CA School of Business Module One Student Overview

advertisement

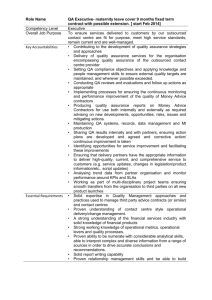

CA School of Business Module One Student Overview May 2011 Copyright 2011 – CA School of Business (CASB) All contents are restricted for authorized CASB candidates, contractors and employees Not to be released without the expressed written consent of CASB Module 1 Student Overview May 2011 Introduction This overview introduces the content and unique challenges in Module 1. For information about CASB administrative policies and advice for a successful experience as a CASB student, see the “Student Resource Guide,” which is available on the Module 1 course site and also on the CASB web site. Unique Challenges in Module 1 The storyboard for Module 1 is shown on page 4. Module 1 introduces students to CASB’s competency-based learning model. In this module (and future modules), students will develop the pervasive skills, professional qualities and specified technical competencies that form the core of a successful CA. Module 1 is the student's initial experience with CASB. Many will find that it is very different from university. In university, the courses are quite structured. In addition, students may be working full-time in their articling positions. University course delivery was generally in the form of lectures and tutorials that students attended in-person. The professor or teaching assistant was personally available for consultation. In CASB, students obtain their tasks and assignments online through the Blackboard Learning System. Instruction comes from a facilitator that is only accessible on-line. The time requirements and need for effective time management as well as the discipline required for self-study become apparent very quickly. If one is not prepared, the process can be very intimidating. Students can avoid the difficulties and common pitfalls many CASB students have encountered by adequately preparing ahead. Module 1 (and all of the other core modules) is integrated. Students are provided with more and more information in each of Weeks 1- 4 and asked to complete various tasks in relation to Hans and Vision. Some information and tasks from one week will “feed into” subsequent weeks. For example, in Week 3 students are required to calculate taxable income for Vision. In order to complete this task, students must use revised financial statements they prepared in Week 1. As well, in Week 4, students are required to determine the causes of Vision's cash flow issues. Before they can complete this task, they must first prepare the cash flow statement in Week 3. Due to the integrative nature of some weeks and tasks in the module, the results from a specific task may affect a task in a subsequent week. For example, in Week 3 students must prepare divisional income statements that must reconcile and agree to income statements they prepared in Week 1. If there are revisions required for the task in Week 1 that are not corrected when Week 3 is submitted, these same revisions will be required for Week 3. It is highly recommended that students clear their revisions on a timely basis See page 3 for the module storyboard and page 4 for a summary of the major roles students will play. Pages 5 to 7 lists the weekly recommended resources and page 8 summarizes the evolution of Vision Windows Ltd. Page 2 of 9 Copyright 2011 – CA School of Business (CASB) All contents are restricted for authorized CASB candidates, contractors and employees Not to be released without the expressed written consent of CASB Module 1 Student Overview May 2011 Module 1 Storyboard – May 2011 Week 2 Week 1 Prepare and explain adjusting journal entries- revenue recognition, inventory cutoff, capitalization of fixed assets, accrued liabilities- and prepare revised financial statements. PM Apply definition of an asset to advertising costs- HB. S1000. PM Factors to consider in switching from a Review to an Audit engagement. Assurance, Pervasive (Critical Thinking) Reflect on critical thinking and communication. Pervasive (Professionalism) Apply the Rules of Professional Conduct. Assurance, Pervasive (Ethics) Week 5 Identify T4 filing deadline and explain tax treatment of shareholder loans and shareholder bonuses. Taxation Recommend whether to purchase a car personally or through a corporation, including calculation of automobile standby charges. Taxation Explain guidelines CRA uses to determine employees vs. contractors. Taxation, Pervasive (Critical