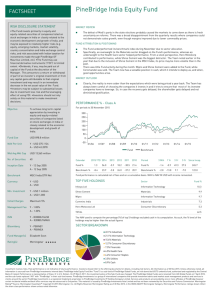

Exploring Multi-Asset Solutions for Distinct Investment Challenges

advertisement

Exploring Multi-Asset Solutions for Distinct Investment Challenges In this profile, we explore the evolving array of multi-asset strategies and diverse roles they can play, with a focus on how the PineBridge Global Dynamic Asset Allocation Strategy is helping investors solve for their distinct investment challenges. AUTHORS: Development from a product design perspective has focused on targeted returns at a managed level of risk. Equities, fixed income, and fixed blends of such asset classes have struggled to deliver targeted outcomes in a consistent manner within their constituents’ time-frames. For qualified investors, hedge funds had been the strategy of choice in an attempt to solve for these challenges. Many investors are looking for other options outside of hedge funds given their disappointing performance, uneconomic pricing, unfriendly legal structures, scandals in some instances, and a general lack of transparency. We believe multi-asset strategies can be used within an overall portfolio to provide solutions to many of the issues investors face. These strategies offer the potential for: MICHAEL J. KELLY, CFA Managing Director, Global Head of Multi-Asset AGAM SHARMA Senior Vice President, Multi-Asset Specialist A structural shift in asset allocation occurred after the storm of the global financial crisis. The methods previously employed focused primarily on relative return investing, with approaches that ranged from short-term/tactical to long-term/strategic, or some combination of the two. The objectives of these strategies were increasingly challenged post crisis. As a result, preferences shifted toward total returns and outcome-based objectives, which produced many new strategies and approaches. The focus for most of these new strategies is on meeting specific outcomes. Whether they are contemplating how to meet the liabilities for a pension fund or endowment, or how to generate income for retirement, the common thread is the continual need to achieve outcomes. • Consistent, sustainable performance towards absolute return targets • Downside protection and lower volatility • Diversified sources of alpha at lower cost, consistent with today’s concepts of good governance • Access to characteristics of liquid alternatives Like hedge funds, multi-asset represents a talent pool instead of an asset class. Yet, taken as a peer group, multi-asset objectives are arguably much more closely aligned with most investors’ objectives. Beyond the common characteristics listed above, the array and profiles of multi-asset strategies have evolved to play diverse roles in investor portfolios. Differentiated Roles Within Investor Portfolios Multi-asset strategies can generally be categorized in three segments. additions seek overall risk reduction for the portfolio, while providing exposures that would be difficult to obtain otherwise for a traditional investor. 1. Alternative to fixed income: consists of strategies where risk generally should not exceed that of fixed income 3. Alternative to equities: the emphasis is more on broadly. In this segment, the focus is on risk with a providing return through growth assets, with less than relatively lower focus on return, as these strategies two-thirds of the risk of equities. We believe that in the seek to reduce interest rate sensitivity and outperform world ahead of low nominal returns and higher volatility fixed income in a rising rate environment. – and with investors focused on outcomes and absolute returns – this category will become increasingly 2. New strategic mix: a broader segment that includes important. risk parity, risk factor parity and diversified growth, and falls between the fixed income and equity alternative. It is within this third segment that the PineBridge Global The focus is predominantly on new strategic allocations Dynamic Asset Allocation Strategy resides, as our focus that are not correlated with the overall strategic mix is on growth-oriented, equity-like returns with less risk. of the investor. Nuanced asset class or risk factor Description ► Objective Return (Per annum) ► Objective Risk (Volatility per annum) ► Role in Portfolio Context ► Alternatives to Fixed Income New Strategic Mix Alternatives to Equities Target volatility of fixed income but with potential for higher returns and low interest rate sensitivity Diversified portfolios including liquid and illiquid alternatives. Various risk management approaches Target return of equities with lower (2/3rds) volatility of equities; focus on growth assets CPI1 plus 2-3% CPI1 plus 4-5% CPI1 plus 5-6% 3-4% 5-7% 8-10% Reduce interest rate sensitivity without raising risk level Diversify by introducing additional asset classes (alternatives & illiquids) Diversification from equities/ bonds while maintaining return level • Liquid alternatives strategy • Objective-based (absolute/total return or target risk) • Diversifier for equity/bond portfolios Common Characteristics CPI is defined as US CPI ex-food & energy. There is no assurance that any investment objective or target will be achieved. For illustrative purposes only. We are not soliciting or recommending any action based on this material. Past performance is not indicative of future results. The targeted returns provided are used as an estimated guideline or comparative measure regarding annual performance returns averaged over a time horizon. They reflect a guideline which the Manager considers reasonable having considered the current industry and interest rate environment as well as quantitative and qualitative analyses. There can be no assurance that the targeted returns will be met over any particular time horizon. If one or more of the assumptions used in the formulation of the targeted returns turns out to be incorrect, the target may not be achieved. Targeted returns do not take into account