overweight to the Materials sector dragged on the Fund’s performance, whereas an

underweight to the Health Care sector helped performance. From a stock perspective, Hero MotoCorp

contributed to performance, while Shree Cement was the biggest detractor. The Team noted earlier in the

year that due to the inclusion of Shree Cement in the MSCI Index, its price may be more volatile than in the

past.

There was little Fund activity during the month. Wipro and Shree Cement were added to the Fund, while

Coromandel was sold. The Team now has a sizeable position in cash, which it intends to deploy as, and when,

good opportunities arise.

MARKET OUTLOOK

Clearly, the reality is more sober than the expectations which were being priced a year back. The Team has

always been careful of choosing the companies it invests in and it tries to ensure that most of its investee

companies have no leverage. So, in case the recovery gets delayed, the shareholder gets delayed and not

diminished gratification.

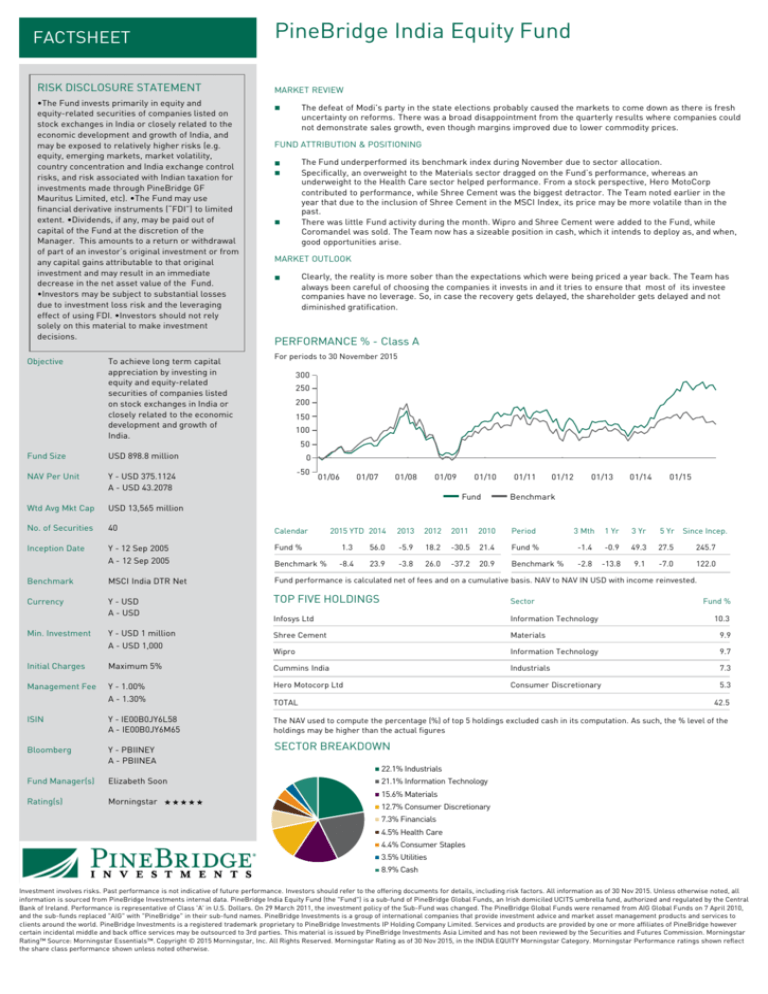

PERFORMANCE % - Class A

For periods to 30 November 2015

300

250

200

150

100

50

USD 898.8 million

0

-50

NAV Per Unit

Y - USD 375.1124

A - USD 43.2078

Wtd Avg Mkt Cap

USD 13,565 million

No. of Securities

40

Calendar

2013

2012

2011

2010

Period

3 Mth

1 Yr

3 Yr

5 Yr

Since Incep.

Inception Date

Y - 12 Sep 2005

Fund %

1.3

56.0

-5.9

18.2

-30.5

21.4

Fund %

-1.4

-0.9

49.3

27.5

245.7

A - 12 Sep 2005

Benchmark %

-8.4

23.9

-3.8

26.0

-37.2

20.9

Benchmark %

-2.8

-13.8

9.1

-7.0

122.0

Benchmark

MSCI India DTR Net

Fund performance is calculated net of fees and on a cumulative basis. NAV to NAV IN USD with income reinvested.

