ACTG 322 INTERMEDIATE ACCOUNTING II

advertisement

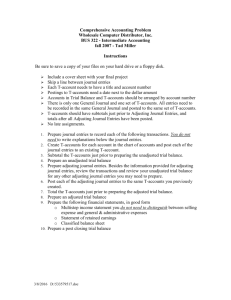

ACTG 322 INTERMEDIATE ACCOUNTING II Fall 2007 Tad Miller M W 8:10 -10:00 & 12:10 -2:00 room 03-206 756-2831 office hours M W 10:10 -11:00 & TR 3:00 -4:00 office - MODOC T92 room 104 EXPANDED COURSE OUTLINE 1.Catalog Description BUS 322 Intermediate Accounting II (4) Comprehensive coverage of financial reporting. 322 covers revenue recognition, income taxes, pensions, liabilities, equities, accounting changes and cash flows. 4 lectures. 2.Text Intermediate Accounting, twelfth ed. Kieso, Wygandt & Warfield Course content includes: (1) Intangible assets (2) Stockholders equity (3) Statement of Cash Flows (4) Dilutive securities (EPS) (5) Earnings per share (6) Investments (7) Revenue recognition 3.Required Prerequisite Preparation BUS 321 with minimum grade of C- 4.Expected Outcomes The successful student will: (1) Acquire an understanding of the basic concepts and principles underlying financial accounting measurement and reporting practices. (2) Develop the critical thinking skills needed to analyze and comprehend the nature and consequences of economic events which are the subject matter of accounting. (3) Gain an appreciation for the behavioral and economic consequences of accounting and reporting alternatives, including ethical considerations. (4) Cultivate the communication skills essential to the financial reporting process. Two mid-term exams and a final exam will be equally weighted. Projects and Quizzes will be weighted according to the amount of material covered. Quizzes and exams must be taken with your assigned section on the scheduled day. Missed quizzes or exams cannot be made up. If you must miss a quiz or exam you must notify TAD MILLER prior to the exam. If the reason is acceptable to me then I will re-weight your other quiz and exam scores. Accounting Cycle Project Due Mid-term chapters 12 & 15 Statement of Cash Flows Due Mid-term chapters 23, 16 & 17 Final exam 8-10 section 12-2 section Total Pts Friday Wednesday Friday Monday Wednesday Friday Sep Oct Oct Nov Dec Dec 28 3 12 5 5 7 25 150 25 150 150 . 500 pts 7:00 am 10:00 pts In order to understand a lecture, you must complete the assigned reading materials, exercises and problems. (Q) indicates a question, (B) a basic exercise, (E) an exercise and (P) a problem on the tentative schedule. The Basic Exercises, Exercises and Problems that I intend to go over in my lecture appear in boldface. Tentative Schedule day date chapter M 9 17 12 W 9 19 F 12A 15 9 28 M 10 1 Reveiw of what we know from 321 assign accounting cycle project - due Friday, sep. 28th Intangible Assets Q 1 3 16 E3 Q 8 9 BE 2 5 7 12 E 4 6 7 10 11 14 Q 5 12 BE 6 8 E 12 15 P5 Q 15 16 17 BE 7 E 11(3) 14 P 5 Q 20 21 BE 10 E 16 17 Software Costs Q 26 27 BE 14 E 18 19 Stockholders equity & div. preference from appendix Q 1 3 4 13 14 15 E8 Issuance Q 9 10 B 1 2 4 5 6 9 E 1 2 3 4 5 T-stock cost method Q 12 17 B78 E67 P25 accounting cycle project - due 15 Preferred Stock (also appendix) dividends and stock splits W 10 3 M 10 8 23 23 section 2 Worksheet statement preparation F 10 12 16 16 16B M 10 22 w 10 31 BE 1 2 3 E3456 CH 5 E 14 15 16 CH 23 E 9 11/12 13/14 15/16 17 Q2345678 B2 E123456 warrants Q9 B45 E79 stock options Q 10 11 13 B 6 E 10 11 12 28 29 Section 2 - Earnings per Share Q 15 16 B79 weighted ave no. of shares B9 E 13 14 15 16 17 18 19 convertible securities Q 17 18 19 20 21 23 B 11 12 E 20 21 22 23 options and warrants B 13 14 E 24 26 Basic & diluted P 6 App B we will use Appendix B as a classroom example for EPS Convertible securities Investments - in debt Debt Invest in Equity (not Equity Method) W 10 24 