Thinking) Identify deficiencies in IT policies and internal controls and provide recommendations. Assurance (IT), Mgmt DM Determine whether Vision 1) can continue to use the taxes payable method for accounting for income taxes as previously allowed under Differential Reporting; 2) must disclose the fair value of the long-term debt. PM Calculate fair value of longterm debt for disclosure. PM Week 6 Identify and explain client acceptance considerations. Assurance, Pervasive (Critical Thinking) Explain measures to safeguard independence when preparing accounting entries for client. Assurance, Pervasive (Ethics) Determine review engagement materiality. Assurance Analyze financial statements and identify accounts needing further investigation. Assurance Explain effects on the Review engagement report –valuation of AR balance and concerns about reasonableness of inventory opening balance. Assurance, Pervasive (Critical Thinking) Compare and contrast Compilation versus Review engagements. Assurance, Pervasive (Critical Thinking) Prepare and explain adjusting journal entries, and calculate revised net Week 3 Prepare a cash flow statement. PM, Mgmt DM Reconcile corporate accounting net income to taxable income. Taxation Recommend method for allocating expenses amongst divisions. Prepare divisional income statements. PM, Mgmt DM Explain benefits of recommended policies and procedures for purchasing, disbursements and payables. Assurance Calculate gross employment income for tax purposes. Taxation Analyze information for buy or lease decision. Finance Week 7 Prepare cash flow projection. PM, Mgmt DM Calculate net and taxable income for personal income tax returns. Explain various personal tax issues. Taxation Explain tax implications of gifting to children. Taxation Explain planning considerations for wills and the transfer of assets upon the death of a taxpayer. Taxation, Pervasive, Pervasive (Critical Thinking) Page 3 of 9 Copyright 2011 – CA School of Business (CASB) All contents are restricted for authorized CASB candidates, contractors and employees Not to be released without the expressed written consent of CASB Week 4 Analyze and explain cash flow and debt problems. Finance, Mgmt DM, Pervasive (Critical Thinking) Calculate corporate taxes payable. Taxation Identify weaknesses in credit granting process and provide recommendations. Assurance Calculate a Break Even Price. Mgmt DM Week 8 Review “rights and things” for tax purposes. Calculate net and taxable income for a deceased individual. Taxation Explain tax administrative matters- deadlines, interest, penalties, retention of records. Taxation Analyze the f/s and identify accounts needing further investigation on a new review engagement. Assurance Assess and explain value added to Vision as an Module 1 Student Overview May 2011 Identify financial statement assertions related to review procedures. Assurance, Pervasive (Critical Thinking) income. PM Reconcile accounting net income to net income for income tax purposes. Taxation Note: Communication competence is required for most tasks, so communication is not listed separately. Page 4 of 9 Copyright 2011 – CA School of Business (CASB) All contents are restricted for authorized CASB candidates, contractors and employees Not to be released without the expressed written consent of CASB assistant controller. Pervasive (Critical Thinking) Module 1 Student Overview May 2011 Roles Students will play two roles during Module 1. During weeks 1 to 4 students will portray the role of Assistant Controller for Vision Windows Ltd. (Vision). During weeks 5 to 8 they will portray the role of an associate at the public accounting firm of Parkhurst & Loewen (P&L). Assistant Controller for Vision Windows During the first 4 weeks in Module 1 students portray the role of assistant controller, where they will be performing research and writing memos to Vision’s owner (Hans Supeene) and Vision's Controller (Denise Charron) on various issues. These issues include accounting adjustments, accounting treatment of various transactions, choosing between assurance engagements, cost allocations, cash management, internal controls, leasing versus buying assets, and income tax issues. Associate for Parkhurst & Loewen Over the course of the last 4 weeks in Module 1 students portray the role of an associate at P&L (approved CA training office). Students will work on the review engagement for Vision and assist Leslee Supeene (Hans' spouse) with her home-based business. Page 5 of 