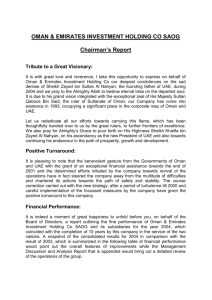

Chairman's Report

advertisement

Chairman’s Report - 31st March 2011 Dear Shareholders, Let me take this opportunity to present the financial performance of Oman & Emirates Investment Holding Co SAOG for the three month period ended 31 March 2011 and also a brief update on the various activities of the company. Financial Results: During the I quarter 2011, the Group has incurred a Net Loss of RO 2,504,088 (I Quarter 2010: Net Profit of RO 2,413,238) and the Parent Company has incurred a Net Loss of RO 1,947,632 (I Quarter 2010: Net Profit of RO 1,560,368). The decline in the stock indices in Oman - MSM by (-) 8.70% and UAE - ADX by (-) 4.15% and DFM by (-) 4.57% during the I Quarter 2011 had a negative impact on the investment valuations and consequently on the profitability of the company. The local conditions in the region have adversely affected the performance of the stock markets in these countries. Net Equity and Investments: The Net Equity of the Group and the Parent Company stands at RO 15.522 Million (31 March 2010: RO 22.043 Million) RO 12.275 Million (31 March 2010: RO 17.499 Million) respectively, as against the share capital of RO 12.187 Million as at 31 March 2011. The total value of the investments for the Group and the Parent Company has become RO 49.428 Million (31 March 2010: RO 50.197 Million) and RO 44.081 Million (31 March 2010: RO 47.628 Million) respectively as at 31 March 2011. New Investments: During Jan 2011, the company has acquired a net additional equity stake of 13.76% at a cost of RO 1.209 Million in The Financial Corporation Co SAOG (FINCORP), thereby increasing the holding to 51.2 and making this as a Subsidiary Company. We believe that this acquisition will help us to strengthen our investment base in the Financial sector. Besides, the company has invested RO 978,254 in the ‘Rights’ offering of Oman Medical Projects Co SAOG in Jan 2011. 1 Associates and Subsidiaries: The associates and subsidiaries have shown mixed performance and the share of results from these companies during the I Quarter 2011, based on our equity holding in these companies as at 31.03.2011 are as follows: Investee Companies Majan Capital Fund CI Capital Gulf Financial Brokerage Co LLC Omani Euro Food Industries Co SAOG Omani Pedigree Goat Breeding Co LLC FINCORP SAOG Oman Hotels and Tourism Co SAOG Oman Medical Projects Co SAOG Horizon Technologies Co SAOC Dhofar Fisheries Industries Co SAOG Oman Fiber Optic Co SAOG Equity Holding % 91.11% 50.00% 65.80% 100.00% 51.20% 31.17% 39.63% 20.00% 39.13% 20.91% Jan – Mar 2011 RO (-) 279,234 (-) 52,174 (-) 65,606 (-) 33,262 (-) 263,973 95,936 75,058 (-) 117,476 (-) 111,101 99,515 Jan – Mar 2010 RO 247,296 (-) 82,090 (-) 50,484 (-) 72,754 50,089 129,879 (-) 130,502 (-) 174,914 - Outlook: It is expected that the stock markets across the region are likely to perform better in the coming months, leading to appreciation in the stock prices, leading to a higher investment valuation at the end of the current year. We are also closely monitoring the operations of the loss making companies in the Group and trying our best to bring in strategic investors for these companies with a view to set in place stable income stream in these companies. We are hopeful of achieving positive results in this matter. Acknowledgement: We take this opportunity to convey our heartfelt gratitude to the Government of the Sultanate of Oman and United Arab Emirates, banks, stock market authorities, shareholders and employees of the Company for their unstinted support and cooperation. May God help us to serve better and better for the furtherance of both the countries under the wise guidance and leadership of His Majesty Sultan Qaboos Bin Said and His Highness Sheikh Khalifa Bin Zayed Al Nahyan. May God’s Grace be bestowed on them in abundance towards achieving greater success in all their endeavours. HILAL HAMAD ABDULLAH AL HASSANI Chairman 7th May 2011 2 3