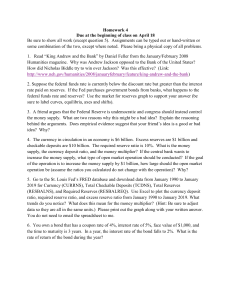

Money Multiplier Flow Chart This helps you apply money multipliers to bond vs. deposit problems. Assume the RRR=.2 Allison deposits $1,000 in her checking account at First National The Federal Reserve BUYS a $1,000 bond from First National What is the immediate impact on the money supply/monetary base? No change. Cash and checking are both in the money supply. An increase of $1,000. The $1,000 the Fed uses was not in the MS already. First National’s change in Required Reserves $200 RRR x deposit NO CHANGE Only when deposits change does THAT bank’s required reserves change. First National’s change in Excess Reserves $800 .8 x $1000 (why .8? b/c they must keep .2 and can lend the rest) $1,000 all of the money from the bond sale to the Fed can now be lent out Maximum change in the MS Due to transaction 1/RRR x change in excess reserve= change in MS 1/.2 5 x $800=$4,000 1/RRR x change in excess reserves=change in MS 1/.2 5 x $1,000=$5,000 Amount in checkable deposits/loans/required reserves $5,000 (checkable deposits) Which includes $4,000 in loans and $1,000 in required reserves (.2 x checkable deposits of $5,000)