Business Math Lesson 8.1 Single Payment Loan

advertisement

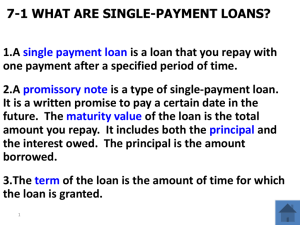

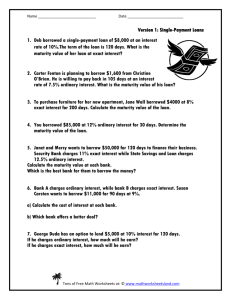

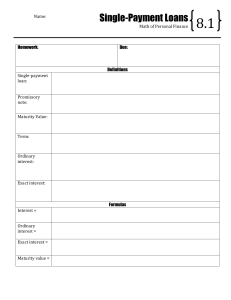

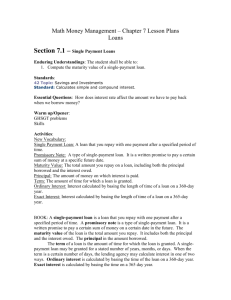

Business Math Lesson 8.1 Single Payment Loan single-payment loan - a loan that you repay with one payment after a specified period of time. ex: promissory note - written for a specified amount to be paid on a specific date in the future maturity value - the total amount of the loan that you must repay term: length of the loan types of interest: ordinary interest - calculated by basing the time of the loan on 360 days exact interest - calculated by basing the time of the loan on 365 days. interest = principal x rate x time ordinary = principal x rate x time/360 exact = principal x rate x time/365 maturity value = principal + interest owed Example 1 : Anita's bank granted her a single-payment loan of $7200 for 91 days at 1 2% ordinary interest. What is the maturity value of the loan? Example 2: Suppose her loan had been granted for 91 days at 1 2% exact interest. What is the maturity value of the loan? What is the difference between the two loans? Homework: p. 285, # 3 - 1 6