Scenic Video Transcript Income Accounts Topics • Temporary

advertisement

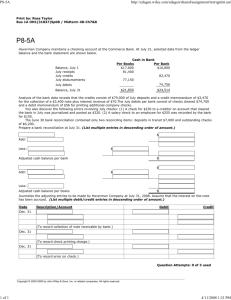

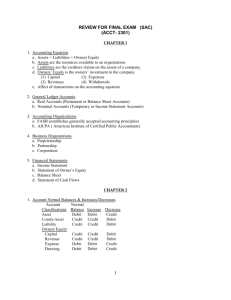

Income Statements » What’s Behind? » Income Statements » Scenic Video www.navigatingaccounting.com/video/scenic-income-accounts-bse-je Scenic Video Transcript Income Accounts Topics Temporary income accounts Account signs: Using balance-sheet equation approach for entries Debit and credit accounts: Using journal entry approach Transcript Introduction Welcome to the Account Scenic Route video where you’re going to quickly learn a couple ways accounts in this chapter can differ from those introduced in the balance sheet chapter. We only have two topics, temporary accounts and account signs so let’s get started. Temporary Accounts Here we have the balance sheet equation matrix for the income chapter. You’ll notice it’s much larger than what we have in the balance sheet chapter because we’re going to be recording many more events and we’re going to need more accounts. And I want you to focus over here on the right side of the balance sheet equation, in the owners’ equity section which I’ve expanded down below. And you’ll notice that we have what’s called “Permanent accounts.” So those are the balance sheet accounts we started in the last chapter, share capital, retained earnings and the reserve account we discussed in this chapter. And then we also have income accounts here. We have comprehensive income and it’s broken up into net income, numerous net income accounts and then one OCI account over here. Now, all of these accounts on the right side are income accounts and we’re going to distinguish the balance sheet accounts which are called permanent accounts from the temporary accounts which are also called income accounts. Permanent accounts have non-zero balances because those balances are carried forward into the next reporting period. By contrast, temporary accounts their defining feature is they all have zero ending balances. Now, that doesn’t mean nothing happens in the accounts during the year because we have all these entries up here. Look at these numbers going in the accounts and in fact, we’re going to be focusing what’s called the Trial Balance Row which is right here when we make an income statement. But, we’re going to close these accounts to zero. In some entries you’ll learn in a subsequent module called closing entries. Now, the question is, why do these accounts have zero balances? And why do they differ from the balance sheet accounts? You may translate this work into your local language, as long as you credit G. Peter & Carolyn R. Wilson and respect the Creative Commons Attribution-Noncommercial-Share Alike United States license. © 1991–2011 NavAcc LLC. www.navigatingaccounting.com 2 Well, if you look at our reporting period, here’s the beginning date. Here’s the ending date for the period and here’s the period. We measure balance sheet at both the beginning and the end of the period or the end of the last period and the end of this period. Now, income on the other hand is measured over the period. So what’s the difference? Well, balance sheets accumulate everything that happened up to this point in time and then everything that happened up to this point in time. By contrast, income accounts only measure activity over a period so they have to start with a zero balance. See, if they didn’t start with a zero balance, well, they’ll be picking up numbers from the prior period and including it in this period. How do we do that? Well, when we get to the end of this period, reset the balance to zero through the closing entries and that guarantees that we have a good start from the next period in our income accounts and we’ll show you how to do that later in the chapter. Account Signs The second topic we want to look at is account signs. Now, the account signs were all positive in the balance sheet chapter and that’s not going to be true here. Again, we’re focusing on the right hand side of the balance sheet equation. Now, we got some revenue or gain accounts and they’re positively signed and expense and loss accounts, well, they’re negatively signed. Now, why is that? Well, almost by definition. Remember, revenues and gains increase net assets but net assets is owners’ equity and owners’ equity is their parent group and remember how we talked about the sign of an account. The sign of an account is determined by how the account affects its parent group. Well, revenues and gains both increase owners’ equity and expenses and losses both decrease owners’ equity. Well, that’s all we have to say about temporary and permanent accounts and about account signs. Debit and Credit Accounts Now, we want to consider the debit and credit account implications of the account sign discussion. You might recall our rules for transitioning from balance sheet equation approach to journal entries. If we had a positively signed account on the left side of the equation, well, that was going to be a debit account. And remember, these are adjective modifiers for the account. They never change so the sign of the revenue account is positive all the way up. Expense is negative all the way up. That contrasts with the sign of the entries which could be positive or they could be negative. What about a positively signed account on the right side of the equation? Well, that would be a credit account. We have a negative on the left side, that’s going to be a credited account and we’ll see one of those later in the chapter. And then we could also have a negative on the right side. Of course, that’s what an expense is and that’s going to be a debit account. So we see our conclusion over here. Revenues and gain accounts are credit accounts and expense and loss accounts, well, they’re debit accounts. All we have to do now is figure out whether we’re going to debit that account or credit that account as we work our way through entries and we’re going to do a lot of entries in this chapter so you’re going to be really good 3 at recognizing whether you have a debit account or a credit account and what to do with that account. Well, see you in the next video.