ACTG 322 INTERMEDIATE ACCOUNTING II

advertisement

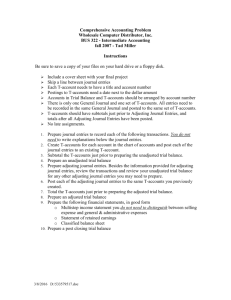

ACTG 322 INTERMEDIATE ACCOUNTING II Fall 2006 W F 8:10 - 10:00 room 03-209 W F 10:00 - 12:00 MWF 2:10 - 3:40 Office Hours Tad Miller 756-2831 office T92-104 EXPANDED COURSE OUTLINE 1.Catalog Description BUS 322 Intermediate Accounting II (4) Comprehensive coverage of financial reporting for intangible assers, stockholers equity, dilutive securities, investments, revenue recognition and the statement of cash flows. 2.Text Intermediate Accounting, eleventh ed. Kieso, Wygandt & Warfield Course content includes: (1) intangible assets (2) stockholders equity (3) dilutive securities (EPS) (5) investments (6) revenue recognition (4) statement of cash flows 3.Required Prerequisite Preparation BUS 321 with minimum grade of C- 4.Expected Outcomes The successful student will: (1) Acquire an understanding of the basic concepts and principles underlying financial accounting measurement and reporting practices. (2) Develop the critical thinking skills needed to analyze and comprehend the nature and consequences of economic events which are the subject matter of accounting. (3) Gain an appreciation for the behavioral and economic consequences of accounting and reporting alternatives, including ethical considerations. Two mid-term exams and a final exam will be equally weighted. Projects and Quizzes will be weighted according to the amount of material covered. Quizzes and exams must be taken with your assigned section on the scheduled day. Missed quizzes or exams cannot be made up. If you must miss a quiz or exam you must notify TAD MILLER prior to the exam. If the reason is acceptable to me then I will re-weight your other quiz and exam scores. Accounting Cycle Project Due Mid-term chapters 12 & 15 Stateof Cash Flows Project Mid-term chapters 16 & 17 Final exam 8:00-10:00 section 12:00- 2:00 section Total Pts Friday Friday Monday Wednesday Wednesday Friday Oct Oct Oct Nov Dec Dec 6 13 23 15 13 15 25 150 25 150 150 . 600 pts 7:10 -10:00 AM 10:10 - 1:00 pts As part of new AACSB accreditation requirements, the Orfalea College of Business is implementing a new comprehensive assessment plan. During the quarter you will be asked to submit an assignment to the STEPS assessment software website https://steps.cob.csuchico.edu/web/ . You will receive further instructions on the assignment to post and how to post it during the quarter. Please understand that your willingness to participate in this process is critical to our success. Assessment is not the measurement of individual students or faculty, but rather it is an instrument used to determine whether or not students as a whole are reaching the program’s learning goals. In order to understand a lecture, you must complete the assigned reading materials, exercises and problems. (Q) indicates a question, (BE) a basic exercise, (E) an exercise and (P) a problem on the tentative schedule. The Basic Exercises, Exercises and Problems that I intend to go over in my lecture appear in boldface. Tentative Schedule day W date chapter 9 27 12 F chapter or topic Review of what we know from 321 assign Accounting Cycle project - due Friday, Oct. 6th Intangible Assets Q 1 3 16 9 29 W 10 F 10 Purchased vs internally created goodwill impairment R&D costs 4 12A Software Costs 15 Accounting Cycle project - due Stockholders Equity (and the first 6 W 10 11 15 F 10 13 W 10 18 Mid Term - chapters 12 & 15 23 section 1 Statement of cash flows special problems 23 section 2 Worksheet statement preparation M 10 23 W 10 25 Q 3 4 5 17 E1 BE 1 2 3 Q 9 10 11 12 15 E3456 BE 4 5 6 7 9 11 Q1 CH 5 E 14 15 16 CH 23 E 9 11/12 13/14 15 16 Statement of Cash Flows group project - due 16 convertible securities (Section 1) 16 & 16a F 10 27 E3 Q 8 9 BE 2 5 7 11 E 4 6 7 10 11 14 Q 5 12 BE 6 8 E 12 15 P5 Q 15 16 17 BE 7 E 11(3) 14 P 5 Q 20 21 BE 9 E 16 