User_778023102015Case+Groupon+Template

advertisement

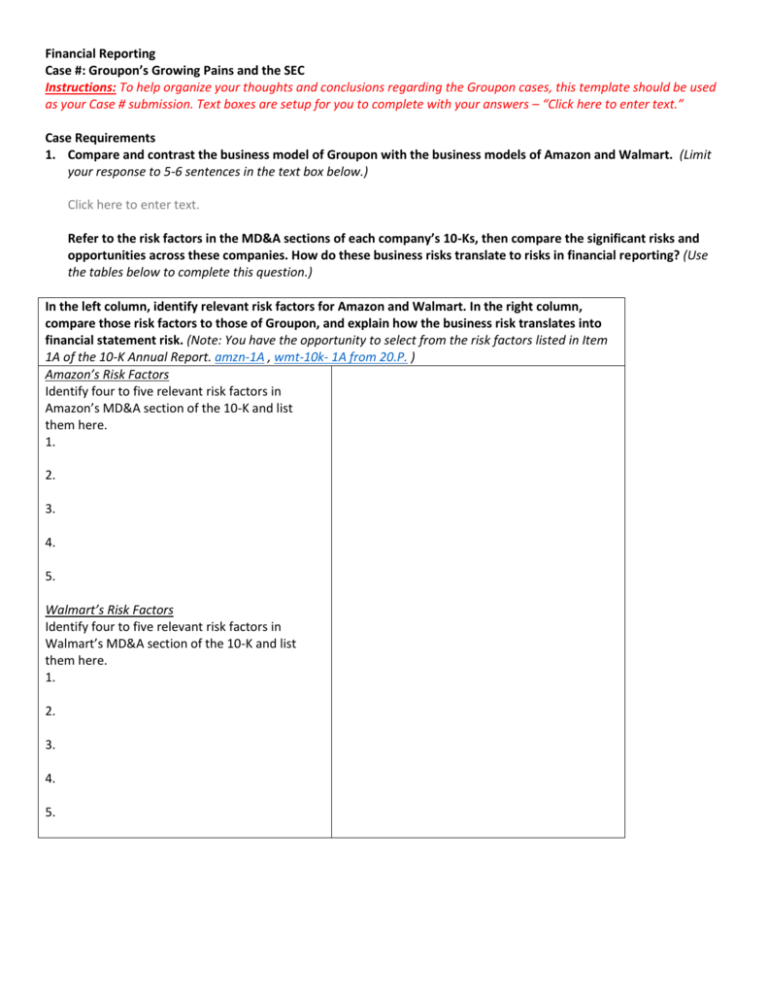

Financial Reporting Case #: Groupon’s Growing Pains and the SEC Instructions: To help organize your thoughts and conclusions regarding the Groupon cases, this template should be used as your Case # submission. Text boxes are setup for you to complete with your answers – “Click here to enter text.” Case Requirements 1. Compare and contrast the business model of Groupon with the business models of Amazon and Walmart. (Limit your response to 5-6 sentences in the text box below.) Click here to enter text. Refer to the risk factors in the MD&A sections of each company’s 10-Ks, then compare the significant risks and opportunities across these companies. How do these business risks translate to risks in financial reporting? (Use the tables below to complete this question.) In the left column, identify relevant risk factors for Amazon and Walmart. In the right column, compare those risk factors to those of Groupon, and explain how the business risk translates into financial statement risk. (Note: You have the opportunity to select from the risk factors listed in Item 1A of the 10-K Annual Report. amzn-1A , wmt-10k- 1A from 20.P. ) Amazon’s Risk Factors Identify four to five relevant risk factors in Amazon’s MD&A section of the 10-K and list them here. 1. 2. 3. 4. 5. Walmart’s Risk Factors Identify four to five relevant risk factors in Walmart’s MD&A section of the 10-K and list them here. 1. 2. 3. 4. 5. 2. “Revenue and revenue growth are more important than income and income growth in new businesses, especially in the new-age economy.” Do you agree with this statement? Support your opinion by analyzing the relationship between Amazon’s revenue, income and stock price from 1997 to 2010. (Data charts and tables provided.) 400 200 0 97 98 99 0 1 2 3 4 5 6 7 8 9 10 -200 -400 -600 -800 Revenue Income Stock Price Year 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 Net income Stock (loss) Total Net sales price $ 1,152,000.00 $ 34,204,000.00 $ 180.00 302,000 24,509,000 134.52 645,000 19,166,000 51.28 476,000 14,835,000 92.64 190,000 10,711,000 39.46 359,000 8,490,000 47.15 588,000 6,921,000 44.29 35,000 5,264,000 52.62 (149,132) 3,932,936 18.89 (567,277) 3,122,433 10.82 (1,411,273) 2,761,983 15.56 (719,968) 1,639,839 76.13 (124,546) 609,819 53.54 (31,020) 147,787 5.02 Annual Percentage Change 34% 162% -45% 135% -16% 6% -16% 179% 75% -30% -80% 42% 967% Click here to enter text. 3. Using the data provided in Tables 1 & 2, prepare common size income statements using revenues and cost-of-goodssold in the original S-1 and amended S-1. Analyze trends of expenses as a percentage of revenue for 2009 and 2010. Compare and contrast the following ratios: a. Gross margin percentage; b. Asset turnover ratio. TABLE 1: Abridged Income Statements for Groupon (in millions) Income Statement Account Revenue Cost of sales Gross margin TABLE 2: Balance Sheet - Assets Section (in '000s) 2009 2010 Gross Net Gross Net $ 30.4 $ 14.5 $ 713.4 $ 312.9 19.50 4.40 433.40 32.50 10.90 10.10 280.00 280.40 Marketing expense General and admin expense Other expenses Net loss Net loss to common shareholders EPS (Basic) 4.60 7.50 (1.34) (6.92) (0.04) 4.90 6.40 (1.09) (6.92) (0.04) 263.20 233.90 203.20 (413.40) (456.30) (2.66) 284.30 213.30 203.20 (420.10) (456.30) (2.66) ASSETS Current assets Cash and cash equivalents Accounts receivable, net Prepaid expenses and other current assets 2009 $ Total current assets Property and equipment, net Goodwill Intangible assets, net Deferred income taxes, non-current Other non-current assets TOTAL ASSETS $ 2010 12,313 $ 601 1,293 118,833 42,407 12,615 14,207 274 239 242 173,855 16,490 132,038 40,775 14,544 3,868 14,962 $ 381,570 Complete the following tables to answer this question: (I recommend copying the tables in Excel, calculating the ratios then pasting them below.) 