Exercises on Chapter 24

advertisement

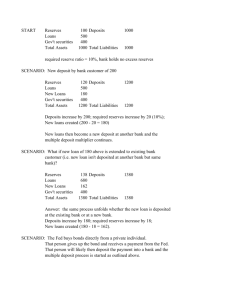

Answers to Exercises: Chapter 26 1. John puts $50,000 of currency into a checking deposit in Bank A. a) Show what happens as a direct result of the preceding transaction in the Balance sheet of Bank A below. Suppose that the required reserve ratio on checking deposits is 30 percent. Change in Assets Total reserves Bank A $50,000 Change in Liabilities John's checkable deposits $50.000 Required $15,000 Excess $ 35,000 b) What happens to MI as a result of the preceding transaction? Explain. No change in MI but change in composition: increase in checkable deposits but decrease in currency in circulation c) What is the maximum amount of money that Bank A can lend out as a result of the preceding transaction? Explain. $35,000 Bank A can not lend more than its excess reserves. d) What happens to MI as a result of the transaction in part (c)? (Assume that Bank A gave a loan for the maximum amount) Explain. MI increases by $35,000 b/c there is an increase in the amount of checkable deposits in the hands of general public. e) Assume that Bank A makes a loan for the maximum amount. What is the change in MI if we assume that the deposit expansion process continues up to its maximum limit given by the money multiplier? Maximum potential increase in Ml I/rrr x initial excess reserves = 1/.30 (35,000) = $116,666.67 2. Suppose that the Fourth National Bank has the following simplified balance sheet. Suppose also that the bank is loaned up. Assets Reserves $ 40,000 Govtbonds 90,000 Loans 70,000 Liabilities Demand Deposits $200,000 a. What is the required reserve ratio? Rrr = $40,000/$200,000 =.20 b. Assume that households and businesses deposit $5,000 worth of currency in this bank and that this currency is added to the bank's reserves. Draw a new balance sheet to show the changes after the transaction. Change in Assets Reserves 5,000 Required $1,000 Excess $4,000 Change in Liabilities checkable deposits 5,000 c. How much has the supply of money changed as a result of this transaction? No change in MI: Only composition has changed (see exercise #1). d. How much excess reserves does this bank now have? Excess reserves = $4,000 e. How much can this bank safely expand its loans from the above transaction? Amount of excess reserves = $4,000 f. Assume that Fourth National Bank makes a loan for the amount cited in part (e) above. What are the ultimate effects of this transaction on the money supply assuming that the deposit expansion process continues up to its maximum limit given by the money multiplier? Maximum potential change in MI = 1/.20 ($4,000) = $20,000