M 10 29 Q 3 4 5 17 E1 Q 9 10 11 12 15 BE 4 5 6 7 9 11 Q1 Statement of Cash Flows project - due 16A W 10 17 E 11 B 10 12 13 14 E 12 13 14 Assign Statement of Cash Flows group project - due Friday 10/12/07 section 1 Statement of cash flows special problems M 10 15 Q 21 27 Q 22 23 24 Mid Term - Chapters 12 & 15 classification of activities indirect or direct method W 10 10 representative problems Purchased vs internally created goodwill impairment R&D costs M 9 24 W 9 26 chapter or topic Equity Method 17A Derivative Instruments - calls / puts Fair Value Hedge Cash Flow Hedge catch up Q 1 4-11 B 1-4 E 1 2 3 4 5 P 1 2 4 7 Q 12-16 B 5 6 9 E 6 7 8 9 10 11 14 P 6 9 10 Q 16-20 B 7 E 12 13 16 17 E 19 P 13 14 15 Q 27 E 23 P 16 18 Q 30 31 E 22 P 17 M 11 5 W 11 7 M 11 12 W 11 14 Mid Term Exam - Chapters 23 - 16 -17 18 Revenue Recognition Q2 sales returns Q5 BE 1 E 1 percentage completion / completed contract Q 7 11 12 BE 2 3 6 E 4 7 10 P234567 Veterans' Day installment sales / cost recovery Q 16-21 BE 7 8 9 E 11 13 14 P89 M 11 19 18A w 11 21 thanksgiving M 11 26 W 11 28 Catch Up Final Exam 8:10-10:00 sectipn 12:10-2:00 section Franchises Q 25 36 BE 11 Wednesday Dec 5th 7:10 - 10:00 am Friday Dec 7th 10:10 - 1:00 E 21 Comprehensive Accounting Problem Wholesale Computer Distributor, Inc. BUS 322 - Intermediate Accounting fall 2007 - Tad Miller Instructions Be sure to save a copy of your files on your hard drive or a floppy disk. Include a cover sheet with your final project Skip a line between journal entries Each T-account needs to have a title and account number Postings to T-accounts need a date next to the dollar amount Accounts in Trial Balance and T-accounts should be arranged by account number There is only one General Journal and one set of T-accounts. All entries need to be recorded in the same General Journal and posted to the same set of T-accounts. T-accounts should have subtotals just prior to Adjusting Journal Entries, and totals after all Adjusting Journal Entries have been posted. No late assignments. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Prepare journal entries to record each of the following transactions. You do not need to write explanations below the journal entries. Create T-accounts for each account in the chart of accounts and post each of the journal entries to an existing T-account. Subtotal the T-accounts just prior to preparing the unadjusted trial balance. Prepare an unadjusted trial balance Prepare adjusting journal entries. Besides the information provided for adjusting journal entries, review the transactions and review your unadjusted trial balance for any other adjusting journal entries you may need to prepare. Post each of the adjusting journal entries to the same T-accounts you previously created. Total the T-accounts just prior to preparing the adjusted trial balance. Prepare an adjusted trial balance Prepare the following financial statements, in good form o Multistep income statement you do not need to distinguish between selling expense and general & administrative expenses o Statement of retained earnings o Classified balance sheet Prepare a post closing trial balance Chart of Accounts to start 1002 Checking 1011 Accounts Receivable Cuesta Computer 1012 Accounts Receivable Mustang Computer 1013 Accounts Receivable SLO CPU 1121 Inventory -Xtreme game systems 1122 Inventory HP office systems 1123 Inventory Gateway home systems 1500 Investment in land 1600 Supplies 1800 Land 1810 Building 1811 accumulated depreciation 1820 Equipment 1821 accumulated depreciation 2001 Accounts Payable Xtreme 2002 Accounts Payable HP 2003 Accounts Payable Gateway 2100 Payroll Liabilities 2101 Wages and Salaries Payable 