unanticipated material changes in the market and/or other economic conditions affecting the investments, transaction costs that may arise, the imposition of taxes and the actual sale or trade of investments. Targeted returns should not be relied upon. 1 Industry Award Recognition for the PineBridge Global Dynamic Asset Allocation Strategy1 Institutional Investor U.S. Investment Manager Award within the Balanced/ Global Tactical Asset Allocation category Global Investor Investment Excellence Award — Global Multi-Asset Manager of the Year For more information on our multi-asset capabilities, please visit www.pinebridge.com. Institutional Investor U.S. Investment Management award methodology: a short-list of top performing managers were identified by Institutional Investor’s editorial and research teams in consultation with eVestment’s research team. Analysis factors included 1-, 3- and 5-year performance, Sharpe ratio, information ratio, standard deviation and upside market capture, the same factors used by institutional investors in their own manager searches. More than 1000 leading U.S. pension plans, foundations, endowments and other institutional investors are surveyed and asked to vote for up to three of the top performing managers in each strategy in which they invested during the past year. Global Investor Award: http://www.pinebridge.com/pdfs/press-release-global-investor-award.pdf. 1 2 PINEBRIDGE INVESTMENTS PineBridge Global Dynamic Asset Allocation is Solving for Targeted Needs Below, we explore a few of the ways the PineBridge Global Dynamic Asset Allocation Strategy has been utilized by investors seeking to address a specific challenge through a multi-asset solution. Client Seeking To Managing Objectives Through the PineBridge Global Dynamic Asset Allocation Strategy Increase the return and Sharpe ratio of the returnseeking side of an LDI program Target equity-like returns with lower volatility, which can be used to enhance returns, reduce risk and accelerate a path to full funding Achieve absolute return objective of CPI + 5% with managed risk as a complement within a strategic asset allocation framework Apply dynamic currency hedging to meet return objective, with half the volatility (8-10%) Access a growth-oriented strategy using dynamic risk management Employ full hedging to local currency, targeting LIBOR + 5% over rolling 5-year period Incorporate liquid alternatives, within a traditional fixed income and equity portfolio, with an absolute return objective Allocate up to 15% in liquid alternatives, enabling diversified exposure to less correlated asset classes The PineBridge Approach: Seeking Absolute Return by Managing Risk & Return We believe the singular focus on risk is a risk in itself, and that managers who focus equally on where the returns will be, and where they will evolve, will be positioned to benefit from changing markets. While the crisis elevated the importance of risk management and restored opportunism within asset allocation, PineBridge Investments’ Global Multi-Asset team has been an innovator in multi-asset, having managed a global dynamic strategy for more than a decade. We recognize that the outlook for fundamentals and the risk/return opportunity set is always evolving, and as a result, our portfolios dynamically adjust to seek growth opportunities in a world where we believe the biggest risk will be a lack of return. Today’s outcome-oriented solutions are typically multiasset class strategies with absolute return targets, along with a risk management component. These strategies are not created equal, however with some focused on risk over returns, versus those who seek returns with a riskconscious approach. We believe risk and return should be equal partners: two sides of the same coin. We view our approach as risk-aware, yet not solely risk-driven. We manage our strategy through a forward-looking fundamental process, which focuses on where returns are being created, and risks are rising. Transparency is important for investors in today’s environment. The ability to look behind the curtain to understand the mechanics of a dynamic strategy is key. As we construct our portfolios, we draw on the expertise of diverse on-the-ground teams within fixed income, equity, currencies and alternatives, with the goal of creating an optimal blend of assets wherein fundamentals will strengthen over an intermediate term of 9-18 months. These views are anchored through our 5 year forward– looking view of fundamentals through our Capital Market Line, and distilled to an intermediate-term view through our monthly set of meetings, leveraging more than 220 investment professionals across PineBridge Investments. We believe our global presence and optimal size offer a distinct advantage, allowing us to nimbly yet thoughtfully share and debate information to make proactive decisions, rather than reactive corrections—helping us position for bigger opportunities while mitigating significant risks through an active, dynamic approach. EXPLORING MULTI-ASSET SOLUTIONS 3 3 About PineBridge PineBridge Investments provides investment solutions that span the full spectrum of asset classes and geographies around the globe. We manage more than US $75 billion in assets, and more than US $13 billion in multi-asset investments. Our investment professionals focus on delivering compelling results for our clients, and the global interconnectivity among our teams allow us to remain at the forefront of opportunity. Investments MULTI-ASSET | FIXED INCOME | EQUITIES | ALTERNATIVES This information is for educational purposes only and is not intended to serve as investment advice. This is not an offer to sell or solicitation of an offer to purchase any investment product or security. Any opinions provided should not be relied upon for investment decisions. Any opinions, projections, forecasts and forward-looking statements are speculative in nature; valid only as of the date hereof and are subject to