9 Copyright 2011 – CA School of Business (CASB) All contents are restricted for authorized CASB candidates, contractors and employees Not to be released without the expressed written consent of CASB Module 1 Student Overview May 2011 Useful Resources and Readings Below is a list of required readings for this module. This list also outlines some additional resources that may help students in the more technically challenging tasks. Week 1: CICA Handbook – Accounting -- Part II – Accounting Standards for Private Enterprises (ASPE) references: o Issue 1 – Sections 1000 Financial Statement Concepts and 3400 Revenue o Issue 2 – Section 1000 Financial Statement Concepts and Section 3031 Inventories o Issue 3 – Section 3061 Property, Plant and Equipment o Issue 4 – Section 3290 Contingencies o Issue 5 – Sections 3400 Revenue and 3831 Non-monetary Transactions ASPE Guide – Sections 1000, 3061, 3290, 3400 and 3831 CICA Handbook – Assurance – Part II references: o Canadian Auditing Standard 200: Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Canadian Auditing Standards o Section 8100: General Review Standards CAS Guide – CAS 200 Comparison of Audits, Reviews, and Compilations Week 2: http://www.cra-arc.gc.ca/tx/bsnss/tpcs/pyrll/rtrns/t4/rtrn/menu-eng.html ITA 15(2), ITA 15(2.6), ITA 5(1) ITA 78(4) ITR 119R4 Canadian Tax Principles/Taxable Income and Taxes Payable for Individuals Canadian Tax Principles/Corporate Taxation and Management Decisions ITA (6)(1)(e) ITA (6)(1)(k) IT 63R5 CRA publication RC 4110 Employee or Self-employed? Ernst & Young's Guide to Preparing Personal Tax Returns/Total Income/Business and Professional Income/Classification of Income by Source/Business Income vs Employment Income Page 6 of 9 Copyright 2011 – CA School of Business (CASB) All contents are restricted for authorized CASB candidates, contractors and employees Not to be released without the expressed written consent of CASB Module 1 Student Overview May 2011 Week 3: CICA Handbook – Accounting – Part II - Section 1540: Classification of cash flows: Paragraphs 1540.12-.19; Example after 1540.48 ASPE Guide – Section 1540 Capital classes: FITAC>>Income tax regulations>>Schedule XI IT – 518R Food, Beverages, and Entertainment Expenses Interest & penalties: FITAC>>ITA 18(1)(t) Net Capital loss: FITAC>>ITA 111 CRA publication RC 4120 Employers’ Guide Filing the T4 Slip and SummaryGross salary CRA publication T4130 Employers’ Guide – Taxable Benefits and Allowances Management Decision-Making Library/Activity Based Costing Finance Library/Lease vs. Buy Decisions Activity from FFIS (The Catering Company) Canadian Tax Principles/Taxable Income and Taxes Payable for Individuals E&Y’s Guide to Preparing Personal Tax Returns/Total Income/Employment Income Week 4: Capital classes: VPL>>FITAC>>Income tax regulations>>Schedule XI CRA Website/T4012/T2 Corporation-Income Tax Guide IT518R Food, Beverages, and Entertainment Expenses Interest & penalties: FITAC>>ITA 18(1)(t) Net Capital loss: FITAC>>ITA 111 Week 5: Canadian Professional Engagement Manual (CPEM) references: o Audit Engagements Phase I – Risk Assessment/Engagement Acceptance and Continuance o Review Engagements/Engagement Acceptance and Continuance o Practice Aids/Sample Engagement Forms and Worksheets/Audits/400499-Planning/Form 405: New Engagement Acceptance o Core Concepts: Review Engagements CICA Handbook – Assurance – Part I references: o CAS 320: Materiality in Planning and Performing an Audit o CAS 520: Analytical Procedures o Section 8200: Public Accountant's Review of Financial Statements o CAS Guide – CAS 320 & CAS 520 Rules of Professional Conduct Week 6: CICA Handbook – Assurance – Part I references: o CAS 705: Modifications to the Opinion in the Independent Auditor’s Report Page 7 of 9 Copyright 2011 – CA School of Business (CASB) All contents are restricted for authorized CASB candidates, contractors and employees Not to be released without the expressed written consent of CASB Module 1 Student Overview May 2011 o Section 8100 – General Review Standards o Section 8200 - Public Accountants Review of Financial Statements CAS Guide – CAS 705 CPEM references: o Review Engagements/Reporting o Compilations IT Bulletin 514 - Work Space in Home and ITA Section 18(12) Canadian Tax Principles/Capital gains and losses/Provisions for Special Assets/Principle Residence Canadian Tax Principles/Income or Loss from a Business Ernst & Young’s Guide to Preparing Personal Income Tax Returns/Total Income/ Business