2103 IRS income tax withheld payable 2104 IRS FICA payable 2105 payable to Franchise Tax Board 2200 Sales Tax Payable 2501 Note Payable 2502 Mortgage Payable 2510 Bonds Payable 2511 discount on Bonds Payable 3010 Capital Stock 3021 Additional Paid in Capital 3099 Retained Earnings 4011 Sales Xtreme game systems 4012 Sales HP office systems 4013 Sales Gateway home systems 4030 Sales Discounts 5000 Cost of Goods Sold 5301 Purchase discounts 6150 Depreciation Expense 6240 Miscellaneous 6560 Wage & Salary Expenses 6770 Supplies expense 7010 Interest Income 8010 Interest Expenses 8011 Mortgage Interest 8012 Note Interest 8013 Bond Interest 8020 Loss on sale of land Suppliers Xtreme -game systems HP -office systems Gateway -home systems Customers Cuesta Computer Mustang Computer SLO CPU walk-in customers price $ 3,000.00 2,000.00 900.00 cost 2,400.00 1,700.00 720.00 terms 1% 15, net 30 1%/20, net/30 2%/10, net/30 terms 2%/10 net 30 terms 2%/10 net 30 terms 2%/10 net 30 cash only - no discount Dec 25 Issued 10,000 shares of $1 par value common stock for $15 per share. Dec 30 Made a $50,000 down payment and signed a $600,000 mortgage to purchase land and building, which will be used as the distribution center. The land comprised of three (3) lots which appraised at $132,000 each ($396,000 total) and the building appraised for $264,000. The building occupies one (1) lot, one (1) lot will serve as parking and WCD intends to sell the third lot. The loan is a ten (10) year, 8.0% mortgage requiring monthly payments consisting of principle and interest. Dec 30 Issued a 100 bonds with $1,000 face value and 6% coupon rate. The bonds mature in ten (10) years and pay interest semi-annually. The bonds sell at a price to yield an 8% effective interest rate. Dec 30 Borrowed $100,000 from First Bank to purchase shelving for the warehouse. The shelving cost $100,000 and is expected to last five (5) years. The note is a three (3) year, 9% note that requires principle and interest payments on the last day or each month. Dec 30 Purchase inventory 150 systems from Gateway at $720 per system 100 systems from HP at $1,700 per system 40 systems from Xtreme at $2,400 per system terms 2%/10, net/30 terms 1%/20, net/30 terms 1% 15, net 30 Jan 1 Paid $1,000 for supplies. Jan 5 Sold Cuesta Computer sixty (60) Gateway sytstems and forty (40) HP systems, on account. Although, Cuesta Computer is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume Cuesta pays 7.5% sales tax. Jan 6 Paid Gateway bill in full (in the discount period) Jan 10 Sold SLO CPU twenty-five (25) Xtreme systems. Although, SLO CPU is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume SLO CPU pays 7.5% sales tax. Jan 14 Received payment in full from Cuesta Computer (in the discount period). Jan 14 Sold Mustang Computer fifty (50) Gateway sytstems and fifty (50) HP systems. Although, Mustang Computer is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume Mustang Computer pays 7.5% sales tax. Jan 14 Paid HP bill in full (in the discount period) Jan 15 Purchase inventory 75 systems from Gateway at $720 per system 50 systems from HP at $1,700 per system 25 systems from Xtreme at $2,400 per system terms 2%/10, net/30 terms 1%/20, net/30 terms 1%/15, net 30 Jan 16 Paid salaries totaling $5,000 for the first half of the month. In order to make this entry you must know that 15% was withheld for federal income tax, 5% was withheld for state income tax, 7.65% (6.2% social security and 1.45% medicare) was withheld for FICA. Don't forget that the employer is also responsible for matching the employee's contribution to FICA. Jan 17 Paid the $xxxxx owed the State Board of Equalization for the sales