17 Q 26 27 BE 13 E 18 19 part of the Appendix) Issuance Q 1 4 9 10 BE 1 2 4 5 6 9 E 1 2 3 4 5 T-stock cost method Q 12 17 BE 7 8 E 6 7 P25 Preferred stock (also Appendix) Q 3 13 14 15 BE 15 E 8 21 22 23 dividends and stock splits Q 22 23 24 25 28 BE 10 12 13 14 E 11 12 14 classification of activities indirect or direct method F 10 20 representative problems 16 warrants stock options Section 2 - Earnings per Share (section 2) weighted ave no. of shares convertible securities options and warrants 16B Basic & diluted Q2345678 B2 E123456 Q9 B45 E79 Q 10 11 13 B 6 7 E 10 11 12 13 14 Q 15 B 8 Q 16 B 9 10 E 15 16 17 18 19 20 21 Q 17 18 19 20 21 23 B 11 12 E 22 23 24 25 B 13 E 26 28 P 6 App B we will use Appendix B as a classroom example for EPS W 11 F 11 W 11 1 3 8 17 Investments - in debt Debt Invest in Equity (not Equity Method) Q 1 4-13 B 1-4 E 1 2 3 4 5 P 1 2 4 7 Q 14-17 B 5 6 9 E 6 7 8 9 10 11 14 P 6 9 10 17 Equity Method 17A Derivative Instruments - calls / puts Fair Value Hedge Cash Flow Hedge Q 18 21 22 B 7 E 12 13 16 17 E 19 P 13 14 15 Q 29 E 22 P 16 18 Q 32 33 P 17 F 11 10 Veteran's Day - academic holiday W 11 15 Mid Term - chapters 16 & 17 F 11 17 18 Revenue Recognition Q2 net v gross I assume you know E2 3 sales returns Q5 BE 1 E 1 percentage completion / completed contract Q 7 11 12 BE 2 3 6 E 4 7 10 P234567 Thanksgiving - academic holiday Thanksgiving - academic holiday 18 installment sales / cost recovery 18A Franchises additional topics on Revenue Recognition additional topics investments - derivatives review W 11 22 F 11 24 W 11 29 F 12 W 12 F 12 1 6 8 Final Exam Q 16-21 BE 7 8 9 E 11 13 14 P89 Q 25 36 BE 11 E 21 8:10-10:00 section Wednesday Dec. 13th 7:10 - 10:00 am 12:00- 2:00 section Friday Dec. 15th 10:10 - 1:00 Comprehensive Accounting Problem Wholesale Computer Distributor, Inc. BUS 322 - Intermediate Accounting fall 2006 - Tad Miller Instructions Completion of the accounting cycle through an adjusted trial balance. Please keep a copy for yourself on your disk or hard drive. Be sure to save a copy of your files on your hard drive or a floppy disk. Include a cover sheet with your final project Skip a line between journal entries Each T-account needs to have a title and account number Postings to T-accounts need a date next to the dollar amount Accounts in Trial Balance and T-accounts should be arranged by account number There is only one General Journal and one set of T-accounts. All entries need to be recorded in the same General Journal and posted to the same set of T-accounts. T-accounts should have subtotals just prior to Adjusting Journal Entries, and totals after all Adjusting Journal Entries have been posted. No late assignments. Prepare journal entries to record each of the following transactions. You do not need to write explanations below the journal entries. 2. Create T-accounts for each account in the chart of accounts and post each of the journal entries to an existing T-account. 3. Subtotal the T-accounts just prior to preparing the unadjusted trial balance. 4. Prepare an unadjusted trial balance 1. Prepare adjusting journal entries. Besides the information provided for adjusting journal entries, review the transactions and review your unadjusted trial balance for any other adjusting journal entries you may need to prepare. 6. Post each of the adjusting journal entries to the same T-accounts you previously created. 7. Total the T-accounts just prior to preparing the unadjusted trial balance. 