and Professional Income Week 7: Superficial Loss: ITA 53, ITA 54, ITA 40(2)(g) Child Care Expenses: ITA 63, IT-495R3 Medical Expenses: ITA 118.2, IT 519R2 Donations: IT 110R3 Employment Expenses: CRA Guide T4044 Canadian Tax Principles Ernst & Young’s Guide to Preparing Personal Income Tax Returns The Canadian Business Compliance Manual Week 8: Canadian Tax Principles references: o Procedures and Administration o Supplementary Readings No. 7 – Final Returns for Deceased Taxpayers IT Regulations 5800 ITA 150 CRA website Page 8 of 9 Copyright 2011 – CA School of Business (CASB) All contents are restricted for authorized CASB candidates, contractors and employees Not to be released without the expressed written consent of CASB Module 1 Student Overview May 2011 Evolution of Vision Windows Limited Module 1 Module 2 Module 3 Module 4 Module 5 First 10 years Next 2 years Next 3 years Next 3 years Next 2 years "The Early Years" "Sale of the business and the transition to new owners and management" "Vision becomes a multinational company" "Time for some introspection" "Vision contemplates an IPO" Vision, incorporated by Hans Supeene, expands to three divisions: vinyl-clad windows, metal doors, and greenhouses and greenhouse windows. As with most companies, cash flow issues arise, and numerous personal and corporate tax matters require attention. Company and external accountants prepare and discuss adjusting journal entries as well as the presentation of selected financial matters. The company faces many decisions including hiring a new external accountant, buying or leasing assets, allocating costs to the three operating divisions, and having an audit or review engagement performed. Hans has received a number of offers to buy Vision. He engages a CA Firm to provide him with a valuation report and determine the tax effects of each offer. Due to the poor economy, the intended purchaser is unable to complete the transaction. Hans is approached by two of his managers (Elmer Hughes and Arnie Chan) who express interest and are successful in completing the purchase of Vision. Hans and his family contemplate the tax consequences of moving to Belgium. The new owners of Vision are eager to expand the business. A third shareholder who has experience in strategy is added, and a potential acquisition, Western Homes Centres Inc. (Western), is identified. Parkhurst and Loewen are engaged to complete the audit of Western. The audit of Vision is completed, and the company acquires 80% of the shares of Western. Vision purchases 100% of Dante Windows Limited, a U.K. company. With the added subsidiaries there are many consolidation and foreign currency issues requiring careful attention. With an expanded accounting department, more attention is being paid to variance analysis, the need to acquire new software, and the adequacy of the company's disaster recovery plan. With a larger employee and management group, management is considering the potential tax consequences of issuing stock options. Vision’s controller, Denise Charron, moves to England to run Dante Windows Limited. The new controller's first job is finalizing the financial statements for the year-end audit. Both Western and Vision are experiencing operational and financial challenges as evidenced by Vision's loss. The three shareholders realize they will not achieve their goal of taking Vision public unless they focus more attention on governance and strategic planning. In conjunction with making improvements in governance, Vision is considering a number of new investment opportunities. As Vision is unable to secure financing with its bankers, it focuses attention on short-term cashflow management and approaches Brennan Brothers, a venture capital group, to provide additional financing. Vision’s managers explore financial reporting, financing, taxation, regulatory and governance issues associated with a potential initial public offering on the Toronto Stock Exchange. The company’s internal and external accountants address a variety of issues including the identification and audit of related parties, information technology controls, tax planning, accounting for pension plans, segment reporting requirements, accounting for financial instruments, and international financial reporting standards. Page 9 of 9 Copyright 2011 – CA School of Business (CASB) All contents are restricted for authorized CASB candidates, contractors and employees Not to be released without the expressed written consent of CASB