tax on sales through Jan. 15th. Jan 17 Paid the $xxxxx the Franchise Tax Board the amounts withheld for state income tax and the IRS the amounts owed for income tax and FICA. Jan 20 Sold Cuesta Computer forty (40) Gateway systems and forty (40) HP systems, on account. Although, Cuesta Computer is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume Cuesta pays 7.5% sales tax. Jan 22 Sold SLO CPU twenty-five (25) Xtreme systems. Although, SLO CPU is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume SLO CPU pays 7.5% sales tax. Jan 23 Jan 24 Jan 25 Received payment in full from Mustang Computers (in discount period). Paid Gateway bill in full (in the discount period) Received payment in full from SLO CPU. The first invoice was out of discount period and the second invoice was in the discount period. Jan 27 Sold the extra parcel of land, which was held as an investment, for $125,000. Jan 28 Paid Xtreme bill in full (first invoice out of the discount period) Paid Xtreme bill in full (second invoice in the discount period) Jan 29 Paid HP bill in full (in the discount period) Jan 29 Received payment in full from Cuesta Computer (in the discount period). Jan 30 Sold Mustang Computer fifty (50) Gateway systems and ten (10) HP systems. Although, Mustang Computer is a retailer and should not have to pay sales tax, in order to make our problem more realistic, assume Mustang Computer pays 7.5% sales tax. Additional information Depreciation on: building - 20 years; Monthly payment on: mortgage payment 10 years at 8%; Interest payment on $100,000, 6% bond issued to yield 8% Supplies worth $175 are on hand at the end of the month Accrue salaries for the second half of the month (same amount) shelving - 5 years note 3 year at 9% Statement of Cash Flows Project due Friday,October 12, 2007 NATIONAL BRANDS CORPORATION Comparative Balance Sheets December 31, 2007 and 2006 ($ in thousands) Assets: 2007 Cash $ 29 Accounts receivable 32 Short-term investments 12 Inventory 46 Prepaid insurance 3 Land 80 Buildings and equipment 81 Less accumulated depreciation(16) $ 267 2006 $ 20 30 0 50 6 60 75 (20) $ 221 Liabilities 2007 Accounts payable $ 26 Salaries payable 3 Income tax payable 6 Notes payable 20 Bonds payable 35 less discount on bond (1) 2006 $ 20 1 8 0 50 (3) Shareholders Equity Common stock 130 Paid-in capital in excess29 Retained earnings 19 $ 267 100 20 25 $ 221 National Brands Corporation Income Statement for the Year Ended December 31, 2007 ($ in thousands) Revenues: Sales revenue Dividend income Gain on sale of land Expenses: Cost of goods sold Salaries expense Depreciation expense Bond interest expense Insurance expense Loss oil sale of equipment Income tax expense Net income $100 3 8 60 13 3 5 7 2 9 $ 12 Additional information from the accounting records: a. b. c. d. A portion of company land, purchased in a previous year for $10,000. was sold for $18,000. Equipment that originally cost $14,000, and which was one-half depreciated, was sold for $5,000 cash. A short-term investment was made by purchasing $12,000 of Mazuma Corp.'s common stock. Property was purchased for $30,000 cash for use as a parking lot. e. On December 30, 2007, new equipment was acquired by issuing a 12%, five-year, $20,000 note payable to the seller. f. On January 1, 2007, $15,000 of bonds were retired at maturity. g. The increase in the common stock account is attributable two events. First, the issuance of a 10% stock dividend (1,000 shares). Second, the issuance of 2,000 shares of common stock for cash. The stock dividend occurred first. Assume the stock had a $10 par value and was selling for $13 per share. h. Cash dividends of $5,000 were paid to shareholders.