Currency

Y - USD

A - USD

TOP FIVE HOLDINGS

Sector

Infosys Ltd

Information Technology

Min. Investment

Y - USD 1 million

Shree Cement

Materials

9.9

Wipro

Information Technology

9.7

Maximum 5%

Cummins India

Industrials

7.3

Y - 1.00%

Hero Motocorp Ltd

Consumer Discretionary

5.3

A - 1.30%

TOTAL

ISIN

Y - IE00B0JY6L58

A - IE00B0JY6M65

The NAV used to compute the percentage (%) of top 5 holdings excluded cash in its computation. As such, the % level of the

holdings may be higher than the actual figures

Bloomberg

Y - PBIINEY

A - PBIINEA

Fund Manager(s)

Elizabeth Soon

Rating(s)

Morningstar

A - USD 1,000

Initial Charges

Management Fee

01/06

01/07

01/08

01/09

01/10

Fund

2015 YTD 2014

01/11

01/12

01/13

01/14

01/15

Benchmark

Fund %

10.3

42.5

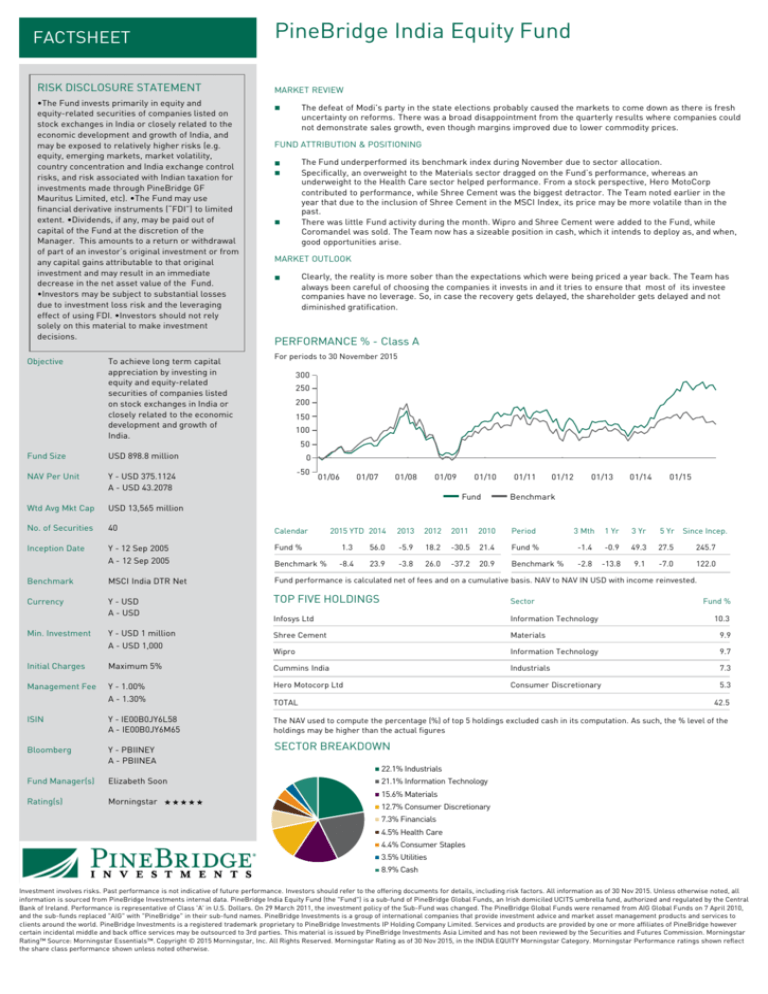

SECTOR BREAKDOWN

22.1% Industrials

21.1% Information Technology

15.6% Materials

12.7% Consumer Discretionary

7.3% Financials

4.5% Health Care

4.4% Consumer Staples

3.5% Utilities

8.9% Cash

Investment involves risks. Past performance is not indicative of future performance. Investors should refer to the offering documents for details, including risk factors. All information as of 30 Nov 2015. Unless otherwise noted, all

information is sourced from PineBridge Investments internal data. PineBridge India Equity Fund (the "Fund") is a sub-fund of PineBridge Global Funds, an Irish domiciled UCITS umbrella fund, authorized and regulated by the Central

Bank of Ireland. Performance is representative of Class 'A' in U.S. Dollars. On 29 March 2011, the investment policy of the Sub-Fund was changed. The PineBridge Global Funds were renamed from AIG Global Funds on 7 April 2010,

and the sub-funds replaced "AIG" with "PineBridge" in their sub-fund names. PineBridge Investments is a group of international companies that provide investment advice and market asset management products and services to

clients around the world. PineBridge Investments is a registered trademark proprietary to PineBridge Investments IP Holding Company Limited. Services and products are provided by one or more affiliates of PineBridge however

certain incidental middle and back office services may be outsourced to 3rd parties. This material is issued by PineBridge Investments Asia Limited and has not been reviewed by the Securities and Futures Commission. Morningstar

Rating™ Source: Morningstar Essentials™. Copyright © 2015 Morningstar, Inc. All Rights Reserved. Morningstar Rating as of 30 Nov 2015, in the INDIA EQUITY Morningstar Category. Morningstar Performance ratings shown reflect

the share class performance shown unless noted otherwise.