2009 Income Statement Account Gross Revenue 100% Cost of sales Gross margin Marketing expense General and admin expense Other expenses Net loss Net loss to common shareholders EPS (Basic) Net 100% 2010 Gross Net 100% 100% Financial Ratios Gross method Gross margin percentage Asset turnover ratio Net method Gross margin percentage Asset turnover ratio 2009 2010 4. Do not answer question four. 5. Groupon had recognized revenue for the sale of high-ticket items in late 2011. Purchasers of the Groupons have a right of return, as specified in the “Groupon Promise,” prominently featured on its website. a. Assess the U.S. GAAP requirement for revenue recognition when right-or-return exists, specified in ASC Section 604-15-25, in the context of Groupon’s business model. Click here to enter text. b. Do you agree with Groupon’s accounting? Why or why not? Click here to enter text. c. What could Groupon have done differently, and how would the financial statements have been affected? Click here to enter text. 6. Groupon’s restatement of 2011 fourth-quarter financials resulted in a reduction of $14.3 million of revenues and a decrease of $30 million of operating income. However, its operating cash flow was unaffected. Explain how this is possible. Click here to enter text. 7. Do not answer question seven. It will be discussed in class on 11/9/2015. 8. In its initial S-1 filing, Groupon presented a non-GAAP performance metric called ACSOI. It was subsequently removed after the SEC objected. a. Why did the SEC question the inclusion of ACSOI in Groupon’s financial statements? Click here to enter text. b. Non-GAAP metrics are common in some industries. These include: Value-at-Risk in the financial sector, samestore-sales in retail, revenue-passenger-miles for airlines, and order-backlog in the semiconductor industry. Explain two of these metrics and assess their value to financial statement users. Click here to enter text. c. While the SEC allows the reporting of metrics identified in (b), it did question the use of ACSOI. What differences between the acceptable non-GAAP metrics in (b) and ACSOI were of concern to the SEC? Click here to enter text. d. Do you agree with Groupon’s contention that discretionary expenses, such as subscription acquisition costs, should be excluded from the financial measures of a company’s performance? Click here to enter text. 9. Groupon’s management needed significant cash to fund its growth. It had three options: (A) Seek private investment, (B) sell the company to Yahoo! or Google, or (C) go public. a. Contrast the financial reporting challenges across the three options In March 2012, Groupon’s auditors noted a material weakness in the company’s internal controls related to ‘‘deficiencies in the financial statement close process.’’ Would this disclosure have been made if Groupon had chosen options (A) or (B)? Click here to enter text. 10. In your opinion, do the problems with Groupon’s choice of accounting methods, use of a non-GAAP metric, and material weakness in its internal control reflect a lack of management experience or a lack of management integrity? Click here to enter text.