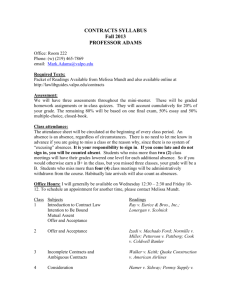

Chapter 8

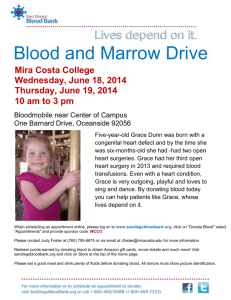

advertisement

Promissory Note A promissory note is a written promise by one party to pay a certain sum of money, with or without interest, at a specific date or on demand, to another party. Chapter 8 Simple Interest Applications 1 2 Terminology of Promissory Notes Terminology of Promissory Notes (continued) • maker - party making promise to pay • payee - party to whom the promise to pay is made • face value - sum of money (principal) specified • rate of interest - stated as a simple annual rate based on the face value (continued) • issue date - date on which the note was made • term of the note - length of time before the note matures (becomes payable) • due date or date of maturity - date on which the note is paid • interest period - time period from the date of issue to the legal due date 3 4 Promissory Notes Legal Due Date • The amount of interest is payable together with the face value on the legal due date. • The maturity value is the amount payable on the due date (face value plus interest). • Canadian law adds three days of grace to the term of the note to obtain the legal due date (Bills of Exchange Act, Section 41) 5 6 Maturity Value of Interest-bearing Promissory Note Legal Due Date • Interest is paid for the three days of grace. • No late payment penalty. • Credit rating remains good. • Write “No Grace Days” on note if you decide not to include the three days of grace. • The legal due date allows for cases in which repayment date falls on a statutory holiday. S = P(1 + rt) S Maturity value P Face value of note r Rate of interest on note t 7 Interest period (number of days between date of issue and legal due date) 8 Finding the Maturity Value of an Interest-bearing Promissory Note Exercise 8.2 A #2, 4 p. 298 Compute the maturity value of a 90 day note with a face value of $1000 issued on April 21, 2005 at an interest rate of 5.5%. P = 1000, r = 0.055, t = 90 + 3 days of grace S=P(1+rt) = 1000((1+.055(93)) =1014 365 9 Present Value of Promissory Note S P= S 1 + rt Face value ( or present value) of note at issue date Maturity value r Rate of interest P 10 Finding the Present Value of a Note A promissory note has a maturity value of $1258.25 and bears an annual interest rate of 8%. If you include the three days of grace, there are 93 days in the interest period. Find the face value or present value of the note. P= S 1+rt t Interest period 11 = 1258.25 = 1233.11 1+.08(93) 365 12 Exercise 8.3 A #1, 2 p. 305 Present Value of a Promissory Note • The present value is the value of the note any time before the due date. • The present value depends on the rate money is worth, the time between the present date and date of maturity, and the maturity value. 13 Finding the Present Value of an Interest-bearing Note 14 Finding the Present Value of an Interest-bearing Note • Step 1 -- Find the maturity value of the note using the stated interest rate. A sixty-day note for $10,000 bears an annual interest rate of 10%. Compute the present value on the date of issue if money is worth 6%. The note matures in 63 days taking the 3 days of grace into consideration. • Step 2 -- Calculate the present value of the note using the rate money is worth. Step 1 -- S = 10000(1+.10(63)) = 10,172.60 365 (continued) 15 16 Finding Present Value Exercise 8.3 B #4 p. 305 (continued) Step 2 --Find present value using the issue date as the focal date. Three days of grace have been added to the 60 days. P = S = 10172.60 = 10,068.33 1+rt 1+.06(63) 365 17 Canadian Treasury Bills 18 Purchasing a T-bill • The T-bill is purchased at a discounted price reflecting a rate of return determined by current market conditions. • The discounted price is determined by finding the present value (P) of the Tbill. • The issuing government guarantees the payment of face value at maturity. • Promissory notes issued by the federal government and most provincial governments to meet short-term financing needs. • Terms of 91, 182, and 364 days. • Do not carry an interest rate. • No days of grace. 19 20 Calculating the Purchase Price of a T-bill Exercise 8.3 C #6 p. 306 An investment dealer bought a 182-day Canadian T-bill with a face value of $100,000 to yield an annual return of 2.33%. Find the purchase price. Present Value = P = 100000 = 98,851.53 1+.0233(182) 365 21 Exercise 8.3 C #6 Cont. 22 Demand Loans • The lender may demand payment of the loan in full or in part at any time. • The borrower may repay all of the loan or any part at any time without penalty. • Interest, based on the unpaid balance, is usually payable monthly. • Interest rate is not fixed. 23 24 Demand Loan Paying Off a Demand Loan (continued) A $1200 demand loan is paid off in four monthly payments of $300 each. In addition, interest is charged at 6% per annum or .005 per month. The interest is calculated on the unpaid balance using the formula: I = Prt. The first month’s interest is 1200(.06)(1) = $6 12 (continued) Month Amount Owed Interest 1 1200 6.00 2 900 4.50 3 600 3.00 4 300 1.50 25 Exercise 8.4 A #2 p. 310 26 Declining Balance Method • A demand loan may be paid off by a series of partial payments. • Each partial payment is first applied to the accumulated interest. • Any remainder is used to reduce the outstanding principal. • Interest is always calculated on the unpaid balance. 27 28 Pointers and Pitfalls Blended Payments • The periodic payment is constant. • The payment is first applied to the accumulated interest. • The remainder of the payment after the interest has been paid is used to reduce the unpaid principal. • The last payment may be different. • The date on which there is a change in the interest rate is counted as the first day at the new interest rate. • The date on which a partial payment is made is counted as the first day at the new outstanding principal balance. 29 30 Homework #8 Exercise 8.4 B #4 p. 311 • Exercise 8.2: #A1, A3. • Exercise 8.3: #A1, A2, B3, C5. • Exercise 8.4: #A1, B3. 31 32