Groupon Finally Restates its Numbers

advertisement

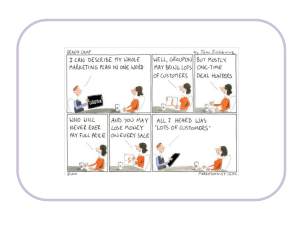

GROUPON FINALLY RESTATES ITS NUMBERS Anthony H. Catanach Jr. and J. Edward Ketz Grumpy Old Accountants Groupon amended its registration a third time on Friday September 23, but this time there is an improvement. The S-1/A#3 restates the income statement to report the proper numbers for revenues, pretty much as we said a month ago. It is refreshing and satisfying to see that sometimes our writings have an impact on practice. You will recall that in August we wrote that you should not trust Groupon’s accountants. In the previous registration statements, Groupon stated that it: Records the gross amount it receives from Groupons, excluding taxes where applicable, as the Company is the primary obligor in the transaction, and records an allowance for estimated customer refunds on total revenue primarily based on historical experience…the Company also records costs related to the associated obligation to redeem the award credits granted as issuance as an offset to revenue. (emphasis added) This accounting method was wrong—it did not follow generally accepted accounting principles. The accounting policy did not conform to the requirements of Emerging Issues Task Force (EITF) 99-19. As the company stated, the merchants are responsible for fulfilling the obligation to deliver the goods and services, which means that Groupon in fact is not the primary obligor but is a guarantor of sorts. This conclusion is further bolstered by observing that Groupon has no inventory, cannot set product or service price, cannot change the product and does not perform part of the service, has no discretion in supplier selection, and is not involved in product or service specifications. SEC Staff Accounting Bulletin 101 on Revenue Recognition, Question 10 specifically, is congruent with EITF 99-19. The SEC stated that firms should report revenues on a net basis if they did not take title to the products, did not have the risk and rewards of ownership, and acted as an agent or broker. All of these indicia imply that Groupon should have reported revenues on a net basis instead of a gross basis. Why its auditor initially allowed gross reporting of revenues is beyond our understanding—and its understanding of EITF 99-19 and SAB 101. Because of the clear violations of GAAP, we complained to the SEC via its Whistleblower Program. We supplied the SEC with a copy of our article and said that it should review Groupon’s filings and make a decision whether Groupon can account for its revenues on a gross or net basis. Apparently the SEC intervened, as reported by Shayndi Raice in “More Trouble for Groupon IPO,” The Wall Street Journal. Douglas MacMillan at Business Week adds: the Groupon Chief Operating Officer is leaving Groupon and going to Google. Groupon now shows the revenues on a net basis. Footnote 2 of the latest S1/A contains Groupon’s mea culpa, such as it is. The reader sees the following: Revenues (000) 2008 2009 2010 As previously reported Restatement adjustment As restated $ $( 89) ( 15,931) (400,424) $ 94 30,471 713,365 5 14,540 312,941 We still think there are various issues in the accounting at Groupon; further, the analysis of their financial statements reveals many question marks. But at least the revenues are properly stated on a net basis, just as we told you they should be. This essay reflects the opinion of the authors and not necessarily the opinions of The Pennsylvania State University, The American College, or Villanova University.