8. Prepare an adjusted trial balance 5. Prepare the following financial statements, in good form o Multistep income statement you do not need to distinguish between selling expense and general & administrative expenses o Statement of retained earnings o Classified balance sheet 10. Prepare a post closing trial balance 9. Chart of Accounts to start 1002 Checking 1011 Accounts Receivable Cuesta Computer 1012 Accounts Receivable Mustang Computer 1013 Accounts Receivable SLO CPU 1121 Inventory -Xtreme game systems 1122 Inventory HP office systems 1123 Inventory Gateway home systems 1500 Investment in land 1600 Supplies 1800 Land 1810 Building 1811 accumulated depreciation 1820 Equipment 1821 accumulated depreciation 2001 Accounts Payable Xtreme 2002 Accounts Payable HP 2003 Accounts Payable Gateway 2100 Payroll Liabilities 2101 Wages and Salaries Payable 2103 IRS income tax withheld payable 2104 IRS FICA payable 2105 payable to Franchise Tax Board 2200 Sales Tax Payable 2501 Note Payable 2502 Mortgage Payable 2510 Bonds Payable 2511 discount on Bonds Payable 3010 Capital Stock 3021 Additional Paid in Capital 3099 Retained Earnings 4011 Sales Xtreme game systems 4012 Sales HP office systems 4013 Sales Gateway home systems 4030 Sales Discounts 5000 Cost of Goods Sold 5301 Purchase discounts 6150 Depreciation Expense 6240 Miscellaneous 6560 Wage & Salary Expenses 6770 Supplies expense 7010 Interest Income 8010 Interest Expenses 8011 Mortgage Interest 8012 Note Interest 8013 Bond Interest 8020 Loss on sale of land Suppliers Xtreme -game systems HP -office systems Gateway -home systems Customers Cuesta Computer Mustang Computer SLO CPU walk-in customers price $ 3,000.00 2,000.00 900.00 cost 2,400.00 1,700.00 720.00 terms 1% 15, net 30 1%/20, net/30 2%/10, net/30 terms 2%/10 net 30 terms 2%/10 net 30 terms 2%/10 net 30 cash only - no discount Sep 25 Issued 10,000 shares of $1 par value common stock for $15 per share. Sep 30 Made a $50,000 down payment and signed a $600,000 mortgage to purchase land and building, which will be used as the distribution center. The land comprised of three (3) lots which appraised at $132,000 each ($396,000 total) and the building appraised for $264,000. The building occupies one (1) lot, one (1) lot will serve as parking and WCD intends to sell the third lot. The loan is a ten (10) year, 8.0% mortgage requiring monthly payments consisting of principle and interest. Sep 30 Issued a 100 bonds with $1,000 face value and 6% coupon rate. The bonds mature in ten (10) years and pay interest semi-annually. The bonds sell at a price to yield an 8% effective interest rate. Sep 30 Borrowed $100,000 from First Bank to purchase shelving for the warehouse. The shelving cost $100,000 and is expected to last five (5) years. The note is a three (3) year, 9% note that requires principle and interest payments on the last day or each month. Sep 30 Purchase inventory 150 systems from Gateway at $720 per system 100 systems from HP at $1,700 per system 40 systems from Xtreme at $2,400 per system terms 2%/10, net/30 terms 1%/20, net/30 terms 1% 15, net 30 Oct 1 Paid $1,000 for supplies. Oct 5 Sold Cuesta Computer sixty (60) Gateway sytstems and forty (40) HP systems, on account. Although, Cuesta Computer is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume Cuesta pays 7.5% sales tax. Oct 6 Paid Gateway bill in full (in the discount period) Oct 10 Sold SLO CPU twenty-five (25) Xtreme systems. Although, SLO CPU is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume SLO CPU pays 7.5% sales tax. Oct 14 Received payment in full from Cuesta Computer (in the discount period). Oct 14 Sold Mustang Computer fifty (50) Gateway sytstems and fifty (50) HP systems. Although, Mustang Computer is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume Mustang Computer pays 7.5% sales tax. Oct 14 Paid HP bill in full (in the discount period) Oct 15 Purchase inventory 75 systems from Gateway at $720 per system 50 systems from HP at $1,700 per system 25 systems from Xtreme at $2,400 per system terms 2%/10, net/30 terms 1%/20, net/30 terms 1% 15, net 30 Oct 16 Paid salaries totaling $5,000 for the first half of the month. In order to make this entry you must know that 15% was withheld for federal income tax, 5% was withheld for state income tax, 