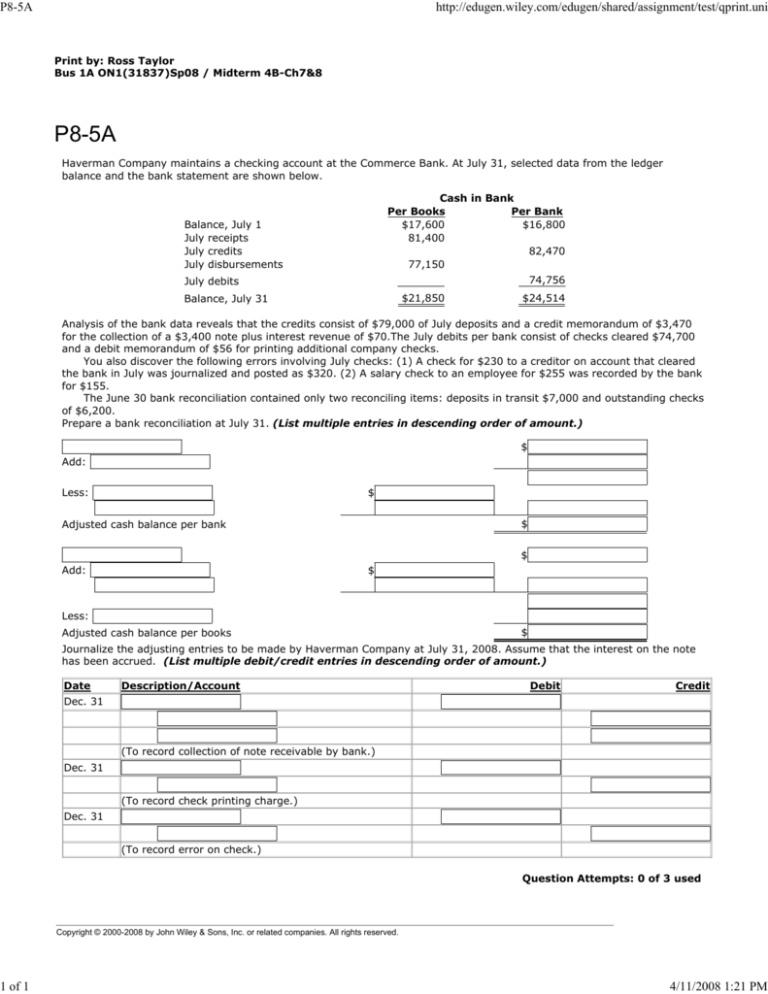

P8-5A

1 of 1

http://edugen.wiley.com/edugen/shared/assignment/test/qprint.uni

Print by: Ross Taylor

Bus 1A ON1(31837)Sp08 / Midterm 4B-Ch7&8

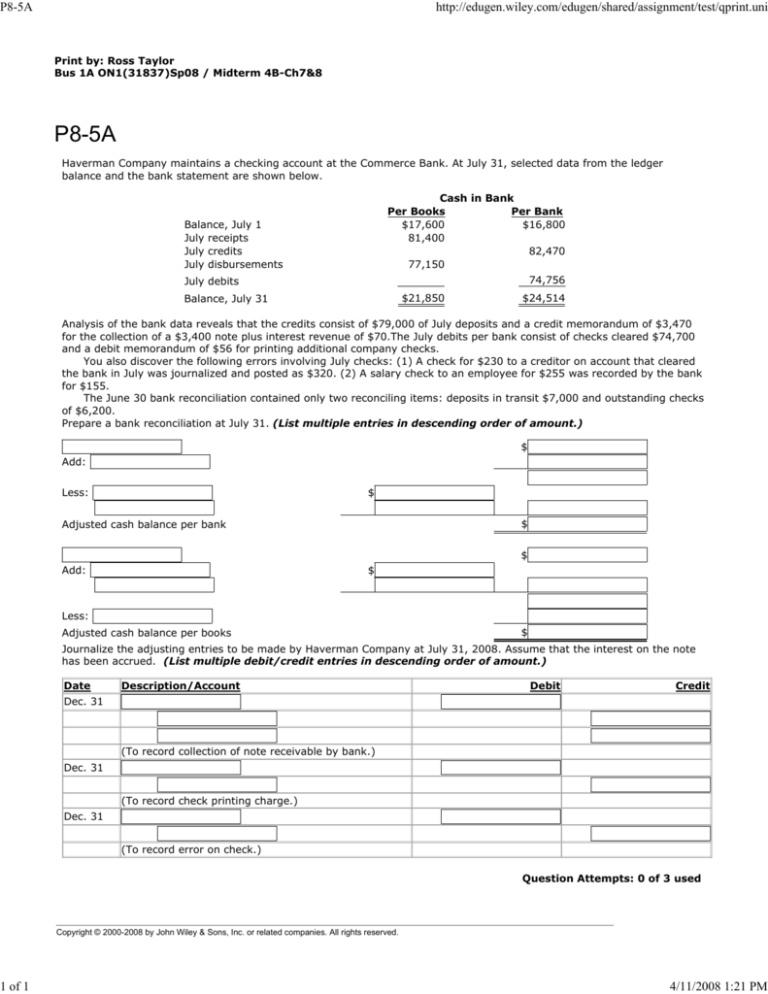

P8-5A

Haverman Company maintains a checking account at the Commerce Bank. At July 31, selected data from the ledger

balance and the bank statement are shown below.

Cash in Bank

Per Bank

Per Books

$17,600

$16,800

81,400

82,470

77,150

Balance, July 1

July receipts

July credits

July disbursements

74,756

July debits

$21,850

Balance, July 31

$24,514

Analysis of the bank data reveals that the credits consist of $79,000 of July deposits and a credit memorandum of $3,470

for the collection of a $3,400 note plus interest revenue of $70.The July debits per bank consist of checks cleared $74,700

and a debit memorandum of $56 for printing additional company checks.

You also discover the following errors involving July checks: (1) A check for $230 to a creditor on account that cleared

the bank in July was journalized and posted as $320. (2) A salary check to an employee for $255 was recorded by the bank

for $155.

The June 30 bank reconciliation contained only two reconciling items: deposits in transit $7,000 and outstanding checks

of $6,200.

Prepare a bank reconciliation at July 31. (List multiple entries in descending order of amount.)

$

Add:

Less:

$

$

Adjusted cash balance per bank

$

Add:

$

Less:

Adjusted cash balance per books

$

Journalize the adjusting entries to be made by Haverman Company at July 31, 2008. Assume that the interest on the note

has been accrued. (List multiple debit/credit entries in descending order of amount.)

Date

Description/Account

Debit

Credit

Dec. 31

(To record collection of note receivable by bank.)

Dec. 31

(To record check printing charge.)

Dec. 31

(To record error on check.)

Question Attempts: 0 of 3 used

Copyright © 2000-2008 by John Wiley & Sons, Inc. or related companies. All rights reserved.

4/11/2008 1:21 PM