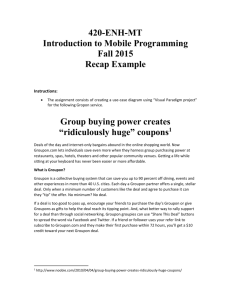

CH 8 Team Case GROUPON Chicago, Illinois From 400 subscribers

advertisement

CH 8 Team Case GROUPON Chicago, Illinois From 400 subscribers and 30 daily deals in 30 cities in December 2008 to 35 million subscribers and 900 daily deals in 550 markets today, Groupon got to $1 billion in sales faster than any other company. Starbucks CEO Howard Schultz, who was an eBay board member and is now a Groupon investor and board member, said, “Starbucks and eBay were standing still compared to what is happening with Groupon. I candidly haven’t witnessed anything quite like this. They have cracked the code on a very significant opportunity.” Eric Lefkofsky, who chairs Groupon’s board said, “The numbers got crazy a long time ago, and they keep getting crazier.” So, what is propelling Groupon’s astronomical growth? How does it work? Groupon sends a daily email to its 35 million subscribers offering a discount to a restaurant, museum, store, or service provider in their city. This “coupon” becomes a “groupon” because the company offering the discount specifies how many people (i.e., a group) must buy before the deal “tips.” For example, a local restaurant may require 100 people to buy. If only 90 do, then no one gets the discount. Daily deals go viral as those who buy send the discount to others who might be interested. When the deal tips (and 95% do), the company and Groupon split the revenue. Why would companies sign up, especially since half of the money goes to Groupon? Nearly all of Groupon’s clients are local companies, which have few cost effective ways of advertising. Radio, newspapers, and online advertising all require upfront payment (whether they work or not). By contrast, local companies pay Groupon only after the daily deal attracts enough customers to be successful. Another problem with traditional ads is that they are broadcast to a wide group of people, many of whom have little interest in what’s being advertised. The viral nature of Groupon’s coupons, however, along with tailoring deals based on subscribers’ ages, interests, and discretionary dollars, lets companies target Groupon’s daily deals to customers who are more likely to buy. Groupon’s CEO, Andrew Mason, said, “We think the Internet has the potential to change the way people discover and buy from local businesses. Because there are few barriers to entry and the basic web platform is easy to copy, Groupon’s record growth and 80 percent U.S. market share has attracted start-up competitors like Living Social, Tippr, Bloomspot, Scoutmob, and BuyWithMe, along with offerings from Google, Facebook, and Walmart. Globally, Groupon’s business has been copied in 50 countries. China alone has 1,000 Groupontype businesses, including one that has copied Groupon’s website down to the www.groupon.cn URL. Likewise, Taobao, which is part of Alibaba Group Holdings, one of China’s largest Internet companies, has a group buying service call “Ju Hua Suan,” which translates to “Group Bargain.” Questions: 1. So although Groupon has grown to $1 billion in sales faster than any other company, competitors threaten to take much of that business, especially in international markets, which Groupon is just starting to enter. As Groupon goes global, should it adapt its business to different cultures? For example, it relies on a large Chicago-based sales force to build and retain business with merchants, and 70 comedy writers to write ad copy. 2. Similarly, who should make key decisions—managers at headquarters or managers in each country? In short, should Groupon run its business the same way all around the world? 3. How should Groupon expand internationally? Should it license its web services to businesses in each area, form a strategic alliance with key foreign business partners (it rejected Google’s $6 billion offer in the United States), or should it completely own and control each Groupon business throughout the world? 4. Finally, deciding where to go global is always important, but with so many foreign markets already heavy with competitors, the question for Groupon isn’t where to expand, but how to expand successfully in so many different places at the same time.