change. PineBridge Investments is not soliciting or recommending any action based on this information. There can be no assurance that any particular strategy will deliver the benefits sought or that any particular investment will be successful. Past performance is not indicative of future results. Diversification does not ensure against loss. Disclosure Statement PineBridge Investments is a group of international companies that provides investment advice and markets asset management products and services to clients around the world. PineBridge Investments is a registered trademark proprietary to PineBridge Investments IP Holding Company Limited. Opinions are the personal views of the authors and do not necessarily reflect the views of PineBridge Investments and there is no undertaking to advise any person of any changes in such views. In addition, the views expressed do not necessarily reflect the opinions of any other investment professional at PineBridge Investments, and may not be reflected in the strategies and products that PineBridge offers. It should not be assumed PineBridge will make investment recommendations in the future that are consistent with the views expressed herein, or use any or all of the techniques or methods of analysis described herein. PineBridge Investments and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this document. Information from third party sources has not been independently verified. For purposes of complying with the Global Investment Performance Standards (GIPS®), the firm is defined as PineBridge Investments Global. Under the firm definition for the purposes of GIPS, PineBridge Investments Global excludes some alternative asset groups and regional legal entities that may be represented in this presentation, such as the assets of PineBridge Investments. Readership: This document is intended solely for the addressee(s) and may not be redistributed without the prior permission of PineBridge Investments. Its content may be confidential. PineBridge Investments and its subsidiaries are not responsible for any unlawful distribution of this document to any third parties, in whole or in part. Opinions: Any opinions expressed in this document may be subject to change without notice. We are not soliciting or recommending any action based on this material. Risk Warning: All investments involve risk, including possible loss of principal. Past performance is not indicative of future results. If applicable, the offering document should be read for further details including the risk factors. Our investment management services relate to a variety of investments, each of which can fluctuate in value. The investment risks vary between different types of instruments. For example, for investments involving exposure to a currency other than that in which the portfolio is denominated, changes in the rate of exchange may cause the value of investments, and consequently the value of the portfolio, to go up or down. In the case of a higher volatility portfolio, the loss on realization or cancellation may be very high (including total loss of investment), as the value of such an investment may fall suddenly and substantially. In making an investment decision, prospective investors must rely on their own examination of the merits and risks involved. Information is unaudited, unless otherwise indicated, and any information from third party sources is believed to be reliable, but PineBridge Investments cannot guarantee its accuracy or completeness. PineBridge Investments Europe Limited is authorised and regulated by the Financial Conduct Authority (“FCA”). In the UK this communication is a financial promotion solely intended for professional clients as defined in the FCA Handbook and has been approved by PineBridge Investments Europe Limited. Should you like to request a different classification, please contact your PineBridge representative. Approved by PineBridge Investments Ireland Limited. This entity is authorised and regulated by the Central Bank of Ireland. In Australia, this document is intended for a limited number of wholesale clients as such term is defined in chapter 7 of the Corporations Act 2001 (CTH). The entity receiving this document represents that if it is in Australia, it is a wholesale client and it will not distribute this document to any other person whether in or outside of Australia. In Hong Kong, the issuer of this document is PineBridge Investments Asia Limited, licensed and regulated by the Securities and Futures Commission (“SFC”). This document has not been reviewed by the SFC. PineBridge Investments Asia Limited holds a Representative Office license issued by the Central Bank of the UAE and conducts its activities in the UAE under the trade name PineBridge Investments Asia Limited– Abu Dhabi. This document has not been reviewed by the Central Bank of the UAE nor the SFC. In the UAE, this document is issued by PineBridge Investments Asia Limited – Abu Dhabi Representative Office. PineBridge Investments Singapore Limited is licensed and regulated by the Monetary Authority of Singapore (the ”MAS”). In Singapore, this material may not be suitable to a retail investor and is not reviewed or endorsed by the MAS. PineBridge Investments Middle East B.S.C.(c) is regulated by the Central Bank of Bahrain as a Category 1 investment firm. This document and the financial products and services to which it relates will only be made available to accredited investors of PineBridge Investments Middle East B.S.C. (c ) and no other person should act upon it. The Central Bank of Bahrain takes no responsibility for the accuracy of the statements and information contained in this document or the performance of the financial products and services, nor shall it have any liability to any person, an investor or otherwise, for any loss or damage resulting from reliance on any statement or information contained therein. Last updated 16 June 2014. Visit us at www.pinebridge.com