7.65% (6.2% social security and 1.45% medicare) was withheld for FICA. Don't forget that the employer is also responsible for matching the employee's contribution to FICA. Oct 17 Paid the $xxxxx owed the State Board of Equalization for the sales tax on sales through Oct. 15th. Oct 17 Paid the $xxxxx the Franchise Tax Board the amounts withheld for state income tax and the IRS the amounts owed for income tax and FICA. Oct 20 Sold Cuesta Computer sixty (40) Gateway sytstems and forty (40) HP systems, on account. Although, Cuesta Computer is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume Cuesta pays 7.5% sales tax. Oct 25 Sold SLO CPU twenty-five (25) Xtreme systems. Although, SLO CPU is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume SLO CPU pays 7.5% sales tax. Oct 23 Received payment in full from Mustang Computers (in discount period). Oct 24 Paid Gateway bill in full (in the discount period) Oct 25 Received payment in full from SLO CPU. The first invoice was out of discount period and the second invoice was in the discount period. Oct 27 Sold the extra parcel of land, which was held as an investment, for $125,000. Oct 28 Paid Xtreme bill in full (first invoice out of the discount period) Paid Xtreme bill in full (second invoice in the discount period) Oct 29 Paid HP bill in full (in the discount period) Oct 29 Received payment in full from Cuesta Computer (in the discount period). Oct 30 Sold Mustang Computer fifty (50) Gateway sytstems and fifty (50) HP systems. Although, Mustang Computer is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume Mustang Computer pays 7.5% sales tax. Additional information Depreciation on: building - 20 years shelving - 5 years Monthly payment on: mortgage payment 10 years at 8% note 3 year at 9% Interest payment on $100,000, 6% bond issued to yield 8% Supplies worth $175 are on hand at the end of the month Accrue salaries for the second half of the month (same amount) Statement of Cash Flows Project due Monday, Oct. 23, 2006 NATIONAL BRANDS CORPORATION Comparative Balance Sheets December 31, 2006 and 2005 ($ in thousands) Assets: 2006 Cash $ 29 Accounts receivable 32 Short-term investments 12 Inventory 46 Prepaid insurance 3 Land 80 Buildings and equipment 81 Less accumulated depreciation(16) $ 267 2005 $ 20 30 0 50 6 60 75 (20) $ 221 Liabilities 2006 Accounts payable $ 26 Salaries payable 3 Income tax payable 6 Notes payable 20 Bonds payable 35 less discount on bond (1) 2005 $ 20 1 8 0 50 (3) Shareholders Equity Common stock 130 Paid-in capital in excess29 Retained earnings 19 $ 267 100 20 25 $ 221 National Brands Corporation Income Statement for the Year Ended December 31, 2006 ($ in thousands) Revenues: Sales revenue Dividend income Gain on sale of land Expenses: Cost of goods sold Salaries expense Depreciation expense Bond interest expense Insurance expense Loss oil sale of equipment Income tax expense Net income $100 3 8 60 13 3 5 7 2 9 $ 12 Additional information from the accounting records: a. b. c. d. e. A portion of company land, purchased in a previous year for $10,000. was sold for $18,000. Equipment that originally cost $1,400, and which was one-half depreciated, was sold for $5,000 cash. A short-term investment was made by purchasing $12,000 of Mazuma Corp.'s common stock. Property was purchased for $30,000 cash for use as a parking lot. On December 30, 2006. new equipment was acquired by issuing a 12%,., five-year, $20,000 note payable to the seller. f. On January 1, 2006, $15,000 of bonds were retired at maturity. g. The increase in the common stock account is attributable two events. First, the issuance of a 10% stock dividend (1,000 shares). Second, the issuance of 2,000 shares of common stock for cash. The stock dividend occurred first. Assume the stock had a $10 par value and was selling for $13 per share. h. Cash dividends of $5,000 were paid to shareholders.