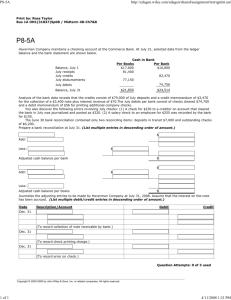

Chapter 8 Cash and Internal Controls QUCIK STUDY QS 8

advertisement

Chapter 8 Cash and Internal Controls QUCIK STUDY QS 8-1 An internal control system consists of all polices and procedures used to , protect assets, ensure reliable accounting, promote efficient operations, and urge adherence to company policies. 1. What is the main objective of internal control procedures? How is that objective policies? 2. Why should recordkeeping for assets be separated from custody over those assets? 3. Why should the responsibility for a transaction be divided between two or more individuals or departments? QS 8-2 Gooding accounting systems help in managing cash and controlling who has access to it. 1. What items are includes in the category of cash? 2. What items are includes in the category of cash equivalents? 3. What does the term liquidity refer to? QS 8-5 1. The petty cash fund of the Kaley Agency is established at $75. At the end of the current period, the fund contained $8.18 and had the following receipts: film rentals, $26.50, refreshments for meetings, $32.17 (both expenditures to be classified an Entertainment Expense); postage, $5.15; and printing, $3. Prepare journal entries to record (a) establishment of the fund and (b) reimbursement of the fund at the end of the current period. 2. Identify the two events that cause a Petty Cash account to be credited in a journal entry. EXERCISES Exercises 8-1 Pacific Company is a rapidly growing start-up business. Its recordkeeper, who was hired one year ago, left town after the company's manager discovered that a large sum of money had disappeared over the past six months. An audit disclosed that the recordkeeper had written and signed several checks made payable to her fiancé and then recorded the checks as salaries expense. The fiancé, who cashed the checks but never worked for the company, left town with the recordkeeper. As a result, the company incurred an uninsured loss of $184,000. Evaluate Pacific's internal control system and indicate which principles of internal control appear to have been ignored. Exercises 8-3 What internal control procedures would you recommend in each of the following situations? 1. A concession company has one employee who sells sunscreen, T-shirts, and sunglasses at the beach. Each day, the employee is given enough sunscreen, shirts, and sunglasses to last though the day and enough cash to make change. The money is kept in a box at the stand. 2. An antique store has one employee who is given cash and sent to garage sales each weekend. The employee pays cash for any merchandise acquired that antique store resells. Exercises 8-4 Fraeson Co. establishes a $350 petty cash fond on January 1. On January 8, the fund shows $140 in cash along with receipts for the following expenditures: postage, $67; transportation- in, $35; delivery expense, $52; and miscellaneous expenses, $56. Freson uses the perpetual system in accounting for merchandise inventory. Prepare journal entries to (1) establish the found on January 1, (2) reimburse it on January 8, and (3) both reimburse the found and increase it to $550 on January 8, assuming no entry in part 2. (Hint: Make two separate entries for part 3.) Exercises 8-8 Austin Clinic deposits all cash receipts on the day when they are received and it makes all cash payments by check. At the cost of business on June 30, 2009, its cash account shows a $15,671 debit balance. Austin Clinic's June 30 bank statement shows $15,382 on deposit in the bank. Prepare a bank reconciliation for Austin Clinic using the following information: a. Outstanding checks as of June 30 total $2,700. b. The June 30 bank statement included a $65 debit memorandum for bank services. c. Check No. 919, listed with the canceled checks, was correctly drawn for $489 in payment of a utility bill on June 15. Austin Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $498. d. The June 30 cash receipts of $2,933 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement.\ Exercises 8-9 Prepare the adjusting journal entries that Austin Clinic must recorded as a result of preparing the bank reconciliation in Exercises 8-8.