HUBLINE BERHAD (“HUBLINE” OR THE “COMPANY”)

MALAYSIAN RESOURCES CORPORATION BERHAD (“MRCB” OR “COMPANY”)

PRIVATISATION AGREEMENT BETWEEN THE GOVERNMENT OF MALAYSIA,

SYARIKAT TANAH DAN HARTA SDN BHD AND COUNTRY ANNEXE SDN BHD,

SUBSIDIARY COMPANY OF MRCB

1.

2.

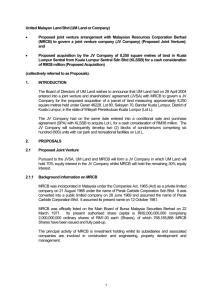

INTRODUCTION

The Company wishes to announce that its 70% subsidiary company, Country Annexe Sdn

Bhd ( “CASB”) had on 5 July 2011 entered into the Privatisation Agreement (“PA”) with the

Government of Malaysia (“Government”) and Syarikat Tanah dan Harta Sdn Bhd

(“Hartanah”) for the construction of the following: i) Little India Project – upgrading and beautification of Jalan Tun Sambanthan,

Brickfields, Kuala Lumpur beginning from the intersection of Jalan Travers and Jalan

Tun Sambanthan up to the entrance of the Brickfields Police Station (“Project 1”); ii) Pines Bazaar – a three-storey building consisting of office space, 28 units of stalls and

140 car park bays on Lot 172, Kuala Lumpur (“Project 2”); and iii) Ang Seng Development – the construction of 212 units of new government Class F quarters near Jalan Ang Seng to replace the government quarters at Jalan Rozario,

Kuala Lumpur (“Project 3”)

(hereinafter referred to as “the Projects”).

The Total Contract Sum for the Projects is RM128,713,000.

In consideration for undertaking the construction of the Projects entirely at its own cost and expense, CASB shall be given two pieces of land situated in the intersection of Lorong

Chan Ah Tong and Jalan Tun Sambanthan, Kuala Lumpur known as Lot 349, measuring

14,297 square meters and Lot 266, measuring approximately 5,642.71 square meters

(“Exchange Land”).

BACKGROUND

On 16 June 2010, the Government awarded to MRCB to jointly construct Project 1 with

DMIA Sdn Berhad (“DMIA”) on a Design, Build, Finance and Transfer basis. On 26

October 2010, Project 1 was completed at a cost of RM36.6 million and the Certificate of

Practical Completion was issued. To support the Government’s initiatives for Greater

Kuala Lumpur, Project 1 was subsequently expanded to cover Project 2 and Project 3.

CASB is a 70:30 special purpose vehicle between MRCB and DMIA respectively, formed to construct the Projects in return for the Exchange Land and to undertake the development on the Exchange Land.

1

DMIA was incorporated in Malaysia under the Companies Act, 1965 on 14 May 2008 as a private limited company under its present name. DMIA has an authorised share capital of

RM25,000,000 comprising 25,000,000 ordinary shares of RM1.00 each of which

16,000,000 ordinary shares of RM1.00 each have been issued and are fully paid-up. The issued and fully paid-up share capital is held by three individuals who are also the directors of DMIA. DMIA is principally engaged in construction and property development.

3. RATIONALE AND PROSPECT

The implementation of the PA will enable CASB to regulate its rights and obligations in relation to the Projects which mainly is performing the construction works for the Projects in return for the Exchange Land.

Upon completion of CASB’s obligations, CASB will be entitled to take possession of the

Exchange Land that is valued at approximately RM601 per square feet. Consequently,

CASB will have the opportunity to develop the Exchange Land into a mixed property development. The estimated gross development value of the mixed property development on the Exchange Land is approximately RM1 billion.

The Company believes that the proposed mixed property development on the Exchange

Land represents a good investment opportunity to further strengthen the future income of

MRCB Group.

4. FINANCIAL EFFECT

The PA is not expected to have material effects on MRCB Group’s earnings, net assets and gearing for the financial year ending 31 December 2011.

5. APPROVALS REQUIRED

The PA is not subject to any approval from the shareholders of MRCB.

6. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS

None of the Directors and/or major shareholders of MRCB or any persons connected to them have any interest, direct and/or indirect, in the PA.

7. DIRECTORS’ STATEMENT

After careful deliberation and having considered all aspects of the PA, the Board is of the opinion that the PA is in the best interest of the MRCB Group.

2