Document

advertisement

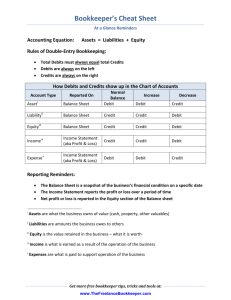

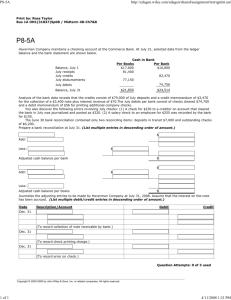

4 Accounting Information Systems FINANCIAL ACCOUNTING 2ND EDITION BY DUCHAC, REEVE, & WARREN PowerPoint Presentation by Gail B. Wright Professor of Accounting Bryant University © Copyright 2007 Thomson South-Western, a part of The Thomson Corporation. Thomson, the Star Logo, and South-Western are trademarks used herein under license. 1 LG 1 BUSINESS INFORMATION SYSTEM Collects, processes data Distributes information to stakeholders 2 LG 2 EXHIBIT 2 Stakeholders Financial, operating data Accounting Information Systems •Management Reporting Stakeholders •Transactions Processing •Financial Reporting Stakeholders 3 LG 2 MANAGEMENT REPORTING SYSTEM • Provides internal information for decision making – Reports • Budgets • Variance analyses 4 LG 2 TRANSACTION PROCESSING SYSTEM • Records, summarizes effects of financial transactions into accounts • Divides transactions into cycles – – – – – Revenue cycle Purchasing cycle Payroll cycle Inventory cycle Treasury cycle 5 LG 2 FINANCIAL REPORTING SYSTEM • Produces financial statements – – – – Income statement Statement of retained earnings Balance sheet Statement of cash flows 6 LEARNING GOALS 3 Describe, illustrate basic elements of transaction processing system. 7 LG 3 THE ACCOUNT Each account has a Title Recording place for debits Title Recording place for credits Left side Debit Right side Credit 8 LG 3 RULES OF DEBIT & CREDIT • Normal balance of account is side used to increase • Asset accounts have debit balances • Example: cash CASH DEBITS INCREASE Continued 9 LG 3 RULES OF DEBIT & CREDIT • Normal balance of account is side used to increase • Liability, Equity accounts have credit balances • Example: Retained Earnings RETAINED EARNINGS CREDITS INCREASE 10 LG 3 BALANCE SHEET EQUATION A = L + E 11 LG 3 RULE 2 OF DEBIT & CREDIT: Assets • Asset accounts on left side of equation are – Increased by debits and – Have debit balances ASSET ACCTS + DEBIT BALANCE 12 LG 3 RULE 2 OF DEBIT & CREDIT: Liability & Equity • Liability & equity accounts on right side of equation are – Increased by credits and – Have credit balances LIABILITY & EQUITY ACCTS + CREDIT BALANCE 13 LG 3 RULE 2 OF DEBIT & CREDIT: Revenue • Revenue accounts increase equity on right side of equation are – Increased by credits and – Have credit balances REVENUE ACCOUNTS + CREDIT BALANCE 14 LG 3 RULE 2 OF DEBIT & CREDIT: Expense • Expense accounts decrease equity which is on right side of equation are – Increased by debits and – Have debit balances EXPENSE ACCTS + DEBIT BALANCE 15 LG 3 RULE 3 OF DEBIT & CREDIT • For each transaction – Total debits will equal total credits TRANSACTION TOTAL DEBITS TOTAL CREDITS 16 LG 3 EXHIBIT 3 17 RECORDING TRANSACTIONS • Transactions recorded in – Journals • Organized by date – Ledgers • Organized by account Click the button to skip journal entries 18 LG 3 ENTRY 11/5: Bought Land SCF BS IS 11/5 Land 20,000 Cash 20,000 Buying land for cash Decreases cash flows, investing Has no effect on balance sheet Has no effect on income statement Click the button to skip journal entries 19 LG 3 ENTRY 11/10: Bought Supplies SCF BS IS 10 Supplies Accounts Payable Buying supplies on account Has no effect on cash flows Increases assets & liabilities Has no effect on income statement 1,350 1,350 Click the button to skip journal entries 20 LG 3 ENTRY 11/18: Earned Fees SCF BS IS 18 Cash R Fees Earned 7,500 7,500 Received cash for fees earned Increases cash flows from operations Increases assets & equity Increases revenue Click the button to skip journal entries 21 LG 3 ENTRY 11/30: Paid Expenses SCF BS IS 30 E Wages 2125 Rent 800 Utilities 450 Misc. 275 Cash Paid cash for expenses Decreases cash flow operations Decreases assets & equity Increases expenses on income statement 3,650 Click the button to skip journal entries 22 LG 3 ENTRY 11/30: Paid Account SCF BS IS 30 Accounts payable Cash 950 950 Paid cash to satisfy accounts payable Decreases cash flow operations Decreases assets, liabilities Has no effect on income statement Click the button to skip journal entries 23 LG 3 ENTRY 11/30: Paid Dividend SCF BS IS 30 Dividend Cash 2,000 2,000 Paid cash dividends Decreases cash flow financing Decreases assets, equity Has no effect on income statement 24 LG 3 EXHIBIT 7 Trial balance lists accounts, balances in debit, credit columns to check recording process. 25 LEARNING GOALS 4 Describe, illustrate basic elements of financial reporting system. 26 LG 4 END OF YEAR: 12/31/2007 • Transactions for December recorded – Journals, ledgers • Trial balance for December transactions • Adjustments recorded – – – – Supplies, insurance used Revenue earned Wages owed Depreciation Continued 27 LG 4 END OF YEAR: 12/31/2007 • Adjusted trial balance – Final check before financial statements • Prepare financial statements – – – – Income statement Statement retained earnings Balance sheet Statement cash flows See Exhibit 12 p. 166-167 28 LG 4 AFTER FINANCIAL STATEMENTS • Closing entries – Transfer balances of temporary (revenue, expense, dividends) accounts to retained earnings – Zero balances of temporary accounts to carry forward • Post-closing trial balance – Final check for asset, liability, equity account balances 29 LG 5 ACCOUNTING CYCLE 1. Transactions analyzed, recorded in journals 2. Transactions posted to ledgers 3. Unadjusted trial balance prepared 4. Adjustment data assembled, analyzed 5. Adjusting entries prepared, recorded in journal Continued 30 LG 5 ACCOUNTING CYCLE 6. Adjusting entries posted to ledger 7. Adjusted trial balance prepared 8. Financial statements prepared 9. Closing entries recorded in journal 10. Closing entries posted to ledgers 11. Post-closing trial balance prepared 31 A pint cannot hold a quart. If it is holding a pint, it is doing the best it can. Plan to be spontaneous tomorrow. S. Wright 32