bac 332 taxation ii - Ubishops.ca

advertisement

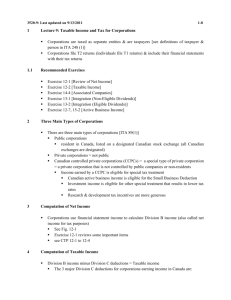

ACCOUNTING DEPARTMENT Course: Professor: Email: BAC 332B - TAXATION II / WINTER 2015 Anthony Vallée avallee@ubishops.ca COURSE OBJECTIVES: • This course builds upon the principles and concepts of Canadian income tax introduced in Taxation I, BAC 331. In particular, it examines the application of income tax law as it applies to Corporations. Attention is given to effective income tax planning for shareholder-management remuneration, tax-effective uses of corporations, and capitalgain tax deferrals. GRADING SCHEME: Test Midterm T2 corporate return Final examination 10 % 25 % 25 % 40 % 100 % NOTE: • • • • • • Tests and examinations will cover all work completed to date. Assignments are due at the start of the class indicated. Late assignments will not be accepted; all assignments should be typed. You need at least 50% in total in the final examination to pass the course. No supplemental (assignments, tests or examination). The only electronic devices allowed will be standard calculators. Use of a reasonably annotated copy of the Income Tax Act is permitted for the exams. TEXT: • • • Byrd & Chen, Canadian Tax Principles, 2014-2015 Edition, Pearson. Ernst & Young, Federal Income Tax Act, 2014 (12th Edition). Lecture notes. CONTENTS 1. INTRODUCTION AND REFRESHER 1.1 1.2 1.3 1.4 1.5 1.6 Review of the structure of the ITA Definitions applicable to corporations Residency of corporations Procedures and administration Review of the classification of income Classification of corporations References: - Chapters 1, 2, 5, 6, 7, 8 Chapter 20 (par. 35 to 41) ITA: 89(1), 125(7), 150, 150.1, 152, 156.1, 157, 163.2, 220, 230, 248(1) “balance-due day”, 250(4) 2. TAXABLE INCOME AND TAX PAYABLE FOR CORPORATIONS 2.1 2.2 2.3 2.4 2.5 2.6 Computation of net income Computation of taxable income Basic computation of taxes of all corporations Corporate rate reductions Small business deduction Related persons and associated corporations References: - Chapter 12 Chapter 14 (par. 35-50) ITA: 110.1, 111, 112, 123, 123.4, 124, 125, 181.2, 251, 256 ITR: 400, 401, 402 3. INTEGRATION, TAXATION OF INVESTMENT INCOME, REFUNDABLE TAXES, OVERVIEW OF GRIP AND LRIP 3.1 3.2 3.3 3.4 3.5 3.6 Integration Refundable Part I tax on income from investments Refundable Part IV tax on dividends received Refundable dividend tax on hand (RTDOH) Dividend refund Designation of eligible dividends References: - Chapter 13 Chapter 7 (par. 74-100) ITA: 82, 89, 121, 129, 185.1, 186 2 4. OTHER ISSUES IN CORPORATE TAXATION 4.1 4.2 Acquisition of control Investment tax credits References: - Chapter 14 (except par. 35-50 and par. 74-134) ITA: 37, 111, 127, 127.1 ITR: 4600 5. CORPORATE DISTRIBUTIONS 5.1 5.2 5.3 5.4 Shareholder’s equity: GAAP, corporate law and tax basis Dividends (taxable and non taxable) Deemed dividends Shareholder benefits and loans References: - Chapter 14 par. 74-134 Chapter 15 par. 100-122 ITA: 15, 80.4, 82, 83, 84, 184, 185 ITR: 2101, 4301 6. CORPORATE TAXATION AND MANAGEMENT DECISIONS 6.1 6.2 6.3 Advantages and disadvantages of incorporation Remuneration : salary versus dividend Other planning aspects of using Corporations : capital gain deduction, introduction to estate freeze & brief overview of the attribution rules References: - Chapter 15 par. 1-99 - Chapter 15 par. 123-181 - ITA: 67 and various sections already covered 3 7. ROLLOVERS UNDER SECTION 85, SPECIFIC ANTI-AVOIDANCE RULES AND OTHER ROLLOVER PROVISIONS 7.1 7.2 7.3 7.4 7.5 7.6 7.7 7.8 7.9 7.10 7.11 Transfer of property to a corporation by a shareholder Restriction on elected transfer price Application of basic rules Application of detailed rules Shareholder’s position Corporation’s position Affiliated persons and losses on transfers Gift to related person Section 84.1 ITA: Dividends stripping Section 55(2) ITA: Capital gains stripping Other rollovers (s. 51, 85.1, 86) References: - Chapters 16, 17 ITA: 51, 55, 84.1, 85, 85.1, 86 8. SALE OF AN INCORPORATED BUSINESS, INTRODUCTION TO TRUSTS AND PARTNERSHIPS 8.1 8.2 8.3 Winding-up of a Canadian corporation and comparison: sale of assets vs shares Introduction to Partnerships Introduction to Trusts References: - Chapters 17, 18, 19 ITA: 88(2), 96 to 105 4 TAXATION II IMPORTANT DATES WINTER 2015 Dates February 3 Test February 24 Mid-Term March 17 Lab session April 7 T2 return TBD (April 14?) Final Exam 5